Printable Motor Vehicle Bill of Sale Document for Florida

When it comes to buying or selling a vehicle in Florida, understanding the Motor Vehicle Bill of Sale form is essential for both parties involved. This document serves as a legal record of the transaction, providing vital information such as the vehicle's make, model, year, and Vehicle Identification Number (VIN). It also includes the names and addresses of both the buyer and seller, ensuring that there is a clear understanding of who is transferring ownership. Additionally, the form outlines the sale price and any terms or conditions agreed upon, which can protect both parties in case of disputes. Importantly, this document is not only a safeguard for the seller but also offers peace of mind to the buyer, confirming that the vehicle is free of liens and encumbrances. Properly completing the Motor Vehicle Bill of Sale form can streamline the process of title transfer, making it a crucial step in vehicle transactions within the Sunshine State.

More State-specific Motor Vehicle Bill of Sale Forms

Used Car Bill of Sale - May include warranties or guarantees provided by the seller regarding the vehicle’s condition.

For those looking to navigate the complexities of vehicle ownership transfer, obtaining a California Motor Vehicle Bill of Sale is a vital step. This form not only acts as a receipt but also ensures the transaction is legally binding, providing security for both the seller and buyer. To streamline the process and access a convenient template, visit Top Document Templates where you can find the necessary resources to complete your form with ease.

Ga Bill of Sale - If mileage is relevant, it should be noted on the Bill of Sale at the time of sale.

How to Write a Bill of Sale Template - Protect yourself with a formal record of sale.

Common Questions

What is a Florida Motor Vehicle Bill of Sale?

A Florida Motor Vehicle Bill of Sale is a legal document that records the sale of a motor vehicle between a seller and a buyer. This form serves as proof of the transaction and includes important details such as the vehicle's identification number (VIN), make, model, year, and the sale price. It is essential for transferring ownership and can be required for registration purposes with the Florida Department of Highway Safety and Motor Vehicles.

Is a Bill of Sale required in Florida for vehicle sales?

While a Bill of Sale is not legally required for every vehicle sale in Florida, it is highly recommended. This document provides a clear record of the transaction, which can protect both the buyer and the seller in case of disputes. Additionally, it may be required when registering the vehicle in the buyer's name or for tax purposes.

What information should be included in the Bill of Sale?

The Bill of Sale should contain specific information to be effective. Key details include the names and addresses of both the buyer and the seller, the vehicle's make, model, year, and VIN, the sale price, and the date of the transaction. It is also advisable to include any disclosures about the vehicle's condition or any warranties, if applicable.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Florida. However, it is important to ensure that all necessary information is included and that the document complies with state laws. Many templates are available online, which can help simplify the process. Alternatively, using a standard form from the Florida Department of Highway Safety and Motor Vehicles can ensure that you meet all requirements.

Do I need to have the Bill of Sale notarized?

In Florida, notarization of the Bill of Sale is not required for the sale of a vehicle. However, having the document notarized can provide an extra layer of security and authenticity, especially if the transaction involves a significant amount of money. It can also help prevent potential disputes regarding the validity of the sale.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and the seller should keep a copy for their records. The seller should also provide the buyer with any necessary documents, such as the vehicle title. The buyer will need to take the Bill of Sale and the title to their local tax collector's office to register the vehicle and pay any applicable taxes.

Can I use a Bill of Sale for a vehicle purchased from a dealership?

When purchasing a vehicle from a dealership, you typically do not need a separate Bill of Sale. The dealership will provide you with the necessary paperwork, including a sales contract, which serves a similar purpose. However, if you wish to have a Bill of Sale for your records, you can request one from the dealership.

What if the vehicle has a lien on it?

If the vehicle has a lien, it is crucial to address this before completing the sale. The seller should disclose any liens to the buyer and ensure that they are resolved during the transaction. This may involve paying off the lien or obtaining a lien release from the lender. The Bill of Sale should reflect any agreements made regarding the lien to protect both parties.

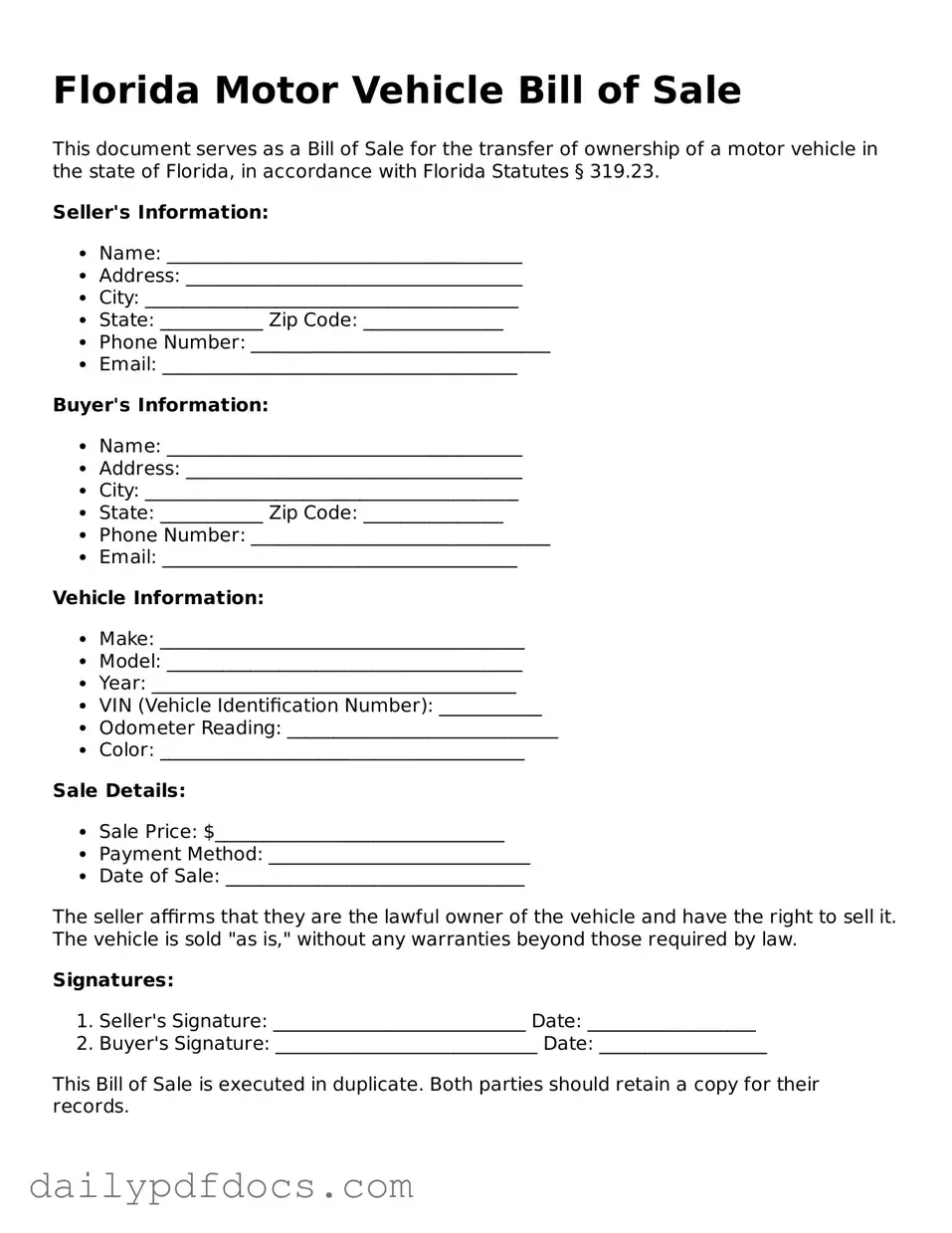

Preview - Florida Motor Vehicle Bill of Sale Form

Florida Motor Vehicle Bill of Sale

This document serves as a Bill of Sale for the transfer of ownership of a motor vehicle in the state of Florida, in accordance with Florida Statutes § 319.23.

Seller's Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ________________________________________

- State: ___________ Zip Code: _______________

- Phone Number: ________________________________

- Email: ______________________________________

Buyer's Information:

- Name: ______________________________________

- Address: ____________________________________

- City: ________________________________________

- State: ___________ Zip Code: _______________

- Phone Number: ________________________________

- Email: ______________________________________

Vehicle Information:

- Make: _______________________________________

- Model: ______________________________________

- Year: _______________________________________

- VIN (Vehicle Identification Number): ___________

- Odometer Reading: _____________________________

- Color: _______________________________________

Sale Details:

- Sale Price: $_______________________________

- Payment Method: ____________________________

- Date of Sale: ________________________________

The seller affirms that they are the lawful owner of the vehicle and have the right to sell it. The vehicle is sold "as is," without any warranties beyond those required by law.

Signatures:

- Seller's Signature: ___________________________ Date: __________________

- Buyer's Signature: ____________________________ Date: __________________

This Bill of Sale is executed in duplicate. Both parties should retain a copy for their records.

Similar forms

Boat Bill of Sale: Much like the Motor Vehicle Bill of Sale, this document serves as proof of ownership transfer for a boat. It includes details such as the boat's make, model, and identification number, ensuring that both the seller and buyer have a clear understanding of the transaction.

Motorcycle Bill of Sale: This form functions similarly to the Motor Vehicle Bill of Sale but is specifically tailored for motorcycles. It captures essential information about the motorcycle, including its VIN (Vehicle Identification Number), and outlines the terms of sale, providing a legal record of the transaction.

Trailer Bill of Sale: When selling or buying a trailer, a Trailer Bill of Sale is used. This document details the specifications of the trailer, including its weight and dimensions, and serves as a legal record of the ownership change, akin to the Motor Vehicle Bill of Sale.

Personal Property Bill of Sale: This broader document can be used for various types of personal property, not just vehicles. It establishes a transfer of ownership and includes details such as the item description, sale price, and the parties involved, much like the Motor Vehicle Bill of Sale.

Misconceptions

Understanding the Florida Motor Vehicle Bill of Sale form is essential for anyone buying or selling a vehicle in the state. However, several misconceptions often cloud the process. Here are nine common misunderstandings:

- A Bill of Sale is not required in Florida. Many people believe that a Bill of Sale is unnecessary when transferring vehicle ownership. While it is not mandatory, having one can protect both parties and provide proof of the transaction.

- The Bill of Sale must be notarized. Some assume that notarization is a requirement for the Bill of Sale. In Florida, notarization is not required, but it can add an extra layer of security and authenticity.

- Only the seller needs to sign the Bill of Sale. It's a common misconception that only the seller's signature is necessary. In fact, both the buyer and seller should sign the document to validate the transaction.

- A Bill of Sale is the same as a title transfer. While a Bill of Sale documents the sale, it does not replace the need for a title transfer. Both processes are essential for legally transferring ownership.

- The Bill of Sale must be completed in person. Many believe that the form must be filled out face-to-face. However, it can be completed remotely, as long as both parties agree on the terms.

- All information on the Bill of Sale is optional. Some think that they can leave out important details. In reality, essential information like the vehicle identification number (VIN), sale price, and the parties’ names must be included.

- The Bill of Sale is only for used vehicles. This misconception leads some to think that new vehicle sales do not require a Bill of Sale. In truth, it is beneficial for both new and used vehicles.

- Once the Bill of Sale is signed, the transaction is complete. People often believe that signing the Bill of Sale finalizes the deal. However, the buyer must also complete the title transfer and register the vehicle to finalize ownership.

- The Bill of Sale can be verbal. Some individuals think that a verbal agreement suffices. A written Bill of Sale is crucial for clarity and legal protection.

By addressing these misconceptions, individuals can navigate the vehicle sale process more effectively and ensure that all legal requirements are met.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The Florida Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | This form is governed by Florida Statutes, specifically Chapter 319, which covers the transfer of ownership for motor vehicles. |

| Required Information | The form must include details such as the vehicle identification number (VIN), make, model, year, and sale price. |

| Signatures | Both the buyer and the seller must sign the form to validate the transaction. |

| Notarization | While notarization is not required, having the signatures notarized can provide additional legal protection. |

| Tax Implications | The sale may be subject to sales tax, which the buyer is responsible for paying at the time of registration. |

| Record Keeping | Both parties should keep a copy of the completed Bill of Sale for their records. |

| Usage | This form is commonly used for private sales, but it can also be useful in dealer transactions. |