Printable Loan Agreement Document for Georgia

When it comes to borrowing money in Georgia, having a clear and comprehensive Loan Agreement form is essential. This document outlines the terms and conditions of the loan, ensuring that both the lender and borrower understand their rights and responsibilities. Key elements of the form include the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Additionally, it specifies what happens in case of default, providing both parties with a sense of security. Whether you're borrowing for personal reasons or business needs, a well-structured Loan Agreement can help prevent misunderstandings and protect your interests. Understanding this form is the first step toward a smooth borrowing experience in Georgia.

More State-specific Loan Agreement Forms

California Promissory Note Template - Inclues terms of renewal or extension for the loan if needed.

For those seeking a reliable way to safeguard sensitive information, a well-drafted solid Non-disclosure Agreement template can be invaluable. This document ensures that both parties are legally bound not to share any confidential details, making it a vital asset in today’s business environment.

Promissory Note Illinois - Clear terms in the agreement help foster trust between parties involved.

Common Questions

What is the Georgia Loan Agreement form?

The Georgia Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is made between a lender and a borrower. This form serves to protect both parties by clearly defining the amount borrowed, interest rates, repayment schedule, and any collateral involved. It is essential for ensuring that both parties understand their rights and responsibilities throughout the loan process.

Who should use the Georgia Loan Agreement form?

This form is suitable for individuals or businesses in Georgia seeking to formalize a loan arrangement. Whether you are lending money to a friend, family member, or a business partner, using this agreement can help prevent misunderstandings and disputes. It is particularly important for larger sums of money or when the terms of repayment are complex.

What key elements are included in the Georgia Loan Agreement?

The agreement typically includes the loan amount, interest rate, repayment terms, and the duration of the loan. It may also specify any fees associated with the loan, the consequences of late payments, and the process for resolving disputes. Additionally, the agreement may detail any collateral that secures the loan, ensuring that the lender has a claim to specific assets if the borrower defaults.

Is the Georgia Loan Agreement form legally binding?

Yes, once both parties sign the Georgia Loan Agreement, it becomes a legally binding contract. This means that both the lender and borrower are obligated to adhere to the terms outlined in the document. If either party fails to comply, the other party may have legal grounds to seek enforcement or damages. It is crucial to ensure that all terms are clear and agreed upon before signing.

Can the Georgia Loan Agreement be modified after it is signed?

Yes, the Georgia Loan Agreement can be modified, but any changes must be documented in writing and signed by both parties. This ensures that all modifications are clear and enforceable. It is advisable to keep a record of any amendments to the original agreement to avoid confusion in the future.

Where can I obtain a Georgia Loan Agreement form?

You can obtain a Georgia Loan Agreement form from various sources, including legal stationery stores, online legal document services, or local attorneys who specialize in contract law. Ensure that the form you choose complies with Georgia state laws and is tailored to your specific loan arrangement to avoid potential legal issues.

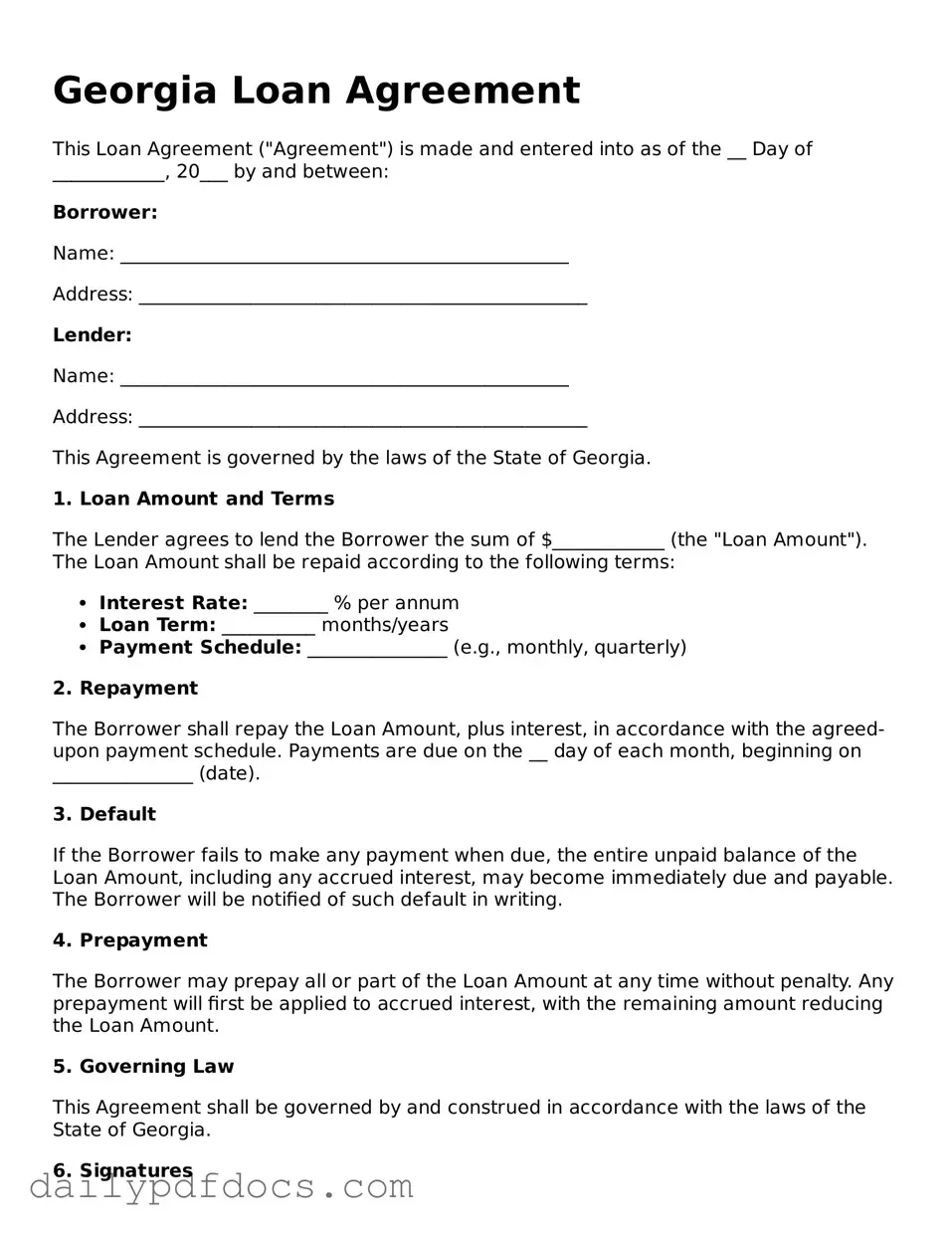

Preview - Georgia Loan Agreement Form

Georgia Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of the __ Day of ____________, 20___ by and between:

Borrower:

Name: ________________________________________________

Address: ________________________________________________

Lender:

Name: ________________________________________________

Address: ________________________________________________

This Agreement is governed by the laws of the State of Georgia.

1. Loan Amount and Terms

The Lender agrees to lend the Borrower the sum of $____________ (the "Loan Amount"). The Loan Amount shall be repaid according to the following terms:

- Interest Rate: ________ % per annum

- Loan Term: __________ months/years

- Payment Schedule: _______________ (e.g., monthly, quarterly)

2. Repayment

The Borrower shall repay the Loan Amount, plus interest, in accordance with the agreed-upon payment schedule. Payments are due on the __ day of each month, beginning on _______________ (date).

3. Default

If the Borrower fails to make any payment when due, the entire unpaid balance of the Loan Amount, including any accrued interest, may become immediately due and payable. The Borrower will be notified of such default in writing.

4. Prepayment

The Borrower may prepay all or part of the Loan Amount at any time without penalty. Any prepayment will first be applied to accrued interest, with the remaining amount reducing the Loan Amount.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Georgia.

6. Signatures

This Agreement is executed as a sealed instrument. By signing below, the Borrower and Lender agree to the terms outlined in this Agreement.

_____________________________

Borrower’s Signature

Date: ______________________

_____________________________

Lender’s Signature

Date: ______________________

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan. Like a Loan Agreement, it specifies the loan amount, interest rate, and repayment terms.

- Mortgage Agreement: This document secures a loan with real property. It shares similarities with a Loan Agreement in detailing the loan terms and conditions, but it also includes property collateral.

- Trailer Bill of Sale: This document is essential for the transfer of ownership of a trailer, ensuring all legal requirements are met. For more information, visit https://legalformspdf.com/.

- Security Agreement: This document provides a lender with rights to specific assets if the borrower defaults. Both agreements involve collateral and repayment terms.

- Credit Agreement: This document governs the terms under which a borrower can access credit. Like a Loan Agreement, it sets out the amount, interest, and repayment schedule.

- Lease Agreement: While primarily for renting property, it outlines payment terms and obligations, similar to how a Loan Agreement specifies loan repayment terms.

- Installment Sale Agreement: This document allows for the purchase of goods over time. It includes payment terms, much like a Loan Agreement, but focuses on the sale of goods rather than cash loans.

- Personal Loan Agreement: This document details the terms of a personal loan. It is similar to a Loan Agreement in that it specifies the amount borrowed, interest rate, and repayment schedule.

- Business Loan Agreement: This document is specifically for business financing. It shares key elements with a Loan Agreement, including loan amount, interest, and repayment terms tailored for business needs.

Misconceptions

Understanding the Georgia Loan Agreement form is essential for both lenders and borrowers. However, misconceptions can lead to confusion and potential issues. Below are ten common misconceptions, along with clarifications to help foster a clearer understanding.

- The form is only for large loans. Many people believe that the Georgia Loan Agreement form is only applicable for significant amounts of money. In reality, it can be used for loans of various sizes, accommodating both small and large transactions.

- Only banks can use this form. Some individuals think that only financial institutions can utilize the Georgia Loan Agreement. However, any individual or entity can use this form to document a loan, ensuring clarity and legal protection.

- The form is not legally binding. A common myth is that the Georgia Loan Agreement is merely a suggestion and holds no legal weight. In fact, when properly completed and signed, it is a legally binding document that outlines the obligations of both parties.

- Verbal agreements are sufficient. Many believe that a verbal agreement is enough for loan transactions. This is misleading; a written agreement, such as the Georgia Loan Agreement, provides necessary documentation and clarity that verbal agreements cannot.

- All loan agreements are the same. Some assume that all loan agreements follow the same format and terms. The Georgia Loan Agreement has specific provisions tailored to state laws and regulations, making it unique.

- Only borrowers need to sign. There is a misconception that only the borrower’s signature is required. Both the lender and the borrower must sign the agreement to ensure that both parties are bound by its terms.

- It does not need to be notarized. Some people think that notarization is unnecessary for the Georgia Loan Agreement. While notarization is not always required, having it notarized can provide additional legal protection.

- It can be changed after signing. A misconception exists that terms of the agreement can be altered after both parties have signed. Changes should be documented through an amendment to the original agreement to ensure clarity and legality.

- Interest rates are fixed and cannot be negotiated. Many believe that the interest rates stated in the agreement are non-negotiable. In fact, terms, including interest rates, can often be negotiated before signing.

- It is only for personal loans. Some individuals think that the Georgia Loan Agreement is limited to personal loans. However, it can also be used for business loans and other types of financial transactions.

By addressing these misconceptions, individuals can better navigate the loan process and ensure that their agreements are clear and enforceable.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Georgia Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower in Georgia. |

| Governing Law | This agreement is governed by the laws of the State of Georgia, specifically under the Georgia Code Title 10, Chapter 1. |

| Parties Involved | The form identifies the lender and the borrower, ensuring that both parties are clearly defined. |

| Loan Amount | The agreement specifies the total amount of money being loaned, which is crucial for both parties to understand their obligations. |

| Interest Rate | The interest rate applicable to the loan is detailed in the agreement, impacting the total amount to be repaid. |

| Repayment Terms | It outlines the repayment schedule, including due dates and any penalties for late payments. |

| Default Conditions | The form specifies what constitutes a default on the loan, outlining the lender's rights in such an event. |

| Signatures | Both parties must sign the agreement to make it legally binding, indicating their acceptance of the terms. |