Printable Deed Document for Illinois

When it comes to transferring property ownership in Illinois, the Illinois Deed form plays a crucial role in ensuring that the process is both legal and transparent. This essential document not only facilitates the transfer of real estate but also provides vital information regarding the parties involved, the property in question, and the terms of the transfer. Key elements of the form include the names and addresses of the grantor (the seller) and the grantee (the buyer), a detailed description of the property being transferred, and any specific conditions or covenants that may apply. Additionally, the form must be properly signed and notarized to ensure its validity. Understanding the nuances of the Illinois Deed form is important for anyone involved in a real estate transaction, as it helps to protect the rights of both parties and ensures compliance with state laws. By familiarizing yourself with this document, you can navigate the complexities of property transfer with greater confidence and clarity.

More State-specific Deed Forms

Texas Deed Forms - Future buyers often ask for copies of previous Deeds.

When completing the transfer of ownership for a mobile home, utilizing the Connecticut Mobile Home Bill of Sale form is essential, and you can find a blank version of this important document at https://mobilehomebillofsale.com/blank-connecticut-mobile-home-bill-of-sale. This form not only formalizes the agreement between the buyer and seller but also includes crucial information regarding the mobile home's identification and sale terms, ensuring clarity and legal protection for both parties.

Estate Title - Involves a description of the property being transferred.

Common Questions

What is an Illinois Deed form?

An Illinois Deed form is a legal document used to transfer ownership of real estate in the state of Illinois. It outlines the details of the transaction, including the parties involved, the property description, and any conditions or restrictions related to the transfer. This document must be signed and notarized to be valid.

What types of Deeds are available in Illinois?

Illinois recognizes several types of Deeds, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property. A Quitclaim Deed transfers whatever interest the seller has without any guarantees. Special Warranty Deeds offer limited warranties, covering only the time the seller owned the property.

Do I need a lawyer to complete an Illinois Deed?

While it's not legally required to have a lawyer for completing an Illinois Deed, it's highly recommended. A lawyer can help ensure that the document is filled out correctly and that all legal requirements are met. They can also provide guidance on any potential issues that may arise during the transfer process.

How do I fill out an Illinois Deed form?

To fill out an Illinois Deed form, start by entering the names and addresses of both the grantor (seller) and grantee (buyer). Next, provide a detailed description of the property, including its address and legal description. Finally, include any terms or conditions of the sale, and ensure that both parties sign and date the document in the presence of a notary public.

Is there a fee to file an Illinois Deed?

Yes, there is typically a fee to file an Illinois Deed with the county recorder's office. The fee varies by county, so it’s important to check with your local office for the exact amount. Additionally, there may be taxes associated with the transfer, such as the Real Estate Transfer Tax.

Can I change the name on an Illinois Deed after it has been recorded?

Changing the name on an Illinois Deed after it has been recorded is not straightforward. You would generally need to create a new deed to reflect the name change and record it with the county. This process may require additional documentation, especially if the name change is due to marriage or divorce.

How long does it take to process an Illinois Deed?

The processing time for an Illinois Deed can vary depending on the county. Generally, once the deed is submitted for recording, it may take anywhere from a few days to a few weeks to process. It's a good idea to follow up with the recorder's office to ensure that everything is in order.

What happens if I don’t record my Illinois Deed?

If you do not record your Illinois Deed, you may lose legal rights to the property. Recording provides public notice of your ownership and protects your interests against claims from third parties. Without recording, it can be difficult to prove ownership if disputes arise.

Where can I obtain an Illinois Deed form?

You can obtain an Illinois Deed form from various sources, including online legal document services, local real estate offices, or your attorney. It’s important to ensure that the form you use complies with Illinois state laws and is appropriate for your specific transaction.

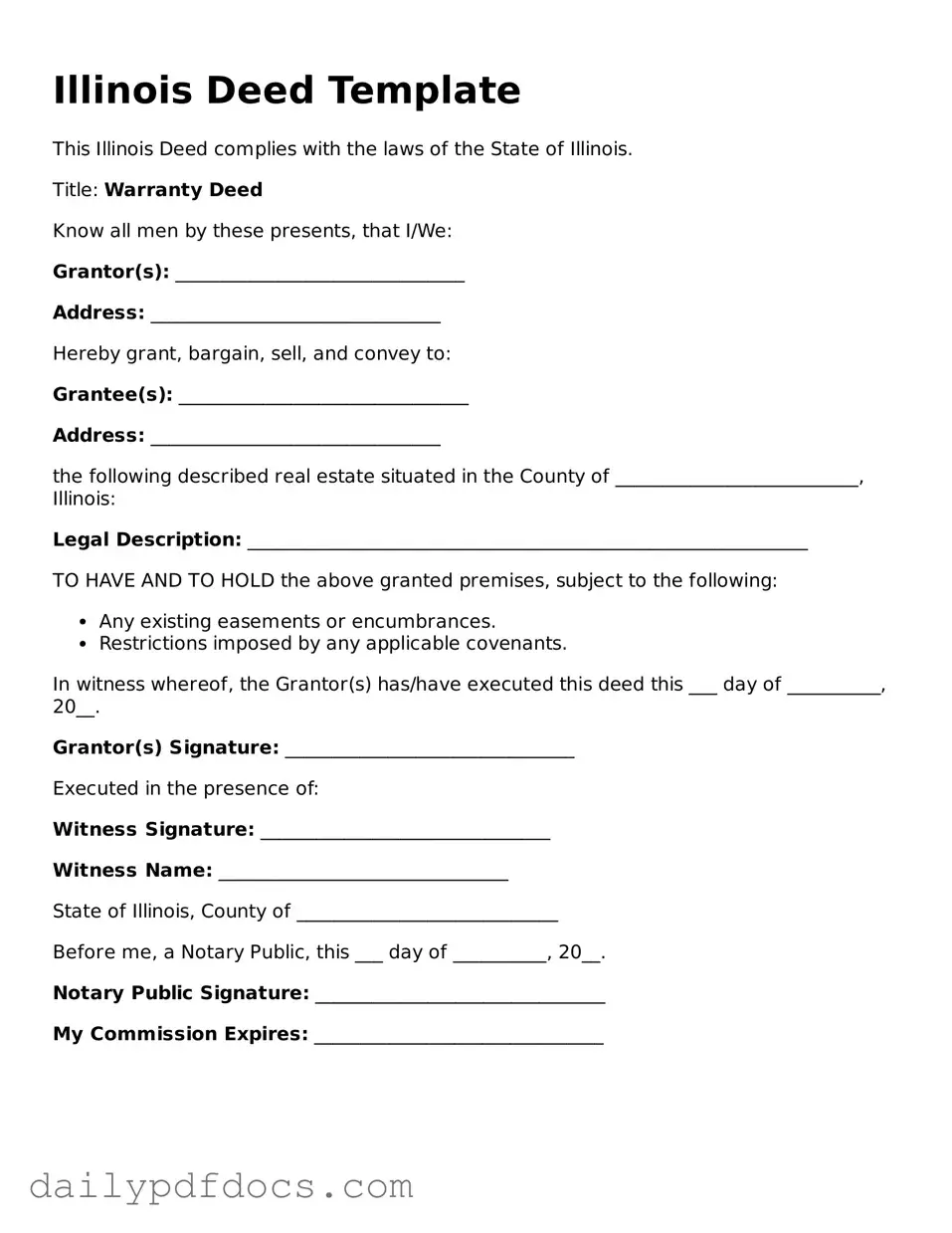

Preview - Illinois Deed Form

Illinois Deed Template

This Illinois Deed complies with the laws of the State of Illinois.

Title: Warranty Deed

Know all men by these presents, that I/We:

Grantor(s): _______________________________

Address: _______________________________

Hereby grant, bargain, sell, and convey to:

Grantee(s): _______________________________

Address: _______________________________

the following described real estate situated in the County of __________________________, Illinois:

Legal Description: ____________________________________________________________

TO HAVE AND TO HOLD the above granted premises, subject to the following:

- Any existing easements or encumbrances.

- Restrictions imposed by any applicable covenants.

In witness whereof, the Grantor(s) has/have executed this deed this ___ day of __________, 20__.

Grantor(s) Signature: _______________________________

Executed in the presence of:

Witness Signature: _______________________________

Witness Name: _______________________________

State of Illinois, County of ____________________________

Before me, a Notary Public, this ___ day of __________, 20__.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

Similar forms

The Deed form serves as a critical document in real estate and property transactions. However, several other documents share similarities in purpose or function. Below is a list of eight such documents, each highlighted for its relationship to the Deed form.

- Title Insurance Policy: This document protects against potential losses from defects in the title, similar to how a Deed establishes ownership rights.

- Power of Attorney: This legal document allows one person to act on behalf of another, often used in property transactions to sign deeds, establishing authority similar to the mandate seen in a deed. For more information, you can visit Ohio PDF Forms.

- Bill of Sale: Used to transfer ownership of personal property, it functions like a Deed by formally documenting the transfer of rights.

- Lease Agreement: While it grants temporary possession of property, it similarly outlines the rights and responsibilities of both parties, akin to a Deed.

- Mortgage Agreement: This document secures a loan with the property as collateral, paralleling the Deed's role in establishing property ownership.

- Quitclaim Deed: A type of Deed that transfers interest without warranties, it highlights the importance of ownership transfer, just like a standard Deed.

- Trust Agreement: Establishes a legal relationship for managing assets, similar to how a Deed formalizes property ownership.

- Power of Attorney: Grants authority to act on someone’s behalf, which can include signing a Deed, thus connecting the two in the realm of property transactions.

- Property Disclosure Statement: While it informs buyers of property conditions, it complements the Deed by ensuring transparency in ownership transfers.

Misconceptions

Understanding the Illinois Deed form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can cloud the process. Here are eight common misunderstandings:

- All deeds are the same. Many people believe that all deed forms are interchangeable. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each serving distinct purposes.

- A deed must be notarized to be valid. While notarization adds an extra layer of authenticity, not all deeds require notarization in Illinois. Some deeds can be valid without it, depending on the circumstances.

- The Illinois Deed form is only for transferring ownership. This is a narrow view. Deeds can also be used to clarify ownership, establish liens, or transfer property as part of an estate plan.

- Once a deed is recorded, it cannot be changed. While recording a deed does solidify its terms, it is possible to modify or correct a deed through a new document, provided the proper legal procedures are followed.

- All deeds must be filed with the county recorder. Although it is advisable to record a deed to protect against future claims, it is not strictly required for the deed to be valid. However, unrecorded deeds may lead to complications.

- Deeds can be created without legal assistance. While it is possible to draft a deed independently, doing so without legal guidance can lead to errors that may complicate future property transactions.

- Only property owners can execute a deed. This is misleading. An authorized representative, such as an attorney or a trustee, can execute a deed on behalf of the property owner if given the proper authority.

- Once a deed is signed, it is final and cannot be undone. This misconception overlooks the possibility of rescission or other legal remedies. Depending on the situation, a deed may be challenged or revoked under certain conditions.

Recognizing these misconceptions can lead to better understanding and smoother real estate transactions in Illinois. Always consider consulting a legal professional when dealing with property deeds to ensure compliance with state laws and regulations.

Form Overview

| Fact Name | Details |

|---|---|

| Governing Law | The Illinois Deed form is governed by the Illinois Compiled Statutes, specifically 765 ILCS 1005. |

| Types of Deeds | Illinois recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Execution Requirements | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded with the county recorder's office. |

| Consideration | The deed should state the consideration, or the amount paid for the property, though it is not always required. |

| Legal Description | A legal description of the property must be included to clearly identify the parcel being conveyed. |

| Transfer Tax | Illinois imposes a transfer tax on property sales, which must be paid before the deed can be recorded. |

| Grantee Information | The name and address of the grantee must be clearly stated in the deed. |