Free Loan Agreement Template

A Loan Agreement form serves as a crucial document in the lending process, outlining the terms and conditions under which a borrower receives funds from a lender. This form typically includes essential details such as the loan amount, interest rate, repayment schedule, and any collateral required. Both parties must understand their rights and obligations, which the agreement clearly delineates. Additionally, the form often specifies the consequences of default, ensuring that borrowers are aware of the potential repercussions of failing to meet their repayment commitments. By providing a structured framework, a Loan Agreement fosters transparency and trust between the lender and borrower, making it a vital tool in personal and business finance transactions.

Find Common Templates

Bill of Sale for Business Template - Provides clarity on financial arrangements associated with the sale.

A Washington Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. This agreement ensures that confidential details remain private and are not disclosed to unauthorized individuals. For those interested in creating a robust NDA, resources such as Washington Templates can be incredibly helpful in guiding you through the process.

Venue Rental Agreement - Addresses promotional use of photos taken during the event.

Loan Agreement Form Subtypes

Common Questions

What is a Loan Agreement form?

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect the interests of both parties by clearly defining their rights and obligations throughout the loan period.

Who should use a Loan Agreement form?

Individuals or entities engaging in a lending arrangement should utilize a Loan Agreement form. This includes personal loans between friends or family members, as well as business loans between companies. By formalizing the loan with a written agreement, all parties can minimize misunderstandings and provide a clear reference in case of disputes.

What are the key components of a Loan Agreement form?

A comprehensive Loan Agreement form typically contains several key components. These include the names and contact information of both the lender and borrower, the principal amount of the loan, the interest rate, the repayment terms, and any fees associated with the loan. Additionally, the agreement may specify the consequences of default and any collateral that secures the loan. Clarity in these components is crucial for both parties.

Is it necessary to have a Loan Agreement form notarized?

While it is not always required to have a Loan Agreement form notarized, doing so can add an extra layer of protection. Notarization serves to verify the identities of the parties involved and ensures that they are entering into the agreement voluntarily. In some cases, lenders may require notarization to enforce the agreement more easily in court. However, for informal loans, a simple signed document may suffice.

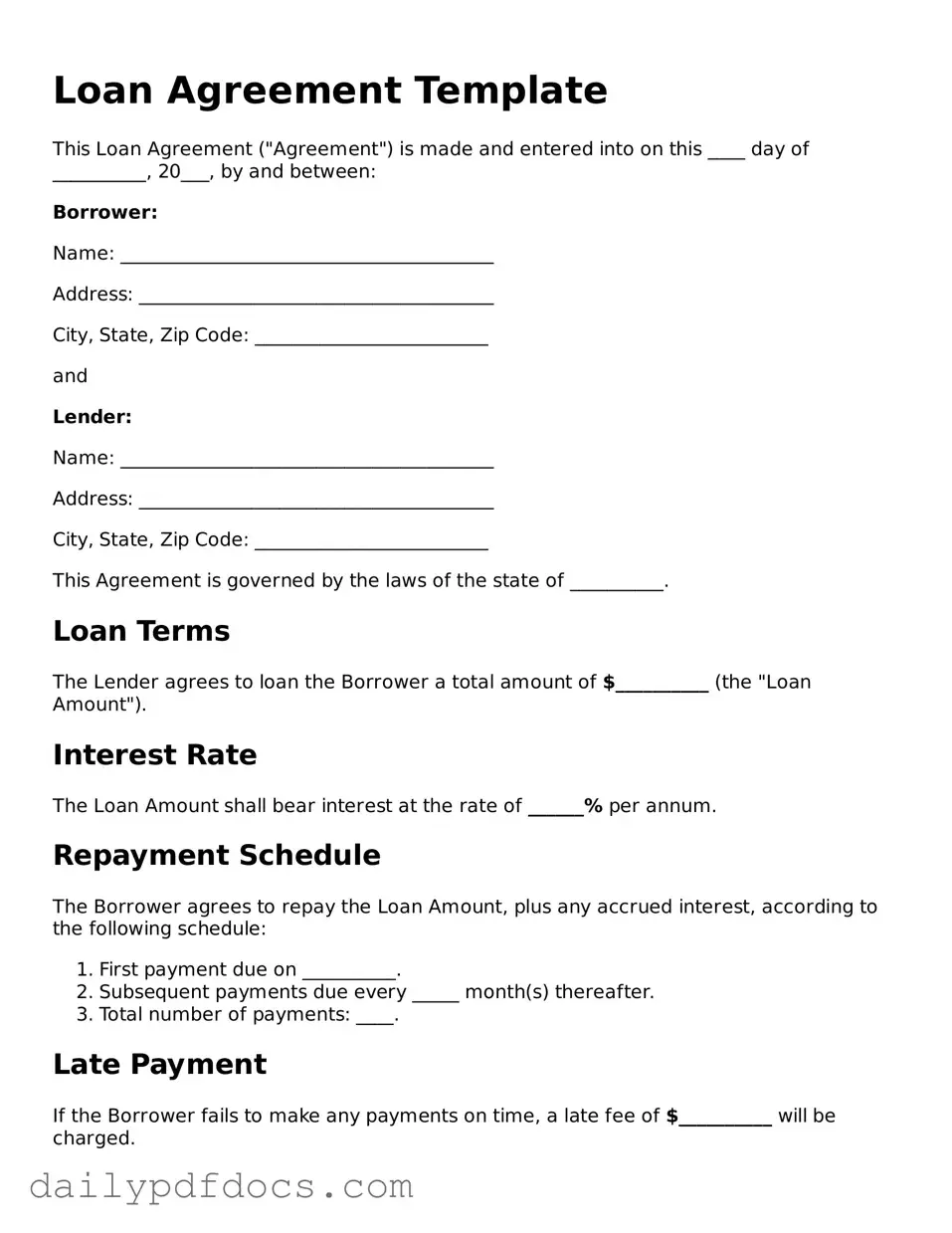

Preview - Loan Agreement Form

Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into on this ____ day of __________, 20___, by and between:

Borrower:

Name: ________________________________________

Address: ______________________________________

City, State, Zip Code: _________________________

and

Lender:

Name: ________________________________________

Address: ______________________________________

City, State, Zip Code: _________________________

This Agreement is governed by the laws of the state of __________.

Loan Terms

The Lender agrees to loan the Borrower a total amount of $__________ (the "Loan Amount").

Interest Rate

The Loan Amount shall bear interest at the rate of ______% per annum.

Repayment Schedule

The Borrower agrees to repay the Loan Amount, plus any accrued interest, according to the following schedule:

- First payment due on __________.

- Subsequent payments due every _____ month(s) thereafter.

- Total number of payments: ____.

Late Payment

If the Borrower fails to make any payments on time, a late fee of $__________ will be charged.

Prepayment

The Borrower may repay the Loan Amount in full or in part at any time without penalty.

Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of __________.

Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

Borrower's Signature: ____________________________________

Date: ____________________________________________

Lender's Signature: _____________________________________

Date: ____________________________________________

Similar forms

The Loan Agreement form shares similarities with several other financial and legal documents. Each of these documents serves specific purposes but often contains overlapping elements. Here’s a list detailing eight documents that are similar to a Loan Agreement:

- Promissory Note: This document outlines the borrower's promise to repay the loan, detailing the amount borrowed, interest rates, and repayment terms, much like a Loan Agreement.

- Mortgage Agreement: When a loan is secured by property, this document specifies the terms of the mortgage, including the loan amount and property details, similar to the collateral terms in a Loan Agreement.

- Credit Agreement: This document governs the terms of a credit facility, including interest rates and repayment schedules, resembling the financial obligations outlined in a Loan Agreement.

- Lease Agreement: While typically related to renting property, a Lease Agreement can include payment terms and conditions, much like the payment structure in a Loan Agreement.

- Personal Guarantee: This document may accompany a Loan Agreement, where a third party agrees to repay the loan if the borrower defaults, similar in purpose to securing repayment.

- Security Agreement: This document details the collateral for a loan, specifying what assets are at risk if the loan is not repaid, akin to the collateral clauses in a Loan Agreement.

- Forbearance Agreement: This document outlines the terms under which a lender agrees to delay foreclosure or other actions, often referencing the original Loan Agreement's terms.

- Debt Settlement Agreement: This document details the terms under which a borrower agrees to settle a debt for less than the full amount owed, similar in that it addresses the obligations of the borrower.

Misconceptions

Loan agreements are often misunderstood. Here are four common misconceptions about them:

-

Loan agreements are only for large amounts of money.

This is not true. Loan agreements can be used for any amount, whether it's a small personal loan or a large mortgage. The key is that both parties agree to the terms.

-

Once signed, a loan agreement cannot be changed.

This misconception can lead to confusion. In reality, loan agreements can be amended if both parties consent to the changes. It's essential to document any modifications in writing.

-

All loan agreements are the same.

This is misleading. Loan agreements can vary significantly based on the type of loan, the lender, and the borrower's needs. Each agreement should be tailored to reflect the specific terms and conditions agreed upon.

-

A loan agreement guarantees loan approval.

Signing a loan agreement does not ensure that the loan will be approved. Approval depends on various factors, including creditworthiness and the lender's policies.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legal document that outlines the terms under which one party lends money to another. |

| Parties Involved | The agreement typically involves a lender and a borrower, each with specific rights and obligations. |

| Governing Law | Each state may have specific laws governing loan agreements. For example, in California, the governing law is the California Civil Code. |

| Interest Rates | The agreement must specify the interest rate, which can be fixed or variable, and must comply with state usury laws. |

| Repayment Terms | Details regarding repayment schedules, including due dates and methods of payment, are crucial components. |

| Default Conditions | The agreement should outline what constitutes a default and the potential consequences for the borrower. |

| Collateral | If applicable, the agreement may specify collateral that secures the loan, protecting the lender's interests. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be enforceable. |