Free Investment Letter of Intent Template

The Investment Letter of Intent form serves as a crucial step in the investment process, establishing the preliminary terms and conditions between parties involved. This document outlines the intent to invest, detailing the amount of capital proposed, the timeline for the investment, and any contingencies that may apply. It typically includes essential information such as the identities of the investors and the entities receiving the funds, along with the purpose of the investment. Additionally, the form may address confidentiality provisions, indicating how sensitive information will be handled. By clearly articulating the expectations and commitments of both parties, the Investment Letter of Intent helps to lay a solid foundation for future negotiations and formal agreements. Ensuring that all relevant details are accurately captured is vital, as it can prevent misunderstandings and facilitate smoother transactions down the line.

Popular Investment Letter of Intent Templates:

Intent to Homeschool - Reinforces the parent's right to choose how to educate their child.

Letter of Intent Business Purchase - Can outline contingencies that must be met for the sale to proceed.

Common Questions

What is an Investment Letter of Intent?

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between parties who intend to engage in an investment. It serves as a starting point for negotiations and can include terms such as investment amounts, timelines, and conditions that need to be met before the final agreement is reached.

Why is an Investment Letter of Intent important?

The LOI is important because it helps clarify the intentions of both parties. By putting key points in writing, it reduces misunderstandings and establishes a framework for future discussions. This document can also signal to investors and stakeholders that serious negotiations are underway.

What should be included in an Investment Letter of Intent?

An effective LOI typically includes several key elements: the names of the parties involved, a description of the investment opportunity, the proposed investment amount, any conditions that must be met, and a timeline for the investment process. It may also outline confidentiality agreements and exclusivity periods, if applicable.

Is an Investment Letter of Intent legally binding?

Generally, an LOI is not legally binding, but it can contain binding provisions, such as confidentiality clauses. The intent of an LOI is to outline the terms of negotiation rather than create a formal contract. However, it’s crucial to clearly state which parts, if any, are binding to avoid confusion.

How does an Investment Letter of Intent differ from a contract?

The primary difference lies in the level of commitment. A contract is a formal agreement that legally obligates the parties to fulfill specific terms. In contrast, an LOI is more of a roadmap for negotiations. It indicates intent but does not typically impose legal obligations on the parties involved.

What should I do after signing an Investment Letter of Intent?

After signing an LOI, both parties should begin working towards a formal agreement. This may involve due diligence, further negotiations, and drafting a more detailed contract. It’s also a good idea to consult legal counsel to ensure that all terms are clear and that the final agreement reflects the intentions outlined in the LOI.

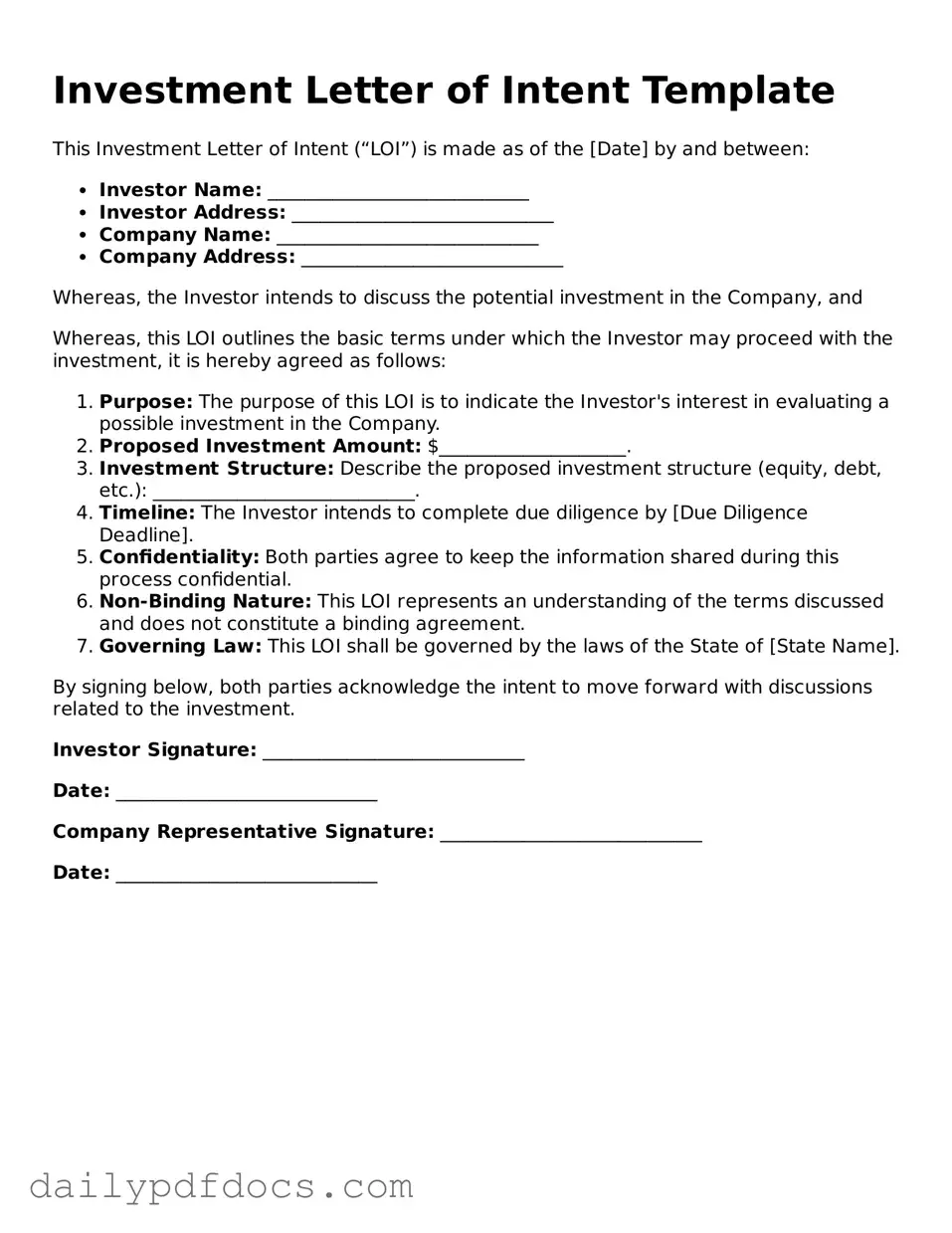

Preview - Investment Letter of Intent Form

Investment Letter of Intent Template

This Investment Letter of Intent (“LOI”) is made as of the [Date] by and between:

- Investor Name: ____________________________

- Investor Address: ____________________________

- Company Name: ____________________________

- Company Address: ____________________________

Whereas, the Investor intends to discuss the potential investment in the Company, and

Whereas, this LOI outlines the basic terms under which the Investor may proceed with the investment, it is hereby agreed as follows:

- Purpose: The purpose of this LOI is to indicate the Investor's interest in evaluating a possible investment in the Company.

- Proposed Investment Amount: $____________________.

- Investment Structure: Describe the proposed investment structure (equity, debt, etc.): ____________________________.

- Timeline: The Investor intends to complete due diligence by [Due Diligence Deadline].

- Confidentiality: Both parties agree to keep the information shared during this process confidential.

- Non-Binding Nature: This LOI represents an understanding of the terms discussed and does not constitute a binding agreement.

- Governing Law: This LOI shall be governed by the laws of the State of [State Name].

By signing below, both parties acknowledge the intent to move forward with discussions related to the investment.

Investor Signature: ____________________________

Date: ____________________________

Company Representative Signature: ____________________________

Date: ____________________________

Similar forms

- Term Sheet: This document outlines the basic terms and conditions of an investment deal. Like the Investment Letter of Intent, it serves as a preliminary agreement that sets the stage for further negotiations.

- Memorandum of Understanding (MOU): An MOU establishes a mutual agreement between parties. Similar to the Investment Letter of Intent, it expresses the intention to move forward with a project or investment.

- Confidentiality Agreement: This document protects sensitive information shared during negotiations. It is similar to the Investment Letter of Intent in that both aim to safeguard the interests of the parties involved.

- Purchase Agreement: This is a binding contract detailing the sale of an asset. While more formal than an Investment Letter of Intent, both documents outline intentions and expectations regarding a transaction.

- Joint Venture Agreement: This outlines the terms of a partnership between two or more parties. Like the Investment Letter of Intent, it reflects the parties’ commitment to collaborate on a specific project.

- Shareholder Agreement: This document governs the relationship between shareholders. It is similar in that it establishes the rights and responsibilities of each party, much like an Investment Letter of Intent does for investors.

- Letter of Intent (LOI): This document expresses a party's intention to enter into a formal agreement. The LOI and the Investment Letter of Intent both serve as preliminary steps before finalizing a deal.

- Investment Proposal: An investment proposal outlines the details of a potential investment opportunity. It is similar to the Investment Letter of Intent in that it presents the opportunity and seeks to gain interest from potential investors.

Misconceptions

Misconceptions about the Investment Letter of Intent (LOI) can lead to confusion among investors and entrepreneurs alike. Here are six common misunderstandings:

- 1. An LOI is a legally binding contract. Many believe that an LOI creates a binding agreement between parties. In reality, while it outlines intentions, most LOIs include disclaimers stating that they are non-binding, except for certain provisions like confidentiality.

- 2. An LOI guarantees funding. Some individuals assume that signing an LOI ensures that funding will occur. However, an LOI merely indicates interest and sets the stage for further negotiations. Actual funding depends on due diligence and final agreements.

- 3. All LOIs are the same. A common misconception is that all Investment LOIs follow a standard format. In truth, each LOI can vary significantly based on the specifics of the investment and the preferences of the parties involved.

- 4. An LOI must be signed by both parties. Many think that both parties must sign the LOI for it to be valid. While signatures can indicate agreement, an LOI can still serve its purpose even if one party issues it without a formal acceptance from the other.

- 5. The LOI process is unnecessary. Some may view the LOI as an unnecessary step in the investment process. However, it serves as an important tool for clarifying intentions and expectations, which can prevent misunderstandings later on.

- 6. An LOI can’t be modified. There is a belief that once an LOI is issued, its terms cannot be changed. In reality, parties can negotiate and amend the LOI as discussions progress, reflecting any changes in their intentions or circumstances.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent form outlines the preliminary terms of an investment agreement between parties. |

| Non-Binding Nature | This document is typically non-binding, meaning it expresses an intention to invest but does not create a legal obligation. |

| Key Components | Common components include the amount of investment, valuation, and proposed timeline for the transaction. |

| Confidentiality | Often, the form includes confidentiality provisions to protect sensitive information shared during negotiations. |

| Governing Law | The governing law may vary by state; for example, California law may apply to agreements made in California. |

| Expiration | The letter may specify an expiration date, after which the terms may no longer be valid. |

| Negotiation Tool | It serves as a useful tool for negotiating terms before drafting a formal agreement. |

| Legal Review | Although it's often a preliminary document, having a legal professional review it can help clarify intentions and protect interests. |