Printable Gift Deed Document for Georgia

The Georgia Gift Deed form is a valuable legal document that allows individuals to transfer property as a gift without any exchange of money. This form is particularly useful for those wishing to give real estate, such as land or a home, to family members or friends. By completing this form, the donor can clearly outline the specifics of the gift, including the property description and the recipient's details. It is essential to understand that this deed must be signed in the presence of a notary public to ensure its validity. Additionally, the form may need to be recorded in the county where the property is located, which helps protect the recipient's ownership rights. Understanding these key aspects can simplify the process of gifting property in Georgia and ensure that all legal requirements are met.

More State-specific Gift Deed Forms

What Is a Gift Deed - It helps ensure that the gift is executed according to the donor’s wishes.

A Florida Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form outlines essential details such as the buyer, seller, and the mobile home's specifications. Understanding this document is crucial for ensuring a smooth transaction and protecting the rights of both parties involved. For more information, you can refer to the following resource: https://mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale.

Common Questions

What is a Gift Deed in Georgia?

A Gift Deed is a legal document used to transfer property ownership from one person to another without any exchange of money. In Georgia, this type of deed is often used when someone wants to give real estate, such as a house or land, to a family member or friend. The person giving the gift is known as the "grantor," while the recipient is called the "grantee." This deed must be executed properly to be valid and to ensure that the transfer of ownership is recognized by the state.

Do I need to pay taxes on a Gift Deed in Georgia?

Generally, the recipient of a gift does not have to pay income tax on the value of the property received through a Gift Deed. However, there may be gift tax implications for the grantor, depending on the value of the property and the amount of gifts given in a year. It's advisable for both parties to consult with a tax professional to understand any potential tax obligations that may arise from the transfer.

Are there any requirements for executing a Gift Deed in Georgia?

Yes, there are specific requirements for executing a Gift Deed in Georgia. The deed must be in writing and signed by the grantor. It is also important to include a clear description of the property being transferred. To ensure the deed is legally binding, it should be notarized and recorded with the county clerk's office where the property is located. Recording the deed provides public notice of the transfer and protects the rights of the grantee.

Can I revoke a Gift Deed in Georgia?

Once a Gift Deed is executed and recorded, it is generally considered a completed transfer of ownership and cannot be revoked. However, there are some exceptions. If the grantor can prove that the gift was made under duress, fraud, or undue influence, they may have legal grounds to challenge the validity of the deed. It's essential to consult with a legal professional if there are concerns about the validity of a Gift Deed.

What happens if the grantor dies after executing a Gift Deed?

If the grantor dies after executing a Gift Deed, the property is already considered the legal property of the grantee. The grantee will not need to go through probate for that property, as it has already been transferred. However, if the grantor had other assets that were not transferred via a Gift Deed, those assets may still be subject to probate proceedings.

Can a Gift Deed be used for personal property as well as real estate?

While a Gift Deed is primarily used for real estate transactions, it can also be used to transfer personal property, such as vehicles, jewelry, or other valuable items. However, the process and documentation may differ for personal property. It's important to ensure that any transfer of personal property is documented properly to avoid disputes in the future.

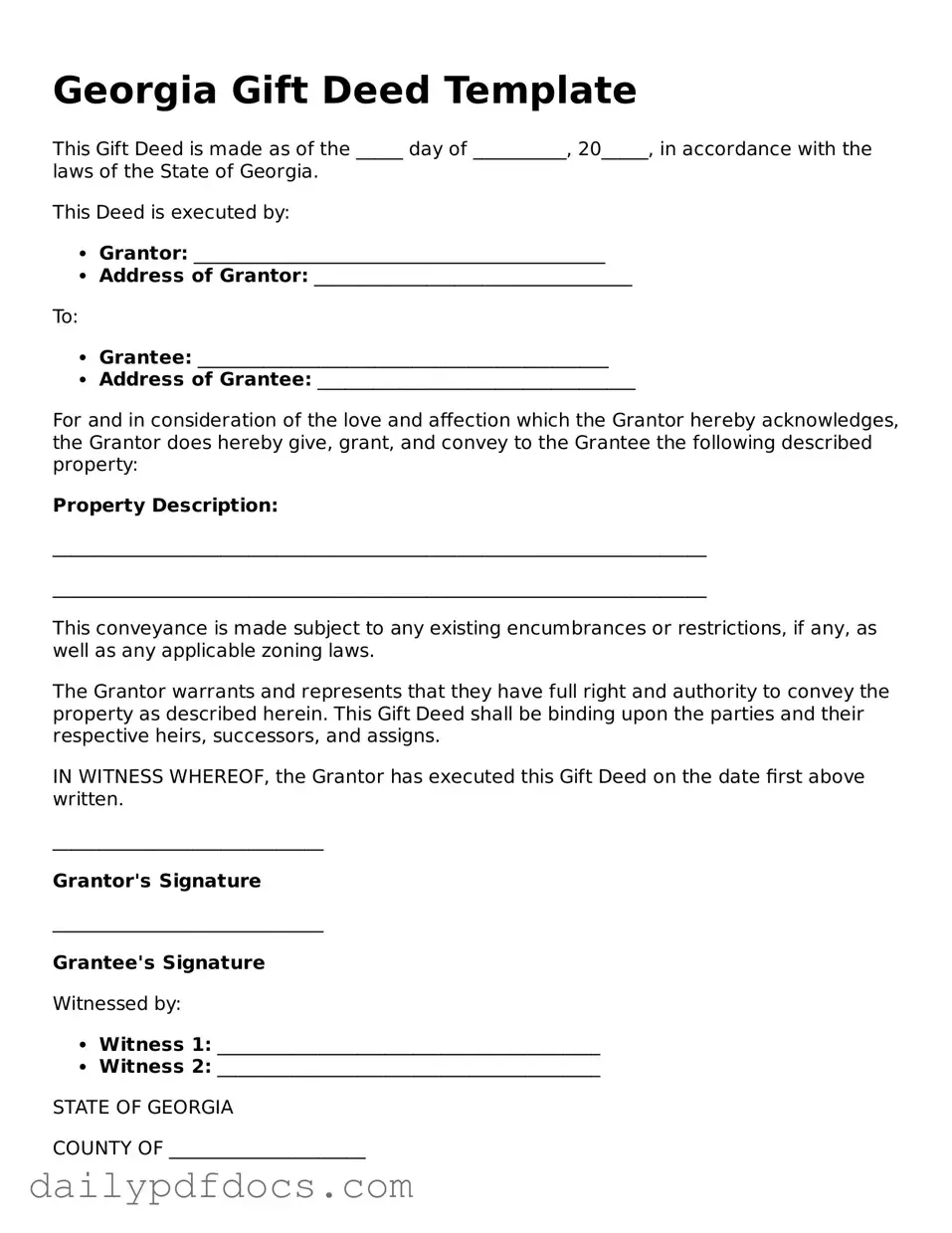

Preview - Georgia Gift Deed Form

Georgia Gift Deed Template

This Gift Deed is made as of the _____ day of __________, 20_____, in accordance with the laws of the State of Georgia.

This Deed is executed by:

- Grantor: ____________________________________________

- Address of Grantor: __________________________________

To:

- Grantee: ____________________________________________

- Address of Grantee: __________________________________

For and in consideration of the love and affection which the Grantor hereby acknowledges, the Grantor does hereby give, grant, and convey to the Grantee the following described property:

Property Description:

______________________________________________________________________

______________________________________________________________________

This conveyance is made subject to any existing encumbrances or restrictions, if any, as well as any applicable zoning laws.

The Grantor warrants and represents that they have full right and authority to convey the property as described herein. This Gift Deed shall be binding upon the parties and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the Grantor has executed this Gift Deed on the date first above written.

_____________________________

Grantor's Signature

_____________________________

Grantee's Signature

Witnessed by:

- Witness 1: _________________________________________

- Witness 2: _________________________________________

STATE OF GEORGIA

COUNTY OF _____________________

Before me, the undersigned authority, on this _____ day of __________, 20_____, personally appeared the Grantor and the Grantee, known to me (or proven to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this _____ day of __________, 20_____.

_____________________________

Notary Public

My commission expires: ___________

Similar forms

- Quitclaim Deed: This document transfers ownership of property from one party to another without any warranties. Like a Gift Deed, it does not require payment and is often used between family members.

- Warranty Deed: A Warranty Deed provides a guarantee that the grantor holds clear title to the property. While it typically involves a sale, it can also be used to transfer property as a gift.

- Trust Agreement: A Trust Agreement allows a person to place their property into a trust for the benefit of others. This can be similar to a Gift Deed when property is transferred to beneficiaries.

- Transfer on Death Deed: This document allows a property owner to transfer their property to a beneficiary upon their death. It is similar to a Gift Deed in that it facilitates the transfer of property without immediate payment.

- Bill of Sale: A Bill of Sale is used to transfer ownership of personal property. Like a Gift Deed, it can be executed without payment if the property is given as a gift.

- Quitclaim Deed: A Quitclaim Deed is a legal document used in Ohio to transfer ownership of real estate without any warranties. This form allows the grantor to relinquish their interest in the property, making it a straightforward option for transferring property rights. For more information, you can visit Ohio PDF Forms.

- Deed of Gift: This document specifically outlines the intention to give property as a gift. It serves a similar purpose to a Gift Deed, emphasizing that no compensation is involved.

- Lease Agreement: While primarily for renting property, a Lease Agreement can be structured to allow for a nominal fee or no fee at all, mimicking the nature of a gift.

- Power of Attorney: A Power of Attorney allows one person to act on behalf of another. This can include transferring property as a gift, similar to the intent behind a Gift Deed.

- Affidavit of Heirship: This document is used to establish the heirs of a deceased person. It can relate to a Gift Deed when property is transferred to heirs without going through probate.

- Charitable Donation Receipt: This document acknowledges a gift made to a charity. Like a Gift Deed, it confirms the transfer of property without expecting anything in return.

Misconceptions

- Gift Deeds are only for family members. Many believe that gift deeds can only be used to transfer property between family members. In reality, anyone can give a gift deed to another person, regardless of their relationship.

- Gift Deeds do not require any formalities. Some think that a gift deed can be created informally without any legal requirements. However, a valid gift deed must be in writing, signed by the donor, and often requires notarization.

- Once a gift deed is signed, it cannot be revoked. Many assume that a gift deed is permanent and cannot be changed. While it is true that a gift deed is generally irrevocable, there are specific circumstances under which it can be contested or revoked.

- Gift Deeds do not incur any taxes. Some people believe that transferring property via a gift deed is entirely tax-free. In fact, there may be gift tax implications depending on the value of the property and the relationship between the giver and receiver.

- All states have the same rules for gift deeds. A common misconception is that gift deed laws are uniform across the country. Each state, including Georgia, has its own specific rules and requirements for gift deeds that must be followed.

- Gift Deeds are the same as wills. Many confuse gift deeds with wills. A gift deed transfers ownership during the giver's lifetime, while a will only takes effect after death.

- Once property is gifted, the donor has no rights to it. Some believe that giving a property away means the donor loses all rights. In some cases, the donor may retain certain rights, such as the right to live on the property or receive income from it.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document that transfers property from one person to another without any payment in return. |

| Governing Law | The Gift Deed in Georgia is governed by Title 44, Chapter 5 of the Official Code of Georgia Annotated. |

| Required Signatures | The deed must be signed by the donor (the person giving the gift) and must be notarized. |

| Tax Implications | Gift tax may apply, depending on the value of the property being transferred and the relationship between the donor and recipient. |

| Recording | To make the transfer official, the Gift Deed should be recorded with the local county clerk's office. |

| Revocation | A Gift Deed cannot be revoked once it has been executed and delivered, unless specific conditions are met. |