Printable Promissory Note Document for Florida

The Florida Promissory Note form serves as a crucial document in financial transactions, outlining the terms of a loan agreement between a lender and a borrower. This form typically includes essential details such as the principal amount borrowed, the interest rate, and the repayment schedule. It also specifies the consequences of default, ensuring that both parties understand their rights and obligations. Additionally, the document may include provisions for prepayment, allowing borrowers to pay off the loan early without penalties. Clear identification of the parties involved, along with their signatures, is necessary for the note to be legally binding. Understanding these components is vital for anyone looking to navigate the lending process in Florida effectively.

More State-specific Promissory Note Forms

Ohio Promissory Note - States may have specific regulations governing promissory notes.

By utilizing the Minnesota Motorcycle Bill of Sale form, buyers and sellers can avoid misunderstandings and ensure a smooth transaction process. This essential document, which can be easily completed, allows both parties to clearly outline the motorcycle's specifications and the terms of sale. For those looking for convenience, an editable document download is available to assist in this process, ensuring all necessary details are captured accurately.

Personal Loan Promissory Note - A promissory note can be essential in establishing creditworthiness for future loans.

Promissory Note Notarized - Establishing clear terms with a promissory note can prevent potential conflicts later.

Common Questions

What is a Florida Promissory Note?

A Florida Promissory Note is a written promise to pay a specified amount of money to a lender or a designated party at a certain time or on demand. This document outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any other conditions agreed upon by the borrower and lender. It serves as a legal record of the debt and can be enforced in court if necessary.

Who can use a Florida Promissory Note?

Anyone can use a Florida Promissory Note, whether you are an individual borrowing money from a friend or a business seeking a loan from a financial institution. It’s important for both parties to understand the terms of the note, ensuring clarity and mutual agreement before signing. The note is beneficial for both lenders and borrowers, as it formalizes the loan agreement.

What information is typically included in a Florida Promissory Note?

A typical Florida Promissory Note includes several key pieces of information. This includes the names and addresses of both the borrower and lender, the principal amount being borrowed, the interest rate, repayment terms, and due dates. Additionally, it may specify any late fees, prepayment penalties, and the governing law applicable to the note. Clear and precise language helps prevent misunderstandings later on.

Is a Florida Promissory Note legally binding?

Yes, a Florida Promissory Note is legally binding as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed by the borrower. It’s also advisable to have the note notarized, which adds an extra layer of authenticity and can help in case of disputes. This means that if the borrower fails to repay the loan, the lender has the right to take legal action to recover the owed amount.

Can a Florida Promissory Note be modified after it is signed?

Yes, a Florida Promissory Note can be modified, but both parties must agree to any changes. It’s best to document these modifications in writing and have both parties sign the updated agreement. This ensures that everyone is on the same page and helps avoid potential conflicts down the line. Keeping clear records of any changes is essential for maintaining the integrity of the agreement.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Florida Promissory Note, the lender has several options. The lender can pursue legal action to recover the debt, which may involve filing a lawsuit. The court may then enforce the terms of the note, allowing the lender to collect the owed amount. It’s crucial for borrowers to understand their obligations and communicate with the lender if they encounter difficulties in making payments.

Do I need a lawyer to create a Florida Promissory Note?

While it’s not strictly necessary to have a lawyer to create a Florida Promissory Note, seeking legal advice can be beneficial, especially for larger loans or complex agreements. A lawyer can help ensure that the note complies with Florida law and adequately protects your interests. However, for straightforward loans between friends or family, a well-drafted template can suffice.

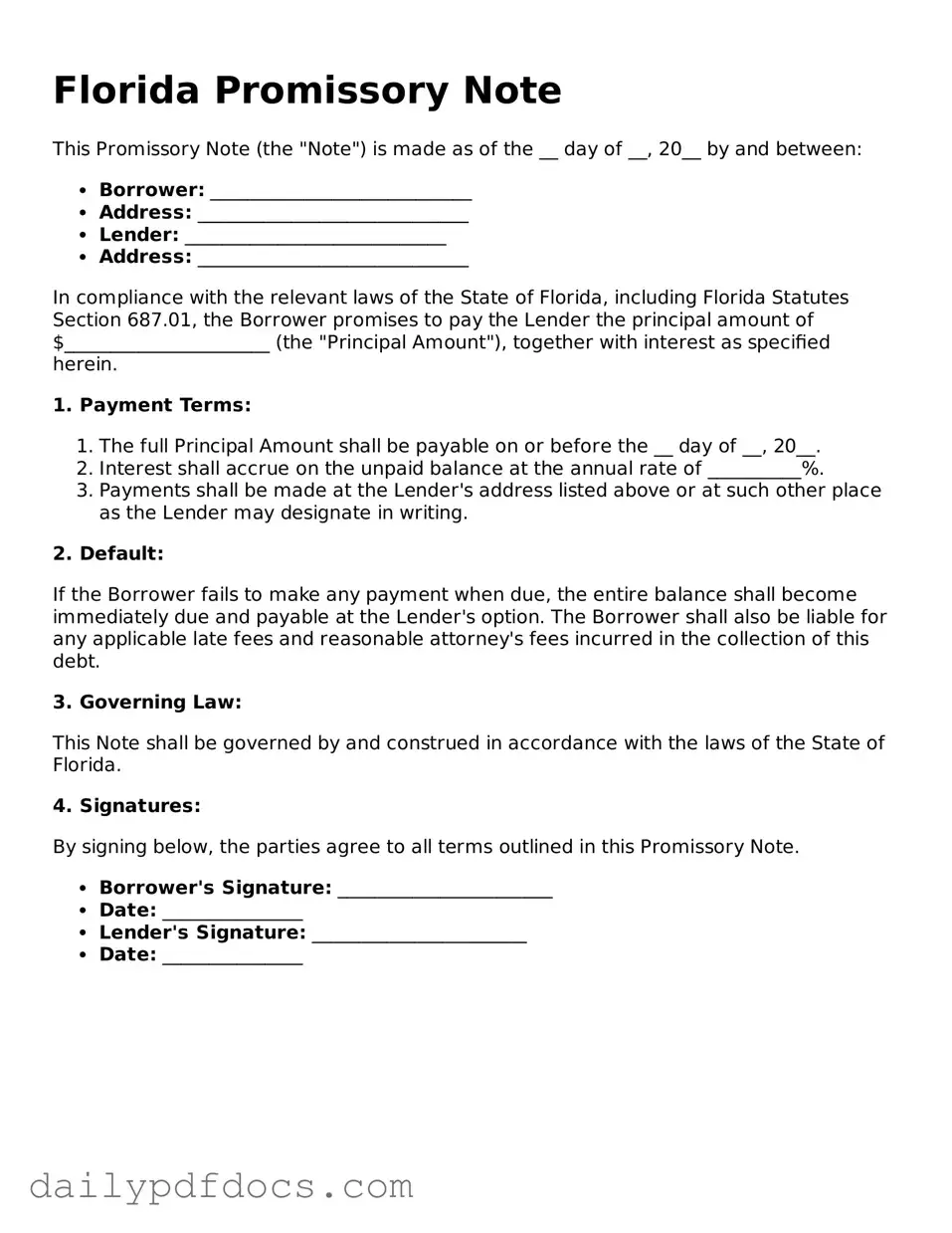

Preview - Florida Promissory Note Form

Florida Promissory Note

This Promissory Note (the "Note") is made as of the __ day of __, 20__ by and between:

- Borrower: ____________________________

- Address: _____________________________

- Lender: ____________________________

- Address: _____________________________

In compliance with the relevant laws of the State of Florida, including Florida Statutes Section 687.01, the Borrower promises to pay the Lender the principal amount of $______________________ (the "Principal Amount"), together with interest as specified herein.

1. Payment Terms:

- The full Principal Amount shall be payable on or before the __ day of __, 20__.

- Interest shall accrue on the unpaid balance at the annual rate of __________%.

- Payments shall be made at the Lender's address listed above or at such other place as the Lender may designate in writing.

2. Default:

If the Borrower fails to make any payment when due, the entire balance shall become immediately due and payable at the Lender's option. The Borrower shall also be liable for any applicable late fees and reasonable attorney's fees incurred in the collection of this debt.

3. Governing Law:

This Note shall be governed by and construed in accordance with the laws of the State of Florida.

4. Signatures:

By signing below, the parties agree to all terms outlined in this Promissory Note.

- Borrower's Signature: _______________________

- Date: _______________

- Lender's Signature: _______________________

- Date: _______________

Similar forms

- Loan Agreement: This document outlines the terms of a loan between a lender and a borrower, including the amount borrowed, interest rates, and repayment schedule. Like a promissory note, it establishes a legal obligation to repay the borrowed amount.

- Credit Agreement: A credit agreement details the terms under which credit is extended to a borrower. Similar to a promissory note, it specifies repayment terms and the borrower's obligations.

- Mortgage Note: This document is used in real estate transactions. It serves as a promise to repay a loan secured by real property. Both documents create a binding obligation for repayment.

- Rental Application: A Rental Application form is essential for prospective tenants to demonstrate their suitability for renting a property. This document often includes comprehensive details about personal history, rental background, and references. For more information, visit https://legalformspdf.com.

- Installment Agreement: An installment agreement allows for payments to be made over time. Like a promissory note, it defines the payment schedule and the total amount owed.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It shares similarities with a promissory note in its function as a commitment to pay.

- IOU (I Owe You): An IOU is a simple acknowledgment of a debt. While less formal than a promissory note, it serves the same purpose of recognizing an obligation to repay.

- Secured Loan Agreement: This document details a loan backed by collateral. Like a promissory note, it specifies the terms of the loan and the borrower's responsibility to repay.

Misconceptions

Understanding the Florida Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here are eight common myths debunked:

- All Promissory Notes are the Same: Many believe that all promissory notes are identical. In reality, they can vary significantly based on state laws and specific terms agreed upon by the parties involved.

- A Promissory Note Must Be Notarized: Some think that notarization is mandatory for a promissory note to be valid. While notarization can add credibility, it is not a legal requirement in Florida.

- Only Banks Can Issue Promissory Notes: There is a misconception that only financial institutions can create promissory notes. Individuals can also draft and enforce these documents.

- Verbal Agreements Are Enough: Some assume that a verbal promise to pay is sufficient. However, having a written promissory note is crucial for legal enforceability.

- Interest Rates Are Unlimited: Many believe that lenders can charge any interest rate they choose. Florida law regulates maximum interest rates, and exceeding these limits can lead to legal issues.

- Promissory Notes Are Only for Large Loans: A common myth is that promissory notes are only necessary for significant amounts. They can be used for any loan amount, regardless of size.

- Once Signed, a Promissory Note Cannot Be Changed: Some think that a signed note is set in stone. However, parties can amend the terms if both agree, as long as the changes are documented properly.

- Defaulting on a Promissory Note Has No Consequences: Many believe that failing to repay a promissory note is without repercussions. In truth, defaulting can lead to legal action and damage to credit ratings.

Being aware of these misconceptions can help ensure that both lenders and borrowers understand their rights and responsibilities when using a Florida Promissory Note.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. |

| Governing Laws | Florida Statutes, Chapter 673 governs negotiable instruments, including promissory notes. |

| Key Elements | Essential elements include the date, amount, interest rate (if applicable), payee, and signatures of the borrower and lender. |

| Enforceability | To be enforceable, the note must meet specific legal requirements, including clarity and intent to create a debt obligation. |