Printable Operating Agreement Document for Georgia

The Georgia Operating Agreement form serves as a foundational document for limited liability companies (LLCs) in the state, outlining the structure and operational procedures of the business. This essential agreement details the roles and responsibilities of members, including management duties and voting rights. It addresses how profits and losses will be allocated among members, ensuring clarity in financial distributions. Additionally, the form includes provisions for the transfer of ownership interests, which can help prevent disputes among members in the future. By establishing guidelines for decision-making processes and outlining procedures for handling potential conflicts, the Operating Agreement promotes stability and transparency within the LLC. Furthermore, it can be customized to reflect the unique needs of the business, making it a versatile tool for entrepreneurs. Understanding the importance of this document is crucial for anyone looking to form an LLC in Georgia, as it not only protects individual interests but also enhances the overall credibility of the business entity.

More State-specific Operating Agreement Forms

Llc Operating Agreement Florida - It ensures that new members understand their rights and responsibilities upfront.

Ohio Llc Operating Agreement - Having an Operating Agreement can enhance the credibility of your LLC.

When you create a Washington Durable Power of Attorney, you are taking a crucial step to safeguard your financial and legal interests. This document grants someone you trust the authority to act on your behalf in the event that you can no longer make decisions due to incapacitation. For a reliable template that meets your needs, visit Washington Templates.

Operating Agreement Llc Pa - By having an Operating Agreement, members are better prepared for audits or legal scrutiny.

How to File Operating Agreement Llc - The Operating Agreement is a beneficial document for compliance with state laws.

Common Questions

What is a Georgia Operating Agreement?

A Georgia Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Georgia. It serves as an internal guideline for the members, detailing their rights, responsibilities, and the distribution of profits and losses. While not required by law, having an Operating Agreement is highly recommended to help prevent disputes among members.

Is an Operating Agreement required in Georgia?

No, Georgia law does not require LLCs to have an Operating Agreement. However, having one can provide clarity and structure to your business operations. It can also help protect your personal assets by reinforcing the separation between personal and business liabilities.

Who should draft the Operating Agreement?

The members of the LLC can draft the Operating Agreement. It’s often beneficial to consult with a legal professional to ensure that the document complies with state laws and adequately addresses the specific needs of the business. This can help avoid potential issues down the line.

What should be included in a Georgia Operating Agreement?

An effective Operating Agreement should include several key components: the name of the LLC, the purpose of the business, the names and addresses of the members, the management structure, voting rights, profit distribution, and procedures for adding or removing members. It may also outline dispute resolution methods and the process for dissolving the LLC.

Can the Operating Agreement be changed?

Yes, the Operating Agreement can be amended. Typically, the process for making changes is outlined within the document itself. Most agreements require a majority or unanimous consent from the members to approve any amendments. Keeping the Operating Agreement updated is essential as the business evolves.

What happens if there is no Operating Agreement?

If an LLC does not have an Operating Agreement, it will be governed by Georgia's default LLC laws. This can lead to unintended consequences, such as default profit-sharing arrangements or management structures that do not align with the members' intentions. Having a clear Operating Agreement helps ensure that all members are on the same page regarding the operation of the business.

Preview - Georgia Operating Agreement Form

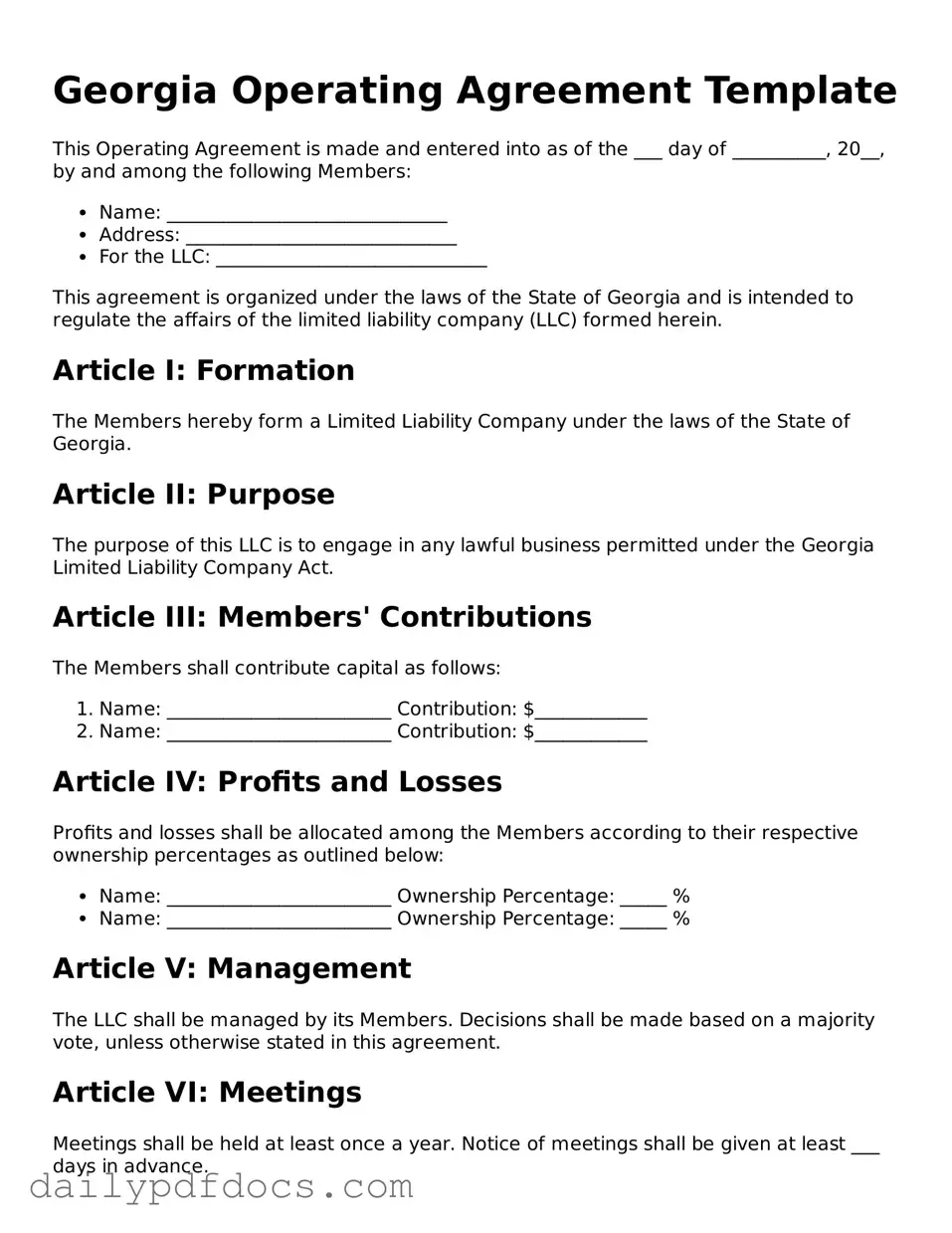

Georgia Operating Agreement Template

This Operating Agreement is made and entered into as of the ___ day of __________, 20__, by and among the following Members:

- Name: ______________________________

- Address: _____________________________

- For the LLC: _____________________________

This agreement is organized under the laws of the State of Georgia and is intended to regulate the affairs of the limited liability company (LLC) formed herein.

Article I: Formation

The Members hereby form a Limited Liability Company under the laws of the State of Georgia.

Article II: Purpose

The purpose of this LLC is to engage in any lawful business permitted under the Georgia Limited Liability Company Act.

Article III: Members' Contributions

The Members shall contribute capital as follows:

- Name: ________________________ Contribution: $____________

- Name: ________________________ Contribution: $____________

Article IV: Profits and Losses

Profits and losses shall be allocated among the Members according to their respective ownership percentages as outlined below:

- Name: ________________________ Ownership Percentage: _____ %

- Name: ________________________ Ownership Percentage: _____ %

Article V: Management

The LLC shall be managed by its Members. Decisions shall be made based on a majority vote, unless otherwise stated in this agreement.

Article VI: Meetings

Meetings shall be held at least once a year. Notice of meetings shall be given at least ___ days in advance.

Article VII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article VIII: Governing Law

This agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

IN WITNESS WHEREOF

The undersigned Members have executed this Operating Agreement as of the day and year first above written.

- Member Signature: ________________________ Date: ___________

- Member Signature: ________________________ Date: ___________

Similar forms

- Partnership Agreement: Like an Operating Agreement, a Partnership Agreement outlines the roles, responsibilities, and profit-sharing arrangements among partners in a business. Both documents aim to clarify expectations and prevent disputes.

- Prenuptial Agreement: To safeguard your assets in the event of a marriage dissolution, refer to our important Prenuptial Agreement resources that help outline key responsibilities and rights.

- Bylaws: Bylaws serve as the internal rules for a corporation, similar to how an Operating Agreement governs an LLC. Both documents define the structure and management of the organization, ensuring smooth operations.

- Shareholder Agreement: This agreement is used in corporations to establish the rights and obligations of shareholders. It shares similarities with an Operating Agreement by detailing how decisions are made and how shares are transferred.

- Joint Venture Agreement: When two or more parties collaborate on a specific project, a Joint Venture Agreement outlines the terms of their partnership. Like an Operating Agreement, it specifies contributions, management roles, and profit distribution.

- Employment Agreement: This document outlines the terms of employment for an individual, including duties, compensation, and termination conditions. While focused on employment, it shares the goal of defining relationships and expectations, similar to an Operating Agreement.

- Franchise Agreement: A Franchise Agreement governs the relationship between a franchisor and franchisee. Both it and an Operating Agreement establish operational guidelines and the responsibilities of each party, ensuring consistency and compliance.

- Non-Disclosure Agreement (NDA): An NDA protects sensitive information shared between parties. While its focus is on confidentiality, like an Operating Agreement, it establishes clear expectations and responsibilities to protect the interests of all involved.

- Purchase Agreement: This document outlines the terms of a sale between a buyer and seller. Similar to an Operating Agreement, it details the rights and obligations of the parties, aiming to prevent misunderstandings and disputes.

Misconceptions

Understanding the Georgia Operating Agreement form can be challenging, and several misconceptions often arise. Below is a list of ten common misunderstandings, each clarified for better insight.

-

It is not necessary to have an Operating Agreement in Georgia.

Many people believe that an Operating Agreement is optional. In reality, while Georgia does not legally require it for LLCs, having one is crucial for outlining the management structure and operational procedures.

-

All members must sign the Operating Agreement.

Some think that every member's signature is mandatory for the agreement to be valid. However, only the members listed in the agreement need to sign, which can simplify the process for smaller LLCs.

-

The Operating Agreement must be filed with the state.

This is a common misconception. The Operating Agreement is an internal document and does not need to be submitted to the state of Georgia. It should be kept with your business records.

-

Operating Agreements are only for multi-member LLCs.

Many people think that single-member LLCs do not need an Operating Agreement. In fact, it is still beneficial for single-member LLCs to have one, as it provides clarity and can help protect personal liability.

-

Once created, the Operating Agreement cannot be changed.

Some believe that the Operating Agreement is set in stone. In truth, it can be amended as needed, provided that all members agree to the changes and follow the amendment process outlined in the agreement itself.

-

The Operating Agreement is the same as the Articles of Organization.

There is a misconception that these two documents serve the same purpose. The Articles of Organization are filed with the state to form the LLC, while the Operating Agreement governs the internal workings of the LLC.

-

Legal counsel is not needed to draft an Operating Agreement.

Some people think they can create an Operating Agreement without any legal help. While templates are available, consulting with a legal professional ensures that the agreement meets specific needs and complies with state laws.

-

The Operating Agreement can be verbal.

There is a belief that a verbal agreement is sufficient. However, for clarity and enforceability, it is essential to have a written Operating Agreement, as verbal agreements can lead to misunderstandings and disputes.

-

Operating Agreements are only for new businesses.

Many assume that only new LLCs need an Operating Agreement. In reality, existing businesses can benefit from having one, especially if there are changes in membership or management structure.

-

All provisions in the Operating Agreement are mandatory.

Some believe that every provision in the Operating Agreement must be followed strictly. While it is important to adhere to the agreement, certain provisions can be flexible, allowing for adjustments based on the LLC's needs.

By addressing these misconceptions, individuals can better understand the importance and function of the Georgia Operating Agreement, ensuring their business operates smoothly and effectively.

Form Overview

| Fact Name | Description |

|---|---|

| Governing Law | The Georgia Operating Agreement is governed by the Georgia Limited Liability Company Act. |

| Purpose | This form outlines the management structure and operational procedures of a limited liability company (LLC) in Georgia. |

| Member Roles | The agreement specifies the roles and responsibilities of each member within the LLC. |

| Profit Distribution | It details how profits and losses will be distributed among members. |

| Amendment Process | The agreement includes provisions for how it can be amended in the future. |

| Decision-Making | It outlines the decision-making process, including voting rights and procedures. |

| Initial Contributions | The form records the initial capital contributions made by each member. |

| Duration | The agreement specifies the duration of the LLC's existence, which can be perpetual or for a defined term. |

| Dispute Resolution | It often includes mechanisms for resolving disputes among members. |

| Compliance | The agreement ensures compliance with state laws and regulations pertaining to LLCs. |