Printable Articles of Incorporation Document for Illinois

When starting a business in Illinois, one of the first steps is filing the Articles of Incorporation. This essential document serves as the foundation for your corporation, outlining key details that define its structure and purpose. The form requires you to provide the corporation's name, which must be unique and not already in use by another entity in the state. Additionally, you will need to specify the corporation's purpose, which can range from general business activities to more specific objectives. Another critical aspect is the registered agent's information; this person or entity will receive legal documents on behalf of the corporation. The form also asks for the number of shares the corporation is authorized to issue, along with the par value of those shares if applicable. Finally, the Articles of Incorporation must be signed by the incorporators, who are the individuals responsible for setting up the corporation. Completing this form accurately is vital, as it lays the groundwork for your business's legal existence and compliance in Illinois.

More State-specific Articles of Incorporation Forms

How to Obtain an Llc - The Articles should be filed with the Secretary of State or a similar state agency.

Articles of Incorporation Ny - Details any required annual reporting obligations for the corporation.

Understanding the importance of a Power of Attorney is crucial for anyone looking to safeguard their interests; for more information on creating this essential document, you can visit Washington Templates which offers helpful resources.

Georgia Secretary of State Forms - It serves as a contract among its owners, typically shareholders.

Common Questions

What is the purpose of the Articles of Incorporation in Illinois?

The Articles of Incorporation serve as the foundational document for establishing a corporation in Illinois. This legal document outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a crucial step in the process of forming a corporation, as it officially registers the business with the state and grants it legal recognition.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Illinois must file the Articles of Incorporation. This includes businesses ranging from small startups to larger enterprises. If you intend to operate as a corporation, completing and submitting this form is necessary to gain the legal protections and benefits that come with incorporation.

What information is required on the Articles of Incorporation form?

The Articles of Incorporation form requires several key pieces of information. This includes the corporation's name, which must be unique and not similar to existing businesses in Illinois. Additionally, you will need to provide the corporation's purpose, the registered agent's name and address, the number of shares the corporation is authorized to issue, and the names and addresses of the initial directors. Ensuring that all information is accurate and complete is essential for a smooth filing process.

How do I file the Articles of Incorporation in Illinois?

Filing the Articles of Incorporation can be done online or by mail. If you choose to file online, you can visit the Illinois Secretary of State's website and complete the form electronically. Alternatively, you can download a paper form, fill it out, and mail it to the appropriate office. There is a filing fee associated with this process, so be sure to include payment as required. Once submitted, the state will review your application and, if approved, issue a certificate of incorporation.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Typically, if you file online, you may receive confirmation of your incorporation within a few business days. If you submit a paper application, it may take longer, often ranging from a week to several weeks, depending on the volume of applications the state is handling. It's wise to plan accordingly and allow ample time for processing.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, you will receive a certificate of incorporation from the state. This document serves as proof that your corporation is legally recognized. After incorporation, you will need to comply with ongoing requirements, such as holding annual meetings, maintaining corporate records, and filing annual reports. Staying on top of these obligations is crucial for maintaining your corporation's good standing in Illinois.

Preview - Illinois Articles of Incorporation Form

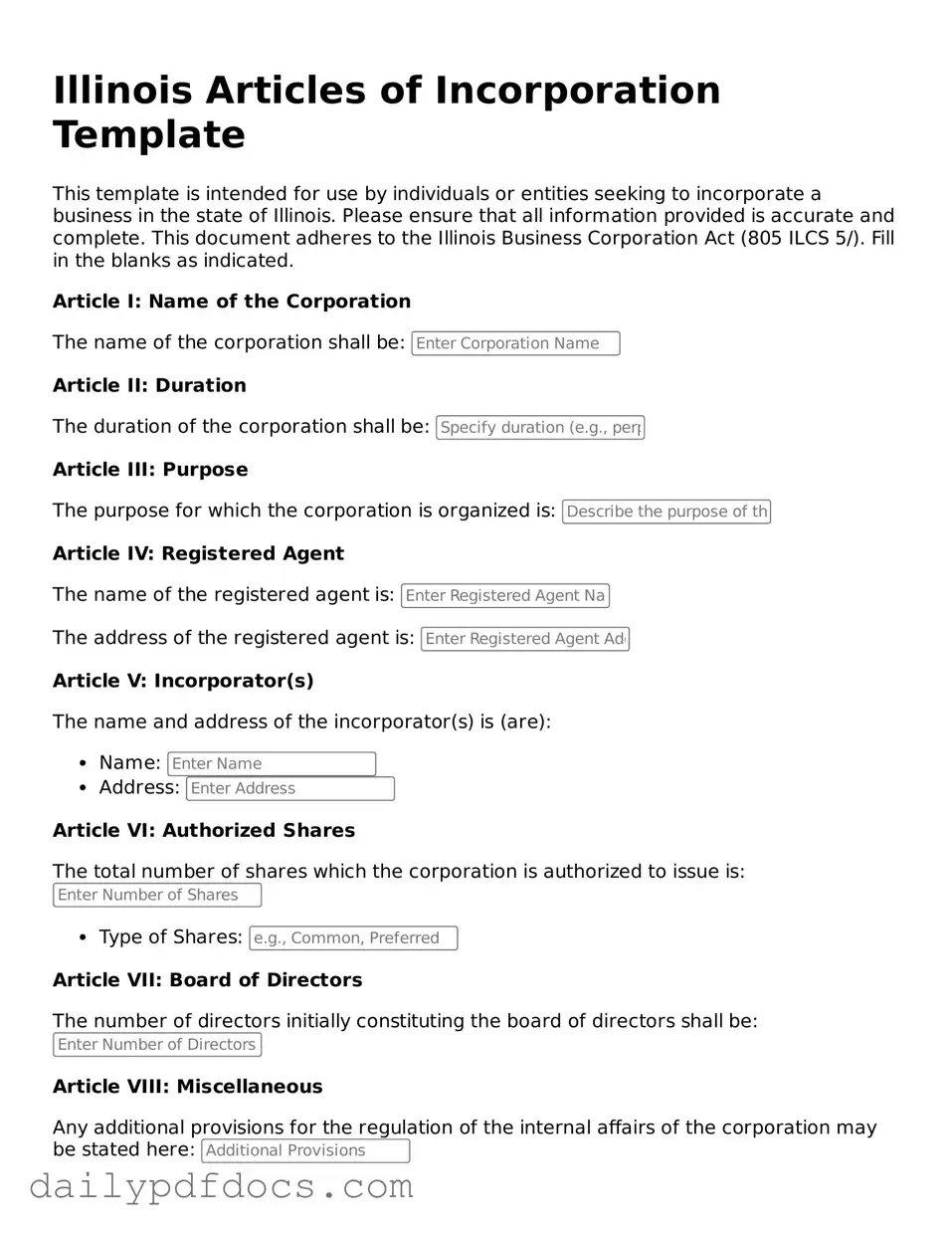

Illinois Articles of Incorporation Template

This template is intended for use by individuals or entities seeking to incorporate a business in the state of Illinois. Please ensure that all information provided is accurate and complete. This document adheres to the Illinois Business Corporation Act (805 ILCS 5/). Fill in the blanks as indicated.

Article I: Name of the Corporation

The name of the corporation shall be:

Article II: Duration

The duration of the corporation shall be:

Article III: Purpose

The purpose for which the corporation is organized is:

Article IV: Registered Agent

The name of the registered agent is:

The address of the registered agent is:

Article V: Incorporator(s)

The name and address of the incorporator(s) is (are):

- Name:

- Address:

Article VI: Authorized Shares

The total number of shares which the corporation is authorized to issue is:

- Type of Shares:

Article VII: Board of Directors

The number of directors initially constituting the board of directors shall be:

Article VIII: Miscellaneous

Any additional provisions for the regulation of the internal affairs of the corporation may be stated here:

Execution

Incorporator Signature: ______________________ Date: ____________

This document must be filed with the Illinois Secretary of State's office. Additional fees may apply. Ensure compliance with all relevant state laws.

Similar forms

- Bylaws: Bylaws serve as the internal rules governing a corporation's operations. Like the Articles of Incorporation, they are essential for establishing the framework within which the corporation functions.

- Operating Agreement: This document outlines the management structure and operating procedures for LLCs. It is similar to the Articles of Incorporation in that it defines the entity's purpose and governance.

- Certificate of Formation: Used primarily for LLCs, this document is akin to the Articles of Incorporation. Both establish the existence of the entity and provide basic information about its structure.

- Partnership Agreement: This document outlines the terms of a partnership. Similar to the Articles of Incorporation, it details the roles and responsibilities of each partner, establishing a framework for operations.

- Business License: A business license grants permission to operate legally within a jurisdiction. Like the Articles of Incorporation, it is a necessary document for establishing a business's legitimacy.

- Employer Identification Number (EIN): An EIN is required for tax purposes. Similar to the Articles of Incorporation, it identifies the business entity for the IRS and is essential for legal operations.

- Shareholder Agreement: This document outlines the rights and obligations of shareholders. Like the Articles of Incorporation, it is crucial for defining ownership and governance within the corporation.

- Annual Report: Corporations must file annual reports to maintain good standing. This document, like the Articles of Incorporation, provides updated information about the corporation's structure and activities.

- Certificate of Good Standing: This document verifies that a corporation is compliant with state regulations. Similar to the Articles of Incorporation, it is vital for demonstrating the corporation's legal status.

Misconceptions

Understanding the Articles of Incorporation form in Illinois is crucial for anyone looking to start a business. Unfortunately, several misconceptions can lead to confusion. Here are nine common misconceptions about this important document:

- All businesses must file Articles of Incorporation. Not every business needs to incorporate. Sole proprietorships and partnerships do not require this form.

- The Articles of Incorporation are the same as a business license. While both are necessary for operating a business, they serve different purposes. The Articles establish the corporation, while a business license allows you to operate legally.

- Filing Articles of Incorporation guarantees the success of a business. Incorporating provides a legal structure but does not ensure profitability or success. Business planning and management are equally important.

- Once filed, Articles of Incorporation cannot be changed. Amendments can be made to the Articles after they are filed, allowing for adjustments as the business evolves.

- Incorporation protects personal assets from all liabilities. While incorporation generally limits personal liability, certain situations, such as personal guarantees or illegal activities, can still expose personal assets.

- The process of filing Articles of Incorporation is overly complicated. While it requires attention to detail, many resources and guides are available to help simplify the process.

- All states have the same requirements for Articles of Incorporation. Each state has its own rules and requirements. It is essential to familiarize yourself with Illinois-specific regulations.

- Incorporating in Illinois is too expensive. The costs associated with filing Articles of Incorporation are relatively modest compared to the potential benefits of limited liability and credibility.

- Once incorporated, you do not need to file anything else. Ongoing compliance requirements exist, including annual reports and taxes, which must be managed to maintain good standing.

Being aware of these misconceptions can help ensure a smoother process in establishing your business in Illinois. Taking the time to understand the Articles of Incorporation and its implications is a valuable investment in your entrepreneurial journey.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Illinois Articles of Incorporation form is used to legally establish a corporation in Illinois. |

| Governing Law | The form is governed by the Illinois Business Corporation Act. |

| Filing Requirement | Filing the Articles of Incorporation is mandatory for all corporations in Illinois. |

| Information Required | The form requires the corporation's name, purpose, registered agent, and address. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Processing Time | Processing typically takes 10 to 15 business days, but expedited options are available. |

| Public Record | Once filed, the Articles of Incorporation become a public document. |

| Amendments | Changes to the Articles of Incorporation require a formal amendment process. |

| Annual Reports | Corporations must file annual reports to maintain good standing in Illinois. |

| Online Filing | Illinois allows for online filing of the Articles of Incorporation for convenience. |