Printable Lady Bird Deed Document for Florida

The Florida Lady Bird Deed, also known as an enhanced life estate deed, serves as a powerful estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form provides the ability to avoid probate, ensuring a smoother transition of property upon the owner's death. One of its key features is the retention of the right to live in and manage the property, which means the owner can sell, mortgage, or alter the property without needing consent from the beneficiaries. Additionally, the Lady Bird Deed offers a significant tax advantage by allowing the property to receive a step-up in basis, potentially reducing capital gains taxes for the heirs. This form is particularly beneficial for Florida residents looking to simplify their estate planning process while maintaining flexibility and control over their assets. Understanding the nuances of the Lady Bird Deed is essential for anyone considering this option as part of their estate plan.

More State-specific Lady Bird Deed Forms

Printable Life Estate Deed Form - A Lady Bird Deed can effectively pass down family history anchored in real estate to future generations.

When engaging in potentially risky activities, it is crucial to utilize legal protections such as the Washington Hold Harmless Agreement, as detailed at Washington Templates, which provides a clear outline of the responsibilities and agreements to safeguard all parties involved.

Common Questions

What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed enables the owner to avoid probate upon their death, as the property automatically transfers to the named beneficiaries without the need for court intervention. It also provides flexibility, allowing the owner to sell or mortgage the property without the beneficiaries' consent while they are still alive.

Who can benefit from using a Lady Bird Deed?

Individuals who wish to pass on their property to family members or loved ones while maintaining control during their lifetime can benefit from a Lady Bird Deed. This deed is particularly useful for seniors who want to ensure their property is transferred to their heirs without going through probate. It can also be advantageous for those concerned about Medicaid eligibility, as the property may not be counted as an asset for Medicaid purposes if structured correctly.

How does a Lady Bird Deed differ from a traditional life estate deed?

The primary difference between a Lady Bird Deed and a traditional life estate deed lies in the control retained by the property owner. With a traditional life estate deed, the owner gives up certain rights to the property, including the ability to sell or mortgage it without the consent of the remaindermen (the beneficiaries). In contrast, a Lady Bird Deed allows the owner to retain full control over the property, including the right to sell, mortgage, or change the beneficiaries without their approval.

Are there any tax implications associated with a Lady Bird Deed?

When a property is transferred via a Lady Bird Deed, it generally receives a step-up in basis for tax purposes upon the owner's death. This means that the beneficiaries may not have to pay capital gains taxes on the appreciation of the property that occurred during the owner's lifetime. However, it is essential to consult with a tax professional to understand specific tax implications and ensure compliance with current tax laws.

How do I create a Lady Bird Deed in Florida?

Creating a Lady Bird Deed in Florida involves drafting the deed with the necessary legal language and information, including the property description and the names of the beneficiaries. It must be signed by the property owner in the presence of a notary public. After signing, the deed should be recorded with the county clerk's office where the property is located to ensure it is legally binding and enforceable. It is advisable to seek assistance from a legal professional to ensure the deed is properly executed and complies with state laws.

Preview - Florida Lady Bird Deed Form

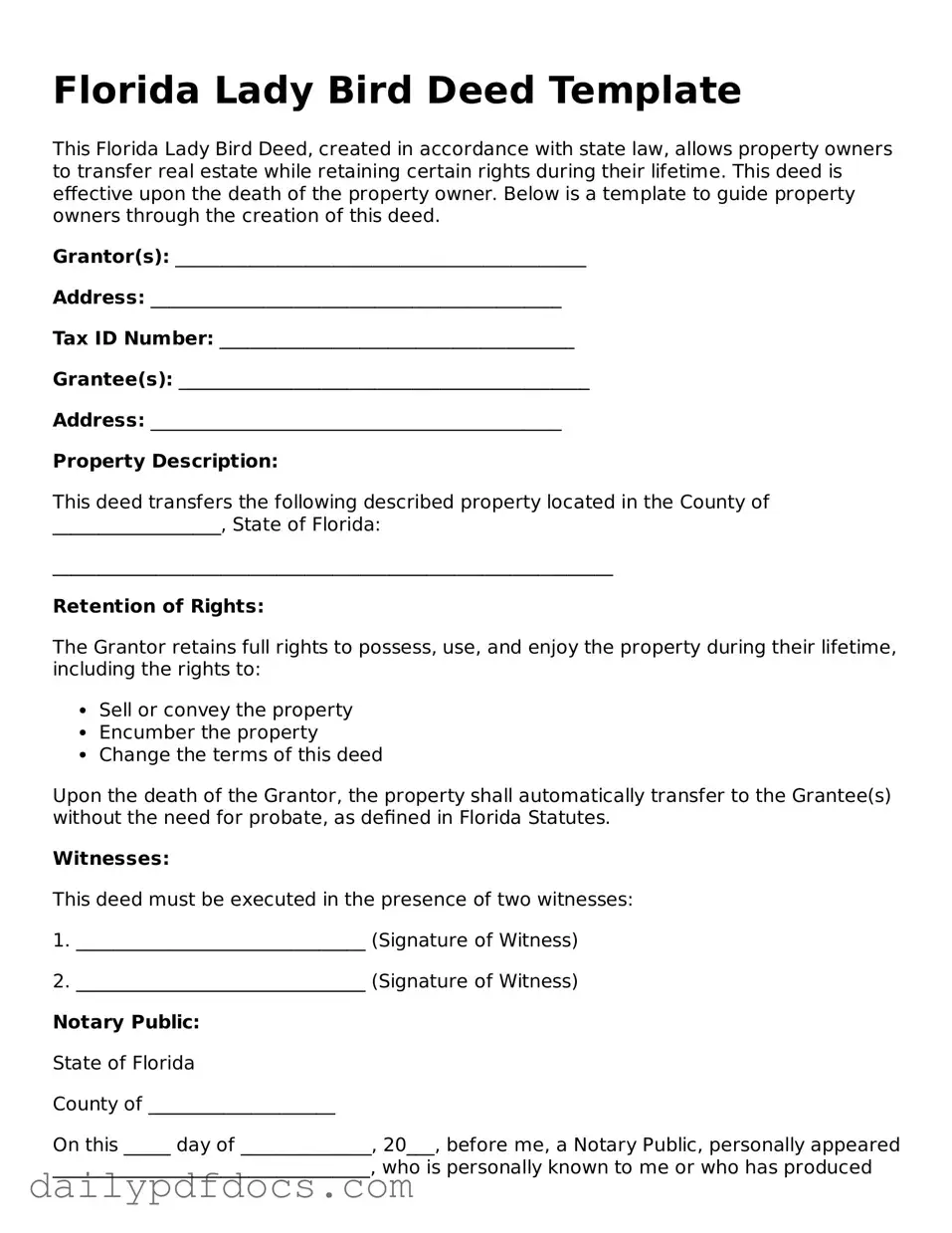

Florida Lady Bird Deed Template

This Florida Lady Bird Deed, created in accordance with state law, allows property owners to transfer real estate while retaining certain rights during their lifetime. This deed is effective upon the death of the property owner. Below is a template to guide property owners through the creation of this deed.

Grantor(s): ____________________________________________

Address: ____________________________________________

Tax ID Number: ______________________________________

Grantee(s): ____________________________________________

Address: ____________________________________________

Property Description:

This deed transfers the following described property located in the County of __________________, State of Florida:

____________________________________________________________

Retention of Rights:

The Grantor retains full rights to possess, use, and enjoy the property during their lifetime, including the rights to:

- Sell or convey the property

- Encumber the property

- Change the terms of this deed

Upon the death of the Grantor, the property shall automatically transfer to the Grantee(s) without the need for probate, as defined in Florida Statutes.

Witnesses:

This deed must be executed in the presence of two witnesses:

1. _______________________________ (Signature of Witness)

2. _______________________________ (Signature of Witness)

Notary Public:

State of Florida

County of ____________________

On this _____ day of ______________, 20___, before me, a Notary Public, personally appeared __________________________________, who is personally known to me or who has produced __________________________________ as identification, and who did take an oath.

Notary Signature: _____________________________________

Notary Seal:

________________________________________________________________

This Florida Lady Bird Deed should be recorded with the County Clerk’s Office where the property is located to ensure proper legal recognition.

Please consult with a legal professional to ensure compliance with all applicable laws and to address any specific needs regarding this deed.

Similar forms

The Lady Bird Deed is a unique legal document that allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. Several other documents serve similar purposes, each with its own features. Here’s a list of eight documents that share similarities with the Lady Bird Deed:

- Transfer on Death Deed (TODD): Like the Lady Bird Deed, a TODD allows property owners to name beneficiaries who will receive the property upon their death, bypassing probate.

- Revocable Living Trust: This document allows individuals to place their assets into a trust, which they can manage during their lifetime. Upon death, the assets can be transferred to beneficiaries without going through probate.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner passes away, their share automatically transfers to the surviving owner(s).

- Ohio Mobile Home Bill of Sale: This form is crucial for transferring ownership of a mobile home, ensuring both parties maintain a clear record of the transaction. For detailed information, visit mobilehomebillofsale.com/blank-ohio-mobile-home-bill-of-sale.

- Life Estate Deed: A life estate deed grants someone the right to use the property during their lifetime, with the property automatically passing to another person upon their death.

- Will: A will outlines how a person wants their assets distributed after death. Unlike the Lady Bird Deed, it typically goes through probate.

- Beneficiary Designation: Certain assets, like retirement accounts and insurance policies, allow individuals to designate beneficiaries directly, ensuring those assets transfer outside of probate.

- Power of Attorney: While not directly transferring property, a power of attorney allows someone to manage another person’s financial affairs, including property, if they become incapacitated.

- Quitclaim Deed: This document transfers any interest the grantor has in a property to another person. It can be used to transfer property between family members but does not provide the same protections as a Lady Bird Deed.

Each of these documents offers different benefits and considerations, making it essential to choose the right one based on individual circumstances and goals.

Misconceptions

The Florida Lady Bird Deed is a useful estate planning tool, but several misconceptions surround it. Understanding these misconceptions can help individuals make informed decisions about their property and estate planning.

- Misconception 1: A Lady Bird Deed automatically avoids probate.

- Misconception 2: The property is not considered part of the grantor's estate.

- Misconception 3: A Lady Bird Deed cannot be revoked.

- Misconception 4: The beneficiaries have immediate rights to the property.

While a Lady Bird Deed can help transfer property outside of probate, it does not guarantee that all aspects of an estate will avoid probate. Other assets may still go through the probate process.

Even with a Lady Bird Deed, the property remains part of the grantor's estate for tax purposes until their death. This means it can still affect estate taxes and Medicaid eligibility.

A Lady Bird Deed can be revoked or modified at any time by the grantor as long as they are alive and competent. This flexibility allows for changes in estate planning as circumstances evolve.

Beneficiaries do not have rights to the property until the grantor passes away. Until that time, the grantor retains full control and ownership of the property.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Florida Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Florida Statutes, specifically Section 731.201. |

| Retained Control | Property owners maintain the right to sell, mortgage, or change the property as they wish. |

| Avoiding Probate | This deed allows for the automatic transfer of property to beneficiaries upon the owner's death, thus avoiding probate. |

| Tax Implications | The transfer does not trigger gift tax, as it is not considered a completed gift until the owner's death. |

| Revocability | Property owners can revoke or change the deed at any time before their death. |

| Beneficiary Designation | Owners can name one or more beneficiaries, and they can specify how the property should be divided. |

| Eligibility | The deed can be used for residential property, but not for commercial real estate or properties held in a trust. |

| Legal Assistance | While not required, it is advisable to seek legal help to ensure the deed is properly executed and meets all legal requirements. |