Printable Deed in Lieu of Foreclosure Document for Illinois

In Illinois, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure form, a legal document that allows a homeowner to voluntarily transfer their property to the lender in exchange for relief from the mortgage obligation. This process can provide a more straightforward and less stressful alternative to foreclosure, which can have long-lasting effects on a homeowner’s credit and financial future. The form typically includes essential details such as the names of the parties involved, a description of the property, and any relevant financial agreements. By signing this document, homeowners can often negotiate terms that may include the cancellation of outstanding debt and the possibility of a smoother transition out of their home. Understanding the implications and requirements of this form is crucial for homeowners seeking to regain financial stability while minimizing the impact on their credit scores.

More State-specific Deed in Lieu of Foreclosure Forms

Will I Owe Money After a Deed in Lieu of Foreclosure - The deed can help avoid the stigma associated with foreclosure, maintaining a better credit score.

In Florida, it is vital for both buyers and sellers to understand the Mobile Home Bill of Sale form, as it serves to officially document the transfer of ownership of a mobile home. This form includes key information such as the identities of the buyer and seller, along with the specific details of the mobile home itself. For those looking to ensure a seamless transaction while safeguarding their rights, additional resources can be found at https://mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale/.

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - A Deed in Lieu of Foreclosure typically requires the homeowner to be current on property taxes and other obligations.

Common Questions

What is a Deed in Lieu of Foreclosure in Illinois?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This option is often considered when homeowners are unable to keep up with mortgage payments and want to minimize the impact on their credit. By voluntarily handing over the property, homeowners can potentially avoid the lengthy and costly foreclosure process. It can also provide a way for the lender to recover their losses more quickly.

How does the Deed in Lieu of Foreclosure process work?

The process begins when a homeowner contacts their lender to discuss the possibility of a Deed in Lieu of Foreclosure. The lender will typically require the homeowner to provide documentation regarding their financial situation, including income, expenses, and any other debts. If the lender agrees to the arrangement, they will prepare the necessary documents. The homeowner must then sign the deed, transferring ownership of the property to the lender. This transaction should be recorded with the county to ensure it is legally recognized.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One of the primary benefits is the potential to reduce the negative impact on the homeowner's credit score compared to a full foreclosure. Additionally, it can provide a quicker resolution to the homeowner's financial difficulties. By opting for this method, homeowners may also avoid the stress and uncertainty that often accompany the foreclosure process. Furthermore, some lenders may offer relocation assistance or other incentives to homeowners who choose this route, making the transition smoother.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential drawbacks to consider. Homeowners may still face tax implications, as the IRS may treat any forgiven debt as taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, so availability can vary. Homeowners should also be aware that they will lose their home and any equity they may have built up. It's essential to weigh these factors carefully and consult with a financial advisor or attorney before making a decision.

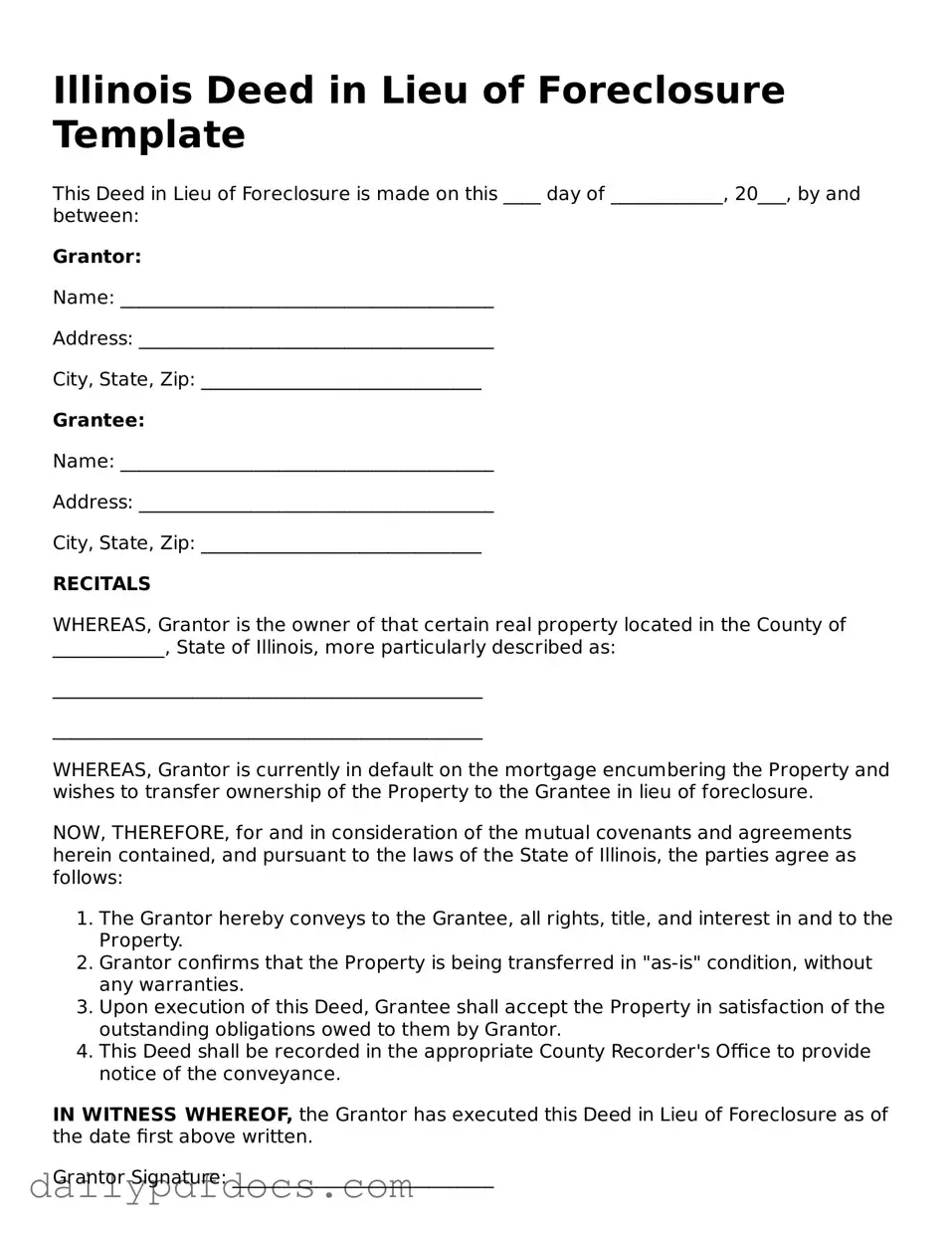

Preview - Illinois Deed in Lieu of Foreclosure Form

Illinois Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this ____ day of ____________, 20___, by and between:

Grantor:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

Grantee:

Name: ________________________________________

Address: ______________________________________

City, State, Zip: ______________________________

RECITALS

WHEREAS, Grantor is the owner of that certain real property located in the County of ____________, State of Illinois, more particularly described as:

______________________________________________

______________________________________________

WHEREAS, Grantor is currently in default on the mortgage encumbering the Property and wishes to transfer ownership of the Property to the Grantee in lieu of foreclosure.

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements herein contained, and pursuant to the laws of the State of Illinois, the parties agree as follows:

- The Grantor hereby conveys to the Grantee, all rights, title, and interest in and to the Property.

- Grantor confirms that the Property is being transferred in "as-is" condition, without any warranties.

- Upon execution of this Deed, Grantee shall accept the Property in satisfaction of the outstanding obligations owed to them by Grantor.

- This Deed shall be recorded in the appropriate County Recorder's Office to provide notice of the conveyance.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor Signature: ____________________________

Grantor Printed Name: ________________________

State of Illinois, County of ____________

Subscribed and sworn to before me on this ____ day of ____________, 20___.

Notary Public Signature: ______________________

Notary Public Printed Name: _________________

My Commission Expires: ______________________

Note: This template is for illustrative purposes only and does not constitute legal advice. It is important to consult with a qualified attorney to ensure compliance with local laws and regulations.

Similar forms

- Loan Modification Agreement: This document changes the terms of your existing mortgage. It can lower your monthly payments or change your interest rate, helping you keep your home.

- Short Sale Agreement: Similar to a deed in lieu, this allows you to sell your home for less than what you owe on the mortgage. The lender agrees to accept the sale proceeds as full payment.

- Forbearance Agreement: In this document, the lender agrees to temporarily reduce or suspend your mortgage payments. This can give you time to get back on your feet financially.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from debt. It can stop foreclosure proceedings and give you a chance to reorganize your finances.

- Repayment Plan: This plan outlines how you will pay back missed mortgage payments over time. It helps you catch up without losing your home.

- Employment Verification Form: Similar to the aforementioned documents, the California Employment Verification form is essential for confirming an individual's employment status, which can also facilitate processes such as loan applications. For more information, visit legalformspdf.com.

- Mortgage Release: This document releases you from your mortgage obligations. It typically occurs when the lender agrees to forgive the debt, often after a deed in lieu or short sale.

- Property Settlement Agreement: Often used in divorce, this document divides property and debts between spouses. It can include agreements about the family home and mortgage responsibilities.

- Quitclaim Deed: This document transfers ownership of property from one person to another without any warranties. It can be used to remove someone from a mortgage obligation.

- Transfer of Ownership Agreement: This outlines the terms under which property ownership is transferred. It can be similar to a deed in lieu if it involves a lender's acceptance of the property.

- Deed of Trust: This document secures a loan with real property. It involves three parties: the borrower, the lender, and a trustee, and can lead to foreclosure if payments are not made.

Misconceptions

The Deed in Lieu of Foreclosure is a legal tool used in Illinois that can help borrowers avoid the lengthy foreclosure process. However, several misconceptions surround this form. Understanding these misconceptions can provide clarity for homeowners considering this option.

- It eliminates all debt immediately. Many believe that signing a deed in lieu will wipe out all mortgage debt. In reality, while it may relieve the borrower of the mortgage obligation, other debts or liens may still exist.

- It is a quick process. Some assume that the deed in lieu process is fast. However, it often involves negotiations with the lender and can take time to finalize.

- It affects credit less than foreclosure. There is a belief that a deed in lieu will have a significantly lesser impact on credit scores compared to foreclosure. In fact, both can negatively affect credit ratings, though the extent may vary.

- All lenders accept deeds in lieu. Homeowners often think that every lender will agree to a deed in lieu arrangement. Not all lenders offer this option, and acceptance can depend on the lender's policies.

- It absolves all legal liabilities. Many think that signing a deed in lieu releases them from any legal responsibilities related to the property. This is not always true, as some obligations may remain.

- It is only for homeowners in financial distress. Some believe that only those facing severe financial hardship can pursue a deed in lieu. However, it can be an option for various situations, including those who simply want to avoid foreclosure.

- It guarantees no deficiency judgment. There is a misconception that executing a deed in lieu guarantees protection against deficiency judgments. In some cases, lenders may still pursue these judgments depending on the circumstances.

- It is a straightforward alternative to foreclosure. While it may seem like a simple solution, the deed in lieu process can be complex, involving legal and financial considerations that should not be overlooked.

- It is the same as a short sale. Some homeowners confuse a deed in lieu with a short sale. Although both involve selling the property, a deed in lieu transfers ownership back to the lender without a sale, while a short sale requires selling the property for less than the mortgage balance with lender approval.

Understanding these misconceptions can help homeowners make informed decisions regarding their options in the face of financial challenges.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers avoid the lengthy and costly foreclosure process while allowing lenders to recover their investment more efficiently. |

| Governing Law | The deed in lieu of foreclosure in Illinois is governed by the Illinois Mortgage Foreclosure Law (765 ILCS 900). |

| Eligibility | Borrowers facing financial hardship and unable to continue mortgage payments may be eligible to use this form. |

| Process | To initiate the deed in lieu process, the borrower must contact the lender and submit the necessary documentation. |

| Impact on Credit | A deed in lieu of foreclosure can negatively affect the borrower’s credit score, but typically less than a formal foreclosure. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any remaining debt after the deed is executed. |

| Legal Advice | It is advisable for borrowers to seek legal counsel before signing a deed in lieu of foreclosure to understand their rights and obligations. |

| Alternative Options | Borrowers should consider other options, such as loan modification or short sale, before opting for a deed in lieu of foreclosure. |