Printable Power of Attorney Document for Florida

When it comes to planning for the future, having a Power of Attorney (POA) in place is a crucial step, especially in Florida. This legal document allows you to appoint someone you trust to make important decisions on your behalf if you become unable to do so yourself. The Florida Power of Attorney form can cover a range of financial and healthcare matters, ensuring that your wishes are respected and that your affairs are managed according to your preferences. It’s essential to understand the different types of POAs available, such as durable, springing, and limited, as each serves a unique purpose. Additionally, the form requires specific language and signatures to be valid, making it important to follow the state's guidelines closely. By establishing a POA, you can provide peace of mind for yourself and your loved ones, knowing that someone will be there to advocate for your interests when needed.

More State-specific Power of Attorney Forms

New York State Power of Attorney - The person you designate is often referred to as your agent.

By setting up a Washington Power of Attorney, you can provide a trusted individual the authority to manage your affairs when you are incapacitated. This important legal document ensures that your preferences regarding healthcare and financial decisions are met. For more information on how to create this essential form, visit Washington Templates and take charge of your future today.

Free Power of Attorney Form California - A Power of Attorney can help your family make timely decisions if needed.

How to Get a Power of Attorney in Texas - Agents may need to present the Power of Attorney at financial institutions when conducting transactions.

Who Can Be a Power of Attorney - This form can help avoid court interventions for guardianship in case of sudden incapacitation.

Common Questions

What is a Power of Attorney in Florida?

A Power of Attorney (POA) in Florida is a legal document that allows one person, known as the principal, to grant another person, known as the agent or attorney-in-fact, the authority to act on their behalf. This authority can cover a wide range of decisions, including financial matters, healthcare decisions, or legal transactions, depending on how the document is structured.

What types of Power of Attorney are available in Florida?

Florida recognizes several types of Power of Attorney. The most common include the Durable Power of Attorney, which remains effective even if the principal becomes incapacitated; the Healthcare Power of Attorney, which allows the agent to make medical decisions; and the Limited Power of Attorney, which grants specific powers for a limited time or purpose.

How do I create a Power of Attorney in Florida?

To create a Power of Attorney in Florida, the principal must be at least 18 years old and mentally competent. The document must be in writing and signed by the principal. Additionally, it must be witnessed by two individuals or notarized to be valid. It’s advisable to consult with a legal professional to ensure that the document meets all legal requirements.

Can I revoke a Power of Attorney in Florida?

Yes, a Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the document, the principal should create a written revocation and notify the agent and any third parties who may rely on the original Power of Attorney. It’s important to destroy any copies of the original document to prevent confusion.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated and has executed a Durable Power of Attorney, the agent can continue to act on their behalf. However, if the Power of Attorney is not durable, it becomes invalid upon the principal's incapacitation. This highlights the importance of selecting the appropriate type of Power of Attorney based on potential future circumstances.

Can an agent be held liable for their actions under a Power of Attorney?

Generally, an agent is not personally liable for decisions made in good faith while acting under a Power of Attorney. However, if the agent acts outside the authority granted in the document or engages in fraudulent or negligent behavior, they may be held accountable for those actions. It’s essential for agents to act in the best interests of the principal and maintain accurate records of their decisions.

Is a Power of Attorney valid in other states?

A Power of Attorney executed in Florida may be recognized in other states, but this can vary based on state laws. It is advisable to check the specific requirements of the state in which the document will be used. Some states may require a new Power of Attorney to be executed to ensure compliance with local laws.

Can I use a Power of Attorney for healthcare decisions?

Yes, a specific type of Power of Attorney, known as a Healthcare Power of Attorney, allows an agent to make medical decisions on behalf of the principal. This document should clearly outline the scope of authority granted to the agent regarding healthcare matters, and it is often accompanied by a living will that specifies the principal’s wishes regarding end-of-life care.

Do I need an attorney to create a Power of Attorney in Florida?

While it is not legally required to have an attorney draft a Power of Attorney in Florida, it is highly recommended. An attorney can ensure that the document complies with all legal requirements, accurately reflects the principal's wishes, and provides guidance on the implications of granting authority to an agent.

What should I consider when choosing an agent for my Power of Attorney?

When selecting an agent for a Power of Attorney, it is crucial to choose someone trustworthy, responsible, and capable of making decisions in your best interest. Consider their understanding of your values and preferences, their willingness to take on the responsibility, and their ability to handle potential conflicts or difficult decisions. Open communication about your wishes is also essential.

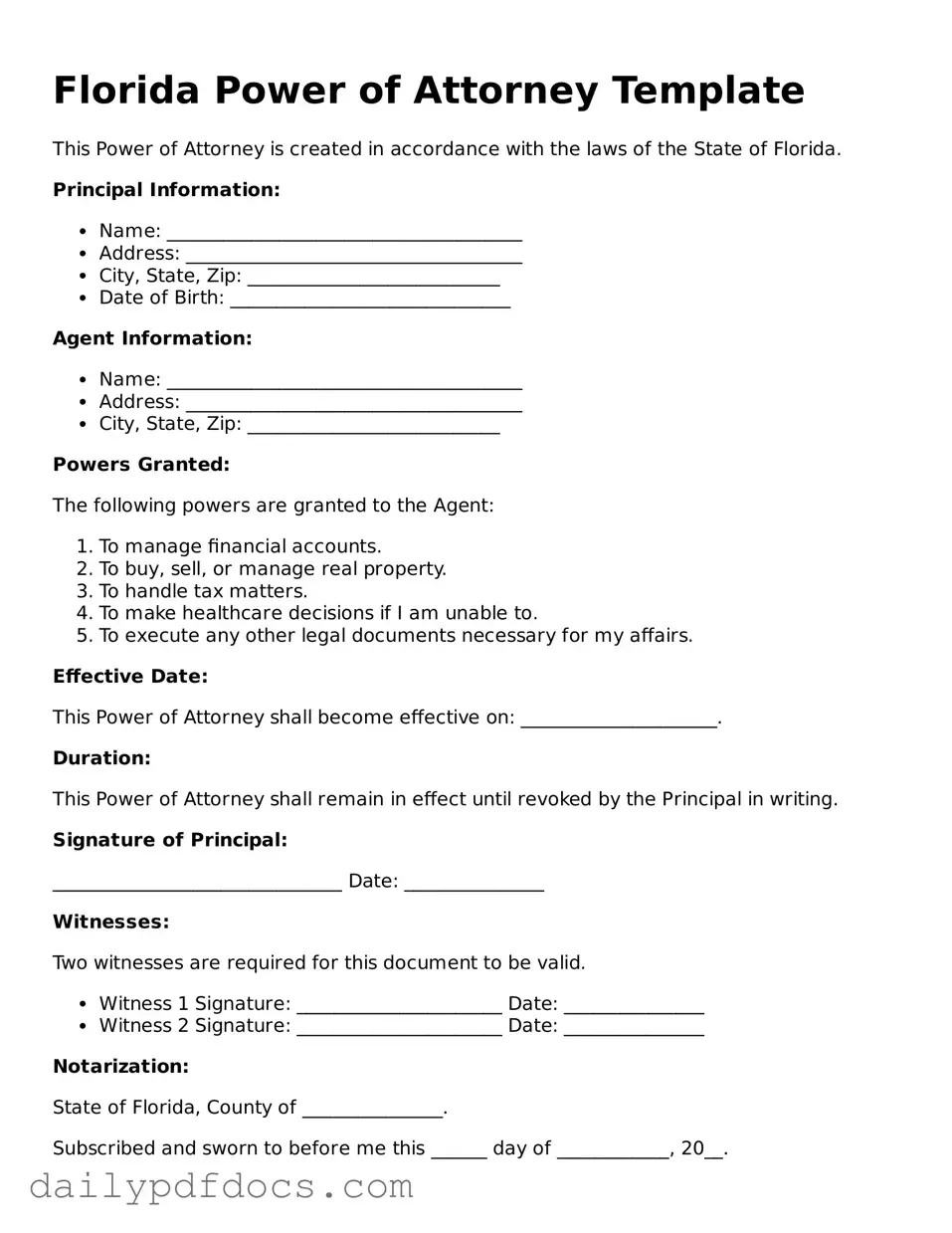

Preview - Florida Power of Attorney Form

Florida Power of Attorney Template

This Power of Attorney is created in accordance with the laws of the State of Florida.

Principal Information:

- Name: ______________________________________

- Address: ____________________________________

- City, State, Zip: ___________________________

- Date of Birth: ______________________________

Agent Information:

- Name: ______________________________________

- Address: ____________________________________

- City, State, Zip: ___________________________

Powers Granted:

The following powers are granted to the Agent:

- To manage financial accounts.

- To buy, sell, or manage real property.

- To handle tax matters.

- To make healthcare decisions if I am unable to.

- To execute any other legal documents necessary for my affairs.

Effective Date:

This Power of Attorney shall become effective on: _____________________.

Duration:

This Power of Attorney shall remain in effect until revoked by the Principal in writing.

Signature of Principal:

_______________________________ Date: _______________

Witnesses:

Two witnesses are required for this document to be valid.

- Witness 1 Signature: ______________________ Date: _______________

- Witness 2 Signature: ______________________ Date: _______________

Notarization:

State of Florida, County of _______________.

Subscribed and sworn to before me this ______ day of ____________, 20__.

Notary Public Signature: __________________________

My Commission Expires: _______________________

Similar forms

- Living Will: A living will outlines your preferences for medical treatment in case you become unable to communicate. Like a Power of Attorney, it allows you to express your wishes regarding healthcare decisions.

- Healthcare Proxy: This document designates someone to make healthcare decisions on your behalf if you cannot. Similar to a Power of Attorney, it grants authority to another person to act in your best interest regarding medical matters.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains in effect even if you become incapacitated. It is similar in purpose but focuses on financial matters rather than healthcare decisions.

- Trust Document: A trust document allows you to place your assets into a trust for management by a trustee. It shares similarities with a Power of Attorney in that it designates authority over your assets but typically involves more complex estate planning.

- Financial Power of Attorney: This document specifically grants someone the authority to manage your financial affairs. It is a variation of the Power of Attorney, focusing solely on financial matters rather than a broader range of decisions.

Misconceptions

When it comes to the Florida Power of Attorney form, several misconceptions can lead to confusion. Understanding these misconceptions can help individuals make informed decisions about their legal affairs.

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney can be used after the principal's death.

- Misconception 3: You cannot revoke a Power of Attorney once it is signed.

- Misconception 4: All Powers of Attorney are the same.

This is not true. While many people associate a Power of Attorney with financial decisions, it can also be used for healthcare decisions. A durable Power of Attorney can grant authority for both financial and medical choices, depending on how it is structured.

This is incorrect. A Power of Attorney becomes invalid upon the death of the principal. Once an individual passes away, their estate is managed according to their will or state law, not through a Power of Attorney.

This is a common misunderstanding. A Power of Attorney can be revoked at any time, as long as the principal is mentally competent. The revocation should be documented in writing and communicated to all relevant parties.

This is misleading. There are different types of Powers of Attorney, such as durable, springing, and limited. Each serves a specific purpose and has different implications, so it is essential to choose the right type for your needs.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney is a legal document that allows one person to act on behalf of another in legal or financial matters. |

| Governing Law | The Florida Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Types | There are several types of Power of Attorney in Florida, including durable, springing, and limited Power of Attorney. |

| Durability | A durable Power of Attorney remains effective even if the principal becomes incapacitated. |

| Springing Power | A springing Power of Attorney only becomes effective upon the occurrence of a specified event, such as incapacitation. |

| Requirements | The form must be signed by the principal and two witnesses, or notarized to be valid. |

| Agent Authority | The agent can perform various tasks, including managing finances, signing documents, and making healthcare decisions, depending on the powers granted. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent. |