Fill Your Gift Letter Form

When it comes to securing a mortgage or purchasing a home, many buyers may receive financial assistance from family members or friends in the form of a monetary gift. To ensure that this money is recognized appropriately by lenders, a Gift Letter form is often required. This form serves as a written declaration that outlines the details of the gift, including the donor's information, the amount gifted, and the relationship between the donor and the recipient. By completing this document, the donor affirms that the funds are indeed a gift and not a loan, which is crucial for the buyer's eligibility for financing. Additionally, the form may need to include statements about the absence of any expectation of repayment. Lenders use this information to assess the financial situation of the borrower and to comply with regulations that govern mortgage lending. Understanding the importance of the Gift Letter form can help potential homeowners navigate the complexities of the home-buying process with greater ease.

Find Other Documents

Roofing Inspection Report Template - Document the date of the last inspection for historical reference.

Utilizing the Washington Mobile Home Bill of Sale is essential for anyone looking to transfer ownership of a mobile home, and you can access a reliable version of this document through Washington Templates. This ensures that all necessary information is clearly outlined and that the sale proceeds without any legal complications.

Ms Word Chart - Column 1: Choose topics that are concise yet informative.

Common Questions

What is a Gift Letter form?

A Gift Letter form is a document used to confirm that a monetary gift is being provided to an individual, typically for the purpose of assisting with a home purchase. This letter serves as proof that the funds are a gift and not a loan, which is important for mortgage lenders. By outlining the details of the gift, including the amount and the relationship between the giver and receiver, it helps clarify the source of the funds and ensures compliance with lending requirements.

Who needs to use a Gift Letter form?

Anyone receiving a financial gift to assist with a home purchase may need to use a Gift Letter form. This is particularly common among first-time homebuyers who may rely on family or friends for financial support. Lenders often require this documentation to verify that the funds are not expected to be repaid, as this can affect the borrower’s debt-to-income ratio and overall loan eligibility.

What information should be included in a Gift Letter form?

A Gift Letter form should include several key pieces of information. First, it should identify the donor and the recipient, along with their relationship. Next, the letter must state the amount of the gift and confirm that it is a gift, not a loan. Additionally, including the date of the gift and the donor's signature can add credibility. Some lenders may also request the donor’s contact information and a statement about the source of the funds.

Do I need to notarize the Gift Letter form?

Generally, notarization of the Gift Letter form is not required, but it can lend additional credibility. Some lenders may request a notarized letter to ensure authenticity, while others may accept a simple signed letter. Always check with the lender for their specific requirements regarding documentation. If notarization is needed, the donor can visit a notary public to have the letter officially witnessed.

Can a Gift Letter form be used for other types of financial assistance?

While the Gift Letter form is primarily used for home purchases, it can also be adapted for other situations where financial gifts are involved. For example, it may be used for funding education or covering medical expenses. However, the context and requirements may vary, so it’s essential to clarify the purpose with the relevant parties involved, such as lenders or educational institutions.

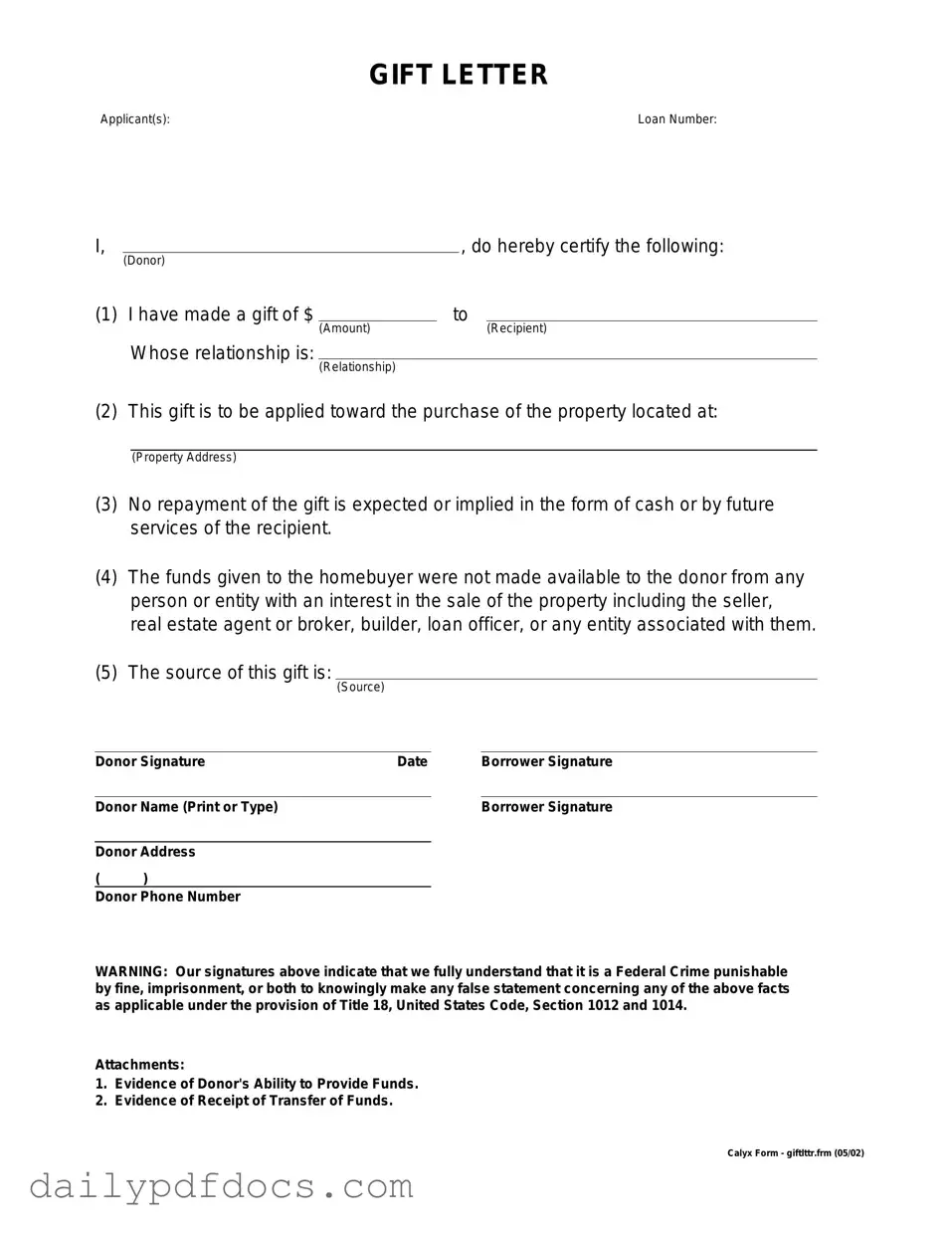

Preview - Gift Letter Form

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Similar forms

- Affidavit of Support: This document is often used in immigration cases to demonstrate that a sponsor can financially support an individual. Like a gift letter, it shows that funds are provided without expectation of repayment.

- Loan Agreement: While a loan agreement outlines terms for borrowing money, it shares similarities with a gift letter in that it requires the lender to confirm the source of the funds. Both documents help clarify the financial relationship between parties.

- Financial Gift Declaration: This document explicitly states that a financial gift has been made. Similar to a gift letter, it serves to confirm that the funds are not a loan and do not need to be repaid.

- Down Payment Assistance Agreement: This agreement is used in real estate transactions to document financial assistance for a home purchase. It parallels a gift letter by verifying that the funds are a gift and not a loan.

- Bank Statement: A bank statement can support a gift letter by providing evidence of the donor’s financial capacity. Both documents serve to validate the source of funds and ensure they are available for the recipient.

- Tax Return Documentation: Tax returns can reveal financial gifts made in a given year. Similar to a gift letter, they provide transparency about financial transactions and can help substantiate the legitimacy of the gift.

- Non-compete Agreement: To protect your business interests, consider the vital Non-compete Agreement form which restricts employees from working with competitors following their employment.

- Promissory Note: This document outlines a promise to pay back borrowed money. While it implies a repayment obligation, it can be similar to a gift letter in that it may also include terms for non-repayment, depending on the arrangement.

- Gift Tax Return (Form 709): This IRS form is used to report gifts that exceed the annual exclusion amount. Like a gift letter, it documents the transfer of funds without expectation of repayment, ensuring compliance with tax regulations.

Misconceptions

When it comes to the Gift Letter form, several misconceptions can lead to confusion for both givers and receivers. Understanding these myths can help streamline the process and ensure compliance with lending requirements.

- Gift Letters Are Only for First-Time Homebuyers: Many believe that only first-time buyers need to provide a gift letter. In reality, anyone receiving a monetary gift for a home purchase may need to document it, regardless of their buying history.

- Gift Letters Must Be Notarized: Some people think that a notarized gift letter is required. However, most lenders only require a signed letter from the donor, which includes specific information about the gift and its purpose.

- All Gifts Require a Gift Letter: Not every monetary gift necessitates a formal letter. Smaller gifts or those that do not significantly impact the loan amount may not require documentation. It’s important to check with the lender for specific guidelines.

- Gift Letters Are the Same as Loan Documents: A common misunderstanding is that a gift letter serves the same purpose as a loan document. In fact, a gift letter merely confirms that the funds are a gift, not a loan that must be repaid.

- Gift Letters Can Be Generic: Some assume that a generic letter will suffice. However, lenders typically require detailed information, including the donor’s relationship to the buyer, the amount of the gift, and a statement confirming that repayment is not expected.

Clarifying these misconceptions can help ensure that the gift-giving process goes smoothly and meets all necessary requirements. Proper documentation not only supports the buyer's financial standing but also fosters transparency in the transaction.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter is used to document a financial gift, typically for a home purchase, to show lenders that the funds are not a loan. |

| Requirements | Most lenders require the letter to include the donor's name, address, relationship to the recipient, and the amount of the gift. |

| State-Specific Forms | Some states may have specific requirements regarding gift letters; for example, California follows the California Civil Code Section 1624 regarding gifts. |

| Impact on Mortgage Approval | Providing a gift letter can positively impact mortgage approval, as it clarifies the source of the down payment funds. |