Printable Deed in Lieu of Foreclosure Document for Georgia

The Georgia Deed in Lieu of Foreclosure form serves as a crucial instrument in the realm of real estate transactions, particularly during the distressing circumstances of mortgage default. This legal document allows a borrower to voluntarily transfer ownership of their property to the lender, effectively sidestepping the often lengthy and costly foreclosure process. By executing this form, the borrower may mitigate the adverse effects of foreclosure on their credit score while simultaneously providing the lender with a streamlined means of recovering the owed debt. The form outlines essential details, including the identities of the parties involved, a description of the property in question, and the acknowledgment of any existing liens or encumbrances. Moreover, it typically incorporates provisions that address potential deficiencies and the release of liability for the borrower, which can significantly ease the burden of financial distress. Understanding the implications of this form is vital for both borrowers seeking a dignified exit from their mortgage obligations and lenders aiming to reclaim their investment with minimal disruption.

More State-specific Deed in Lieu of Foreclosure Forms

Will I Owe Money After a Deed in Lieu of Foreclosure - Potential tax consequences of a Deed in Lieu should be considered before acting.

Foreclosure Vs Deed in Lieu - This option empowers borrowers to manage their situation proactively rather than reactively facing foreclosure.

The use of a comprehensive Non-disclosure Agreement is vital for safeguarding sensitive information in business dealings. This document ensures that parties involved are legally bound to maintain confidentiality, thereby protecting trade secrets and proprietary knowledge.

Will I Owe Money After a Deed in Lieu of Foreclosure - Homeowners should carefully review their mortgage agreement and lender policies before proceeding.

Foreclosure Vs Deed in Lieu - The process can vary between different lenders and states.

Common Questions

What is a Deed in Lieu of Foreclosure in Georgia?

A Deed in Lieu of Foreclosure is a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This option is often considered when homeowners are struggling to make mortgage payments and want to avoid the lengthy and stressful foreclosure process. By opting for a Deed in Lieu, homeowners can potentially protect their credit score from the more severe impact of foreclosure while also providing the lender with a quicker resolution to the defaulted loan situation.

What are the benefits of pursuing a Deed in Lieu of Foreclosure?

There are several benefits to consider. First, homeowners may be able to avoid the negative consequences associated with a foreclosure, which can remain on a credit report for up to seven years. Second, the process is typically quicker and less costly than foreclosure. Homeowners can also negotiate with the lender to potentially receive relocation assistance or a cash incentive to vacate the property. Finally, a Deed in Lieu may allow homeowners to regain some control over the situation, as they are actively participating in the decision to transfer the property rather than waiting for the lender to initiate foreclosure proceedings.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are advantages, there are also important drawbacks to consider. One significant concern is that lenders are not obligated to accept a Deed in Lieu, and they may prefer to proceed with foreclosure. Additionally, homeowners may still be liable for any deficiency balance if the property sells for less than the amount owed on the mortgage. Furthermore, the process may have tax implications, as the IRS may consider forgiven debt as taxable income. It is crucial for homeowners to consult with a financial advisor or attorney to fully understand these potential consequences before proceeding.

How do I initiate a Deed in Lieu of Foreclosure in Georgia?

The process begins with contacting the lender to express interest in a Deed in Lieu. Homeowners should be prepared to provide detailed financial information, including income, expenses, and any hardships that have led to the inability to make mortgage payments. After the lender reviews the situation, they may require a formal application or specific documentation. If the lender agrees to the Deed in Lieu, both parties will need to execute the deed and ensure it is properly recorded with the county. It is advisable to seek legal counsel throughout this process to ensure all steps are completed correctly and to protect one’s interests.

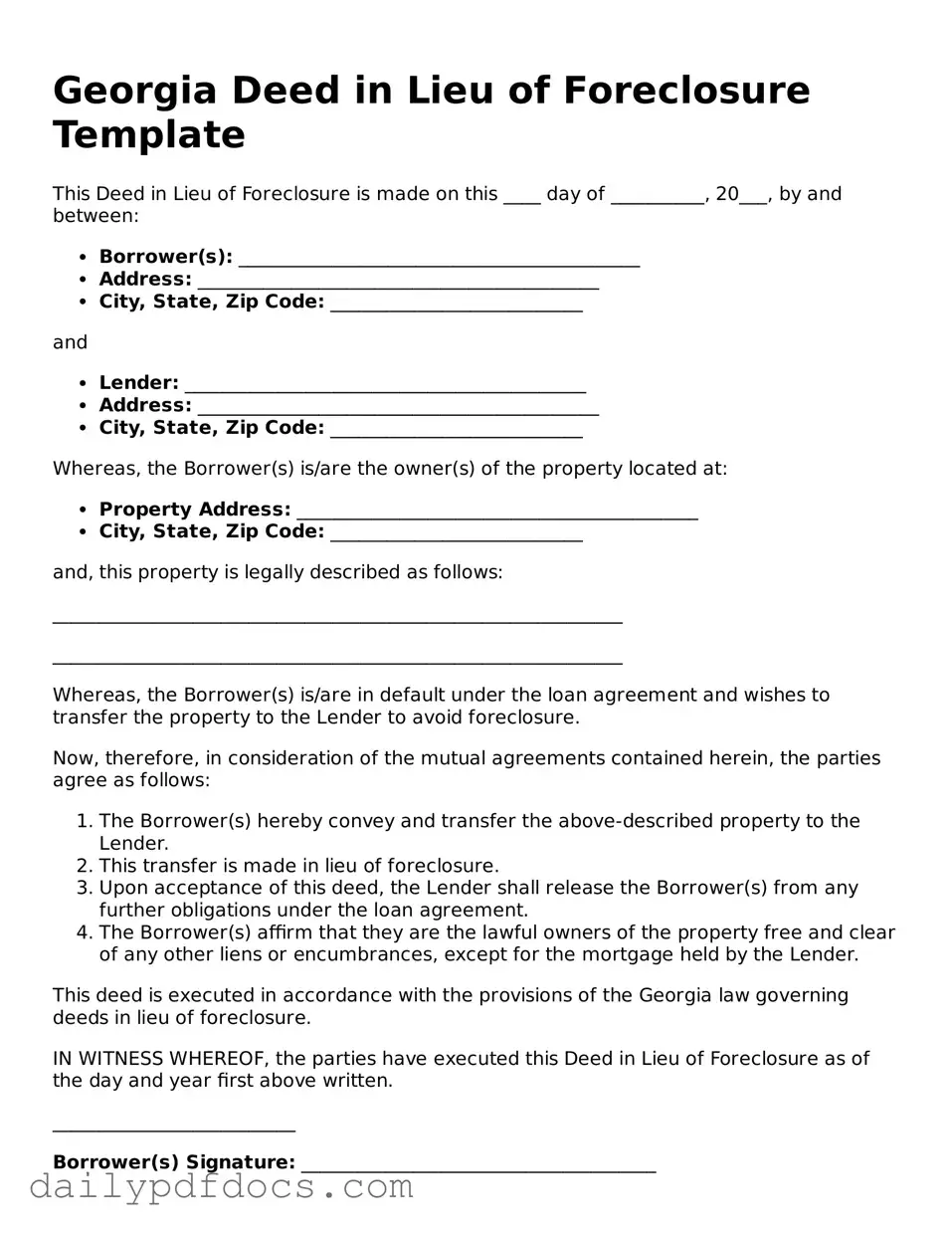

Preview - Georgia Deed in Lieu of Foreclosure Form

Georgia Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made on this ____ day of __________, 20___, by and between:

- Borrower(s): ___________________________________________

- Address: ___________________________________________

- City, State, Zip Code: ___________________________

and

- Lender: ___________________________________________

- Address: ___________________________________________

- City, State, Zip Code: ___________________________

Whereas, the Borrower(s) is/are the owner(s) of the property located at:

- Property Address: ___________________________________________

- City, State, Zip Code: ___________________________

and, this property is legally described as follows:

_____________________________________________________________

_____________________________________________________________

Whereas, the Borrower(s) is/are in default under the loan agreement and wishes to transfer the property to the Lender to avoid foreclosure.

Now, therefore, in consideration of the mutual agreements contained herein, the parties agree as follows:

- The Borrower(s) hereby convey and transfer the above-described property to the Lender.

- This transfer is made in lieu of foreclosure.

- Upon acceptance of this deed, the Lender shall release the Borrower(s) from any further obligations under the loan agreement.

- The Borrower(s) affirm that they are the lawful owners of the property free and clear of any other liens or encumbrances, except for the mortgage held by the Lender.

This deed is executed in accordance with the provisions of the Georgia law governing deeds in lieu of foreclosure.

IN WITNESS WHEREOF, the parties have executed this Deed in Lieu of Foreclosure as of the day and year first above written.

__________________________

Borrower(s) Signature: ______________________________________

Date: ___________________

__________________________

Lender Signature: ___________________________________________

Date: ___________________

Witnessed By:

__________________________

Witness Signature: ______________________________________

Date: ___________________

Similar forms

- Short Sale Agreement: Similar to a deed in lieu of foreclosure, a short sale involves the homeowner selling the property for less than the mortgage balance. Both options aim to avoid foreclosure and minimize the financial impact on the homeowner.

- Loan Modification Agreement: This document modifies the terms of an existing mortgage to make payments more manageable. Like a deed in lieu, it seeks to help the homeowner retain their property while alleviating financial strain.

- Forbearance Agreement: A forbearance agreement allows the homeowner to temporarily pause or reduce mortgage payments. This document shares the goal of providing relief to homeowners facing financial difficulties, similar to a deed in lieu.

- Repayment Plan: A repayment plan outlines how a borrower will pay back missed mortgage payments over time. This document, like a deed in lieu, aims to help homeowners avoid foreclosure while addressing their financial obligations.

- Quitclaim Deed: A quitclaim deed transfers ownership of a property without any warranties. While it can be used in various situations, it may be similar to a deed in lieu when transferring property to a lender to settle a debt.

- Property Settlement Agreement: Often used in divorce proceedings, this document divides property between parties. It can resemble a deed in lieu when one party relinquishes their claim to a property to settle financial obligations.

- Ohio Unclaimed Funds Reporting Form: Companies must accurately complete the Ohio PDF Forms to report unclaimed funds to the state, ensuring compliance with regulations.

- Mortgage Release or Satisfaction: This document confirms that a mortgage has been paid off. While it is the end of a mortgage, it shares a common goal with a deed in lieu by relieving the homeowner from further obligations to the lender.

- Deed of Trust: A deed of trust secures a loan with real property. While it serves a different function, both documents involve the transfer of property rights, often to facilitate financial resolution.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to reorganize debt. Like a deed in lieu, it offers homeowners a chance to manage their financial difficulties and avoid losing their home.

Misconceptions

Understanding the Georgia Deed in Lieu of Foreclosure form is essential for homeowners facing financial difficulties. However, several misconceptions can lead to confusion. Below are four common misconceptions regarding this legal process.

- It eliminates all debt associated with the property. A deed in lieu of foreclosure may not discharge all debts. While it can help with the mortgage, other liens or obligations may still remain.

- It is a quick and easy solution. Although a deed in lieu can expedite the process compared to foreclosure, it still requires negotiation and approval from the lender, which can take time.

- It has no impact on credit scores. A deed in lieu of foreclosure can negatively affect credit scores, similar to a foreclosure, though the extent may vary depending on the lender's reporting practices.

- It is available to anyone facing foreclosure. Not all homeowners qualify for a deed in lieu. Lenders typically have specific criteria that must be met, including demonstrating financial hardship.

Awareness of these misconceptions can help individuals make informed decisions regarding their financial situations and explore the best options available to them.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | Georgia law governs the Deed in Lieu of Foreclosure, specifically under O.C.G.A. § 44-14-233. |

| Purpose | This form helps borrowers avoid the lengthy foreclosure process and its negative impact on credit scores. |

| Eligibility | Typically, borrowers facing financial hardship and unable to keep up with mortgage payments can use this option. |

| Process | The borrower must negotiate with the lender to accept the deed in lieu as a resolution for the mortgage default. |

| Benefits | It can expedite the resolution of mortgage defaults and may allow borrowers to walk away without further liabilities. |

| Risks | Borrowers may still face tax implications or potential deficiency judgments depending on the agreement. |

| Documentation | Proper documentation, including a clear title and any outstanding liens, is essential for the deed to be valid. |

| Impact on Credit | While a deed in lieu is less damaging than foreclosure, it can still negatively affect a borrower's credit score. |

| Legal Advice | Consulting with a legal professional is advisable to understand the implications and ensure the process is handled correctly. |