Free Lady Bird Deed Template

The Lady Bird Deed, also known as an enhanced life estate deed, serves as a valuable estate planning tool for property owners in the United States. This form allows individuals to transfer their real estate to beneficiaries while retaining control over the property during their lifetime. One of its key features is the ability to avoid probate, which simplifies the transfer process upon the owner's death. Additionally, the Lady Bird Deed provides the owner with the flexibility to sell, mortgage, or change the beneficiaries without needing consent from them. This deed can also offer protection from creditors in certain situations, making it an attractive option for those looking to safeguard their assets. Understanding the nuances of the Lady Bird Deed is essential for anyone considering this form of property transfer, as it can significantly impact estate planning strategies and the management of real estate assets.

Popular Lady Bird Deed Templates:

Problems With Transfer on Death Deeds California - The Transfer-on-Death Deed is effective immediately upon recording but only takes effect after your death.

The Washington Articles of Incorporation form is a legal document that establishes a corporation in the state of Washington. This form outlines essential details about the corporation, such as its name, purpose, and registered agent. For those looking to ensure the process goes smoothly, resources like Washington Templates can provide valuable guidance. Completing this form is a crucial step in starting your business, so be sure to fill it out by clicking the button below.

What Is a Gift Deed in Real Estate - This form simplifies the process of transferring property within families.

Quick Title Deed - A Quitclaim Deed removes personal rights to the property conveyed.

Common Questions

What is a Lady Bird Deed?

A Lady Bird Deed is a type of property deed that allows an individual to transfer real estate to a beneficiary while retaining the right to live on and control the property during their lifetime. This deed is often used to avoid probate and can provide certain tax benefits.

Who can benefit from using a Lady Bird Deed?

Individuals who want to ensure that their property passes directly to their chosen beneficiaries upon their death may find a Lady Bird Deed beneficial. It is particularly useful for those looking to avoid the probate process, which can be lengthy and costly.

How does a Lady Bird Deed work?

With a Lady Bird Deed, the property owner retains full control over the property during their lifetime. They can sell, mortgage, or change the beneficiaries at any time without needing the beneficiaries' consent. Upon the owner's death, the property automatically transfers to the designated beneficiaries without going through probate.

What are the advantages of a Lady Bird Deed?

Some advantages include the avoidance of probate, potential tax benefits, and the ability to retain control of the property during the owner's lifetime. Additionally, it can simplify the transfer of property to heirs, making the process smoother for families.

Are there any disadvantages to a Lady Bird Deed?

While there are many benefits, there can be disadvantages as well. For example, the property may still be subject to creditors' claims, and the transfer may affect eligibility for certain government benefits. It's essential to consider individual circumstances and consult with a professional before proceeding.

Can a Lady Bird Deed be revoked?

Yes, a Lady Bird Deed can be revoked or modified at any time by the property owner. This flexibility allows the owner to change their mind about the beneficiaries or make adjustments based on their evolving circumstances.

Is a Lady Bird Deed recognized in all states?

No, not all states recognize Lady Bird Deeds. This type of deed is primarily used in certain states, such as Florida and Texas. It is important to check the specific laws in your state or consult with a legal professional to understand your options.

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, one typically needs to draft the deed with the proper legal language, including the names of the current owner and the beneficiaries. It is advisable to have the deed reviewed by a legal professional and then recorded with the appropriate county office to ensure it is legally binding.

Preview - Lady Bird Deed Form

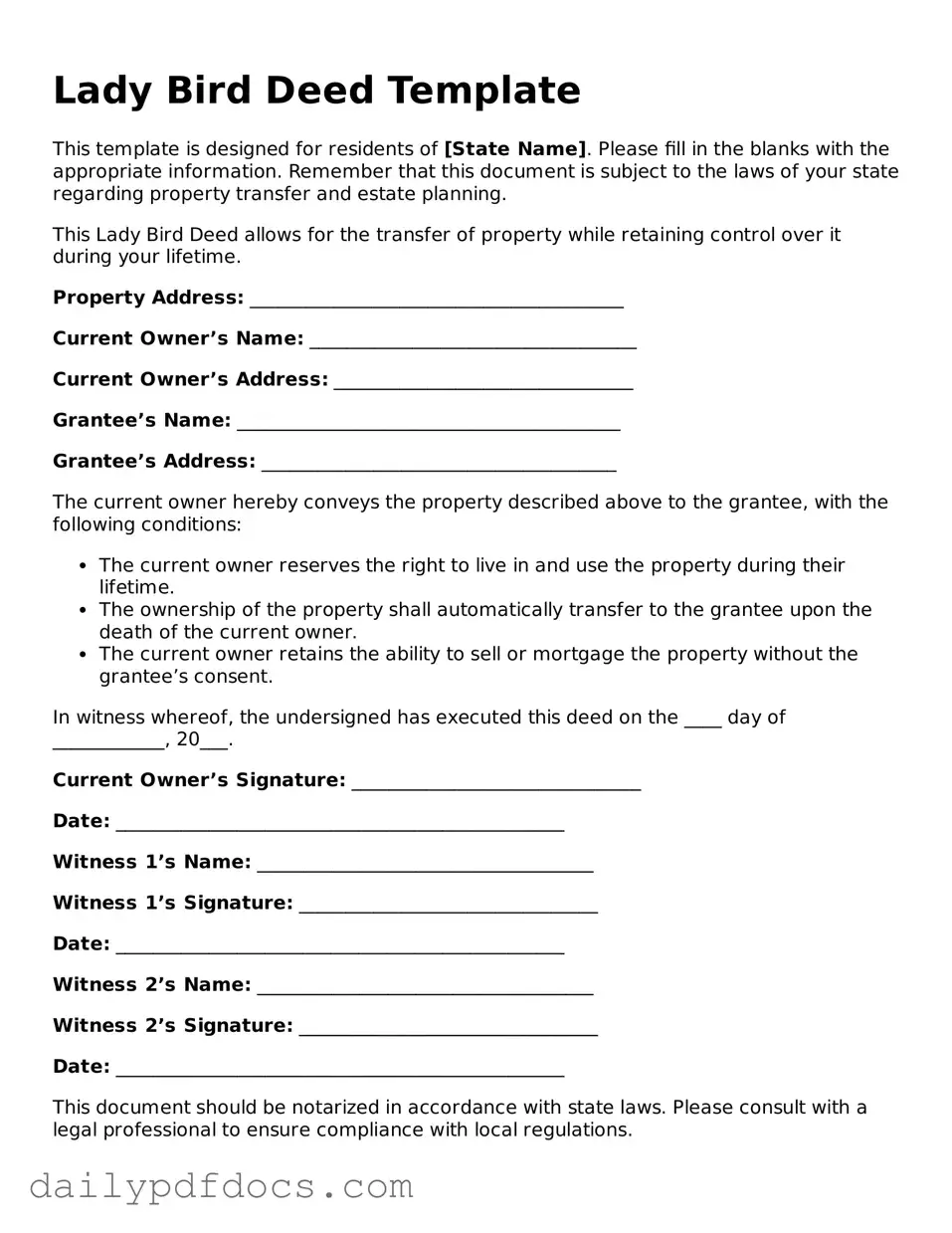

Lady Bird Deed Template

This template is designed for residents of [State Name]. Please fill in the blanks with the appropriate information. Remember that this document is subject to the laws of your state regarding property transfer and estate planning.

This Lady Bird Deed allows for the transfer of property while retaining control over it during your lifetime.

Property Address: ________________________________________

Current Owner’s Name: ___________________________________

Current Owner’s Address: ________________________________

Grantee’s Name: _________________________________________

Grantee’s Address: ______________________________________

The current owner hereby conveys the property described above to the grantee, with the following conditions:

- The current owner reserves the right to live in and use the property during their lifetime.

- The ownership of the property shall automatically transfer to the grantee upon the death of the current owner.

- The current owner retains the ability to sell or mortgage the property without the grantee’s consent.

In witness whereof, the undersigned has executed this deed on the ____ day of ____________, 20___.

Current Owner’s Signature: _______________________________

Date: ________________________________________________

Witness 1’s Name: ____________________________________

Witness 1’s Signature: ________________________________

Date: ________________________________________________

Witness 2’s Name: ____________________________________

Witness 2’s Signature: ________________________________

Date: ________________________________________________

This document should be notarized in accordance with state laws. Please consult with a legal professional to ensure compliance with local regulations.

Similar forms

- Transfer on Death Deed (TODD): Similar to the Lady Bird Deed, a Transfer on Death Deed allows property owners to designate beneficiaries who will receive the property upon their death without going through probate.

- Trailer Bill of Sale Form: For those involved in trailer transactions, the comprehensive Trailer Bill of Sale guide provides essential documentation for a smooth transfer of ownership.

- Life Estate Deed: A Life Estate Deed grants ownership to an individual for their lifetime, after which the property passes to a designated beneficiary. Both documents facilitate the transfer of property while avoiding probate.

- Joint Tenancy Deed: This deed creates a shared ownership of property between two or more individuals. Like the Lady Bird Deed, it allows for the automatic transfer of ownership to the surviving joint tenant upon the death of one owner.

- Revocable Living Trust: A Revocable Living Trust allows individuals to place their assets into a trust during their lifetime. Similar to the Lady Bird Deed, it helps avoid probate and can provide flexibility in managing assets.

- Will: A Will outlines how a person's assets will be distributed upon their death. While it does not avoid probate like a Lady Bird Deed, both documents serve to convey the owner's wishes regarding property transfer.

- Quitclaim Deed: A Quitclaim Deed transfers any interest the grantor has in the property without guaranteeing that the title is clear. Like the Lady Bird Deed, it can be used to transfer property quickly, though it does not provide the same level of protection.

- Beneficiary Deed: This document allows property owners to designate a beneficiary who will inherit the property upon the owner's death. Similar to the Lady Bird Deed, it avoids probate and ensures a smooth transfer of property ownership.

Misconceptions

The Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a tool that can simplify estate planning. However, several misconceptions surround its use. Here are eight common misunderstandings:

- It is only for married couples. The Lady Bird Deed can be utilized by individuals, couples, and even families. It is not limited to spouses.

- It avoids probate entirely. While it can help avoid probate for the property listed, other assets may still go through probate unless addressed separately.

- It is the same as a traditional life estate. Unlike a traditional life estate, a Lady Bird Deed allows the property owner to retain control over the property during their lifetime, including the ability to sell or change the deed.

- It can only be used for primary residences. The Lady Bird Deed can be applied to various types of real estate, including vacation homes and rental properties.

- It is a one-size-fits-all solution. Each person's situation is unique. The Lady Bird Deed may not be the best option for everyone, depending on individual circumstances.

- It eliminates tax implications. While it can help with estate planning, tax consequences may still arise, particularly concerning capital gains taxes.

- It is a complicated legal document. The Lady Bird Deed is relatively straightforward compared to other estate planning tools, but proper understanding is still essential.

- It guarantees that property will pass to heirs. While it is designed to facilitate the transfer of property, it does not guarantee that heirs will receive the property if other legal issues arise.

Understanding these misconceptions can help individuals make informed decisions about their estate planning needs. Always consider consulting with a professional for personalized advice.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is recognized in several states, including Texas and Florida. |

| Retained Rights | The property owner retains the right to sell, mortgage, or change the property without the beneficiaries' consent. |

| Tax Benefits | Using a Lady Bird Deed may help avoid probate and potentially reduce estate taxes. |

| Beneficiary Designation | Beneficiaries can be individuals or organizations, and they receive the property automatically upon the owner's death. |

| Revocability | The deed can be revoked or changed at any time by the property owner. |

| Effect on Medicaid | In some states, a Lady Bird Deed may protect the property from Medicaid estate recovery. |

| Execution Requirements | The deed must be signed and notarized to be valid. |

| State Variations | Specific requirements and implications can vary by state, so local laws should be consulted. |