Printable Operating Agreement Document for Florida

The Florida Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal governance structure, defining the roles and responsibilities of members and managers. It addresses essential aspects such as ownership percentages, profit distribution, and decision-making processes, ensuring clarity and reducing potential disputes among members. Furthermore, the agreement provides guidelines for the admission of new members, the transfer of ownership interests, and procedures for dissolution, if necessary. By establishing these foundational elements, the Florida Operating Agreement not only promotes a harmonious working relationship among members but also enhances the overall stability and credibility of the LLC in the eyes of potential investors and stakeholders. Understanding the significance of this document is vital for anyone looking to form or operate an LLC in Florida, as it lays the groundwork for a successful business endeavor.

More State-specific Operating Agreement Forms

Operating Agreement Llc Pa - This agreement can help manage expectations among members regarding business growth.

To ensure a smooth and legally binding transaction, you can utilize the resources available through Washington Templates for understanding and completing your Motor Vehicle Bill of Sale.

Ohio Llc Operating Agreement - This document can help prevent misunderstandings by clearly stating each member's role.

How to File Operating Agreement Llc - An Operating Agreement often includes specific provisions for member compensation.

Operating Agreement Llc New York - By creating an Operating Agreement, you set clear expectations.

Common Questions

What is a Florida Operating Agreement?

A Florida Operating Agreement is a legal document that outlines the management structure and operational procedures of a Limited Liability Company (LLC) in Florida. It serves as the foundation for how the LLC will function, detailing the rights and responsibilities of its members.

Is an Operating Agreement required in Florida?

No, Florida law does not require LLCs to have an Operating Agreement. However, having one is highly recommended. It helps clarify expectations among members and can prevent disputes down the line. Additionally, it provides a framework for decision-making and management.

What should be included in a Florida Operating Agreement?

An effective Operating Agreement should include several key components. These typically consist of the LLC's name, purpose, member contributions, profit and loss distribution, management structure, and procedures for adding or removing members. It may also outline dispute resolution methods and the process for dissolving the LLC.

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many templates are available online, and you can customize them to fit your LLC's needs. However, it is advisable to consult with a legal professional to ensure that your agreement complies with Florida laws and adequately protects your interests.

How does an Operating Agreement affect liability protection?

An Operating Agreement reinforces the limited liability protection that an LLC provides. By clearly outlining the roles and responsibilities of members, it helps to demonstrate that the LLC operates as a separate entity. This separation is crucial in protecting personal assets from business liabilities.

Can members amend the Operating Agreement?

Yes, members can amend the Operating Agreement. The process for making amendments should be outlined within the document itself. Typically, a majority vote or unanimous consent of the members is required to approve any changes. Keeping the agreement updated is essential as the business evolves.

What happens if we don’t have an Operating Agreement?

Without an Operating Agreement, your LLC will default to Florida's statutory rules governing LLCs. This can lead to unexpected outcomes, such as default profit-sharing arrangements and management structures that may not reflect the members' intentions. Disputes may arise more easily without a clear framework in place.

Where can I find a Florida Operating Agreement template?

Templates for Florida Operating Agreements can be found online through various legal websites, business formation services, and state resources. While using a template can be a good starting point, ensure that you tailor it to your specific needs and consider seeking legal advice for completeness and compliance.

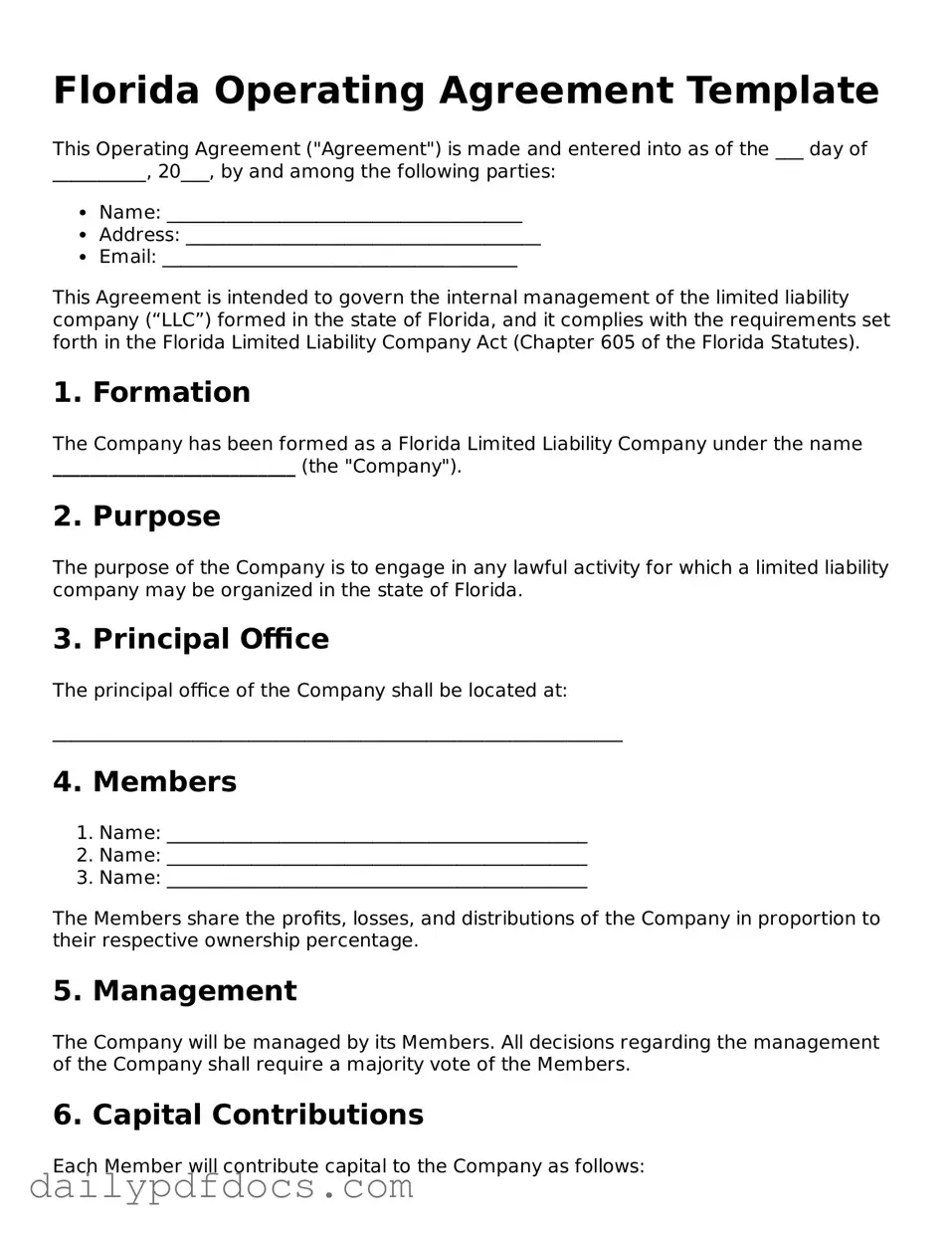

Preview - Florida Operating Agreement Form

Florida Operating Agreement Template

This Operating Agreement ("Agreement") is made and entered into as of the ___ day of __________, 20___, by and among the following parties:

- Name: ______________________________________

- Address: ______________________________________

- Email: ______________________________________

This Agreement is intended to govern the internal management of the limited liability company (“LLC”) formed in the state of Florida, and it complies with the requirements set forth in the Florida Limited Liability Company Act (Chapter 605 of the Florida Statutes).

1. Formation

The Company has been formed as a Florida Limited Liability Company under the name __________________________ (the "Company").

2. Purpose

The purpose of the Company is to engage in any lawful activity for which a limited liability company may be organized in the state of Florida.

3. Principal Office

The principal office of the Company shall be located at:

_____________________________________________________________

4. Members

- Name: _____________________________________________

- Name: _____________________________________________

- Name: _____________________________________________

The Members share the profits, losses, and distributions of the Company in proportion to their respective ownership percentage.

5. Management

The Company will be managed by its Members. All decisions regarding the management of the Company shall require a majority vote of the Members.

6. Capital Contributions

Each Member will contribute capital to the Company as follows:

- Name: ______________________________________ Amount: $________

- Name: ______________________________________ Amount: $________

- Name: ______________________________________ Amount: $________

7. Distributions

Distributions shall be made to the Members at the times and in the amounts determined by the Members, based on their respective ownership percentages.

8. Amendments

This Agreement may be amended only by a written agreement signed by all Members.

9. Governing Law

This Agreement shall be governed by, and construed in accordance with, the laws of the State of Florida.

IN WITNESS WHEREOF, the undersigned Members have executed this Operating Agreement as of the date first written above:

_______________________________ (Signature)

_______________________________ (Printed Name)

_______________________________ (Date)

_______________________________ (Signature)

_______________________________ (Printed Name)

_______________________________ (Date)

Similar forms

-

Partnership Agreement: This document outlines the terms and conditions between partners in a business. Like an Operating Agreement, it defines roles, responsibilities, and profit-sharing arrangements among partners.

-

Bylaws: Bylaws govern the internal management of a corporation. Similar to an Operating Agreement, they establish rules for decision-making, meetings, and the roles of directors and officers.

-

Shareholder Agreement: This agreement is between shareholders of a corporation. It addresses ownership rights and obligations, akin to how an Operating Agreement specifies member rights in an LLC.

-

Joint Venture Agreement: This document outlines the terms of a joint venture between two or more parties. Like an Operating Agreement, it specifies contributions, profit distribution, and management responsibilities.

-

Memorandum of Understanding (MOU): An MOU outlines an agreement between parties without creating legally binding obligations. It shares similarities with an Operating Agreement in terms of clarifying intentions and roles.

-

Franchise Agreement: This document governs the relationship between a franchisor and franchisee. It includes operational guidelines and obligations, similar to the rules set forth in an Operating Agreement.

-

Employment Agreement: This contract outlines the terms of employment between an employer and employee. Like an Operating Agreement, it defines roles, responsibilities, and compensation.

-

Non-Disclosure Agreement (NDA): An NDA protects confidential information shared between parties. While it serves a different purpose, it can be similar in that both documents establish clear expectations and obligations.

- Mobile Home Bill of Sale: This legal document is essential for transferring ownership of a mobile home and includes detailed information about both parties involved and the transaction. For more information, visit https://mobilehomebillofsale.com/blank-texas-mobile-home-bill-of-sale/.

-

Asset Purchase Agreement: This document governs the purchase of assets between parties. It outlines the terms of the transaction, akin to how an Operating Agreement details the structure and management of an LLC.

Misconceptions

Many people have misunderstandings about the Florida Operating Agreement form. Here are six common misconceptions, along with clarifications to help you understand this important document.

-

All LLCs are required to have an Operating Agreement.

This is not true. In Florida, while having an Operating Agreement is highly recommended, it is not legally required. However, having one can help clarify the roles and responsibilities of members.

-

The Operating Agreement must be filed with the state.

This misconception can lead to confusion. The Operating Agreement is an internal document and does not need to be submitted to the state. It is kept on file with the LLC’s records.

-

All members must sign the Operating Agreement.

While it is best practice for all members to sign, it is not a strict requirement. An Operating Agreement can still be valid even if not all members have signed, provided there is mutual agreement on its terms.

-

The Operating Agreement is the same as the Articles of Organization.

This is a common mix-up. The Articles of Organization is a public document filed with the state to form the LLC, while the Operating Agreement outlines the internal workings and management of the LLC.

-

Once created, the Operating Agreement cannot be changed.

This is incorrect. An Operating Agreement can be amended as needed, provided all members agree to the changes. Flexibility is one of its key advantages.

-

The Operating Agreement is only necessary for multi-member LLCs.

This is a misconception. Even single-member LLCs can benefit from having an Operating Agreement. It helps establish clear guidelines and can provide legal protection.

Understanding these points can help ensure that you approach the Florida Operating Agreement with the right expectations. It is a valuable tool for any LLC, regardless of its size or structure.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | The Florida Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Florida. |

| Governing Law | The Florida Operating Agreement is governed by the Florida Limited Liability Company Act, specifically Chapter 605 of the Florida Statutes. |

| Purpose | This agreement serves to define the roles and responsibilities of members and managers, as well as the distribution of profits and losses. |

| Member Rights | Members have specific rights and obligations outlined in the agreement, which can help prevent disputes and clarify expectations. |

| Flexibility | The agreement allows for flexibility in management and operational procedures, enabling LLCs to tailor their structure to fit their needs. |

| Not Mandatory | While it is not legally required to have an Operating Agreement in Florida, it is highly recommended to protect members' interests. |

| Amendments | Members can amend the Operating Agreement as needed, allowing for adjustments in response to changes in the business or membership. |

| Dispute Resolution | The agreement can include provisions for resolving disputes among members, which can help avoid costly litigation. |

| Duration | The Operating Agreement can specify the duration of the LLC, whether it is perpetual or for a fixed term. |

| Tax Implications | The agreement can outline how the LLC will be taxed, which can have significant implications for members' personal tax situations. |