Printable Quitclaim Deed Document for Florida

The Florida Quitclaim Deed form serves as a vital tool for property owners looking to transfer ownership without the complexities often associated with traditional deeds. This form allows individuals to relinquish any claim they may have on a property, making it particularly useful in situations such as family transfers, divorce settlements, or the settling of estates. Unlike warranty deeds, which guarantee a clear title, a quitclaim deed offers no such assurances. Instead, it conveys whatever interest the grantor possesses at the time of the transfer, which may be complete or partial. The simplicity of the form, combined with its lack of warranties, means that it can be executed quickly, often requiring only the signatures of the parties involved. However, this straightforward approach does come with risks, as the grantee receives no protection against potential claims from third parties. Understanding the nuances of the Florida Quitclaim Deed is essential for anyone considering its use, as it can significantly impact future ownership rights and responsibilities.

More State-specific Quitclaim Deed Forms

Quit Claim Deed Form Ohio - A Quitclaim Deed is reversible only through mutual consent of parties involved.

New York Quitclaim Deed - A Quitclaim Deed minimizes paperwork but increases risk for the recipient.

The Texas Mobile Home Bill of Sale is a legal document that facilitates the transfer of ownership of a mobile home from one party to another. This form outlines essential details, including the buyer's and seller's information, the mobile home's specifications, and the sale price. For those looking to create or obtain this important paperwork, resources can be found at mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale. Understanding this document is crucial for ensuring a smooth transaction and protecting both parties' interests.

Quitclaim Deed Attorney - Can serve as a temporary solution for property ownership.

Common Questions

What is a Florida Quitclaim Deed?

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property title. This means that the person transferring the property, known as the grantor, does not guarantee that they hold clear title to the property. Instead, the deed simply conveys whatever interest the grantor has in the property to the recipient, known as the grantee. This type of deed is often used between family members or in situations where the parties know each other well, as it does not provide the same level of protection as other types of deeds, such as a warranty deed.

How do I complete a Florida Quitclaim Deed?

To complete a Florida Quitclaim Deed, you will need to gather specific information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. The document must be signed by the grantor in the presence of a notary public. After signing, it is essential to file the deed with the county clerk's office in the county where the property is located. This filing process ensures that the deed is officially recorded and becomes part of the public record, providing notice to others about the change in ownership.

Are there any tax implications when using a Quitclaim Deed in Florida?

Yes, there can be tax implications when using a Quitclaim Deed in Florida. While transferring property via a quitclaim deed typically does not incur a transfer tax, it is important to consider potential capital gains taxes if the property is sold in the future. Additionally, the grantee may need to file a documentary stamp tax on the deed, depending on the value of the property being transferred. It is advisable to consult with a tax professional or attorney to understand any tax consequences specific to your situation.

Can a Quitclaim Deed be revoked in Florida?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally by the grantor. The transfer of property is considered final unless both parties agree to reverse the transaction through a new legal document. If the grantor wishes to regain ownership, they would need to create a new deed transferring the property back from the grantee. As with any legal matter, it is recommended to seek guidance from a qualified attorney to navigate the complexities of property ownership and transfers.

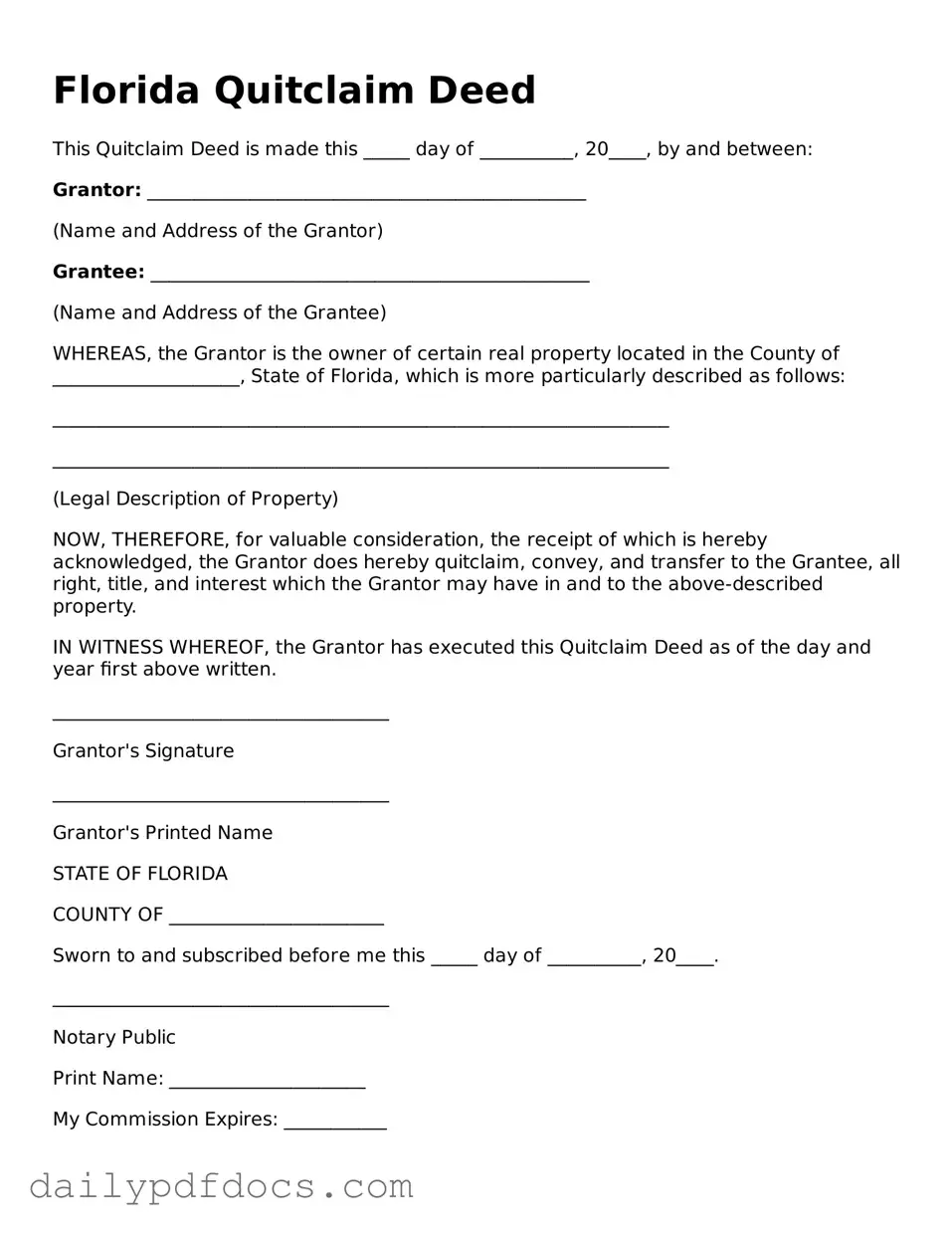

Preview - Florida Quitclaim Deed Form

Florida Quitclaim Deed

This Quitclaim Deed is made this _____ day of __________, 20____, by and between:

Grantor: _______________________________________________

(Name and Address of the Grantor)

Grantee: _______________________________________________

(Name and Address of the Grantee)

WHEREAS, the Grantor is the owner of certain real property located in the County of ____________________, State of Florida, which is more particularly described as follows:

__________________________________________________________________

__________________________________________________________________

(Legal Description of Property)

NOW, THEREFORE, for valuable consideration, the receipt of which is hereby acknowledged, the Grantor does hereby quitclaim, convey, and transfer to the Grantee, all right, title, and interest which the Grantor may have in and to the above-described property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

____________________________________

Grantor's Signature

____________________________________

Grantor's Printed Name

STATE OF FLORIDA

COUNTY OF _______________________

Sworn to and subscribed before me this _____ day of __________, 20____.

____________________________________

Notary Public

Print Name: _____________________

My Commission Expires: ___________

This document should be recorded in the public records of the County where the property is located.

Please consult with a qualified attorney before executing any legal document.

Similar forms

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a quitclaim deed, a warranty deed provides a warranty against any future claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed conveys property ownership but may not provide the same level of protection. It assures that the property hasn’t been sold to anyone else and that there are no undisclosed encumbrances.

- Deed of Trust: This document involves three parties: the borrower, the lender, and a trustee. It secures a loan by placing a lien on the property, similar to how a quitclaim deed transfers ownership but with a focus on securing a financial interest.

- Lease Agreement: While primarily used for rental situations, a lease agreement can transfer the right to use a property for a specified time. It differs from a quitclaim deed in that it does not transfer ownership, only the right to occupy.

- Motor Vehicle Bill of Sale: This form is essential when transferring ownership of a vehicle in Washington, ensuring all details like VIN, sale price, and buyer/seller information are documented. For more information on how to properly fill out this form, visit Washington Templates.

- Life Estate Deed: This deed allows a person to use the property during their lifetime, with the ownership transferring to another party upon their death. It shares similarities with a quitclaim deed in that it can transfer property rights without warranties.

- Bill of Sale: Though typically used for personal property, a bill of sale can serve as a transfer document for certain types of real estate interests. It conveys ownership, similar to a quitclaim deed, but is not specific to real estate.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. While it doesn’t transfer ownership itself, it can facilitate the use of a quitclaim deed by enabling someone to sign on behalf of the property owner.

- Partition Deed: When co-owners of a property wish to divide their interests, a partition deed can be used. This document, like a quitclaim deed, transfers ownership rights but is specifically for dividing jointly owned property.

Misconceptions

Understanding the Florida Quitclaim Deed form is essential for anyone involved in property transactions. However, several misconceptions can lead to confusion. Here are six common myths about the Quitclaim Deed:

- A Quitclaim Deed transfers ownership completely. This is not entirely true. While it does transfer whatever interest the grantor has in the property, it does not guarantee that the grantor has any legal claim to the property.

- Quitclaim Deeds are only for transferring property between family members. Although they are often used in family transactions, Quitclaim Deeds can be used in various situations, including sales, divorces, and other transfers.

- Using a Quitclaim Deed eliminates the need for a title search. This is misleading. A Quitclaim Deed does not provide any warranty or guarantee of title. A title search is still recommended to ensure there are no liens or claims against the property.

- Quitclaim Deeds are complicated legal documents. In reality, Quitclaim Deeds are relatively straightforward. They require basic information about the parties involved and a description of the property.

- A Quitclaim Deed can be used to remove a co-owner from a property. While it can transfer interest, it does not remove a co-owner's rights unless the co-owner agrees to the transfer. Consent is essential.

- Once a Quitclaim Deed is signed, it cannot be revoked. This is incorrect. A Quitclaim Deed can be revoked or modified, but it typically requires a new deed or legal action to do so.

Being aware of these misconceptions can help individuals make informed decisions regarding property transactions in Florida.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title. |

| Governing Law | In Florida, quitclaim deeds are governed by Florida Statutes, Chapter 689. |

| Use Cases | Commonly used among family members, in divorce settlements, or to clear up title issues. |

| Title Guarantee | Quitclaim deeds do not provide any warranty or guarantee regarding the property title. |

| Execution Requirements | The deed must be signed by the grantor and may need to be notarized to be valid. |

| Recording | To protect the interest of the grantee, the deed should be recorded with the county clerk's office. |

| Tax Implications | While transferring property, a quitclaim deed may trigger documentary stamp taxes in Florida. |