Printable Promissory Note Document for Georgia

The Georgia Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money. This legally binding document outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It is essential for both lenders and borrowers to understand the implications of the agreement, as it provides clarity and protection for both parties involved. The form typically requires the signatures of the borrower and lender, ensuring that both are in agreement with the terms laid out. Additionally, it may include provisions for default, which detail the consequences should the borrower fail to meet their obligations. Understanding the nuances of this form can empower individuals to make informed financial decisions, fostering trust and transparency in the lending process.

More State-specific Promissory Note Forms

Free Promissory Note Template California - This document highlights the seriousness of a lending agreement, fostering responsible borrowing.

The use of a standard Non-disclosure Agreement is crucial for safeguarding sensitive information exchanged between parties in various professional settings. This agreement plays a vital role in ensuring that confidential material remains protected, allowing businesses to operate without the fear of information leaks during negotiations or partnerships.

Personal Loan Promissory Note - A promissory note can also include witness signatures for added legal weight.

Illinois Promissory Note - Used often in real estate transactions for financing purchases.

Common Questions

What is a Georgia Promissory Note?

A Georgia Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party at a designated time or on demand. It serves as a written record of the debt and outlines the terms of repayment.

Who can use a Promissory Note in Georgia?

Any individual or business can use a Promissory Note in Georgia. It is commonly used in personal loans, business transactions, and real estate deals. The borrower and lender must agree on the terms before signing.

What information should be included in a Georgia Promissory Note?

A typical Promissory Note should include the names and addresses of the borrower and lender, the loan amount, the interest rate (if any), the repayment schedule, and any penalties for late payments. It should also specify whether the loan is secured or unsecured.

Do I need a lawyer to create a Promissory Note in Georgia?

While it is not legally required to have a lawyer draft a Promissory Note, it is advisable. A lawyer can help ensure that the document complies with Georgia laws and accurately reflects the agreement between the parties.

Is a Promissory Note legally binding in Georgia?

Yes, a properly executed Promissory Note is legally binding in Georgia. This means that if the borrower fails to repay the loan, the lender can take legal action to recover the owed amount.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the new agreement to avoid disputes later.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, the lender has several options. They can pursue legal action to recover the amount owed, negotiate a new payment plan, or, if the note is secured, take possession of the collateral. The specific actions will depend on the terms outlined in the note.

Are there any specific laws governing Promissory Notes in Georgia?

Yes, Promissory Notes in Georgia are governed by state laws, including the Uniform Commercial Code (UCC). These laws outline the rights and responsibilities of both parties and provide guidance on enforcement and collection procedures.

What is the difference between a secured and unsecured Promissory Note?

A secured Promissory Note is backed by collateral, meaning the lender can claim the asset if the borrower defaults. An unsecured Promissory Note does not have collateral, making it riskier for the lender, as they have no specific asset to claim in case of default.

How can I ensure my Promissory Note is enforceable?

To ensure enforceability, make sure the Promissory Note is clear, complete, and signed by both parties. Include all necessary details, and consider having it notarized. Following these steps can help protect your interests in case of a dispute.

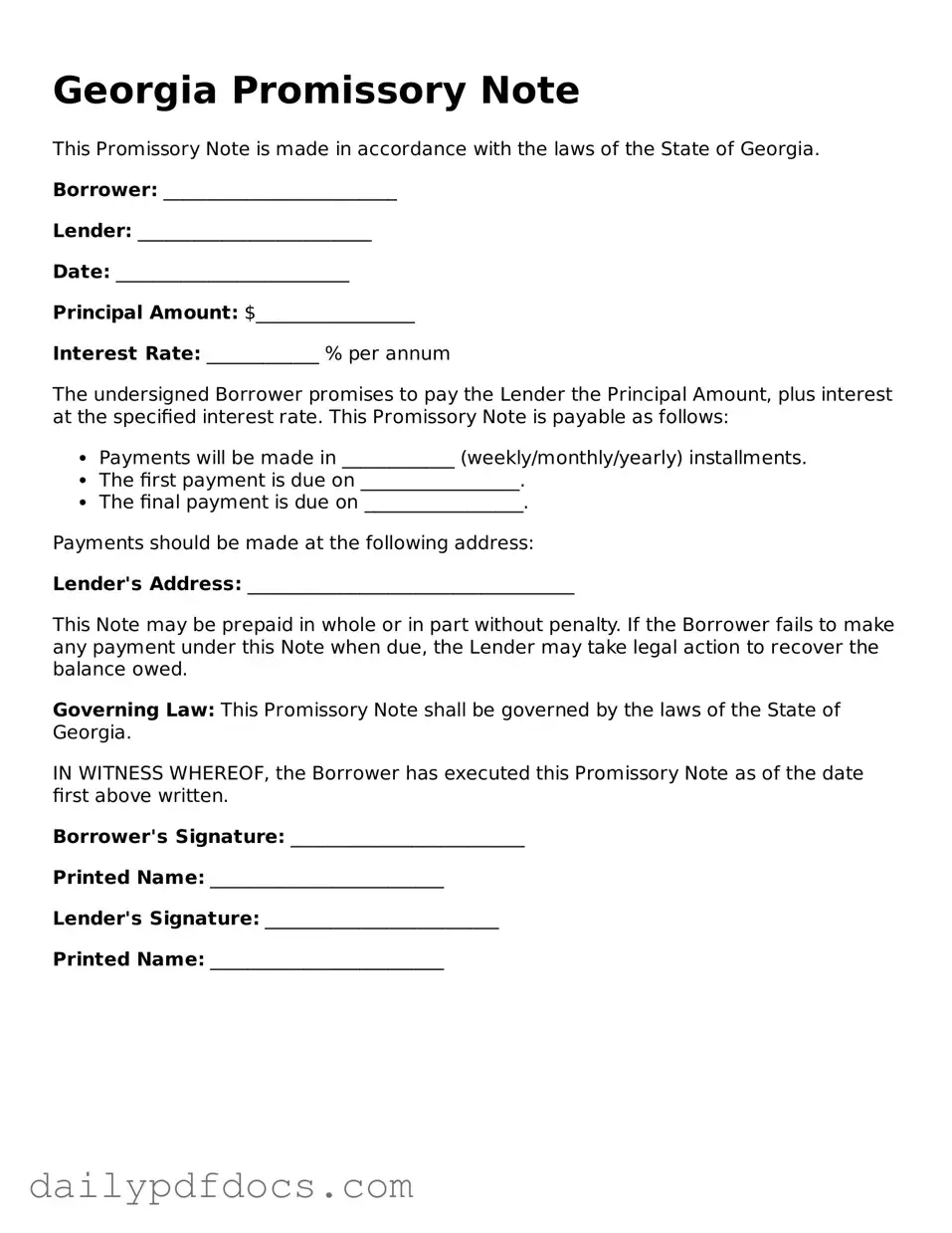

Preview - Georgia Promissory Note Form

Georgia Promissory Note

This Promissory Note is made in accordance with the laws of the State of Georgia.

Borrower: _________________________

Lender: _________________________

Date: _________________________

Principal Amount: $_________________

Interest Rate: ____________ % per annum

The undersigned Borrower promises to pay the Lender the Principal Amount, plus interest at the specified interest rate. This Promissory Note is payable as follows:

- Payments will be made in ____________ (weekly/monthly/yearly) installments.

- The first payment is due on _________________.

- The final payment is due on _________________.

Payments should be made at the following address:

Lender's Address: ___________________________________

This Note may be prepaid in whole or in part without penalty. If the Borrower fails to make any payment under this Note when due, the Lender may take legal action to recover the balance owed.

Governing Law: This Promissory Note shall be governed by the laws of the State of Georgia.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the date first above written.

Borrower's Signature: _________________________

Printed Name: _________________________

Lender's Signature: _________________________

Printed Name: _________________________

Similar forms

A Promissory Note is a financial document that signifies a promise to pay a specified amount of money to a designated person or entity under agreed-upon terms. Several other documents share similarities with a Promissory Note, primarily in their purpose and structure. Below is a list of ten such documents, along with an explanation of how they are alike.

- Loan Agreement: Like a Promissory Note, a Loan Agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. However, it often includes more detailed provisions regarding collateral and borrower obligations.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While it is less formal than a Promissory Note, it serves the same basic purpose of recognizing a financial obligation between parties.

-

Power of Attorney: This legal document allows an individual to grant another person the authority to make decisions on their behalf, covering areas like financial and medical matters. To understand more about creating your own Power of Attorney, visit Ohio PDF Forms.

- Mortgage Note: This document is similar to a Promissory Note but specifically pertains to real estate loans. It details the borrower's promise to repay the loan used to purchase property, including terms related to foreclosure in case of default.

- Secured Note: A Secured Note is a type of Promissory Note that is backed by collateral. If the borrower fails to repay, the lender has the right to seize the collateral, which adds a layer of security for the lender.

- Personal Guarantee: This document involves an individual agreeing to repay a debt if the primary borrower defaults. It shares the essence of a Promissory Note by ensuring a promise to pay, albeit from a different party.

- Bond: A bond is a formal contract to repay borrowed money with interest at a later date. Like a Promissory Note, it represents a promise to pay, but bonds are typically issued by corporations or governments and are more formalized.

- Installment Agreement: This document outlines a repayment plan for a debt. Similar to a Promissory Note, it specifies the amount owed and the payment schedule, often used for larger purchases or debts.

- Letter of Credit: A Letter of Credit guarantees payment to a seller, acting as a promise from a bank. While it serves a different function, it shares the underlying principle of ensuring payment under specific conditions.

- Vendor Financing Agreement: This document allows a buyer to purchase goods or services while deferring payment. It resembles a Promissory Note in that it involves a promise to pay, typically with interest over time.

- Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Similar to a Promissory Note, it signifies a commitment to repay, albeit often under renegotiated terms.

Misconceptions

Understanding the Georgia Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions often cloud this important document. Here’s a look at eight common misunderstandings:

-

All Promissory Notes Are the Same:

Many people assume that all promissory notes are interchangeable. In reality, each state has its own regulations and requirements. The Georgia Promissory Note is specifically tailored to comply with state laws, making it unique.

-

A Promissory Note Is a Loan Agreement:

While a promissory note does outline the terms of a loan, it is not the same as a loan agreement. The note serves as a promise to pay, while the loan agreement includes additional details like collateral and repayment terms.

-

Signing a Promissory Note Guarantees Payment:

Some believe that signing a promissory note guarantees that the borrower will repay the loan. However, if the borrower defaults, the lender may need to pursue legal action to recover the funds.

-

Interest Rates Are Fixed:

Another misconception is that interest rates on promissory notes are always fixed. In Georgia, borrowers and lenders can agree on either fixed or variable interest rates, depending on their preferences.

-

Promissory Notes Don't Need Witnesses:

Some individuals think that a promissory note can be valid without witnesses. In Georgia, while not always required, having a witness can add an extra layer of credibility to the document.

-

Electronic Signatures Are Not Valid:

Many people believe that only handwritten signatures are valid on promissory notes. However, electronic signatures are legally recognized in Georgia, provided both parties agree to this method.

-

Once Signed, a Promissory Note Cannot Be Changed:

Another common misunderstanding is that a promissory note is set in stone once signed. In fact, the terms can be modified if both parties agree to the changes, and this should be documented in writing.

-

Promissory Notes Are Only for Large Loans:

Finally, many think that promissory notes are only for significant amounts of money. In truth, they can be used for any loan amount, making them versatile tools for personal and business transactions.

By dispelling these misconceptions, individuals can better navigate the complexities of the Georgia Promissory Note form and ensure that their lending and borrowing experiences are smooth and informed.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a determined time. |

| Governing Law | The Georgia Promissory Note is governed by the Georgia Uniform Commercial Code (UCC), specifically under Title 11, Article 3. |

| Requirements | The note must include essential elements such as the principal amount, interest rate, payment schedule, and signatures of the involved parties. |

| Types | Georgia recognizes various types of promissory notes, including secured and unsecured notes, as well as demand and installment notes. |

| Enforceability | For a promissory note to be enforceable in Georgia, it must be clear, definite, and not contain any illegal terms. |

| Default Consequences | If a borrower defaults on a promissory note, the lender may pursue legal action to recover the owed amount, including interest and fees. |