Printable Transfer-on-Death Deed Document for Georgia

The Georgia Transfer-on-Death Deed form serves as an important tool for property owners looking to simplify the transfer of real estate upon their death. This legal document allows an individual to designate one or more beneficiaries who will automatically receive the property, bypassing the often lengthy probate process. By completing this form, property owners can maintain control over their assets during their lifetime while ensuring a smooth transition to their heirs after they pass away. The form requires specific information, including the names of the property owner, the designated beneficiaries, and a detailed description of the property being transferred. Additionally, it must be signed in the presence of a notary public and recorded with the county clerk to be legally effective. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about estate planning, ultimately providing peace of mind for both the property owner and their loved ones.

More State-specific Transfer-on-Death Deed Forms

Todi Illinois - The Transfer-on-Death Deed has no tax implications upon transfer, as it does not constitute a gift until after the original owner's death.

For anyone looking to buy or sell a trailer in Ohio, it's crucial to use the appropriate documentation to ensure a smooth transaction. The Ohio Trailer Bill of Sale form is a legal document used to record the sale and transfer of ownership of a trailer in Ohio. This form serves as proof of the transaction between the seller and the buyer, ensuring that both parties have a clear understanding of the terms. Having a properly completed bill of sale can help avoid disputes and provide essential information for registration purposes. To access and learn more about this important form, visit Ohio PDF Forms.

Where Can I Get a Tod Form - Making arrangements ahead of time with a Transfer-on-Death Deed illustrates a proactive approach to estate planning.

Ohio Transfer on Death Form - Using this deed can enhance the overall efficiency of managing an estate after the owner's death.

Common Questions

What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Georgia to transfer real estate to a designated beneficiary upon the owner's death. This deed enables the transfer to occur outside of probate, simplifying the process for heirs and ensuring a smoother transition of property ownership.

Who can create a Transfer-on-Death Deed?

Any individual who owns real property in Georgia can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. It is important that the owner properly executes the deed to ensure its validity.

How do I complete a Transfer-on-Death Deed?

To complete a Transfer-on-Death Deed, the property owner must fill out the appropriate form, which includes details such as the owner's name, the legal description of the property, and the beneficiary's name. The deed must be signed by the owner in the presence of a notary public and then recorded in the county where the property is located.

Is there a fee to file a Transfer-on-Death Deed?

Yes, there is typically a fee associated with recording a Transfer-on-Death Deed. The fee varies by county, so it is advisable to check with the local county clerk's office for the exact amount. Additionally, there may be costs related to notarization and obtaining legal descriptions of the property.

Can I change or revoke a Transfer-on-Death Deed after it is filed?

Yes, a property owner can change or revoke a Transfer-on-Death Deed at any time before their death. To do this, the owner must execute a new deed that either names a different beneficiary or explicitly states the revocation of the previous deed. It is important to record any changes with the county to ensure they are legally recognized.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed will not automatically transfer the property to that beneficiary's heirs. Instead, the property may pass according to the owner's will or, if there is no will, according to Georgia's intestacy laws. To avoid complications, the owner may want to designate alternate beneficiaries.

Can a Transfer-on-Death Deed be contested?

Yes, a Transfer-on-Death Deed can be contested in court. Challenges may arise based on claims of undue influence, lack of capacity, or improper execution of the deed. If a dispute occurs, it may require legal intervention to resolve the matter.

Does a Transfer-on-Death Deed affect property taxes?

Generally, a Transfer-on-Death Deed does not affect property taxes during the owner's lifetime. However, once the property is transferred to the beneficiary after the owner's death, the new owner may be subject to property taxes based on the assessed value of the property at that time. It is advisable for beneficiaries to consult with a tax professional for specific guidance.

Is legal advice necessary when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting with an attorney can be beneficial. An attorney can provide guidance on the implications of the deed, ensure it complies with state laws, and help avoid potential issues in the future. This can be especially important for those with complex estates or specific wishes regarding their property.

Preview - Georgia Transfer-on-Death Deed Form

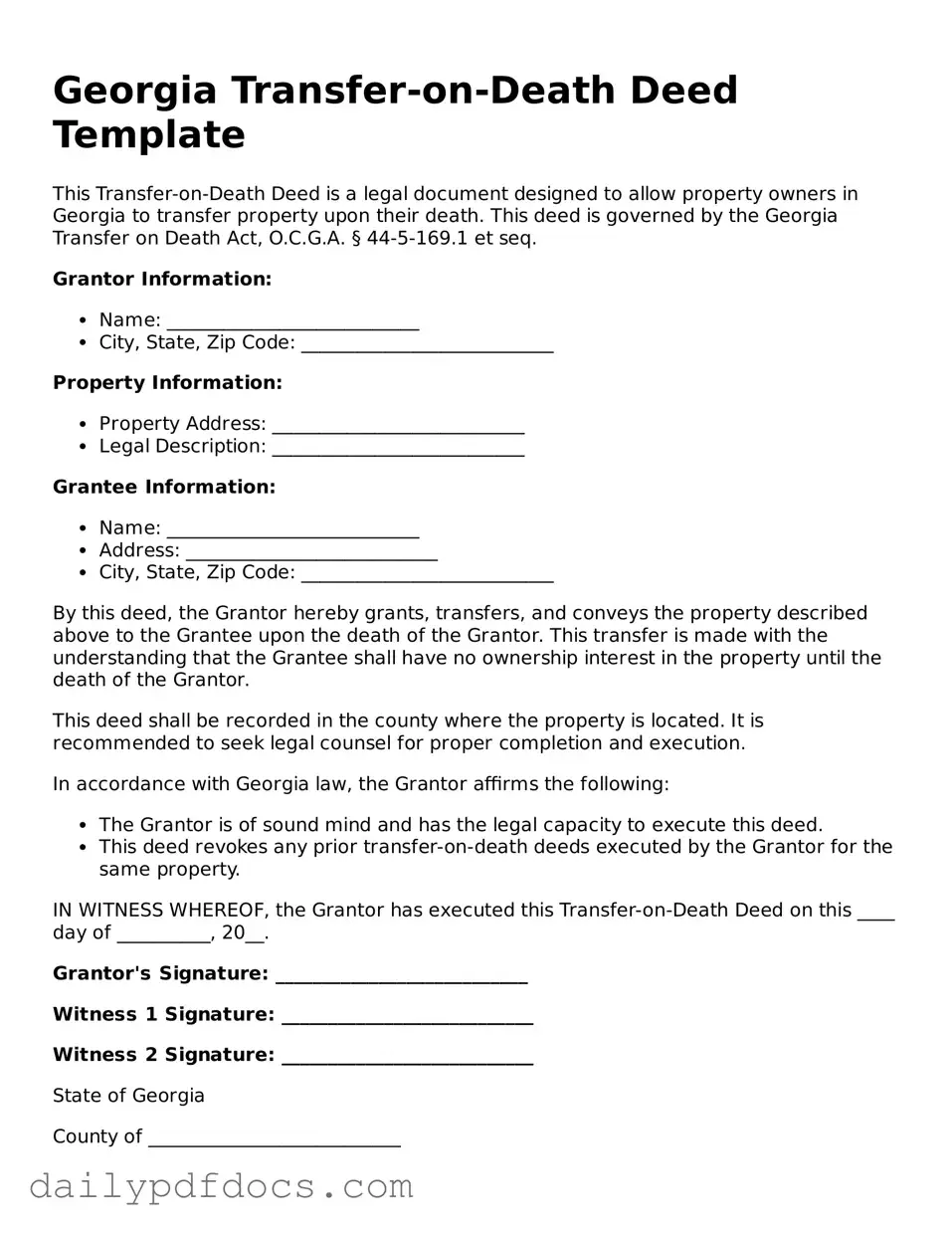

Georgia Transfer-on-Death Deed Template

This Transfer-on-Death Deed is a legal document designed to allow property owners in Georgia to transfer property upon their death. This deed is governed by the Georgia Transfer on Death Act, O.C.G.A. § 44-5-169.1 et seq.

Grantor Information:

- Name: ___________________________

- City, State, Zip Code: ___________________________

Property Information:

- Property Address: ___________________________

- Legal Description: ___________________________

Grantee Information:

- Name: ___________________________

- Address: ___________________________

- City, State, Zip Code: ___________________________

By this deed, the Grantor hereby grants, transfers, and conveys the property described above to the Grantee upon the death of the Grantor. This transfer is made with the understanding that the Grantee shall have no ownership interest in the property until the death of the Grantor.

This deed shall be recorded in the county where the property is located. It is recommended to seek legal counsel for proper completion and execution.

In accordance with Georgia law, the Grantor affirms the following:

- The Grantor is of sound mind and has the legal capacity to execute this deed.

- This deed revokes any prior transfer-on-death deeds executed by the Grantor for the same property.

IN WITNESS WHEREOF, the Grantor has executed this Transfer-on-Death Deed on this ____ day of __________, 20__.

Grantor's Signature: ___________________________

Witness 1 Signature: ___________________________

Witness 2 Signature: ___________________________

State of Georgia

County of ___________________________

On this ____ day of __________, 20__, before me, the undersigned notary public, personally appeared _________________________, who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged that they executed the same in their capacity, and that by their signature on the instrument, the person executed the instrument.

Notary Public Signature: ________________________

My Commission Expires: _______________________

Similar forms

The Transfer-on-Death Deed (TOD) form allows individuals to transfer real estate to beneficiaries upon their death without going through probate. This document has similarities with several other legal documents that facilitate the transfer of assets or property. Here are ten documents that share similarities with the TOD deed:

- Will: A will outlines how a person's assets will be distributed after their death. Like a TOD deed, it allows for the transfer of property but typically requires probate, while a TOD deed does not.

- Living Trust: A living trust holds a person's assets during their lifetime and specifies how they should be distributed after death. Both documents help avoid probate, but a trust can manage assets during the grantor's lifetime.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, this document allows individuals to name beneficiaries who will receive assets upon death, similar to how a TOD deed names beneficiaries for real estate.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to automatically inherit each other's share upon death, akin to the transfer mechanism of a TOD deed.

- Transfer-on-Death Registration for Securities: This document allows for the transfer of stocks and bonds to beneficiaries upon death, functioning similarly to a TOD deed for real estate.

- Life Estate Deed: This deed allows a person to retain the right to use a property during their lifetime, with the property automatically passing to a designated beneficiary afterward, resembling the TOD deed's intent.

- Power of Attorney: While primarily used for financial and healthcare decisions, a durable power of attorney can enable an agent to manage property, similar to how a TOD deed designates a beneficiary for property after death.

- Family Limited Partnership Agreement: This agreement allows family members to manage and transfer assets, providing a way to pass on property while retaining control, similar to the goals of a TOD deed.

- Real Estate Purchase Agreement: This document outlines the terms of a property sale, including how the property will be transferred, which parallels the transfer aspect of a TOD deed.

- Bill of Sale: The Washington Templates provide a streamlined way to document the sale of personal property, ensuring all necessary details are captured to protect both parties involved in the transaction.

- Deed of Gift: A deed of gift transfers property ownership without consideration, allowing individuals to give property to beneficiaries during their lifetime, similar to the intent of a TOD deed.

Misconceptions

The Transfer-on-Death Deed (TOD) in Georgia allows property owners to transfer their real estate to beneficiaries upon their death without going through probate. However, several misconceptions surround this legal tool. Here are seven common misunderstandings:

- It replaces a will. Many believe that a TOD deed eliminates the need for a will. While it can simplify the transfer of specific properties, it does not address other assets or personal wishes outlined in a will.

- It is irrevocable. Some think that once a TOD deed is executed, it cannot be changed. In reality, property owners can revoke or modify the deed at any time before their death.

- It avoids all taxes. A common belief is that transferring property through a TOD deed avoids all taxes. While it may help bypass probate fees, beneficiaries may still face capital gains taxes or inheritance taxes.

- Only one beneficiary can be named. Some people assume that a TOD deed allows for only one beneficiary. In fact, property owners can designate multiple beneficiaries, making it easier to distribute property among family members.

- It applies to all types of property. There is a misconception that TOD deeds can be used for any type of property. However, they are limited to real estate and cannot be used for personal property, bank accounts, or other assets.

- Beneficiaries have immediate ownership rights. Many believe that once the TOD deed is signed, beneficiaries own the property right away. Ownership only transfers upon the death of the property owner.

- It is a simple process with no legal help needed. Some think that creating a TOD deed is straightforward and does not require legal assistance. While it is a relatively simple form, consulting with a legal professional can help ensure that it is executed correctly and meets all legal requirements.

Understanding these misconceptions can help property owners make informed decisions about their estate planning and ensure their wishes are honored after their passing.

Form Overview

| Fact Name | Details |

|---|---|

| Purpose | The Georgia Transfer-on-Death Deed allows property owners to transfer real estate to designated beneficiaries upon their death, avoiding probate. |

| Governing Law | This deed is governed by Georgia Code § 44-6-90 through § 44-6-94. |

| Requirements | The form must be signed by the property owner and notarized. It must also be recorded in the county where the property is located. |

| Revocation | The transfer-on-death deed can be revoked at any time before the owner's death by filing a new deed or a revocation document. |