Printable Promissory Note Document for Illinois

In Illinois, a Promissory Note serves as a crucial financial document that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This legally binding instrument details essential elements such as the principal amount, interest rate, repayment schedule, and any applicable penalties for late payments. It also specifies the rights and responsibilities of both parties, ensuring clarity and protection throughout the loan process. The form can be tailored to accommodate various lending scenarios, whether for personal loans, business transactions, or real estate financing. By providing a clear framework for the loan agreement, the Illinois Promissory Note helps to minimize misunderstandings and disputes, making it an indispensable tool for both borrowers and lenders in the state.

More State-specific Promissory Note Forms

Promissory Note Template Florida Pdf - Use this form as a straightforward way to formalize a loan and set boundaries for repayment.

A Florida Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form outlines essential details such as the buyer, seller, and the mobile home's specifications. For more information on this important document, you can visit mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale. Understanding this document is crucial for ensuring a smooth transaction and protecting the rights of both parties involved.

Ohio Promissory Note - The terms can include specific conditions related to the borrower's performance.

Common Questions

What is a promissory note in Illinois?

A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. In Illinois, this document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payment. It serves as a legal record of the agreement between the borrower and lender.

What are the essential components of an Illinois promissory note?

An Illinois promissory note should include the following components: the names and addresses of the borrower and lender, the principal amount of the loan, the interest rate (if applicable), the repayment terms, and the date of the agreement. Additionally, it should specify any late fees or penalties and include a signature line for both parties.

Is a promissory note legally binding in Illinois?

Do I need a witness or notarization for a promissory note in Illinois?

While Illinois law does not require a witness or notarization for a promissory note to be valid, having a notary public sign the document can provide additional legal protection. It can help verify the identities of the parties involved and the authenticity of their signatures, which may be useful if disputes arise later.

Can a promissory note be modified after it is signed?

What happens if the borrower defaults on the promissory note?

If the borrower defaults on the promissory note, the lender has the right to take legal action to recover the owed amount. This may include filing a lawsuit or seeking a judgment against the borrower. Depending on the terms of the note, the lender may also be able to impose late fees or accelerate the repayment schedule.

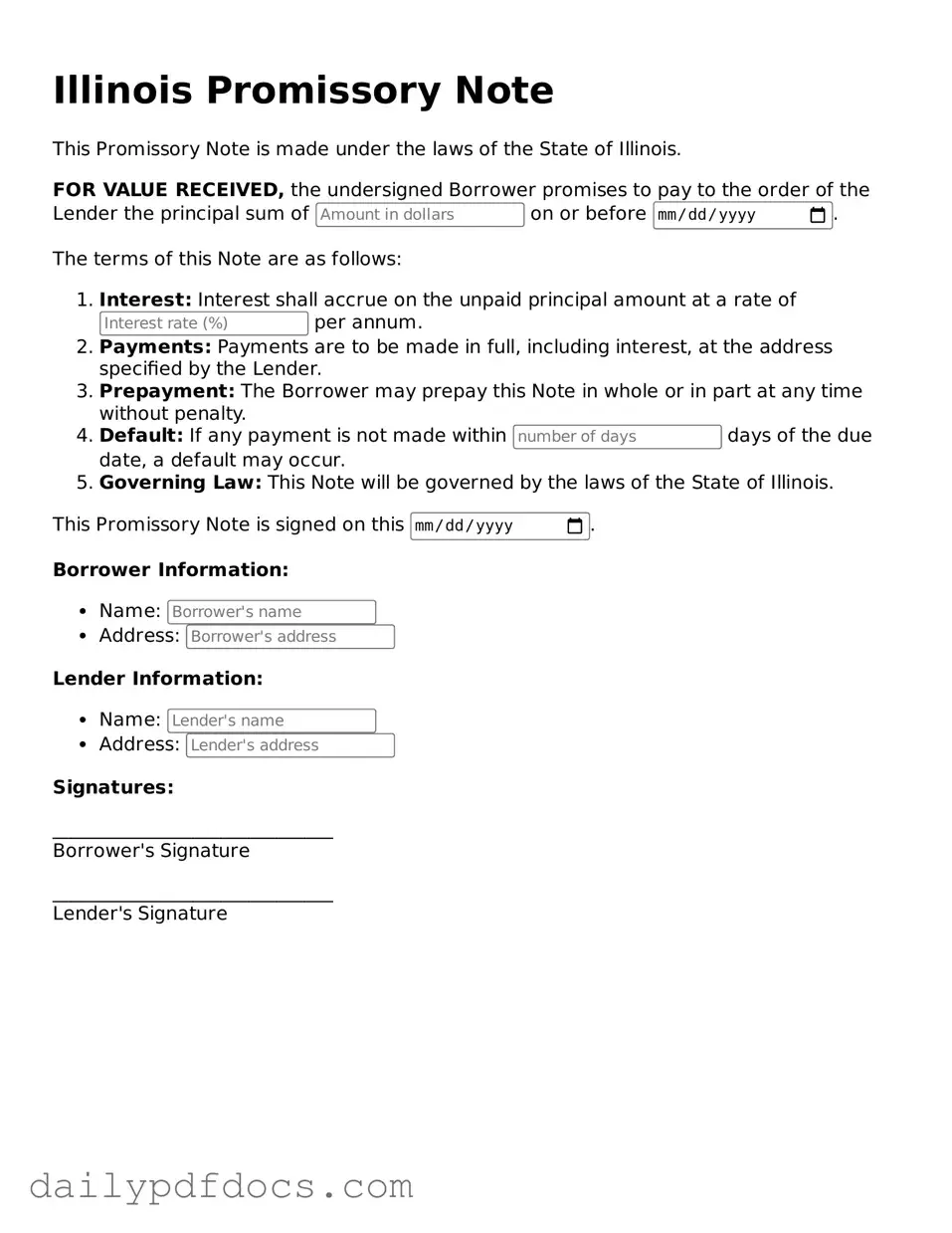

Preview - Illinois Promissory Note Form

Illinois Promissory Note

This Promissory Note is made under the laws of the State of Illinois.

FOR VALUE RECEIVED, the undersigned Borrower promises to pay to the order of the Lender the principal sum of on or before .

The terms of this Note are as follows:

- Interest: Interest shall accrue on the unpaid principal amount at a rate of per annum.

- Payments: Payments are to be made in full, including interest, at the address specified by the Lender.

- Prepayment: The Borrower may prepay this Note in whole or in part at any time without penalty.

- Default: If any payment is not made within days of the due date, a default may occur.

- Governing Law: This Note will be governed by the laws of the State of Illinois.

This Promissory Note is signed on this .

Borrower Information:

- Name:

- Address:

Lender Information:

- Name:

- Address:

Signatures:

______________________________

Borrower's Signature

______________________________

Lender's Signature

Similar forms

-

Loan Agreement: Like a promissory note, a loan agreement outlines the terms of borrowing money. It details the amount borrowed, interest rates, repayment schedules, and any penalties for late payments. However, a loan agreement typically includes more comprehensive terms and conditions than a promissory note.

-

Mortgage: A mortgage is a specific type of loan secured by real property. Similar to a promissory note, it includes a promise to repay the borrowed amount. However, it also involves the property itself as collateral, which adds an additional layer of security for the lender.

-

Installment Agreement: This document outlines a plan for paying off a debt in regular installments over time. Like a promissory note, it specifies the total amount owed and the payment schedule. The key difference lies in the focus on periodic payments rather than a single lump-sum payment.

-

Last Will and Testament: A Last Will and Testament form is a crucial document that outlines a person's final wishes regarding their possessions and the care of their dependents. This legal instrument ensures that their assets are distributed according to their preferences, safeguarding the future of their loved ones. It serves as a foundational element of personal estate planning, making the intentions clear and legally enforceable. For more information, visit legalformspdf.com/.

-

Personal Guarantee: A personal guarantee is a commitment made by an individual to repay a debt if the primary borrower defaults. Similar to a promissory note, it establishes a legal obligation to pay. However, it is often used in business transactions to provide additional security for lenders.

-

Credit Agreement: This document governs the terms of a credit relationship between a lender and borrower. Like a promissory note, it includes details about the loan amount and repayment terms. However, a credit agreement may cover multiple loans or credit extensions, making it broader in scope.

Misconceptions

Understanding the Illinois Promissory Note form can be challenging due to various misconceptions. Here are eight common misunderstandings that can lead to confusion:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, each note can be tailored to fit the specific agreement between the borrower and lender.

- A Promissory Note Must Be Notarized: Some think that notarization is a requirement for all promissory notes. While notarization can add an extra layer of security, it is not mandatory for a promissory note to be legally binding in Illinois.

- Only Banks Can Issue Promissory Notes: It is a common misconception that only financial institutions can create promissory notes. In fact, individuals can also draft and sign these documents for personal loans.

- Promissory Notes Are Only for Large Amounts: Many assume that promissory notes are only applicable for significant loans. However, they can be used for any amount, regardless of size, as long as both parties agree.

- Verbal Agreements Are Sufficient: Some believe that a verbal agreement is enough to secure a loan. While verbal agreements can be valid, having a written promissory note provides clear documentation and protection for both parties.

- Interest Rates Must Be Included: There is a misconception that all promissory notes must include an interest rate. While many do, it is possible to create a note without interest, depending on the agreement.

- Once Signed, a Promissory Note Cannot Be Changed: Many people think that once a promissory note is signed, it cannot be altered. In fact, parties can agree to modify the terms as long as both sides consent to the changes.

- Promissory Notes Are Only for Loans: Some believe that promissory notes are exclusively for loan agreements. However, they can also be used in other financial arrangements, such as repayment plans or business transactions.

By addressing these misconceptions, individuals can better navigate the process of creating and using promissory notes in Illinois.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | An Illinois Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Illinois Uniform Commercial Code (UCC) governs promissory notes in Illinois, specifically Article 3. |

| Parties Involved | Typically, there are two parties: the maker (borrower) who promises to pay, and the payee (lender) who receives the payment. |

| Interest Rate | The interest rate can be specified in the note. If not, Illinois law allows for a default interest rate of 5% per annum. |

| Payment Terms | Payment terms, including due dates and installment amounts, should be clearly outlined in the note to avoid confusion. |

| Signatures | The note must be signed by the maker to be legally binding. A witness or notary is not required but can add an extra layer of security. |

| Default Consequences | If the maker fails to pay as promised, the payee has the right to pursue legal action to recover the owed amount. |

| Transferability | Promissory notes in Illinois can often be transferred to another party, making them negotiable instruments under the UCC. |