Printable Operating Agreement Document for Illinois

The Illinois Operating Agreement form is a crucial document for individuals and entities looking to establish a limited liability company (LLC) in the state of Illinois. This form serves as a foundational agreement among the members of the LLC, outlining the management structure, financial arrangements, and operational procedures that will govern the company. Key components often included in the agreement are the roles and responsibilities of each member, the process for making important business decisions, and guidelines for profit distribution. Additionally, the form addresses the procedures for adding new members or handling the departure of existing ones, ensuring that all parties have a clear understanding of their rights and obligations. By clearly defining these aspects, the Illinois Operating Agreement fosters transparency and helps to prevent disputes among members, ultimately contributing to the long-term success of the LLC.

More State-specific Operating Agreement Forms

Ohio Llc Operating Agreement - The form can outline the rights of each member in terms of management and profits.

For those looking to manage their healthcare decisions, understanding the importance of a proper Living Will is crucial. This directive ensures that your medical preferences are honored, particularly during unexpected health crises. To learn more about preparing this vital document, visit the informative guide on the Arizona Living Will process.

Operating Agreement Llc New York - Creating an Operating Agreement can streamline business operations.

Common Questions

What is an Illinois Operating Agreement?

An Illinois Operating Agreement is a legal document that outlines the management structure and operating procedures of a Limited Liability Company (LLC) in Illinois. It details the rights and responsibilities of the members, how profits and losses are distributed, and the procedures for making decisions. While not required by law, having an Operating Agreement is highly recommended as it helps prevent disputes among members and provides clarity on how the business will operate.

Who should have an Operating Agreement?

All LLCs in Illinois, whether single-member or multi-member, should have an Operating Agreement. Even if you are the sole owner, this document can help protect your personal assets and establish clear guidelines for your business. For multi-member LLCs, it is especially important to have an Operating Agreement to ensure everyone is on the same page regarding roles, responsibilities, and profit-sharing.

What should be included in the Operating Agreement?

Your Operating Agreement should cover several key areas, including the name of the LLC, the purpose of the business, the names of the members, and their ownership percentages. It should also outline how decisions will be made, the process for adding or removing members, and how profits and losses will be distributed. Additionally, consider including provisions for dispute resolution and what happens if a member wants to leave the LLC.

Is the Operating Agreement filed with the state?

No, the Operating Agreement is not filed with the state of Illinois. It is an internal document that remains with the LLC. However, it is important to keep it updated and accessible to all members. Having a well-drafted Operating Agreement can be beneficial if you ever face legal disputes or need to clarify roles within the business.

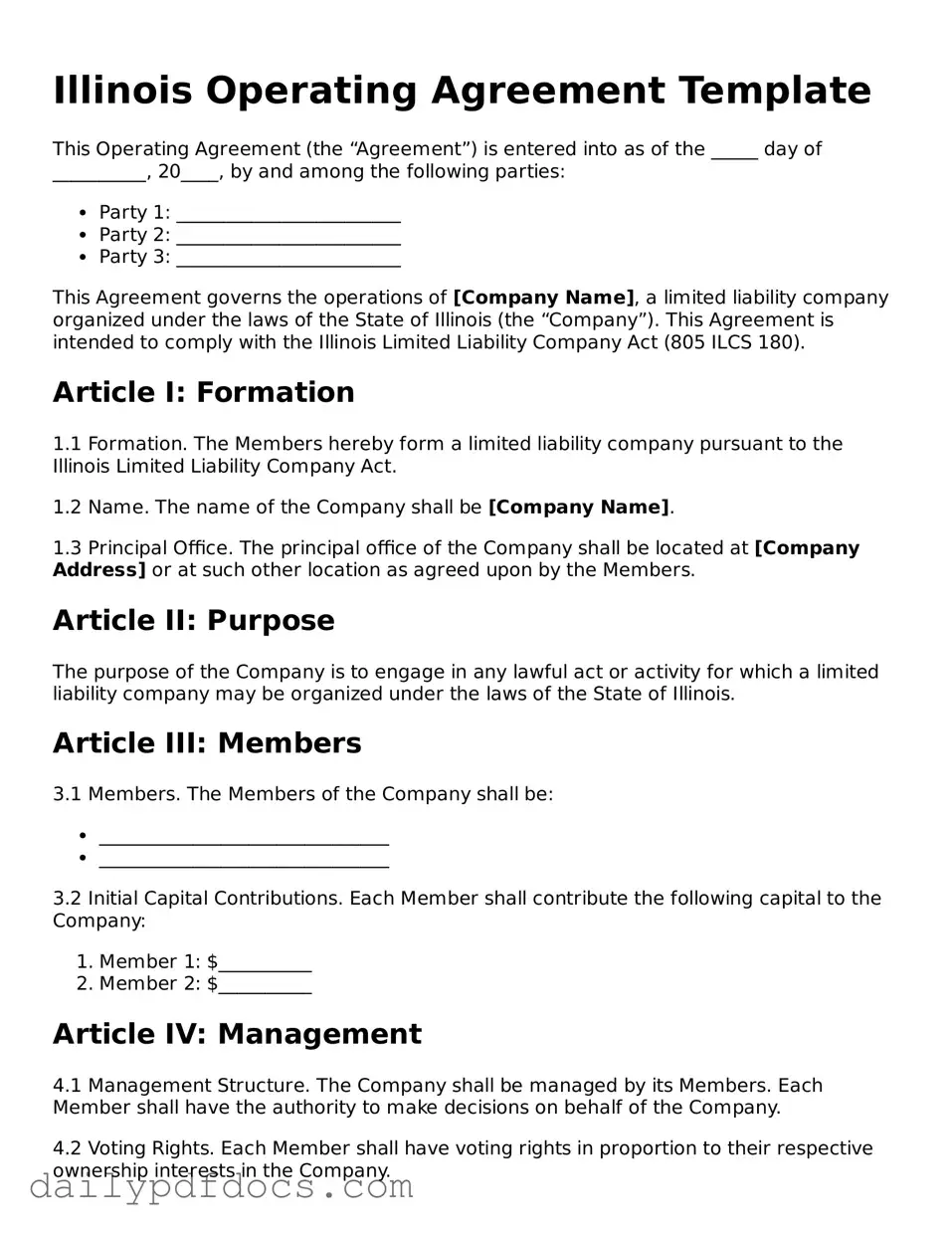

Preview - Illinois Operating Agreement Form

Illinois Operating Agreement Template

This Operating Agreement (the “Agreement”) is entered into as of the _____ day of __________, 20____, by and among the following parties:

- Party 1: ________________________

- Party 2: ________________________

- Party 3: ________________________

This Agreement governs the operations of [Company Name], a limited liability company organized under the laws of the State of Illinois (the “Company”). This Agreement is intended to comply with the Illinois Limited Liability Company Act (805 ILCS 180).

Article I: Formation

1.1 Formation. The Members hereby form a limited liability company pursuant to the Illinois Limited Liability Company Act.

1.2 Name. The name of the Company shall be [Company Name].

1.3 Principal Office. The principal office of the Company shall be located at [Company Address] or at such other location as agreed upon by the Members.

Article II: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a limited liability company may be organized under the laws of the State of Illinois.

Article III: Members

3.1 Members. The Members of the Company shall be:

- _______________________________

- _______________________________

3.2 Initial Capital Contributions. Each Member shall contribute the following capital to the Company:

- Member 1: $__________

- Member 2: $__________

Article IV: Management

4.1 Management Structure. The Company shall be managed by its Members. Each Member shall have the authority to make decisions on behalf of the Company.

4.2 Voting Rights. Each Member shall have voting rights in proportion to their respective ownership interests in the Company.

Article V: Distributions

5.1 Distributions of Profits and Losses. Profits and losses of the Company shall be allocated to the Members in accordance with their percentage interests.

Article VI: Indemnification

The Company shall indemnify any Member or former Member to the fullest extent permitted by law against any and all expenses and liabilities incurred in connection with the Company's activities.

Article VII: Amendments

This Agreement may be amended only by a written instrument signed by all Members.

Article VIII: Miscellaneous

8.1 Governing Law. This Agreement shall be governed by the laws of the State of Illinois.

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the day and year first above written.

Member Signatures:

- _______________________________

- _______________________________

- _______________________________

Similar forms

- Partnership Agreement: Similar to an Operating Agreement, a Partnership Agreement outlines the roles and responsibilities of partners in a business. Both documents clarify how decisions are made and how profits are shared.

- Bylaws: Bylaws serve as the internal rules for a corporation, detailing how the organization operates. Like an Operating Agreement, they specify governance structures and procedures for meetings.

- Employment Verification: To confirm an employee's work history and job details, utilize the Washington Employment Verification form, which is a vital document in processes such as loan applications and background checks. For more information, visit Washington Templates.

- Shareholder Agreement: This document governs the relationship between shareholders in a corporation. It is similar to an Operating Agreement in that it outlines rights, obligations, and procedures for transferring shares.

- Membership Agreement: A Membership Agreement is used in limited liability companies (LLCs) to define the rights and duties of members. It functions similarly to an Operating Agreement by establishing the framework for member interactions.

- Joint Venture Agreement: This agreement is used when two or more parties collaborate on a specific project. Like an Operating Agreement, it defines contributions, responsibilities, and profit-sharing among the parties involved.

- Service Agreement: A Service Agreement outlines the terms under which services will be provided. It shares similarities with an Operating Agreement in that both documents clarify expectations and responsibilities of the parties.

- Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While it serves a different purpose, it is similar in that it establishes clear terms and conditions for the relationship between the parties involved.

Misconceptions

Misconceptions about the Illinois Operating Agreement form can lead to confusion for business owners. Here are eight common misunderstandings:

- It is only necessary for large businesses. Many believe that only large companies need an Operating Agreement. However, all LLCs in Illinois benefit from having one, regardless of size.

- It is a public document. Some think that the Operating Agreement must be filed with the state and is public information. In reality, it is a private document that remains with the members of the LLC.

- It is not legally binding. There is a misconception that an Operating Agreement holds no legal weight. In fact, it is a binding contract among the members, outlining their rights and responsibilities.

- It cannot be changed. Some believe that once an Operating Agreement is created, it cannot be modified. In truth, members can amend the agreement as needed, following the procedures outlined within it.

- All members must agree on every decision. Many think that unanimous consent is required for all decisions. While some major decisions may require unanimous agreement, most day-to-day operations can be managed by a majority vote.

- It is only for multi-member LLCs. Some individuals think that single-member LLCs do not need an Operating Agreement. However, having one can still clarify the owner's intentions and protect personal assets.

- It is the same as the Articles of Organization. There is a common belief that these two documents serve the same purpose. The Articles of Organization establish the LLC with the state, while the Operating Agreement governs internal operations.

- It is optional. Some may think that having an Operating Agreement is optional. In Illinois, while it is not legally required, it is highly recommended to avoid disputes and clarify member roles.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Operating Agreement outlines the management structure and operational guidelines for a Limited Liability Company (LLC). |

| Governing Law | The agreement is governed by the Illinois Limited Liability Company Act. |

| Mandatory Requirement | While not required by law, having an Operating Agreement is highly recommended for LLCs in Illinois. |

| Member Rights | The agreement specifies the rights and responsibilities of each member within the LLC. |

| Profit Distribution | It outlines how profits and losses will be distributed among members. |

| Decision-Making | The Operating Agreement defines the decision-making process, including voting rights and procedures. |

| Amendments | It provides a framework for how the agreement can be amended in the future. |

| Dispute Resolution | The agreement may include provisions for resolving disputes among members. |

| Duration | It can specify the duration of the LLC, whether it is perpetual or for a set term. |

| State Filing | No need to file the Operating Agreement with the state; it is kept internally by the LLC. |