Printable Quitclaim Deed Document for Illinois

The Illinois Quitclaim Deed form serves as a crucial tool in the transfer of real estate ownership, enabling property owners to convey their interest in a property without guaranteeing the title's validity. This straightforward document is often utilized in situations where the parties involved have a level of trust, such as transfers between family members or in divorce settlements. Importantly, the form requires essential information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. While it is less formal than other deed types, the Quitclaim Deed still necessitates proper execution, including signatures and notarization, to ensure its legal effectiveness. Understanding the nuances of this form is vital for anyone looking to navigate property transfers smoothly in Illinois, as it can significantly impact the rights and responsibilities of all parties involved.

More State-specific Quitclaim Deed Forms

How Much Does an Attorney Charge for a Quit Claim Deed - Use this deed to facilitate family property divisions.

Florida Quit Claim Deed Filled Out - While a quitclaim deed is relatively simple, its effects can be legally binding once executed properly.

New York Quitclaim Deed - The form may be completed without a notary, depending on state laws.

Ensuring legal compliance is crucial for businesses, and utilizing a tailored Non-compete Agreement can be a vital step in this process. To explore how you can create a customized document to protect your business interests, visit the resource on the Non-compete Agreement form guide.

Quit Claim Deed Form Ohio - This type of deed is useful for resolving unclear ownership situations.

Common Questions

What is a Quitclaim Deed in Illinois?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. In Illinois, it allows the current owner, known as the grantor, to relinquish any claim they may have on the property to the new owner, called the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property, making it essential for the grantee to understand the risks involved.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several situations. Common scenarios include transferring property between family members, such as from parents to children, or in divorce settlements where one party relinquishes their claim to the property. It is also useful when correcting a title issue or adding someone to the title without a sale.

How do I complete a Quitclaim Deed in Illinois?

To complete a Quitclaim Deed, you will need to fill out the form with specific details. This includes the names of the grantor and grantee, a legal description of the property, and the date of transfer. After filling it out, the grantor must sign the deed in front of a notary public. Once notarized, the deed should be filed with the county recorder’s office where the property is located.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed transfers whatever interest the grantor may have, without any warranties or guarantees. This makes Quitclaim Deeds riskier for the grantee.

Are there any fees associated with filing a Quitclaim Deed in Illinois?

Yes, there are fees involved in filing a Quitclaim Deed in Illinois. These fees vary by county, so it is important to check with your local recorder’s office for the exact amount. Additionally, there may be costs associated with obtaining a notary public's services, if needed.

Do I need an attorney to prepare a Quitclaim Deed?

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed to transfer the property back or to another party if they wish. It is important to understand that once the deed is filed, the transfer is generally considered final.

What happens if the grantor has debts?

If the grantor has outstanding debts, transferring property through a Quitclaim Deed does not necessarily shield the property from creditors. Creditors may still pursue the property to satisfy debts. It is wise to consult with a financial advisor or attorney if there are concerns about debts before completing a Quitclaim Deed.

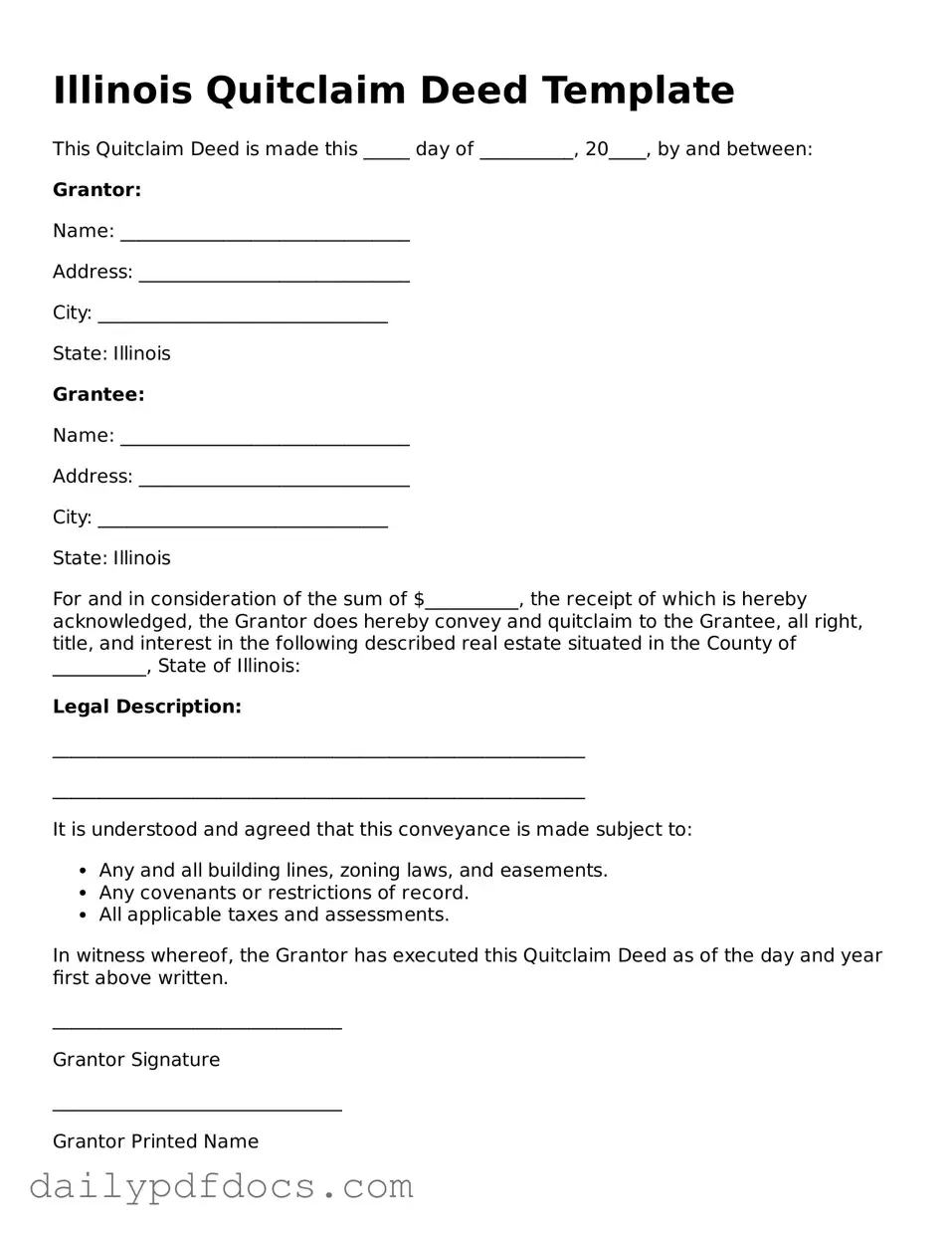

Preview - Illinois Quitclaim Deed Form

Illinois Quitclaim Deed Template

This Quitclaim Deed is made this _____ day of __________, 20____, by and between:

Grantor:

Name: _______________________________

Address: _____________________________

City: _______________________________

State: Illinois

Grantee:

Name: _______________________________

Address: _____________________________

City: _______________________________

State: Illinois

For and in consideration of the sum of $__________, the receipt of which is hereby acknowledged, the Grantor does hereby convey and quitclaim to the Grantee, all right, title, and interest in the following described real estate situated in the County of __________, State of Illinois:

Legal Description:

_________________________________________________________

_________________________________________________________

It is understood and agreed that this conveyance is made subject to:

- Any and all building lines, zoning laws, and easements.

- Any covenants or restrictions of record.

- All applicable taxes and assessments.

In witness whereof, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_______________________________

Grantor Signature

_______________________________

Grantor Printed Name

State of Illinois

County of __________

On this _____ day of __________, 20____, before me, a notary public in and for said county, personally appeared ___________________________, known to me to be the person(s) whose name(s) is (are) subscribed to the within instrument and acknowledged that they executed the same for the purposes therein contained.

Witness my hand and official seal.

_______________________________

Notary Public

My commission expires: __________

Similar forms

A Quitclaim Deed is a specific type of legal document used to transfer ownership of real estate. However, there are several other documents that serve similar purposes in property transactions. Here are four documents that share similarities with a Quitclaim Deed:

- Warranty Deed: This document provides a guarantee that the seller holds clear title to the property and has the right to transfer it. Unlike a Quitclaim Deed, which offers no warranties, a Warranty Deed assures the buyer that they will not face claims against the property.

- Ohio Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home and can be accessed at https://mobilehomebillofsale.com/blank-ohio-mobile-home-bill-of-sale/, ensuring both parties maintain a clear record of the transaction.

- Grant Deed: A Grant Deed also transfers property ownership and includes certain warranties. It guarantees that the property has not been sold to anyone else and that there are no undisclosed liens. This contrasts with a Quitclaim Deed, which does not make such assurances.

- Deed of Trust: This document is used in real estate transactions involving financing. It secures a loan by transferring the title of the property to a trustee until the loan is paid off. While it serves a different purpose than a Quitclaim Deed, both involve the transfer of property rights.

- Lease Agreement: Although primarily used for rental arrangements, a Lease Agreement can convey certain rights to use and occupy a property. Like a Quitclaim Deed, it involves the transfer of specific rights related to property, but it does not convey ownership.

Misconceptions

Understanding the Illinois Quitclaim Deed can be tricky. Here are ten common misconceptions about this form, along with clarifications to help you navigate it better.

- It transfers ownership completely. A quitclaim deed transfers whatever interest the grantor has in the property. If the grantor has no ownership, the deed conveys nothing.

- It guarantees clear title. A quitclaim deed does not guarantee that the title is clear. It simply transfers the interest the grantor has, which may include liens or other claims.

- It's only for family transfers. While often used among family members, quitclaim deeds can be used in various situations, including sales and transfers between friends or business partners.

- It requires a lawyer to complete. While having a lawyer can help, it's not legally required to fill out a quitclaim deed. Many people complete it on their own.

- It is the same as a warranty deed. A quitclaim deed is different from a warranty deed. A warranty deed provides a guarantee of clear title, while a quitclaim deed does not.

- It can be used to remove a co-owner. A quitclaim deed can transfer a co-owner’s interest, but it does not remove them from the title unless they willingly sign the deed.

- It must be notarized. In Illinois, a quitclaim deed must be signed in front of a notary public to be valid. This is an important step to ensure its legality.

- It can be used for any type of property. A quitclaim deed can be used for real estate but is not suitable for personal property like vehicles or other assets.

- It is a quick way to sell property. While it can be a fast way to transfer ownership, it does not replace the need for a proper sale process, including disclosures and negotiations.

- Once signed, it cannot be revoked. While a quitclaim deed is generally final, the grantor may be able to revoke it under certain circumstances, such as mutual agreement or legal action.

Being aware of these misconceptions can help you make informed decisions regarding property transfers in Illinois. Always consider seeking professional advice if you have questions or concerns.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | An Illinois Quitclaim Deed transfers ownership of real property without guaranteeing that the title is clear. |

| Governing Law | The Illinois Quitclaim Deed is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Parties Involved | The form involves two parties: the grantor (seller) and the grantee (buyer). |

| Consideration | While a monetary consideration is typically included, it is not required for the deed to be valid. |

| Notarization | The signature of the grantor must be notarized to ensure authenticity. |

| Recording | To protect the grantee's interest, the deed should be recorded with the county recorder's office. |

| Limitations | A quitclaim deed does not provide any warranties or guarantees regarding the property title. |

| Usage | This type of deed is commonly used in family transfers, divorces, or to clear up title issues. |