Printable Transfer-on-Death Deed Document for Illinois

The Illinois Transfer-on-Death Deed (TOD Deed) offers a straightforward way for property owners to transfer their real estate to beneficiaries upon their passing, avoiding the lengthy probate process. This deed allows individuals to maintain full control of their property during their lifetime while designating one or more beneficiaries who will receive the property automatically after their death. Importantly, the TOD Deed must be properly executed and recorded to be valid. It is essential for property owners to understand that this form does not create any present interest for the beneficiaries; they only gain rights to the property once the owner has passed away. Additionally, the form can be revoked or modified at any time before the owner's death, providing flexibility. This deed can be an effective estate planning tool, simplifying the transfer process and ensuring that the owner’s wishes are honored without the complications of probate court. Understanding how to use the Illinois Transfer-on-Death Deed can help individuals make informed decisions about their property and estate planning needs.

More State-specific Transfer-on-Death Deed Forms

How to Avoid Probate in Pa - Property owners can create multiple Transfer-on-Death Deeds for various properties and designate different beneficiaries for each.

Ladybird Deed Texas Form - Ensure the beneficiaries are aware of the deed and its implications for future planning.

In Florida, the use of a Mobile Home Bill of Sale form is fundamental to facilitate the transfer of ownership of a mobile home, ensuring that both the buyer and seller are protected in the transaction. For those seeking a template or further guidance on this legal document, resources such as mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale can be incredibly helpful in providing clarity and structure to the process.

Free Printable Transfer on Death Deed Form Georgia - Utilizing this deed effectively can help manage family dynamics related to inheritance.

Common Questions

What is a Transfer-on-Death Deed in Illinois?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Illinois to transfer their real estate directly to a designated beneficiary upon their death. This process bypasses the probate court, making it a simpler and often quicker way to pass on property to heirs. The owner retains full control of the property during their lifetime, and they can sell or change the beneficiary at any time before their death.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Illinois can use a Transfer-on-Death Deed. This includes single individuals, married couples, and even joint owners. However, it’s important to ensure that the deed is properly executed and recorded to be valid. It’s advisable to consult with a professional if there are any complexities in ownership or if multiple beneficiaries are involved.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you will need to fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, it must be signed by the property owner in front of a notary public. Once notarized, the deed must be recorded with the county recorder’s office where the property is located. This step is crucial, as the transfer only takes effect upon the owner’s death if the deed is recorded.

Can I change the beneficiary on a Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time before your death. To do this, you will need to create a new Transfer-on-Death Deed that names the new beneficiary and record it with the county recorder’s office. Additionally, you may also revoke the original deed if you no longer wish for the previous beneficiary to inherit the property. Proper documentation is key in these situations.

What happens if I sell the property before I die?

If you sell the property before your death, the Transfer-on-Death Deed becomes void. The new owner will not be affected by the deed, as it only applies to the original property owner. If you wish to transfer a different property after selling, you will need to create a new Transfer-on-Death Deed for that new property.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property through a Transfer-on-Death Deed does not trigger immediate tax consequences. The property is still considered part of the owner’s estate for tax purposes until their death. However, beneficiaries may need to consider capital gains taxes based on the property’s value at the time of the owner's death. It’s wise to consult a tax professional for personalized advice regarding your situation.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a beneficial tool for many, but it may not be suitable for everyone. It works well for straightforward situations where the owner wants to pass property to a single beneficiary. However, if there are multiple heirs, complex family dynamics, or if the property is subject to debts, other estate planning tools may be more appropriate. It’s important to evaluate your individual circumstances and possibly seek legal advice to determine the best approach for your estate planning needs.

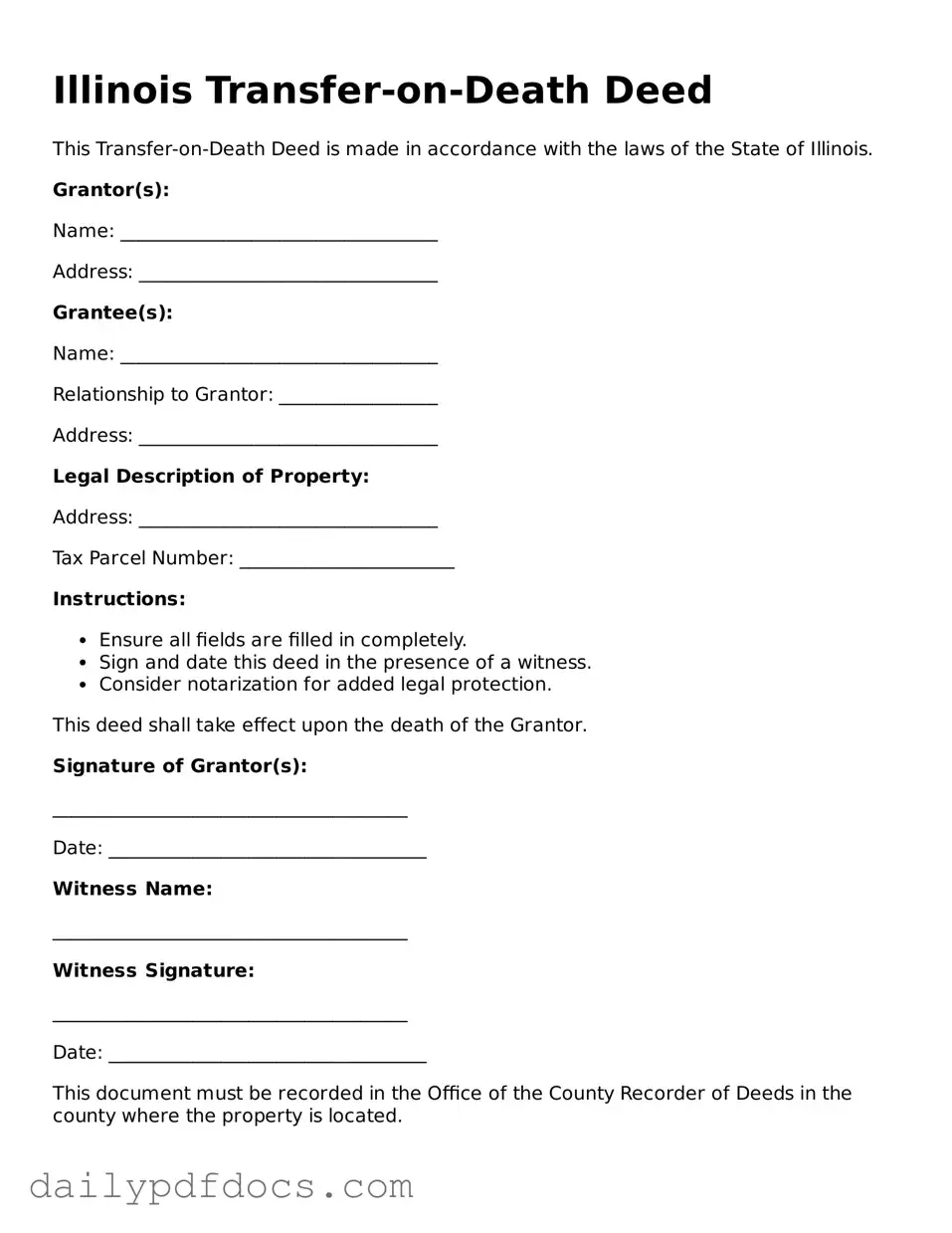

Preview - Illinois Transfer-on-Death Deed Form

Illinois Transfer-on-Death Deed

This Transfer-on-Death Deed is made in accordance with the laws of the State of Illinois.

Grantor(s):

Name: __________________________________

Address: ________________________________

Grantee(s):

Name: __________________________________

Relationship to Grantor: _________________

Address: ________________________________

Legal Description of Property:

Address: ________________________________

Tax Parcel Number: _______________________

Instructions:

- Ensure all fields are filled in completely.

- Sign and date this deed in the presence of a witness.

- Consider notarization for added legal protection.

This deed shall take effect upon the death of the Grantor.

Signature of Grantor(s):

______________________________________

Date: __________________________________

Witness Name:

______________________________________

Witness Signature:

______________________________________

Date: __________________________________

This document must be recorded in the Office of the County Recorder of Deeds in the county where the property is located.

Similar forms

- Last Will and Testament: This document outlines how a person wishes their assets to be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate, which can be a lengthy process.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed upon death. Similar to a Transfer-on-Death Deed, it avoids probate but requires more management and setup.

- Beneficiary Designation Forms: These forms are used for financial accounts and insurance policies to designate who will receive the assets upon the account holder's death. Like the Transfer-on-Death Deed, they allow for direct transfer without going through probate.

- Joint Tenancy with Right of Survivorship: This ownership structure allows two or more people to own property together, with the surviving owner automatically receiving the deceased owner’s share. This is akin to a Transfer-on-Death Deed in that it facilitates a seamless transfer of property upon death.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon their death. Similar to a Transfer-on-Death Deed, it bypasses probate and allows for a straightforward transfer of assets.

- Transfer-on-Death Registration for Securities: This is a method for transferring ownership of securities directly to a designated beneficiary upon the owner's death, mirroring the function of a Transfer-on-Death Deed for real estate.

- Family Limited Partnership Agreements: These agreements can help manage and transfer family-owned business interests or property. They share similarities with the Transfer-on-Death Deed in that they provide a mechanism for transferring assets while potentially minimizing tax implications.

- Quitclaim Deed: A Quitclaim Deed is a straightforward option for transferring property rights in Ohio without warranties, allowing the grantor to relinquish their interest in the property. For more information on how to properly complete this form, visit Ohio PDF Forms.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime while designating a beneficiary to receive the property after their death. Like the Transfer-on-Death Deed, it facilitates a transfer of ownership without the need for probate.

- Durable Power of Attorney: While primarily used for financial and healthcare decisions, a durable power of attorney can also include provisions for asset management. This document can work in conjunction with a Transfer-on-Death Deed by ensuring that the designated agent can manage assets effectively until death.

Misconceptions

Understanding the Illinois Transfer-on-Death Deed can be challenging. Here are seven common misconceptions that people may have about this form:

- It automatically transfers property upon signing. Many believe that simply signing the deed transfers ownership. In reality, the transfer only occurs upon the death of the property owner.

- It replaces a will. Some think that a Transfer-on-Death Deed serves as a substitute for a will. However, it is an additional tool for transferring property and does not replace a will.

- It can be used for all types of property. People often assume that any property can be transferred using this deed. In Illinois, it is limited to residential real estate and cannot be used for commercial properties or personal belongings.

- It requires court approval. There is a misconception that a Transfer-on-Death Deed needs to go through probate. This is incorrect; the property transfers outside of probate.

- All heirs must agree to the transfer. Some believe that all heirs must consent to the Transfer-on-Death Deed. In fact, the property owner can designate beneficiaries without needing agreement from other heirs.

- It is irrevocable once executed. Many think that once the deed is signed, it cannot be changed. However, the property owner can revoke or change the deed at any time before death.

- It eliminates estate taxes. Some individuals believe that using a Transfer-on-Death Deed will avoid estate taxes. This is not true; the property may still be subject to taxes upon the owner's death.

Being informed about these misconceptions can help ensure that property owners make the best decisions for their estate planning needs.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | The Illinois Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Illinois Probate Act, specifically 755 ILCS 27-1 et seq. |

| Eligibility | Any individual who owns real estate in Illinois can create a Transfer-on-Death Deed. |

| Beneficiaries | Multiple beneficiaries can be named, and they can be individuals or entities such as trusts or charities. |

| Revocation | The deed can be revoked at any time by the property owner, as long as they are alive and competent. |

| No Immediate Transfer | The transfer of property only occurs after the owner's death; until then, the owner retains full control of the property. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded with the county recorder's office where the property is located to be effective. |

| Tax Implications | There are generally no tax implications for the transfer until the beneficiary sells the property, at which point capital gains taxes may apply. |

| Form Availability | Illinois provides a standardized form for the Transfer-on-Death Deed, which is available online or through legal resources. |

| Legal Advice | While the form is straightforward, consulting with an attorney is advisable to ensure that it meets individual circumstances and complies with all legal requirements. |