Printable Transfer-on-Death Deed Document for Florida

The Florida Transfer-on-Death Deed form is a powerful tool that allows property owners to pass their real estate directly to designated beneficiaries upon their death, without the need for probate. This legal document simplifies the transfer process, making it easier for families to manage their loved ones' estates. By filling out this form, property owners can specify who will inherit their property, ensuring that their wishes are honored. The deed must be properly executed, recorded, and comply with Florida laws to be valid. Additionally, it offers flexibility, as the owner can revoke or change the beneficiaries at any time before their death. Understanding how to use this form effectively can help individuals protect their assets and provide peace of mind for their families during difficult times.

More State-specific Transfer-on-Death Deed Forms

Tod in California - You maintain control over the property until your passing with this deed.

How to Avoid Probate in Pa - Beneficiaries must acknowledge and accept the deed's terms, which can sometimes require signatures depending on state law.

Free Printable Transfer on Death Deed Form Georgia - It's a straightforward solution for property owners wanting to simplify their estate without significant complexities.

Having a well-structured Employee Handbook is crucial for creating a clear understanding of workplace expectations; for those looking for a template or further resources, legalformspdf.com offers valuable tools and information to assist in the development of such a document.

Where Can I Get a Tod Form - This deed serves as a way to bypass probate, facilitating a smoother transfer of property to heirs.

Common Questions

What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Florida to transfer their real estate to designated beneficiaries upon their death. This deed bypasses the probate process, making it a straightforward way to ensure that your property goes directly to your chosen heirs without unnecessary delays or costs.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Florida can use a Transfer-on-Death Deed. This includes homeowners, co-owners, and even those with partial interests in a property. However, it’s important to ensure that the property is not subject to any liens or other legal complications that could affect the transfer.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you need to fill out the appropriate form, which includes details about the property and the beneficiaries. It must be signed by the property owner in the presence of a notary public. Once completed, you must record the deed with the county clerk's office where the property is located to make it effective.

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do so, you will need to complete a new deed that either names different beneficiaries or explicitly revokes the previous deed. This new deed must also be signed and recorded to be valid.

What happens if I die without a Transfer-on-Death Deed?

If you die without a Transfer-on-Death Deed, your property will go through probate. This legal process can be lengthy and costly, as the court will determine how your assets are distributed according to your will or state laws if you die intestate (without a will). Using a TODD can help avoid this scenario.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. However, the property may be subject to estate taxes upon your death, depending on its value and your overall estate. It’s advisable to consult a tax professional to understand any potential tax consequences fully.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a beneficial tool for many, but it may not be suitable for everyone. Consider your specific circumstances, such as family dynamics, the nature of your assets, and your estate planning goals. Consulting with a legal professional can help you determine if this option aligns with your needs.

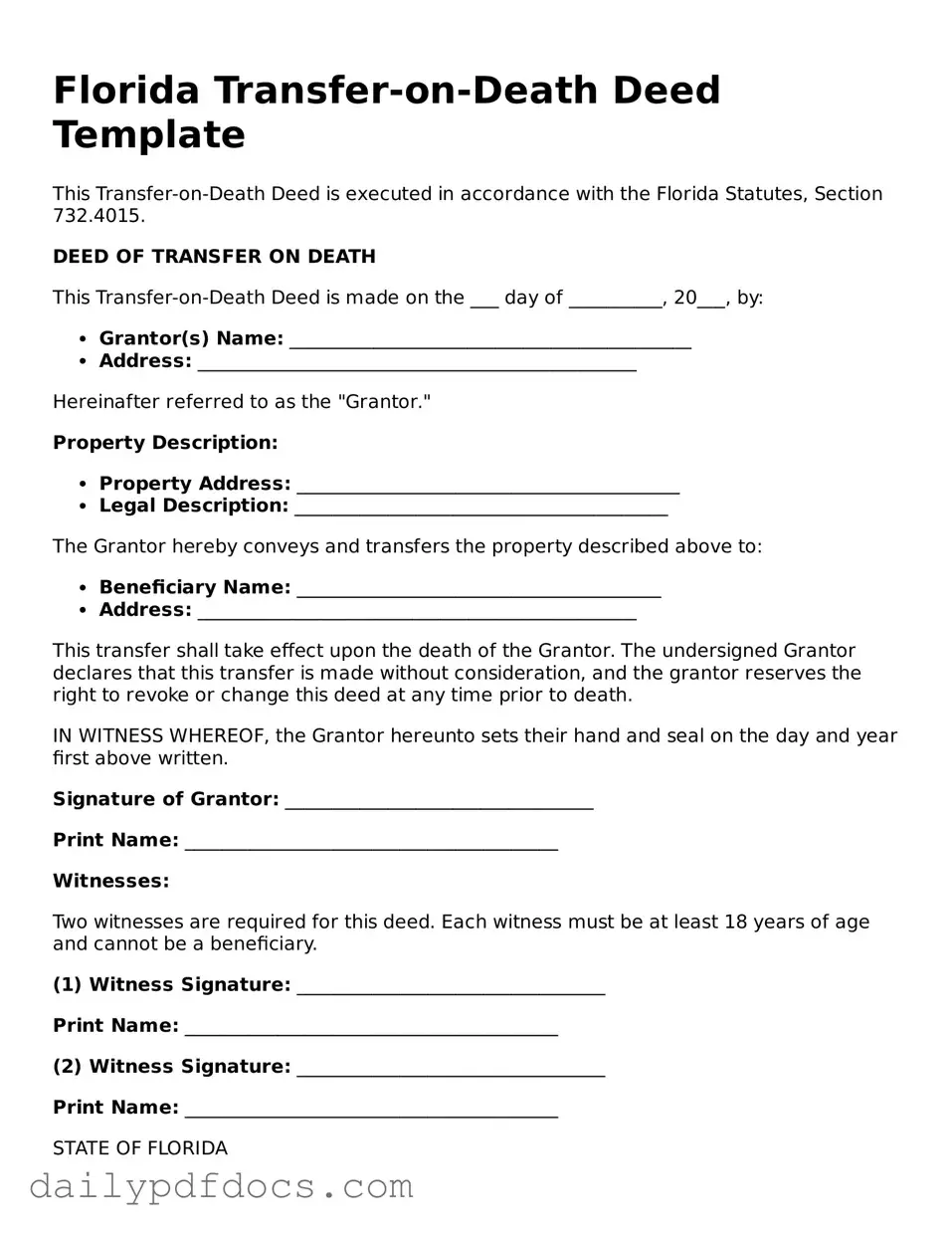

Preview - Florida Transfer-on-Death Deed Form

Florida Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Florida Statutes, Section 732.4015.

DEED OF TRANSFER ON DEATH

This Transfer-on-Death Deed is made on the ___ day of __________, 20___, by:

- Grantor(s) Name: ___________________________________________

- Address: _______________________________________________

Hereinafter referred to as the "Grantor."

Property Description:

- Property Address: _________________________________________

- Legal Description: ________________________________________

The Grantor hereby conveys and transfers the property described above to:

- Beneficiary Name: _______________________________________

- Address: _______________________________________________

This transfer shall take effect upon the death of the Grantor. The undersigned Grantor declares that this transfer is made without consideration, and the grantor reserves the right to revoke or change this deed at any time prior to death.

IN WITNESS WHEREOF, the Grantor hereunto sets their hand and seal on the day and year first above written.

Signature of Grantor: _________________________________

Print Name: ________________________________________

Witnesses:

Two witnesses are required for this deed. Each witness must be at least 18 years of age and cannot be a beneficiary.

(1) Witness Signature: _________________________________

Print Name: ________________________________________

(2) Witness Signature: _________________________________

Print Name: ________________________________________

STATE OF FLORIDA

COUNTY OF ______________

Before me, the undersigned authority, personally appeared the Grantor and the witnesses, who are known to me or have provided identification, and who executed this Transfer-on-Death Deed.

Notary Public Signature: ____________________________

Print Name: ________________________________________

My Commission Expires: ____________________________

Seal: ________________

Similar forms

The Transfer-on-Death Deed (TOD) is a unique legal instrument that allows an individual to transfer property to a beneficiary upon their death without the need for probate. However, it shares similarities with several other documents in estate planning. Here are five documents that are comparable to the TOD deed:

- Will: A will is a legal document that outlines how a person's assets should be distributed after their death. Like the TOD deed, it allows for the designation of beneficiaries, but a will generally requires probate, while a TOD deed does not.

- Living Trust: A living trust is an arrangement where a person places their assets into a trust during their lifetime, which can then be managed by a trustee. Similar to a TOD deed, a living trust allows for the direct transfer of assets upon death, avoiding the probate process.

- Beneficiary Designation Forms: These forms are often used for financial accounts, retirement plans, and insurance policies. They allow individuals to name beneficiaries who will receive assets directly upon death, much like the TOD deed does for real property.

- Payable-on-Death (POD) Accounts: A POD account is a type of bank account that allows the account holder to designate a beneficiary who will receive the funds upon their death. This is similar to the TOD deed in that it facilitates direct transfer without probate.

Illinois Motorcycle Bill of Sale: This legal document is crucial for the sale and transfer of ownership of a motorcycle in Illinois. It ensures protection for both parties involved in the transaction. To smoothly complete the sale, click here to get the document.

- Joint Tenancy with Right of Survivorship: This is a form of property ownership where two or more individuals hold title to property together. Upon the death of one owner, the surviving owner(s) automatically inherit the deceased's share, akin to the transfer mechanism of a TOD deed.

Misconceptions

When it comes to the Florida Transfer-on-Death Deed (TODD), there are several misconceptions that can lead to confusion. It's essential to clarify these points to ensure that individuals understand how this legal tool works and how it can benefit them.

- Misconception 1: The TODD automatically transfers property upon death without any action required.

- Misconception 2: A TODD can only be used for residential property.

- Misconception 3: A TODD deed is irrevocable once it is created.

- Misconception 4: The beneficiary of a TODD automatically assumes ownership responsibilities.

- Misconception 5: A TODD avoids all taxes associated with the property.

- Misconception 6: All heirs must agree to the terms of the TODD.

- Misconception 7: A TODD is the same as a will.

- Misconception 8: A TODD is only beneficial for wealthy individuals.

While the TODD does allow for property to transfer outside of probate, it must be properly executed and recorded during the owner's lifetime. Failure to do so means the property will not transfer as intended.

This is not true. The TODD can be utilized for various types of real estate, including commercial properties and vacant land, as long as the property is titled in the owner’s name.

In reality, a TODD can be revoked or changed by the property owner at any time before their death. This flexibility allows for adjustments based on changing circumstances or wishes.

Ownership responsibilities, including taxes and maintenance, do not transfer until the owner passes away. Until that time, the original owner retains all responsibilities associated with the property.

While a TODD allows for the avoidance of probate taxes, it does not exempt the property from other taxes, such as property taxes, which will still be the responsibility of the owner until death.

This is incorrect. The property owner has the sole authority to designate beneficiaries without needing consent from other potential heirs.

A TODD is not a will. It specifically deals with the transfer of real estate upon death, while a will encompasses all aspects of an individual's estate, including personal property and financial accounts.

This misconception overlooks the fact that anyone with real estate can benefit from a TODD. It simplifies the transfer process for all property owners, regardless of their overall wealth.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Florida to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of the Transfer-on-Death Deed in Florida is governed by Florida Statutes Section 732.4015. |

| Eligibility | Any individual who owns real property in Florida can create a Transfer-on-Death Deed. |

| Revocability | Property owners can revoke or change the Transfer-on-Death Deed at any time before their death. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed, and they can also specify alternate beneficiaries. |

| Filing Requirements | The deed must be recorded with the county clerk’s office in the county where the property is located to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not affect the property owner’s tax obligations during their lifetime. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, such as property held in a trust or jointly owned property. |