Fill Your Intent To Lien Florida Form

The Intent To Lien Florida form serves as a critical notification tool for contractors, subcontractors, and suppliers who have provided services or materials for property improvements but have not received payment. This form is designed to formally inform property owners of an impending claim of lien, which can arise when payment issues occur. By issuing this notice, the sender not only adheres to Florida's legal requirements but also establishes a clear communication channel regarding the outstanding balance. The form includes essential details such as the date of the notice, the names and addresses of the property owner and general contractor, and a description of the property involved. It outlines the amount owed for services rendered and specifies the timeline for response—30 days to address the payment issue before a lien is recorded. The notice emphasizes the potential consequences of inaction, including foreclosure proceedings and additional costs, thereby urging prompt resolution. This proactive approach aims to prevent disputes from escalating, encouraging property owners to engage with the sender to settle the outstanding payment amicably.

Find Other Documents

Bill of Loading - A Bill of Lading with a Supplement form provides essential information for the transportation of goods.

For individuals looking to navigate the complexities of purchasing a trailer, understanding the nuances of the crucial Trailer Bill of Sale document is imperative. This form not only serves as evidence of the transaction but also delineates the responsibilities and rights of both the buyer and seller involved.

California Dmv Forms - Complete the DL 44 form to update your personal information, such as a name change.

Common Questions

What is the Intent to Lien Florida form?

The Intent to Lien Florida form is a legal document that notifies property owners of an intent to file a lien against their property due to non-payment for labor, materials, or services provided. It serves as a warning, allowing property owners the opportunity to address the outstanding payment before a lien is formally recorded.

Who needs to file an Intent to Lien?

How long before filing a lien must the Intent to Lien be served?

According to Florida law, the Intent to Lien must be served at least 45 days prior to recording a Claim of Lien. This timeframe allows property owners to respond and settle any outstanding payments before any legal actions are taken.

What happens if the property owner does not respond to the Intent to Lien?

If the property owner fails to respond or make payment within 30 days of receiving the Intent to Lien, the party who filed the notice may proceed to record a Claim of Lien against the property. This could lead to foreclosure proceedings and additional costs for the property owner.

What information is required on the Intent to Lien form?

The form requires several key pieces of information, including the date, the property owner's full legal name and mailing address, the general contractor's details (if applicable), a description of the property, and the amount owed. Clear and accurate information is crucial to ensure the notice is valid.

Can the Intent to Lien be sent via email?

No, the Intent to Lien must be served through traditional methods such as certified mail, registered mail, hand delivery, delivery by a process server, or publication. This ensures that there is a verifiable record of the notice being sent to the property owner.

What should a property owner do upon receiving an Intent to Lien?

Upon receiving an Intent to Lien, the property owner should review the document carefully. It is advisable to contact the sender promptly to discuss the payment issue. Addressing the matter quickly can help avoid further legal complications, including the recording of a lien.

What are the consequences of a recorded lien?

If a lien is recorded, it can significantly impact the property owner's ability to sell or refinance the property. Additionally, the owner may face foreclosure proceedings and could be liable for attorney fees and court costs associated with the lien process.

Is there a way to dispute an Intent to Lien?

Yes, property owners can dispute an Intent to Lien by contacting the filer to discuss the payment issue. If a resolution cannot be reached, legal advice may be necessary to explore options for contesting the lien or negotiating a settlement.

Can the Intent to Lien be withdrawn?

Yes, if the payment issue is resolved before the lien is recorded, the party who filed the Intent to Lien can withdraw it. This typically involves notifying the property owner in writing and ensuring that no lien is recorded against the property.

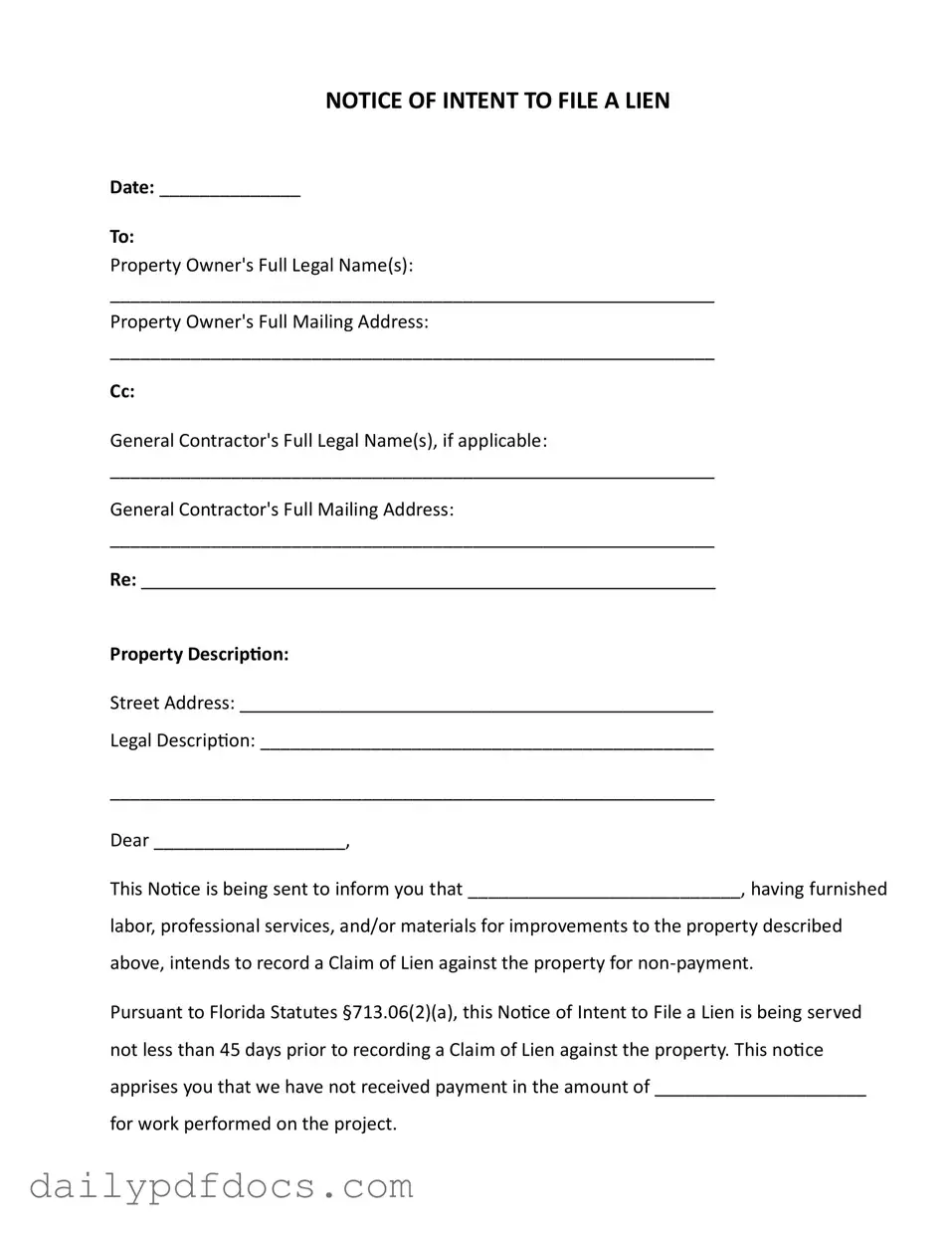

Preview - Intent To Lien Florida Form

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Similar forms

The Intent To Lien Florida form serves a specific purpose in the construction and property improvement industry. It is similar to several other documents that also address payment issues and property rights. Below are six documents that share similarities with the Intent To Lien form:

- Notice of Non-Payment: This document informs property owners that payment has not been received for services or materials. Like the Intent To Lien, it serves as a warning before further action is taken.

- Claim of Lien: Once the notice period has passed, this document can be filed to formally claim a lien against the property. It outlines the amount owed and the work performed, similar to the Intent To Lien, but is a step further in the legal process.

- Trailer Bill of Sale: This document is crucial for the sale and transfer of ownership of a trailer in Ohio, ensuring both parties have a clear understanding of the terms. For more information, you can visit Ohio PDF Forms.

- Notice to Owner: This document is sent to property owners to inform them that a contractor or supplier has been hired. It provides a record of who is working on the property, ensuring that the owner is aware of potential lien claims, akin to the Intent To Lien.

- Release of Lien: If payment is made, this document releases the lien on the property. It confirms that the debt has been settled, much like the Intent To Lien indicates a potential claim before any lien is recorded.

- Demand Letter: A demand letter requests payment for services rendered. This document serves as a formal request before legal actions are initiated, similar to the Intent To Lien, which seeks to resolve payment issues amicably.

- Contractor's Affidavit: This document may be used to affirm that all parties have been paid for their work. It provides assurance to property owners, similar to the Intent To Lien, which aims to clarify payment responsibilities.

Understanding these documents can help property owners navigate their rights and responsibilities when it comes to construction and improvement projects. Each serves a unique role but shares the common goal of ensuring fair payment practices in the industry.

Misconceptions

Misconceptions about the Intent To Lien Florida form can lead to confusion and mismanagement of property-related issues. Below is a list of nine common misconceptions along with clarifications for each.

- The Intent To Lien is a lien itself. Many believe that submitting the Intent To Lien form automatically places a lien on the property. In reality, it is a notification that a lien may be filed if payment is not received.

- All contractors must file an Intent To Lien. Not all contractors are required to submit this notice. It primarily applies to those who wish to preserve their right to file a lien for unpaid work or materials.

- The 45-day notice period is flexible. Some assume that the 45-day period can be adjusted. However, Florida law mandates this timeframe to ensure proper notification before a lien is recorded.

- Payment must be made within 30 days of the notice. While the notice states that a response is required within 30 days, it does not mean that payment must be made within that timeframe. A satisfactory response can also be a discussion or negotiation regarding payment.

- The Intent To Lien can be ignored. Ignoring the notice can have serious consequences. Failure to respond may lead to the filing of a lien, which can result in foreclosure proceedings.

- Once the Intent To Lien is filed, the property owner loses all rights. This is not true. Property owners still have rights and can dispute the lien if they believe it is unjustified.

- All notices are the same. Some believe that all Intent To Lien forms are identical. Each form must be tailored to the specific project and parties involved, reflecting accurate information.

- Filing an Intent To Lien guarantees payment. While it serves as a strong reminder for payment, it does not guarantee that the property owner will pay the outstanding amount.

- The form can be filed without proper service. Proper service of the notice is crucial. Simply filing the form without notifying the property owner may invalidate the lien claim.

Understanding these misconceptions can help property owners and contractors navigate the complexities of lien laws in Florida more effectively.

File Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an impending lien due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien. |

| Notice Period | The notice must be sent at least 45 days before filing a Claim of Lien against the property. |

| Response Time | Property owners have 30 days to respond or make payment to avoid the recording of a lien. |

| Consequences | If the lien is recorded, the property may face foreclosure proceedings, and the owner may incur additional costs. |

| Certificate of Service | A Certificate of Service is included to confirm that the notice was delivered to the property owner. |