Printable Power of Attorney Document for Illinois

The Illinois Power of Attorney form serves as a crucial legal document that empowers individuals to designate another person to make decisions on their behalf, particularly in matters related to health care and financial affairs. This form is essential for ensuring that a person's preferences are respected when they are unable to communicate their wishes due to illness or incapacitation. The document can be tailored to specify the scope of authority granted to the agent, allowing for a broad or limited range of powers. Additionally, it includes provisions that can address various situations, such as medical treatment decisions or the management of financial assets. Importantly, the Illinois Power of Attorney form requires the signatures of both the principal and the agent, as well as witnesses or a notary, to ensure its validity. Understanding the intricacies of this form is vital for anyone considering establishing a power of attorney, as it provides a framework for making informed choices about personal and financial well-being during times of need.

More State-specific Power of Attorney Forms

Printable Power of Attorney Form Florida - A way to appoint someone to handle healthcare decisions.

A Power of Attorney is an important tool for anyone looking to ensure their affairs are in order. With a Washington Power of Attorney form, you can appoint a trusted individual to make crucial decisions during times when you may not be able to express your wishes yourself. It is advisable to utilize resources like Washington Templates to guide you through the process, making sure every detail is correctly addressed and your preferences are honored.

New York State Power of Attorney - It can be tailored to specific tasks or general authority.

How to Fill Out Power of Attorney - A comprehensive Power of Attorney can eliminate potential legal battles among family members.

Power of Attorney in Ohio - This document can grant authority for financial matters or healthcare decisions.

Common Questions

What is a Power of Attorney in Illinois?

A Power of Attorney (POA) in Illinois is a legal document that allows one person, known as the "principal," to designate another person, referred to as the "agent" or "attorney-in-fact," to make decisions on their behalf. This can include financial decisions, medical decisions, or other personal matters. The POA can be limited to specific tasks or can grant broad authority, depending on the principal's wishes.

What types of Power of Attorney are available in Illinois?

Illinois recognizes several types of Power of Attorney documents. The most common are the Durable Power of Attorney for Health Care, which allows the agent to make medical decisions, and the Durable Power of Attorney for Property, which grants the agent authority over financial matters. There are also springing POAs that only take effect under certain conditions, such as when the principal becomes incapacitated.

How do I create a Power of Attorney in Illinois?

To create a Power of Attorney in Illinois, you must complete a specific form that meets state requirements. This form needs to be signed by the principal and witnessed by at least one individual who is not the agent. In some cases, notarization may also be required. It's crucial to ensure that the document is clear and accurately reflects your wishes.

Can I revoke a Power of Attorney in Illinois?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To do this, you should create a written revocation notice and notify your agent and any relevant third parties. It’s advisable to also destroy any copies of the original POA to prevent confusion.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a Durable Power of Attorney remains in effect, allowing the agent to act on the principal's behalf. However, if the POA is not durable, it will become invalid upon the principal's incapacity. This is why many people choose a durable option to ensure their wishes are honored even when they can no longer communicate them.

Do I need an attorney to create a Power of Attorney?

While it is not legally required to have an attorney to create a Power of Attorney in Illinois, consulting one is highly recommended. An attorney can help ensure that the document meets all legal requirements and accurately reflects your intentions. This can prevent potential disputes or issues down the line.

Can an agent be held liable for their actions under a Power of Attorney?

An agent has a fiduciary duty to act in the best interests of the principal. If the agent fails to do so, they may be held liable for any resulting damages. It's important for agents to understand their responsibilities and act with care, honesty, and loyalty to avoid legal repercussions.

Is there a specific form I must use for a Power of Attorney in Illinois?

Yes, Illinois has a statutory form for Power of Attorney documents that is widely used. While you can create a custom POA, using the statutory form helps ensure that all legal requirements are met. This form can be found on the Illinois Secretary of State's website or through legal resources.

Can a Power of Attorney be used for both financial and health care decisions?

Yes, a Power of Attorney can be set up to cover both financial and health care decisions, but it's often recommended to create separate documents for clarity. A Durable Power of Attorney for Health Care specifically addresses medical decisions, while a Durable Power of Attorney for Property focuses on financial matters. This separation can help avoid confusion about the agent's authority in different situations.

What should I consider when choosing an agent for my Power of Attorney?

Choosing an agent is a significant decision. It's essential to select someone you trust completely, as they will have considerable authority over your affairs. Consider their ability to make decisions, their understanding of your values and wishes, and their willingness to take on the responsibility. Open communication with your chosen agent about your preferences and expectations is also crucial.

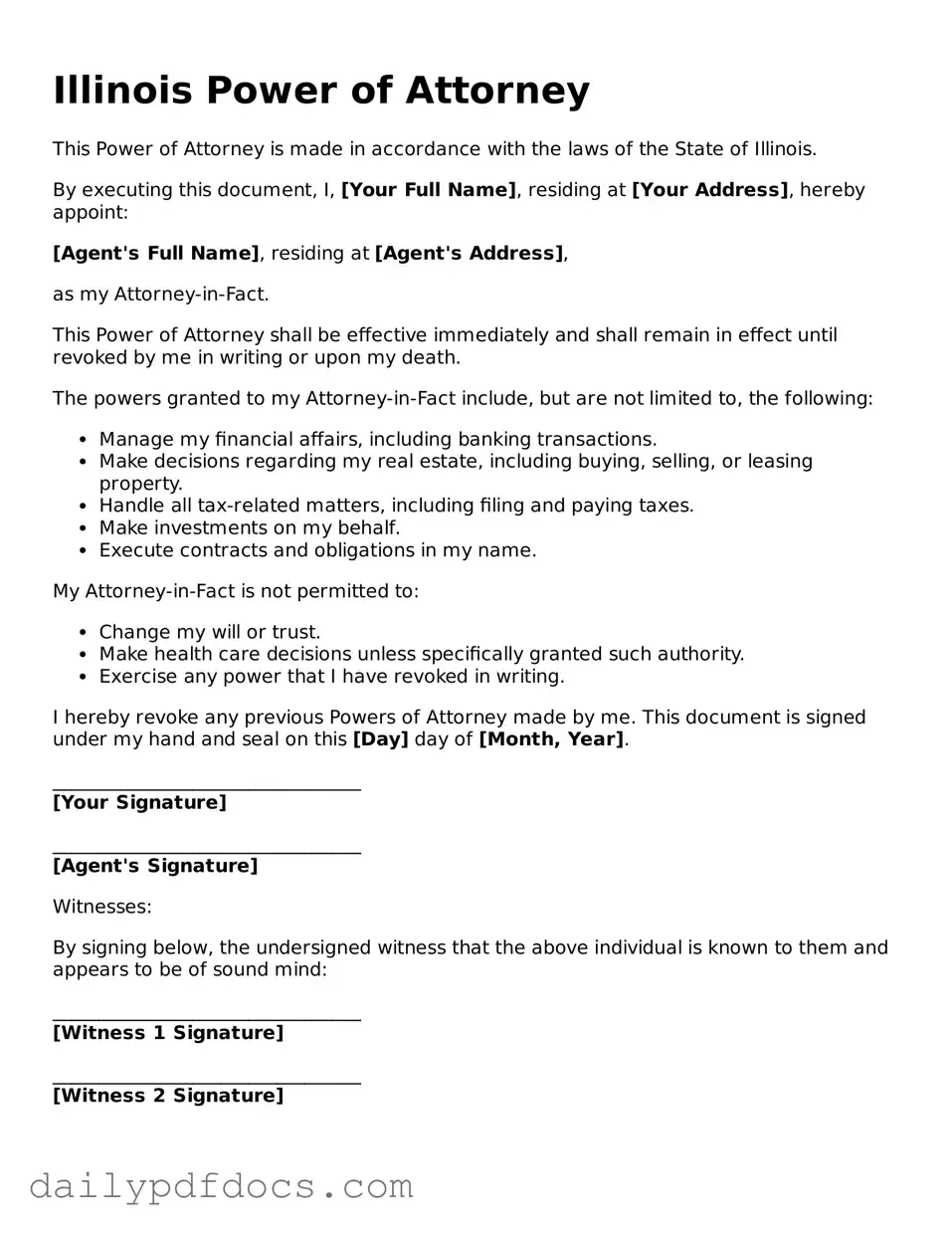

Preview - Illinois Power of Attorney Form

Illinois Power of Attorney

This Power of Attorney is made in accordance with the laws of the State of Illinois.

By executing this document, I, [Your Full Name], residing at [Your Address], hereby appoint:

[Agent's Full Name], residing at [Agent's Address],

as my Attorney-in-Fact.

This Power of Attorney shall be effective immediately and shall remain in effect until revoked by me in writing or upon my death.

The powers granted to my Attorney-in-Fact include, but are not limited to, the following:

- Manage my financial affairs, including banking transactions.

- Make decisions regarding my real estate, including buying, selling, or leasing property.

- Handle all tax-related matters, including filing and paying taxes.

- Make investments on my behalf.

- Execute contracts and obligations in my name.

My Attorney-in-Fact is not permitted to:

- Change my will or trust.

- Make health care decisions unless specifically granted such authority.

- Exercise any power that I have revoked in writing.

I hereby revoke any previous Powers of Attorney made by me. This document is signed under my hand and seal on this [Day] day of [Month, Year].

_________________________________

[Your Signature]

_________________________________

[Agent's Signature]

Witnesses:

By signing below, the undersigned witness that the above individual is known to them and appears to be of sound mind:

_________________________________

[Witness 1 Signature]

_________________________________

[Witness 2 Signature]

Similar forms

-

Living Will: A living will outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. Like a Power of Attorney, it is a legal document that provides guidance on how decisions should be made, but it specifically focuses on healthcare decisions rather than financial or legal matters.

-

Health Care Proxy: This document allows an individual to designate someone to make healthcare decisions on their behalf if they become incapacitated. Similar to a Power of Attorney, a health care proxy grants authority to another person, but it is specifically limited to health-related decisions.

-

Durable Power of Attorney: This is a specific type of Power of Attorney that remains in effect even if the person who created it becomes incapacitated. Both documents empower someone to act on another's behalf, but the durable version ensures that the authority persists during periods of incapacity.

-

Financial Power of Attorney: This document allows an individual to appoint someone to manage their financial affairs. While a general Power of Attorney can cover a range of decisions, a financial Power of Attorney specifically focuses on financial matters, such as managing bank accounts, paying bills, and handling investments.

Misconceptions

Understanding the Illinois Power of Attorney form can be challenging due to various misconceptions. Here are eight common misunderstandings, along with clarifications to help individuals navigate this important legal document.

-

Misconception: A Power of Attorney is only for the elderly.

This is not true. Anyone, regardless of age, can benefit from having a Power of Attorney. It is particularly useful for individuals who may face medical emergencies or other situations where they cannot make decisions for themselves.

-

Misconception: A Power of Attorney gives unlimited power to the agent.

While a Power of Attorney does grant significant authority, the powers are defined within the document itself. The principal can specify what powers are granted and can limit them as necessary.

-

Misconception: A Power of Attorney is permanent and cannot be revoked.

This is incorrect. The principal can revoke a Power of Attorney at any time, as long as they are mentally competent. Revocation must be done in writing and communicated to the agent.

-

Misconception: An agent must be a lawyer or a financial professional.

While it is common for individuals to choose professionals as their agents, any trustworthy adult can serve in this role. The key is to select someone who understands your wishes and can act in your best interest.

-

Misconception: A Power of Attorney is only useful for financial matters.

This is a misconception. A Power of Attorney can also be used for healthcare decisions. In Illinois, a separate form, known as the Power of Attorney for Health Care, allows the agent to make medical decisions on behalf of the principal.

-

Misconception: A Power of Attorney is the same as a living will.

These are distinct documents. A living will outlines an individual's wishes regarding medical treatment in end-of-life situations, while a Power of Attorney designates someone to make decisions on behalf of the individual.

-

Misconception: A Power of Attorney can only be used when the principal is incapacitated.

This is misleading. A Power of Attorney can be effective immediately upon signing, or it can be set to become effective only upon the principal's incapacity, depending on the preferences expressed in the document.

-

Misconception: Once a Power of Attorney is signed, it cannot be changed.

This is not accurate. The principal has the right to update or change their Power of Attorney at any time, as long as they are mentally competent. Changes should be documented properly to avoid confusion.

By addressing these misconceptions, individuals can make informed decisions about their Power of Attorney and ensure their wishes are respected in various situations.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | The Illinois Power of Attorney form allows individuals to designate another person to make decisions on their behalf regarding financial and medical matters. |

| Governing Law | This form is governed by the Illinois Power of Attorney Act (755 ILCS 45/1-1 et seq.). |

| Types of Powers | There are two main types: Power of Attorney for Health Care and Power of Attorney for Property. Each serves a different purpose. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent to do so. |