Free Gift Deed Template

A Gift Deed serves as a vital legal instrument for individuals wishing to transfer ownership of property or assets without any exchange of monetary compensation. This document outlines the intent of the donor, who voluntarily gives the gift, and the recipient, who accepts it. Key components of a Gift Deed include a clear description of the property being gifted, the identities of both parties, and any conditions that may apply to the transfer. The document must be executed with the appropriate signatures and often requires witnesses to ensure its validity. Additionally, the implications of a Gift Deed extend beyond mere ownership transfer; it can affect tax liabilities for both the giver and the receiver. Understanding these aspects is crucial for anyone considering making a significant gift, as the legal and financial ramifications can be substantial. Proper execution and adherence to state laws can safeguard the interests of both parties involved, making it essential to approach the process with care and diligence.

Popular Gift Deed Templates:

Correction Deed California - Utilizing this form demonstrates due diligence in property management.

A prenuptial agreement form in Ohio is a legal document that couples create before marriage to outline the division of assets and responsibilities in the event of a divorce. This form helps ensure that both parties have a clear understanding of their rights and obligations. By addressing financial matters ahead of time, couples can foster open communication and reduce potential conflicts in the future. For more information, you can visit Ohio PDF Forms.

What Is a Deed in Lieu of Foreclosure? - Overall, a Deed in Lieu offers a potential lifeline for homeowners struggling to meet mortgage obligations.

Gift Deed - Tailored for Individual States

Common Questions

What is a Gift Deed?

A Gift Deed is a legal document that allows one person to transfer ownership of property or assets to another person without expecting anything in return. This can include real estate, money, or personal items. The transfer is usually made voluntarily and is often done for reasons such as love, affection, or charity.

What are the requirements for a valid Gift Deed?

To create a valid Gift Deed, the following elements must be present: the donor (the person giving the gift) must have the legal capacity to do so, the gift must be clearly defined, and there must be an intention to make the gift. Additionally, the deed should be signed by the donor and, in many cases, witnessed to ensure its validity.

Do I need to register a Gift Deed?

Yes, registering a Gift Deed is often recommended, especially for real estate. Registration provides legal proof of the transfer and helps avoid disputes in the future. In most states, you must file the deed with the local government office where the property is located. This process usually involves paying a small fee.

Can a Gift Deed be revoked?

In general, a Gift Deed is irrevocable once it has been executed and delivered. However, if the donor has not completed the transfer or if there are specific conditions outlined in the deed, it may be possible to revoke it. It's important to consult with a legal expert if you are considering revocation.

Are there any tax implications for a Gift Deed?

Yes, there can be tax implications for both the donor and the recipient. The IRS allows individuals to give a certain amount each year without incurring gift tax. However, if the value exceeds this limit, the donor may need to file a gift tax return. Recipients generally do not pay tax on gifts received, but they should keep records of the value for future reference.

What happens if the donor dies after giving a Gift Deed?

If the donor dies after executing a Gift Deed, the gift typically remains valid, and the recipient retains ownership of the property or assets. However, if the donor had intended to keep the property until death, the gift may be challenged by heirs or beneficiaries. This situation can lead to legal disputes, so it's wise to consult with an attorney to clarify intentions.

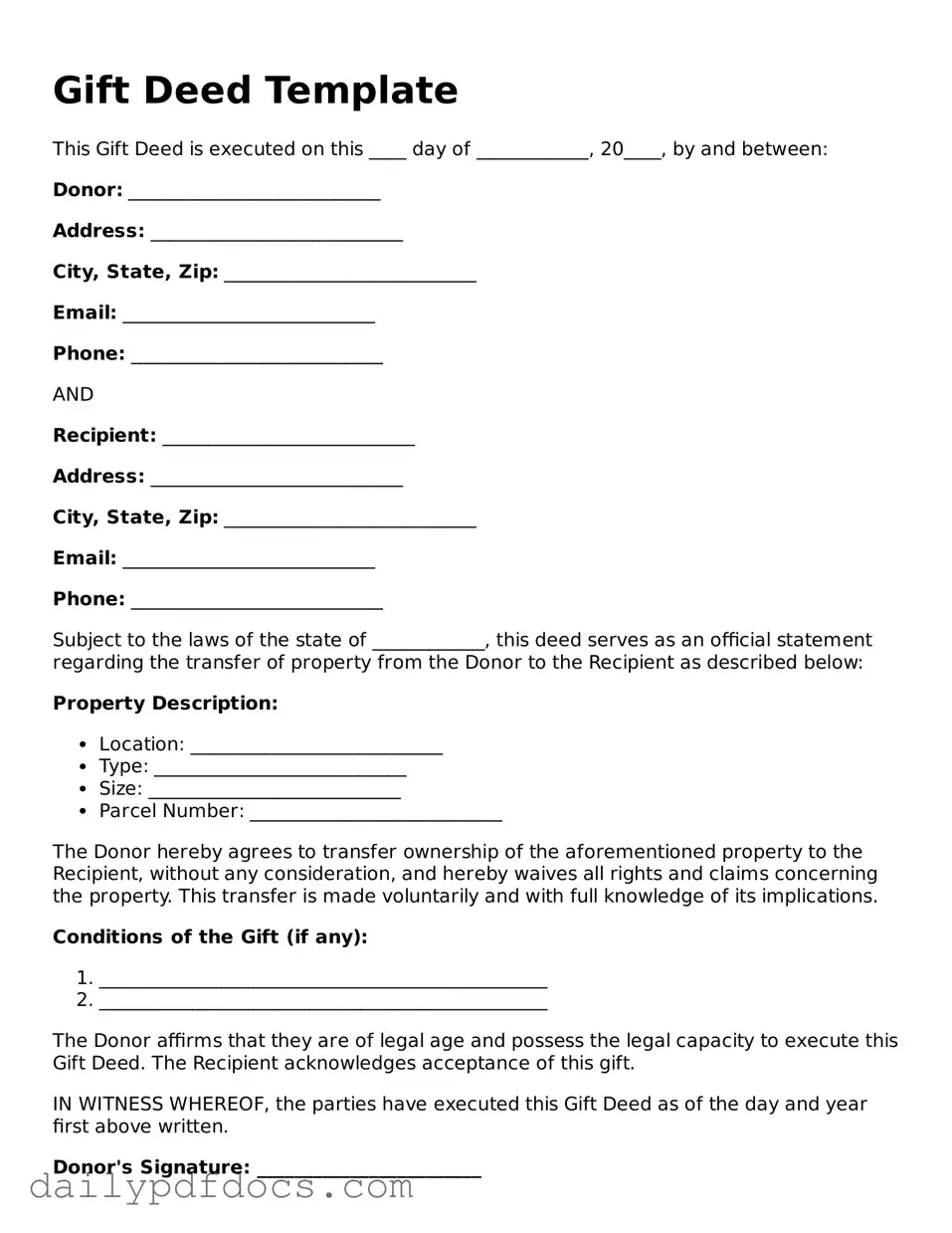

Preview - Gift Deed Form

Gift Deed Template

This Gift Deed is executed on this ____ day of ____________, 20____, by and between:

Donor: ___________________________

Address: ___________________________

City, State, Zip: ___________________________

Email: ___________________________

Phone: ___________________________

AND

Recipient: ___________________________

Address: ___________________________

City, State, Zip: ___________________________

Email: ___________________________

Phone: ___________________________

Subject to the laws of the state of ____________, this deed serves as an official statement regarding the transfer of property from the Donor to the Recipient as described below:

Property Description:

- Location: ___________________________

- Type: ___________________________

- Size: ___________________________

- Parcel Number: ___________________________

The Donor hereby agrees to transfer ownership of the aforementioned property to the Recipient, without any consideration, and hereby waives all rights and claims concerning the property. This transfer is made voluntarily and with full knowledge of its implications.

Conditions of the Gift (if any):

- ________________________________________________

- ________________________________________________

The Donor affirms that they are of legal age and possess the legal capacity to execute this Gift Deed. The Recipient acknowledges acceptance of this gift.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the day and year first above written.

Donor's Signature: ________________________

Date: ________________________

Recipient's Signature: ________________________

Date: ________________________

Witness Signature (if required): ________________________

Date: ________________________

Similar forms

-

Will: A will outlines how a person's assets will be distributed after their death. Like a gift deed, it transfers ownership, but it takes effect only after the person passes away.

-

Trust Agreement: A trust agreement allows a person to place assets in a trust for the benefit of others. Similar to a gift deed, it can transfer ownership, but it often involves ongoing management of the assets.

-

Sale Deed: A sale deed is a document that transfers ownership of property from one person to another in exchange for payment. While both documents transfer ownership, a sale deed involves a financial transaction, whereas a gift deed does not.

-

Transfer on Death Deed: This deed allows property to transfer to a beneficiary upon the owner's death. Like a gift deed, it facilitates a transfer of ownership, but it is effective only after the owner's death.

- Mobile Home Bill of Sale: A Florida Mobile Home Bill of Sale form is essential for transferring ownership of a mobile home and can be found at mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale, ensuring all details are accurately documented during the transaction.

-

Quitclaim Deed: A quitclaim deed transfers whatever interest a person has in a property without guaranteeing that interest. Both documents can transfer ownership, but a quitclaim deed does not confirm the value or validity of the interest being transferred.

Misconceptions

Understanding the Gift Deed form is essential for anyone considering gifting property. However, several misconceptions often arise. Here are nine common misunderstandings about Gift Deeds:

- Gift Deeds are only for family members. Many believe that Gift Deeds can only be used to transfer property between family members. In reality, anyone can gift property to another individual, regardless of their relationship.

- Gift Deeds require payment of taxes. Some people think that gifting property incurs the same tax obligations as a sale. While there may be tax implications, in many cases, the recipient may not have to pay taxes at the time of the gift.

- Once a Gift Deed is signed, it cannot be revoked. It is a common belief that a Gift Deed is irrevocable. However, under certain circumstances, the donor may have the right to revoke the deed before the transfer is completed.

- A Gift Deed must be notarized to be valid. While notarization is highly recommended for authenticity, it is not always a legal requirement. The validity can depend on state laws and specific circumstances.

- Gift Deeds do not require witnesses. Many assume that witnesses are unnecessary for a Gift Deed. However, having witnesses can strengthen the document's validity and help prevent future disputes.

- All types of property can be gifted using a Gift Deed. Some people think any property can be transferred with a Gift Deed. While real estate and personal property can generally be gifted, certain restrictions may apply to specific types of assets.

- Gift Deeds are the same as wills. There is a misconception that Gift Deeds and wills serve the same purpose. Unlike a will, which takes effect after death, a Gift Deed transfers ownership immediately.

- A Gift Deed can only be created by an attorney. Many believe that only legal professionals can draft Gift Deeds. While it is advisable to consult an attorney, individuals can create their own Gift Deeds as long as they comply with legal requirements.

- Once a Gift Deed is executed, the donor loses all rights to the property. It is a common misunderstanding that the donor cannot retain any rights after gifting property. In some cases, donors can retain certain rights, such as the right to live on the property or receive income from it.

Addressing these misconceptions can help individuals make informed decisions about property gifting. Always consider seeking professional advice to navigate the complexities involved.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property from one person to another without any exchange of money. |

| Consideration | In a Gift Deed, no monetary consideration is involved. The transfer is made voluntarily and without compensation. |

| Governing Law | Each state has its own laws governing Gift Deeds. For example, in California, the relevant laws can be found in the California Civil Code. |

| Requirements | To be valid, a Gift Deed typically must be in writing, signed by the donor, and may require notarization. |

| Revocation | Once a Gift Deed is executed and delivered, it generally cannot be revoked unless specific conditions are met. |

| Tax Implications | Gift Deeds may have tax implications. Donors should consider consulting a tax professional to understand any potential gift tax responsibilities. |