Printable Loan Agreement Document for Illinois

The Illinois Loan Agreement form serves as a vital document for individuals and businesses seeking to formalize a loan arrangement. This form outlines the terms and conditions agreed upon by both the lender and the borrower, ensuring clarity and protection for both parties involved. Key aspects of the form include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it specifies the rights and responsibilities of each party, including consequences for defaulting on the loan. By detailing these elements, the agreement helps to prevent misunderstandings and disputes, fostering a transparent relationship between the lender and borrower. Whether for personal use or business financing, understanding the Illinois Loan Agreement form is essential for anyone entering into a loan arrangement in the state.

More State-specific Loan Agreement Forms

Promissory Note Template Florida Pdf - This form might address the rights to transfer or sell the loan under certain conditions.

California Promissory Note Template - Outlines the rights of both parties in the event of default.

The Ohio Operating Agreement form is a legal document that outlines the management structure and operational procedures of a limited liability company (LLC) in Ohio. This form serves as a foundational agreement among members, detailing their rights and responsibilities. For those interested in learning more about this important document, additional resources can be found at Ohio PDF Forms, which provide guidance on its components to ensure compliance and effective governance within the LLC.

Promissory Note Georgia - Understanding the consequences of early repayment is essential for borrowers.

Common Questions

What is an Illinois Loan Agreement form?

The Illinois Loan Agreement form is a legal document used to outline the terms of a loan between a lender and a borrower. It specifies the amount borrowed, the interest rate, repayment schedule, and any other conditions that both parties agree upon. This form helps protect the rights of both the lender and the borrower by clearly stating their obligations.

Who should use the Illinois Loan Agreement form?

This form is suitable for individuals or businesses that wish to formalize a loan arrangement. Whether you are lending money to a friend, family member, or a business, using this agreement can help avoid misunderstandings and disputes in the future.

What key elements should be included in the agreement?

Essential elements of the Illinois Loan Agreement include the loan amount, interest rate, repayment schedule, due dates, and any collateral involved. Additionally, it should outline the consequences of late payments or defaults. Both parties should review these terms carefully to ensure clarity and mutual understanding.

Is it necessary to have a witness or notary for the agreement?

While it is not always required to have a witness or notary for a loan agreement in Illinois, having one can add an extra layer of legitimacy to the document. If either party later disputes the agreement, having a notarized document can help prove its validity in court.

Can the terms of the loan be modified after the agreement is signed?

Yes, the terms of the loan can be modified after the agreement is signed, but this should be done in writing. Both parties must agree to the changes and sign an amendment to the original agreement. Verbal changes are not legally binding, so it’s important to document any modifications.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take action as specified in the agreement. This could include charging late fees, demanding immediate repayment, or taking legal action. The specific consequences should be clearly outlined in the agreement to ensure both parties understand their rights and responsibilities.

Are there any state-specific laws that affect the loan agreement?

Yes, Illinois has specific laws regarding loans, including maximum interest rates and consumer protection regulations. It’s important to ensure that the agreement complies with these laws to avoid potential legal issues. Consulting with a legal professional familiar with Illinois law can help ensure compliance.

Where can I find a template for the Illinois Loan Agreement form?

Templates for the Illinois Loan Agreement form can be found online through legal websites or local government resources. However, it’s advisable to customize any template to fit your specific situation and to seek legal advice if you have questions about the terms or conditions.

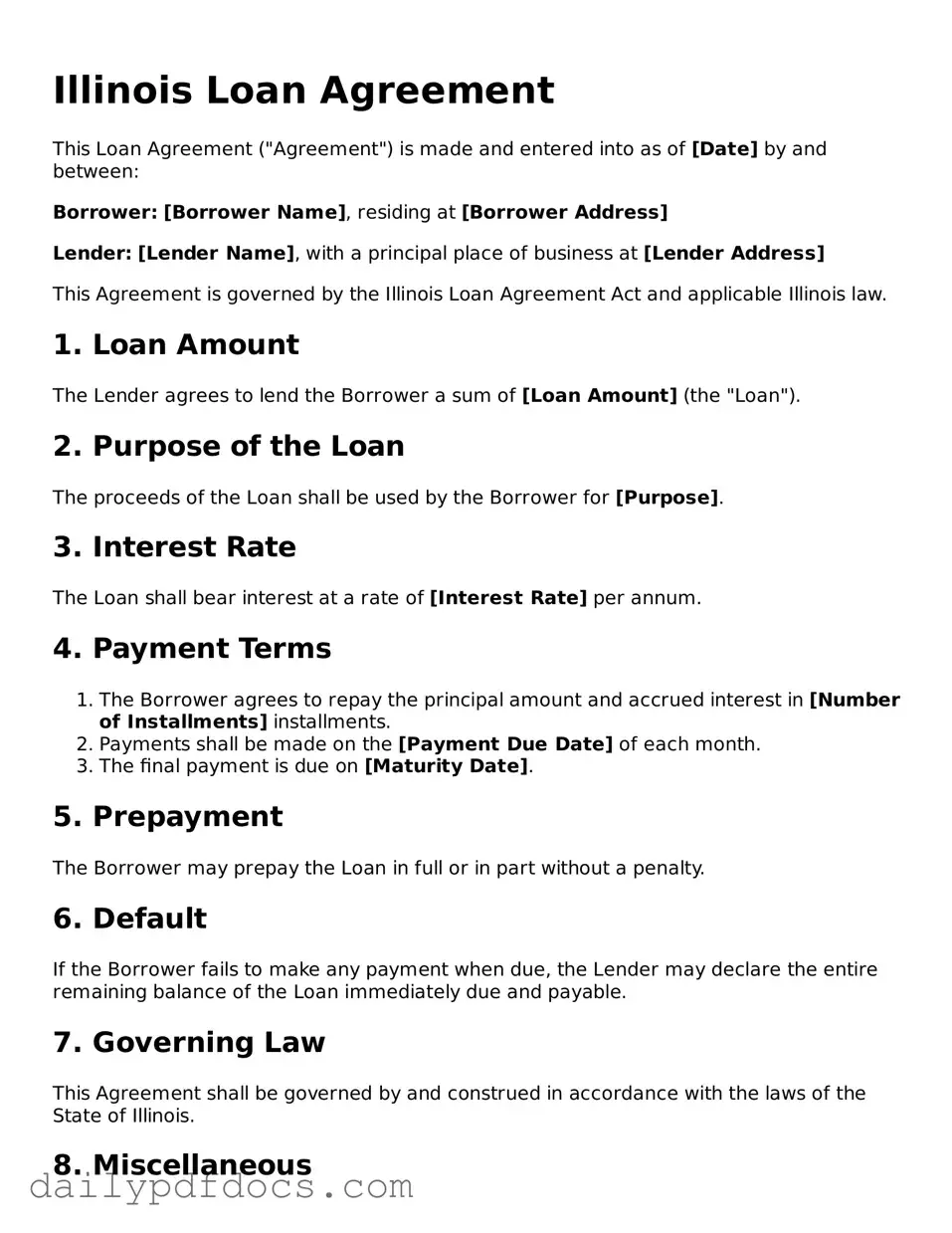

Preview - Illinois Loan Agreement Form

Illinois Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of [Date] by and between:

Borrower: [Borrower Name], residing at [Borrower Address]

Lender: [Lender Name], with a principal place of business at [Lender Address]

This Agreement is governed by the Illinois Loan Agreement Act and applicable Illinois law.

1. Loan Amount

The Lender agrees to lend the Borrower a sum of [Loan Amount] (the "Loan").

2. Purpose of the Loan

The proceeds of the Loan shall be used by the Borrower for [Purpose].

3. Interest Rate

The Loan shall bear interest at a rate of [Interest Rate] per annum.

4. Payment Terms

- The Borrower agrees to repay the principal amount and accrued interest in [Number of Installments] installments.

- Payments shall be made on the [Payment Due Date] of each month.

- The final payment is due on [Maturity Date].

5. Prepayment

The Borrower may prepay the Loan in full or in part without a penalty.

6. Default

If the Borrower fails to make any payment when due, the Lender may declare the entire remaining balance of the Loan immediately due and payable.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Illinois.

8. Miscellaneous

- This Agreement constitutes the entire agreement between the parties.

- Any modifications must be in writing and signed by both parties.

- If any provision of this Agreement is found to be invalid, the remaining provisions shall continue in full force.

IN WITNESS WHEREOF, the parties hereto have executed this Loan Agreement as of the day and year first above written.

Borrower Signature: ___________________________ Date: _____________

Lender Signature: ___________________________ Date: _____________

Similar forms

-

Promissory Note: This document outlines a borrower's promise to repay a loan under specified terms. Like a loan agreement, it details the amount borrowed, interest rate, and repayment schedule, but it is often simpler and focuses primarily on the borrower's commitment to pay back the loan.

-

Mortgage Agreement: This document secures a loan with the borrower's property. Similar to a loan agreement, it includes terms of the loan, but it specifically addresses the collateral involved, which is typically real estate.

-

Lease Agreement: While primarily used for renting property, a lease agreement shares similarities with a loan agreement in that it outlines the terms of use and payment obligations. Both documents establish a relationship between a lender and a borrower, or a landlord and tenant.

-

Homeschool Letter of Intent: This essential document informs the state about a family's decision to homeschool their children. It provides the necessary information required by law to ensure that homeschooling is recognized. For more details, visit homeschoolintent.com/editable-washington-homeschool-letter-of-intent/.

-

Credit Agreement: This document governs the terms of a line of credit. Like a loan agreement, it specifies the amount available, interest rates, and repayment terms, but it allows for borrowing up to a limit rather than a fixed sum.

-

Personal Guarantee: This document is often used in conjunction with a loan agreement to ensure that an individual will repay the loan if the primary borrower defaults. It shares the same purpose of securing repayment, focusing on personal accountability.

-

Service Agreement: While primarily focused on services rather than loans, this document can include payment terms similar to those found in a loan agreement. Both documents establish obligations and expectations between parties regarding financial transactions.

-

Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay less than the full amount owed. It resembles a loan agreement in that it details payment terms, but it focuses on settling a debt rather than establishing a new loan.

Misconceptions

Understanding the Illinois Loan Agreement form can be challenging. Here are ten common misconceptions that people often have:

- All loan agreements are the same. Many believe that all loan agreements follow a standard format. In reality, each agreement can vary significantly based on the lender, the type of loan, and specific terms negotiated.

- You don’t need to read the agreement. Some borrowers think they can sign without reading. It's crucial to understand all terms and conditions to avoid surprises later.

- Only large loans require a formal agreement. Many assume that small loans don’t need documentation. However, even smaller loans can benefit from a written agreement to clarify expectations.

- Verbal agreements are sufficient. Some people think that a verbal agreement is enough. Without written documentation, it can be difficult to enforce any terms or conditions.

- All loan agreements are legally binding. While most are, some informal agreements may not hold up in court. It’s essential to ensure that the agreement meets legal standards.

- You can change the terms anytime. Many believe they can modify the agreement at will. Changes typically require mutual consent from both parties and should be documented.

- Only the lender can terminate the agreement. Borrowers often think they have no say. In fact, borrowers can also terminate under certain conditions, depending on the agreement’s terms.

- Interest rates are fixed. Some assume that once set, interest rates cannot change. In reality, many agreements include variable rates that can fluctuate over time.

- Late payments have no consequences. Many borrowers underestimate the impact of late payments. They can lead to penalties, increased interest rates, or even default.

- Signing means you understand everything. Just because a borrower signs the agreement doesn’t mean they fully comprehend it. It's vital to ask questions and seek clarification on any unclear terms.

Being informed about these misconceptions can help you navigate the Illinois Loan Agreement form with confidence.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Loan Agreement form is used to outline the terms of a loan between a lender and a borrower. |

| Governing Law | This form is governed by the laws of the State of Illinois, specifically under the Illinois Compiled Statutes. |

| Key Components | Essential elements include loan amount, interest rate, repayment schedule, and any collateral involved. |

| Signatures Required | Both the lender and borrower must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |