Printable Loan Agreement Document for Florida

The Florida Loan Agreement form serves as a crucial document in establishing the terms and conditions between a lender and a borrower in the state of Florida. This form outlines key details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It is designed to protect both parties by clearly defining their rights and obligations. Additionally, the agreement may include provisions for late fees, default consequences, and dispute resolution methods. By providing a structured framework, the Florida Loan Agreement helps to ensure transparency and mutual understanding, making it an essential tool for anyone entering into a loan transaction in the state.

More State-specific Loan Agreement Forms

Promissory Note Template New York - The Loan Agreement may require notarization for legal validity.

For individuals looking to navigate the complexities of transferring ownership, a thorough Trailer Bill of Sale process can ensure that all legal requirements are met while providing a clear record of the transaction.

Promissory Note Georgia - Both parties should clearly understand their rights and responsibilities as outlined in the document.

Common Questions

What is a Florida Loan Agreement?

A Florida Loan Agreement is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Florida. This agreement specifies details such as the loan amount, interest rate, repayment schedule, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities.

Who can use a Florida Loan Agreement?

Any individual or business in Florida looking to borrow or lend money can use a Florida Loan Agreement. Whether you are a friend lending money to someone in need or a business providing a loan to a client, this document can help formalize the arrangement. It is important for both parties to understand the terms before signing.

What are the key components of a Florida Loan Agreement?

A typical Florida Loan Agreement includes several key components: the names and contact information of both parties, the loan amount, the interest rate, the repayment terms (including the schedule), any collateral securing the loan, and the consequences of default. These elements ensure clarity and help prevent misunderstandings.

Is a Florida Loan Agreement legally binding?

Yes, a Florida Loan Agreement is legally binding once both parties have signed it. This means that if either party fails to adhere to the terms, the other party can take legal action to enforce the agreement. To ensure enforceability, both parties should fully understand the terms before signing.

Do I need a lawyer to create a Florida Loan Agreement?

While it is not required to have a lawyer draft a Florida Loan Agreement, it can be beneficial, especially for larger loans or more complex situations. Many people choose to use templates or online services to create simple agreements. However, consulting with a legal professional can help ensure that all necessary terms are included and compliant with state laws.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has the right to take action as specified in the Loan Agreement. This may include demanding immediate repayment, charging late fees, or taking possession of any collateral. It’s crucial for both parties to understand the default terms outlined in the agreement to avoid potential disputes.

Can a Florida Loan Agreement be modified after it is signed?

Yes, a Florida Loan Agreement can be modified, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the lender and borrower. This helps maintain clarity and ensures that all parties are aware of the new terms.

Where can I find a Florida Loan Agreement template?

Florida Loan Agreement templates can be found online through various legal document websites. Many of these resources offer customizable templates that can be tailored to your specific needs. It’s important to choose a reputable source to ensure the template complies with Florida laws and adequately protects both parties.

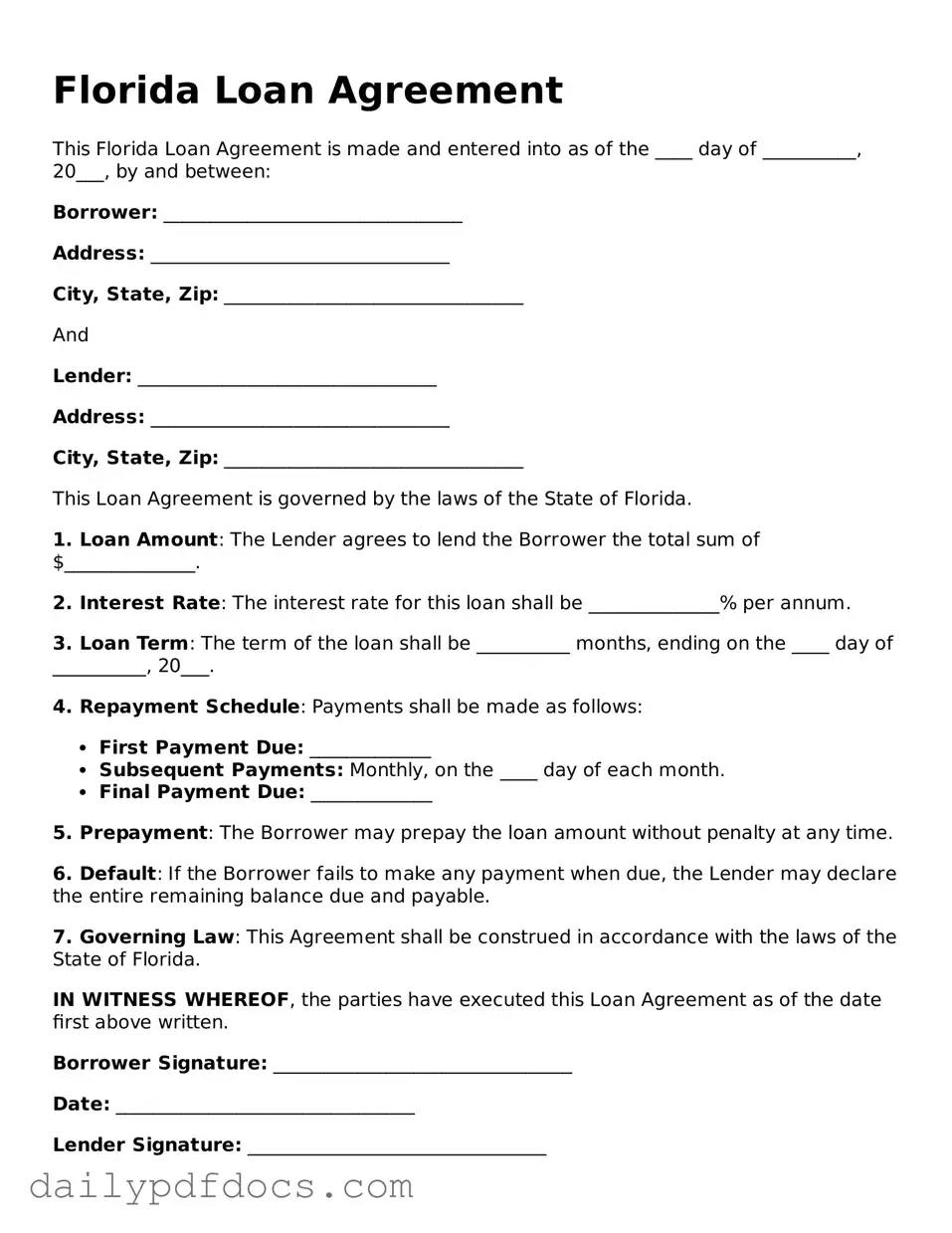

Preview - Florida Loan Agreement Form

Florida Loan Agreement

This Florida Loan Agreement is made and entered into as of the ____ day of __________, 20___, by and between:

Borrower: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

And

Lender: ________________________________

Address: ________________________________

City, State, Zip: ________________________________

This Loan Agreement is governed by the laws of the State of Florida.

1. Loan Amount: The Lender agrees to lend the Borrower the total sum of $______________.

2. Interest Rate: The interest rate for this loan shall be ______________% per annum.

3. Loan Term: The term of the loan shall be __________ months, ending on the ____ day of __________, 20___.

4. Repayment Schedule: Payments shall be made as follows:

- First Payment Due: _____________

- Subsequent Payments: Monthly, on the ____ day of each month.

- Final Payment Due: _____________

5. Prepayment: The Borrower may prepay the loan amount without penalty at any time.

6. Default: If the Borrower fails to make any payment when due, the Lender may declare the entire remaining balance due and payable.

7. Governing Law: This Agreement shall be construed in accordance with the laws of the State of Florida.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the date first above written.

Borrower Signature: ________________________________

Date: ________________________________

Lender Signature: ________________________________

Date: ________________________________

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan. It includes details such as the loan amount, interest rate, and repayment schedule, similar to a Loan Agreement.

- Mortgage Agreement: A Mortgage Agreement secures a loan with property collateral. Like a Loan Agreement, it specifies the terms of the loan and the obligations of both parties.

Mobile Home Bill of Sale: This legal document facilitates the transfer of ownership for a mobile home and serves as proof of the transaction. It is crucial to ensure that all details are accurately documented to protect the interests of both the buyer and seller, which can be further understood by visiting mobilehomebillofsale.com/blank-missouri-mobile-home-bill-of-sale/.

- Security Agreement: This document provides a lender with rights to specific assets if a borrower defaults. It shares similarities with a Loan Agreement in defining the terms and conditions of the loan.

- Line of Credit Agreement: This agreement allows borrowers to access funds up to a certain limit. It includes terms and conditions that are comparable to those in a Loan Agreement.

- Lease Agreement: While primarily for renting property, a Lease Agreement can include terms for payment and obligations, paralleling aspects of a Loan Agreement.

- Personal Loan Agreement: This document details the terms of an unsecured personal loan, much like a Loan Agreement, including repayment terms and interest rates.

- Business Loan Agreement: This agreement is tailored for business financing. It outlines the loan terms and conditions, similar to a standard Loan Agreement.

- Credit Card Agreement: This document details the terms under which credit is extended. It shares features with a Loan Agreement, such as interest rates and payment obligations.

- Debt Settlement Agreement: This document outlines the terms for settling a debt for less than the full amount owed. It includes terms similar to those found in a Loan Agreement regarding repayment.

Misconceptions

Many people have misunderstandings about the Florida Loan Agreement form. Here are some common misconceptions:

-

It is a legally binding contract without signatures.

A loan agreement requires signatures from all parties involved to be enforceable. Without signatures, the document holds no legal weight.

-

All loan agreements are the same.

Loan agreements can vary significantly based on the terms, amounts, and parties involved. Each agreement should be tailored to the specific situation.

-

Verbal agreements are sufficient.

While verbal agreements can be valid, they are difficult to enforce. A written agreement provides clear evidence of the terms.

-

The lender can change terms at any time.

Once signed, the terms of a loan agreement are fixed unless both parties agree to modifications. Changes should be documented in writing.

-

Only banks can issue loan agreements.

Any individual or entity can create a loan agreement. This includes private lenders, friends, and family members.

-

Loan agreements do not need to be notarized.

Notarization is not always required, but it can add an extra layer of authenticity and protection for both parties.

-

Defaulting on a loan means immediate loss of property.

Defaulting on a loan can lead to legal actions, but it does not automatically result in losing property. The lender must follow legal procedures.

-

Interest rates are fixed in all agreements.

Interest rates can be fixed or variable. It’s essential to understand the terms before signing the agreement.

-

Loan agreements are only for large sums of money.

Loan agreements can be used for any amount, big or small. They are useful for personal loans, business loans, and more.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | The Florida Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Florida, particularly under the Florida Statutes Title XXXIX. |

| Parties Involved | The form identifies the lender and the borrower, both of whom must provide their legal names and contact information. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement, ensuring transparency for both parties. |

| Interest Rate | The form specifies the interest rate applicable to the loan, which can be fixed or variable as agreed upon by the parties. |

| Repayment Terms | It outlines the repayment schedule, including the frequency of payments and the duration of the loan. |

| Default Conditions | The agreement includes terms regarding what constitutes a default and the remedies available to the lender in such cases. |

| Signatures | Both parties must sign the agreement to validate it, indicating their acceptance of the terms outlined. |

| Amendments | The form may include provisions for amendments, allowing changes to be made with mutual consent of both parties. |