Printable Quitclaim Deed Document for Georgia

When it comes to transferring property in Georgia, the Quitclaim Deed form serves as a straightforward tool for property owners. This form allows one party to transfer their interest in a property to another without making any guarantees about the title's quality. It is commonly used in situations like family transfers, divorce settlements, or when a property owner wishes to relinquish their interest without the complexities of a warranty deed. Understanding the key components of the Quitclaim Deed is essential. The form typically requires details such as the names of the grantor and grantee, a description of the property, and the signatures of the parties involved. While it may seem simple, using a Quitclaim Deed carries significant implications. It is crucial for both parties to understand their rights and responsibilities before proceeding with this type of transfer. By knowing what to expect, property owners can navigate the process smoothly and ensure that their interests are protected.

More State-specific Quitclaim Deed Forms

Quit Claim Deed Form Texas Pdf - Parties can quickly change names on the property title using a Quitclaim Deed.

New York Quitclaim Deed - Transferring property through a Quitclaim Deed is quick and uncluttered.

How Much Does an Attorney Charge for a Quit Claim Deed - A Quitclaim Deed does not warrant the value or condition of the property.

Common Questions

What is a Quitclaim Deed in Georgia?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property (the grantor) has clear title to it. Instead, it simply conveys whatever interest the grantor may have in the property, if any. This type of deed is often used between family members or in situations where the parties know each other well, as it provides less protection to the buyer than other deeds might.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several scenarios. Common situations include transferring property between family members, such as from parents to children, or during a divorce when one spouse is relinquishing their interest in a property. It can also be useful for clearing up title issues, such as when a person wants to remove a former spouse or co-owner from the title. However, it’s important to remember that this deed does not provide any warranties about the property’s title.

How do I complete a Quitclaim Deed in Georgia?

Completing a Quitclaim Deed in Georgia involves several steps. First, you will need to obtain the appropriate form, which can usually be found online or at local legal offices. Next, you must fill out the form with the required information, including the names of the parties involved, a description of the property, and the date of the transfer. Once completed, the document must be signed in the presence of a notary public. Finally, to make the transfer official, you should file the Quitclaim Deed with the county clerk’s office where the property is located.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. It also offers protection to the buyer against any claims or disputes regarding the property’s title. In contrast, a Quitclaim Deed offers no such guarantees. It simply transfers whatever interest the grantor may have, if any, without any warranties. This distinction is crucial, especially for buyers who want to ensure they are receiving clear ownership of the property.

Are there any tax implications when using a Quitclaim Deed in Georgia?

Yes, there can be tax implications when using a Quitclaim Deed in Georgia. While transferring property through a Quitclaim Deed typically does not trigger a capital gains tax, it may still be subject to other taxes, such as the Georgia transfer tax. This tax is generally based on the value of the property being transferred. Additionally, if the property is being transferred as part of a sale, the seller may need to consider any applicable capital gains tax. It is advisable to consult with a tax professional to understand the specific implications based on your situation.

Can I revoke a Quitclaim Deed after it has been executed?

Once a Quitclaim Deed has been executed and recorded, it cannot be unilaterally revoked by the grantor. The transfer of property is considered final. However, if the parties involved agree, they can execute a new deed to reverse the transfer. This new deed would need to be properly completed and recorded to ensure the change is recognized legally. It’s important to approach such situations with caution and, if necessary, seek legal advice to understand the best course of action.

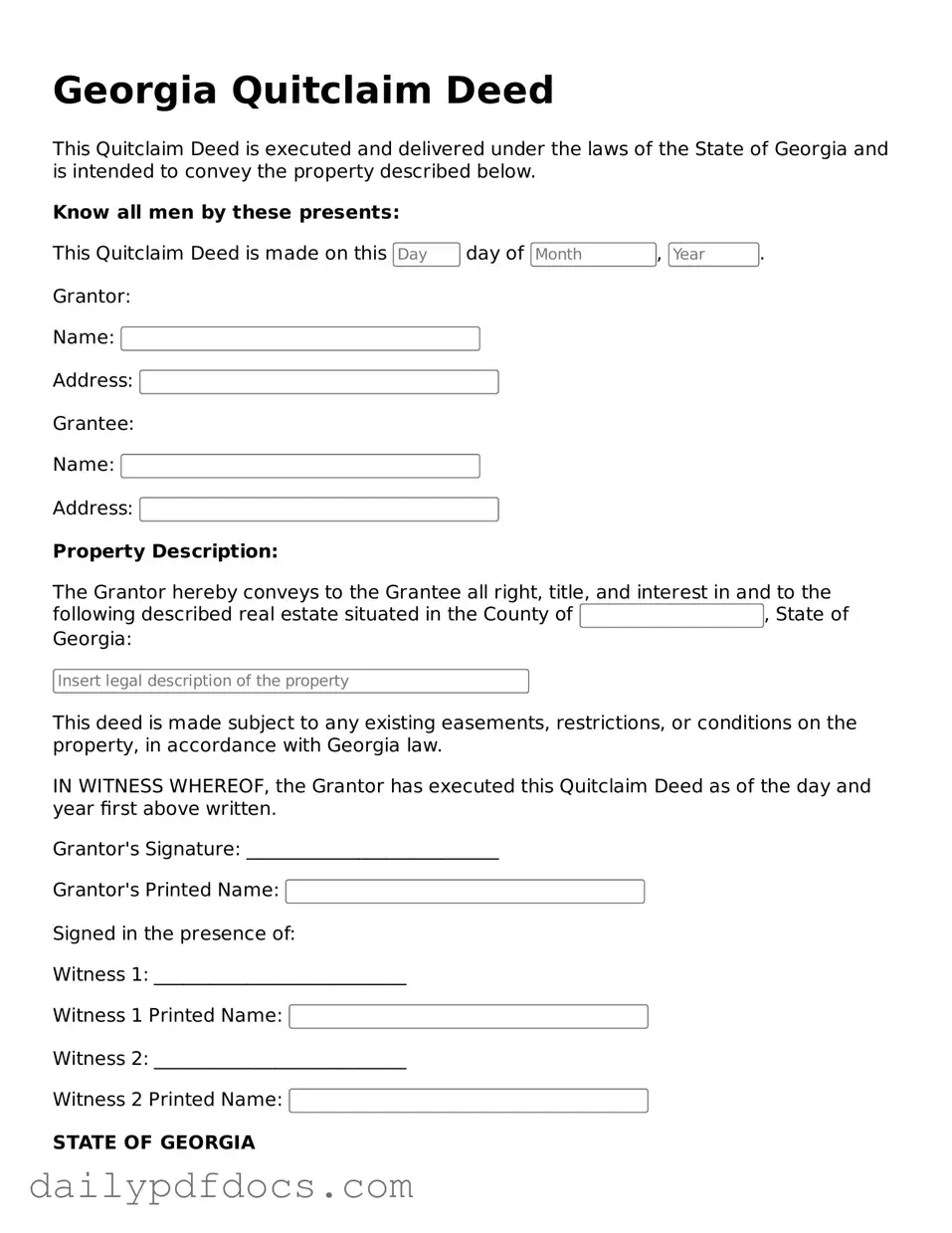

Preview - Georgia Quitclaim Deed Form

Georgia Quitclaim Deed

This Quitclaim Deed is executed and delivered under the laws of the State of Georgia and is intended to convey the property described below.

Know all men by these presents:

This Quitclaim Deed is made on this day of , .

Grantor:

Name:

Address:

Grantee:

Name:

Address:

Property Description:

The Grantor hereby conveys to the Grantee all right, title, and interest in and to the following described real estate situated in the County of , State of Georgia:

This deed is made subject to any existing easements, restrictions, or conditions on the property, in accordance with Georgia law.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

Grantor's Signature: ___________________________

Grantor's Printed Name:

Signed in the presence of:

Witness 1: ___________________________

Witness 1 Printed Name:

Witness 2: ___________________________

Witness 2 Printed Name:

STATE OF GEORGIA

COUNTY OF

Personally came before me, the undersigned Notary Public, the above-named Grantor, who acknowledged that they executed the same for the purposes therein expressed.

Given under my hand and official seal this day of , .

Notary Public: ___________________________

My Commission Expires:

Similar forms

-

Warranty Deed: This document transfers property ownership and guarantees that the seller has clear title to the property. Unlike a quitclaim deed, a warranty deed provides a warranty of title, meaning the seller is responsible for any title issues that arise after the sale.

-

Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership and includes assurances that the property has not been sold to anyone else and that it is free from undisclosed encumbrances. However, it does not offer the same level of protection as a warranty deed.

- Power of Attorney: A crucial document that ensures your wishes are respected when you're unable to make decisions, enabling designated individuals to manage your affairs effectively. For more information, visit Washington Templates.

-

Deed of Trust: This document secures a loan by transferring the property title to a trustee until the borrower repays the loan. While it serves a different purpose than a quitclaim deed, both documents involve the transfer of property rights.

-

Special Purpose Deed: This category includes various deeds used for specific situations, such as a personal representative deed or a trustee deed. Like a quitclaim deed, these documents may not provide warranties regarding the title but serve to transfer ownership under particular circumstances.

Misconceptions

Understanding the Georgia Quitclaim Deed form is essential for anyone looking to transfer property rights. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this form, along with clarifications for each.

-

A Quitclaim Deed transfers ownership of the property.

Actually, a Quitclaim Deed transfers whatever interest the grantor has in the property, if any. It does not guarantee that the grantor has any ownership rights to transfer.

-

Quitclaim Deeds are only used between family members.

While they are often used in familial situations, Quitclaim Deeds can be used in various transactions, including sales, divorces, or transferring property into a trust.

-

A Quitclaim Deed eliminates all liabilities associated with the property.

This is not true. The new owner may still be responsible for any liens or encumbrances on the property, regardless of the type of deed used.

-

Quitclaim Deeds are not legally binding.

On the contrary, Quitclaim Deeds are legally binding documents once properly executed and recorded. They carry weight in property law.

-

Using a Quitclaim Deed is a complicated process.

In fact, the process is relatively straightforward. It typically involves filling out the form, signing it, and filing it with the appropriate county office.

-

A Quitclaim Deed is the same as a Warranty Deed.

This is a misconception. A Warranty Deed provides guarantees about the title, while a Quitclaim Deed offers no such assurances.

-

Quitclaim Deeds can only be used for real estate transactions.

While primarily used for real estate, Quitclaim Deeds can also be used to transfer interests in other types of property, such as vehicles or personal property.

-

All states use the same Quitclaim Deed form.

This is incorrect. Each state has its own requirements and forms for Quitclaim Deeds, including specific language and filing procedures.

-

You do not need to have the Quitclaim Deed notarized.

In Georgia, notarization is typically required to ensure the document is valid and can be recorded.

-

A Quitclaim Deed can be revoked after it is executed.

Once a Quitclaim Deed is executed and recorded, it cannot be revoked. The transfer of interest is final unless both parties agree to a new arrangement.

By understanding these misconceptions, individuals can make more informed decisions regarding property transfers in Georgia.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties. |

| Governing Law | The Georgia Quitclaim Deed is governed by Georgia state law, specifically O.C.G.A. § 44-5-30 et seq. |

| Parties Involved | The parties involved in a quitclaim deed are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranties | Unlike other types of deeds, a quitclaim deed does not guarantee that the grantor holds clear title to the property. |

| Common Uses | Quitclaim deeds are often used in divorce settlements, transfers between family members, or to clear up title issues. |

| Filing Requirements | To be effective, the quitclaim deed must be signed by the grantor and may need to be notarized, depending on local requirements. |

| Recording | It is advisable to record the quitclaim deed with the county clerk’s office to provide public notice of the transfer. |

| Tax Implications | Transferring property via a quitclaim deed may have tax implications, so consulting a tax professional is recommended. |

| Limitations | A quitclaim deed may not be suitable for all situations, especially when a buyer requires assurance of clear title. |