Fill Your Independent Contractor Pay Stub Form

The Independent Contractor Pay Stub form is an essential document that provides a clear record of payments made to independent contractors. This form typically includes key information such as the contractor's name, payment date, and the amount earned for services rendered. Additionally, it outlines any deductions or withholdings that may apply, giving contractors a transparent view of their earnings. By detailing the hours worked or project milestones achieved, the pay stub helps maintain clarity in the financial relationship between contractors and clients. It serves not only as a payment receipt but also as a useful tool for contractors when tracking their income for tax purposes. Understanding this form is crucial for both contractors and businesses to ensure compliance and foster a transparent working environment.

Find Other Documents

Without Prejudice Ucc 1-308 - Affidavit content must be thorough and devoid of misleading information.

For business owners seeking to protect their interests, understanding the significance of a thorough Non-compete Agreement can be invaluable. This legal resource ensures that sensitive information remains confidential and deters ex-employees from starting competing ventures. You can access the necessary templates and guidance by reviewing the Arizona Non-compete Agreement documentation available here: informed Arizona Non-compete Agreement options.

Pregnancy Verification Letter Planned Parenthood - There are options for patients to communicate their current birth control methods on the form.

Common Questions

What is an Independent Contractor Pay Stub form?

The Independent Contractor Pay Stub form serves as a record of payment made to independent contractors for services rendered. Unlike traditional employees, independent contractors typically do not receive regular paychecks. Instead, this form provides a detailed breakdown of payments, including the amount earned, any deductions, and the total payment issued. It is essential for both contractors and businesses to maintain accurate records for tax purposes and to ensure transparency in financial transactions.

What information is typically included on the pay stub?

An Independent Contractor Pay Stub generally includes several key pieces of information. First, it lists the contractor's name and contact details, as well as the business's name and contact information. The pay stub will detail the payment period, the total amount earned, and any applicable deductions, such as taxes or fees. Additionally, it may include the payment method, whether via check, direct deposit, or another means. This comprehensive information helps both parties keep accurate financial records.

How can independent contractors use the pay stub for tax purposes?

Independent contractors can use the pay stub as a crucial document for tax reporting. Since they are responsible for reporting their income, the pay stub provides a clear record of earnings, which simplifies the process of filing taxes. Contractors can use the information on the pay stub to report their income accurately, ensuring compliance with tax regulations. Additionally, it may help in calculating any self-employment taxes owed, thus assisting in avoiding potential penalties for underreporting income.

Is it mandatory for businesses to provide a pay stub to independent contractors?

While there is no federal law mandating that businesses provide pay stubs to independent contractors, it is considered best practice. Offering a pay stub promotes transparency and helps maintain a professional relationship between the contractor and the business. Some states may have specific regulations regarding payment documentation, so businesses should be aware of local laws. Providing a pay stub can also protect the business by documenting payments made, which may be useful in case of disputes or audits.

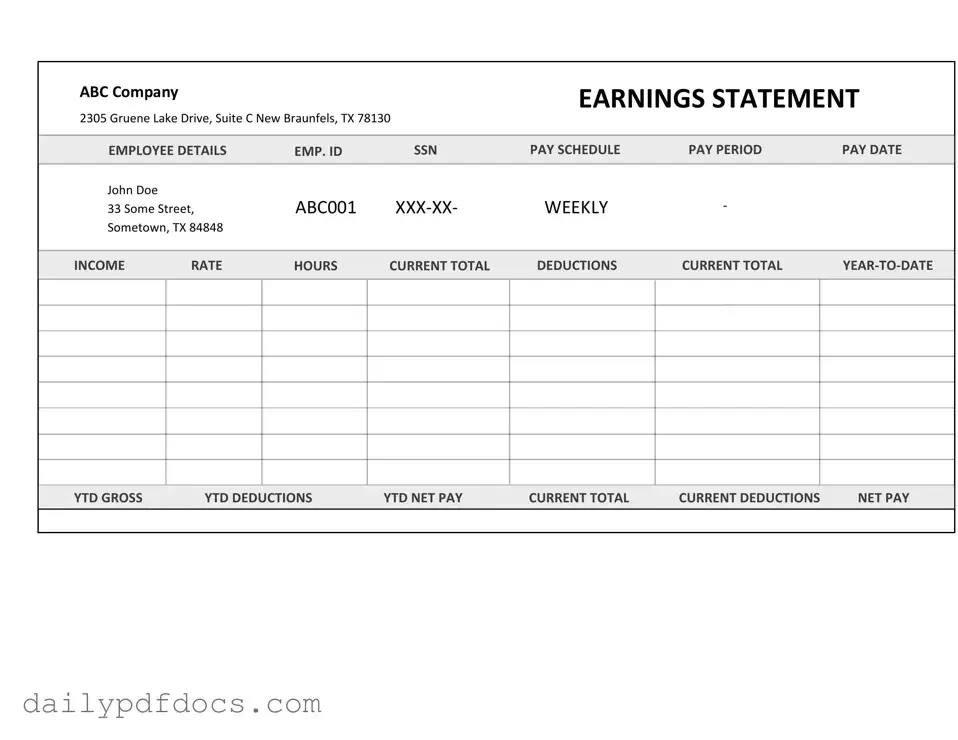

Preview - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Similar forms

- W-2 Form: This document is used by employers to report wages paid to employees and the taxes withheld. While the Independent Contractor Pay Stub shows payments made to a contractor, the W-2 outlines an employee's earnings and tax withholdings.

- Hold Harmless Agreement: Similar to other legal documents, a Hold Harmless Agreement delineates liability aspects and can be crucial for independent contractors, especially when entering risky ventures. For more information, consider visiting Washington Templates.

- 1099 Form: Independent contractors receive this form to report income earned from various sources. Similar to the Pay Stub, the 1099 details payments made, but it is specifically for tax purposes rather than a breakdown of each payment period.

- Invoice: Contractors often submit invoices to request payment for services rendered. Like the Pay Stub, an invoice itemizes services and amounts due, but it is typically issued before payment rather than after.

- Payroll Summary: This document summarizes all payroll transactions for a specific period. It shares similarities with the Pay Stub in that both provide a breakdown of earnings and deductions, but the Payroll Summary is generally used for employees rather than independent contractors.

- Payment Receipt: After payment is made, a receipt is issued to confirm the transaction. While the Pay Stub provides details about the payment, the receipt serves as proof of payment received.

- Expense Report: Contractors may submit this document to claim reimbursement for business-related expenses. Both the Expense Report and the Pay Stub help track financial transactions, but they serve different purposes—one for income and the other for expenses.

- Contract Agreement: This document outlines the terms of the working relationship between a contractor and a client. While it does not provide financial details like the Pay Stub, it is crucial for understanding the basis for payments made.

- Time Sheet: Contractors often use time sheets to record hours worked on specific projects. Similar to the Pay Stub, it reflects work completed, but the time sheet focuses on hours rather than payments received.

Misconceptions

Many people have misunderstandings about the Independent Contractor Pay Stub form. Here are some common misconceptions:

- Independent contractors do not need pay stubs. This is false. Even though independent contractors are not employees, they may still require pay stubs for their records, tax purposes, or to provide proof of income.

- All independent contractors are self-employed. While many independent contractors operate as self-employed individuals, some may work through a business entity or partnership, which can affect how they handle taxes and pay stubs.

- Pay stubs are only for employees. This is a misconception. Independent contractors can also receive pay stubs, especially if they work with clients who prefer to provide detailed payment records.

- Independent contractors cannot request a pay stub. In reality, independent contractors can and should request a pay stub if they need one for financial documentation.

- Pay stubs must include tax deductions for independent contractors. This is not accurate. Independent contractors are responsible for their own taxes, so the pay stub may not reflect tax withholdings like those for employees.

- All pay stubs look the same. Pay stubs can vary significantly based on the company or individual providing them. Different formats may include varying details, such as payment frequency and itemized services.

- Receiving a pay stub guarantees employment status. Receiving a pay stub does not change the independent contractor status. It merely serves as a record of payment.

- Independent contractors do not have to keep pay stubs. This is incorrect. It is advisable for independent contractors to keep pay stubs for their financial records and tax filings.

File Attributes

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for an independent contractor. |

| Purpose | This form provides clarity on payment details, helping contractors keep track of their income and taxes. |

| Required Information | The form typically includes the contractor's name, payment period, total earnings, and any deductions. |

| State-Specific Forms | Some states may have specific requirements for pay stubs, governed by local labor laws. |

| California Law | In California, employers must provide pay stubs that include specific information as per Labor Code Section 226. |

| Tax Implications | Independent contractors are responsible for their own taxes, and the pay stub serves as a record for tax filing. |

| Frequency of Issuance | Pay stubs should be issued regularly, typically with each payment cycle, to maintain accurate records. |

| Importance for Disputes | Having a pay stub can be crucial in resolving payment disputes between contractors and clients. |