Fill Your Louisiana act of donation Form

The Louisiana act of donation form serves as a crucial legal document that facilitates the transfer of property or assets from one individual to another without the expectation of compensation. This form is particularly significant in Louisiana, where the civil law system governs property transactions. It outlines the specifics of the donation, including details about the donor and the recipient, a description of the property being donated, and any conditions attached to the donation. By using this form, donors can ensure that their intentions are clearly documented, which helps prevent disputes in the future. Additionally, the act of donation form may require notarization to validate the transaction, adding an extra layer of authenticity. Understanding the requirements and implications of this form is essential for anyone considering making a donation of property in Louisiana, as it not only impacts the donor and recipient but also has potential tax implications that should be taken into account.

Find Other Documents

Printable Trucking Company Owner Operator Lease Agreement Form Pdf - Owner Operators must comply with all federal, state, and local regulations while transporting hazardous materials.

When engaging in the sale of a mobile home, it is imperative to utilize the appropriate documentation; for instance, by accessing the form at https://mobilehomebillofsale.com/blank-connecticut-mobile-home-bill-of-sale, sellers and buyers can ensure clarity and legal compliance throughout the transaction process.

Lyft Inspection Form Pass - Proper documentation on the form can expedite the inspection process.

Common Questions

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document used to transfer ownership of property or assets from one person to another without any exchange of money. This form is particularly useful for individuals wishing to gift property to family members or friends. The act ensures that the donation is legally recognized and protects the rights of both the donor and the recipient.

Who can use the Louisiana Act of Donation Form?

Any person who legally owns property in Louisiana can use the Act of Donation Form. This includes individuals, married couples, or entities such as businesses or trusts. However, the donor must have the legal capacity to make a gift, meaning they must be of sound mind and at least 18 years old.

What types of property can be donated using this form?

The form can be used to donate various types of property, including real estate, vehicles, personal belongings, and financial assets. However, it is important to ensure that the property being donated is not subject to any liens or encumbrances that could complicate the transfer.

Is the donation subject to taxes?

In Louisiana, donations can be subject to gift taxes, depending on the value of the property being transferred. Donors should consult with a tax professional to understand any potential tax implications and ensure compliance with federal and state tax laws.

What information is required to complete the form?

To complete the Louisiana Act of Donation Form, you will need to provide detailed information about the donor and the recipient, including names, addresses, and contact information. Additionally, a clear description of the property being donated must be included, along with any relevant identification numbers or titles.

Do I need witnesses or notarization for the form?

Yes, the Louisiana Act of Donation Form must be signed in the presence of a notary public. It is also advisable to have witnesses present during the signing to further validate the document. This helps ensure that the donation is legally binding and can be upheld in court if necessary.

How do I submit the completed form?

Once the Louisiana Act of Donation Form is completed and signed, it should be filed with the appropriate parish clerk of court where the property is located. This filing will officially record the donation and provide public notice of the transfer of ownership.

Can the donation be revoked after the form is signed?

Generally, once the Louisiana Act of Donation Form is signed and filed, the donation is considered final and cannot be revoked. However, there may be exceptions in certain circumstances, such as if the donor can prove that they were coerced or lacked the capacity to make the donation. Legal advice may be necessary if revocation is being considered.

Preview - Louisiana act of donation Form

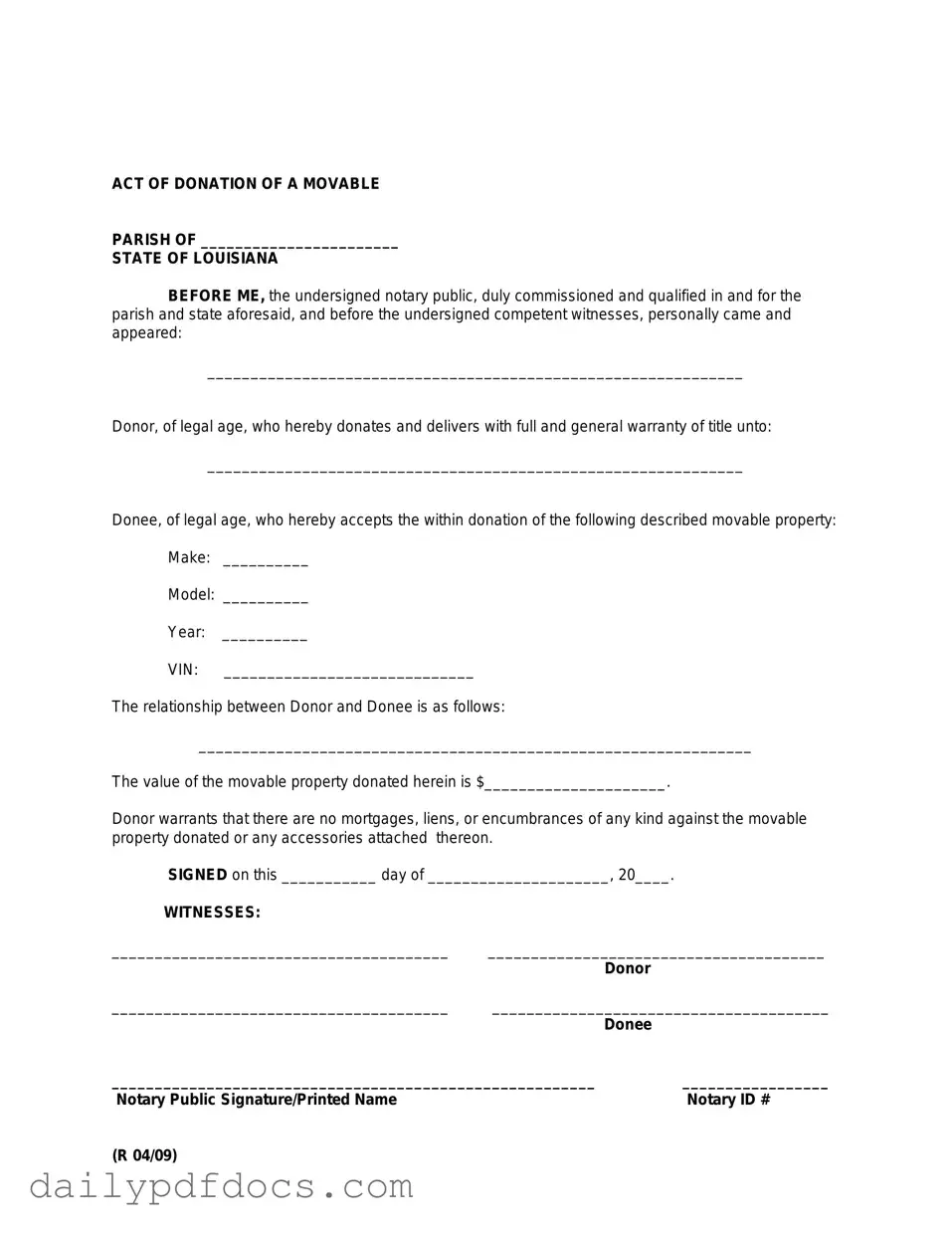

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)

Similar forms

The Louisiana act of donation form shares similarities with several other legal documents. Each serves a specific purpose in transferring rights or property. Below is a list of documents that are comparable to the act of donation form:

- Deed of Gift: This document allows a person to transfer property to another without any exchange of money. Like the act of donation, it must be executed voluntarily and typically requires the signature of the donor.

- Will: A will specifies how a person's assets should be distributed after their death. Similar to the act of donation, it involves the intention to transfer property, although a will becomes effective only upon death.

- Trust Agreement: This document creates a trust, allowing a trustee to manage assets for the benefit of a beneficiary. Both the trust agreement and act of donation involve the transfer of property, often for specific purposes.

- Power of Attorney: A power of attorney grants someone the authority to act on another's behalf. While it does not transfer ownership, it allows for the management of assets, akin to how an act of donation transfers rights.

- Sales Contract: This document outlines the terms of a sale between a buyer and a seller. Both documents detail the transfer of property, but a sales contract involves compensation, whereas the act of donation does not.

- Employment Verification Form: This important document confirms an employee's work status and is essential for compliance with employment laws, ensuring a smooth hiring process. For further information, you can visit legalformspdf.com.

- Lease Agreement: A lease allows one party to use another's property for a specified period in exchange for rent. While it does not transfer ownership, both documents involve the use and rights to property.

- Assignment Agreement: This document transfers rights or interests from one party to another. Similar to the act of donation, it requires clear intent and agreement between the parties involved.

- Quitclaim Deed: This deed transfers whatever interest the grantor has in the property without guaranteeing that the title is clear. Like the act of donation, it is a simple way to transfer property rights without extensive legal formalities.

Misconceptions

The Louisiana act of donation form is an important legal document, but several misconceptions surround it. Understanding these misconceptions can help individuals navigate the donation process more effectively.

- Misconception 1: The act of donation is only for wealthy individuals.

- Misconception 2: The act of donation requires a lawyer to complete.

- Misconception 3: Donations made through this act are irrevocable.

- Misconception 4: The act of donation is only applicable to real estate.

- Misconception 5: The act of donation is the same as a will.

- Misconception 6: There are no tax implications for donations.

This is not true. Anyone can use the act of donation to transfer property or assets, regardless of their financial status. It serves as a way to gift assets during one’s lifetime.

While having legal assistance can be beneficial, it is not a requirement. Individuals can fill out the form themselves as long as they understand the process and requirements.

This is misleading. While many donations are intended to be permanent, certain conditions allow for revocation under specific circumstances.

In fact, this act can be used for various types of property, including personal belongings, vehicles, and financial assets.

This is incorrect. A will takes effect upon death, while the act of donation transfers ownership during the donor's lifetime.

While some donations may not incur taxes, others could have tax consequences. It is wise to consult with a tax professional to understand potential liabilities.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Louisiana Act of Donation form is used to legally transfer ownership of property from one person to another as a gift. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 through 1471. |

| Types of Donations | Donations can be made in various forms, including real estate, personal property, and money. |

| Notarization Requirement | The Act of Donation must be notarized to be valid and enforceable. |

| Revocability | Once executed, a donation is generally irrevocable, meaning it cannot be undone without consent. |

| Tax Implications | Donations may have tax consequences for both the donor and the recipient, potentially impacting gift tax obligations. |

| Witness Requirement | Two witnesses must sign the form to validate the donation, in addition to the notary. |