Printable Durable Power of Attorney Document for Florida

The Florida Durable Power of Attorney form is a crucial legal document that allows individuals to designate someone they trust to make financial and legal decisions on their behalf. This form remains effective even if the principal becomes incapacitated, ensuring that their affairs can be managed without interruption. It covers various aspects, including the powers granted to the agent, the duration of those powers, and any limitations the principal wishes to impose. The principal must be of sound mind when executing the form, and it requires notarization to be legally binding. Additionally, the agent's responsibilities can encompass managing bank accounts, real estate transactions, and other financial obligations, making it an essential tool for estate planning and ensuring that one's wishes are honored during times of need.

More State-specific Durable Power of Attorney Forms

Durable Power of Attorney Pdf - Understanding the scope of authority can prevent future disputes.

Power of Attorney in Ohio Requirements - The form remains effective, no matter where you are, ensuring continuity in care and management.

Durable Power of Attorney Form Georgia - This form is recognized across all states, with slight variations in requirements.

Common Questions

What is a Durable Power of Attorney in Florida?

A Durable Power of Attorney (DPOA) in Florida is a legal document that allows you to appoint someone you trust to make decisions on your behalf. This authority remains effective even if you become incapacitated. The person you designate, known as your agent or attorney-in-fact, can handle financial matters, manage property, and make other important decisions as specified in the document. It’s important to choose someone who understands your wishes and can act in your best interest.

How do I create a Durable Power of Attorney in Florida?

Creating a Durable Power of Attorney in Florida involves a few steps. First, you must complete a DPOA form that complies with Florida law. This form should clearly outline the powers you are granting to your agent. After filling out the form, you must sign it in the presence of two witnesses and a notary public. This ensures that the document is valid and enforceable. Once completed, it is wise to provide copies to your agent and any financial institutions or healthcare providers that may need to reference it.

Can I revoke a Durable Power of Attorney in Florida?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke the DPOA, you should create a written notice stating your intention to revoke it. You should then inform your agent and any institutions that may have relied on the original document. It is also a good practice to destroy any copies of the original DPOA to avoid confusion. If you create a new DPOA, it automatically revokes any previous ones, provided that it is clear in the new document.

What happens if my agent misuses their authority?

If you believe that your agent is misusing their authority or acting against your best interests, you have options. You can revoke the Durable Power of Attorney, as mentioned earlier, and notify any relevant institutions of the revocation. In cases of abuse or fraud, you may also consider seeking legal action against the agent. Florida law provides protections for individuals in such situations, and it may be beneficial to consult with a legal professional to explore your options further.

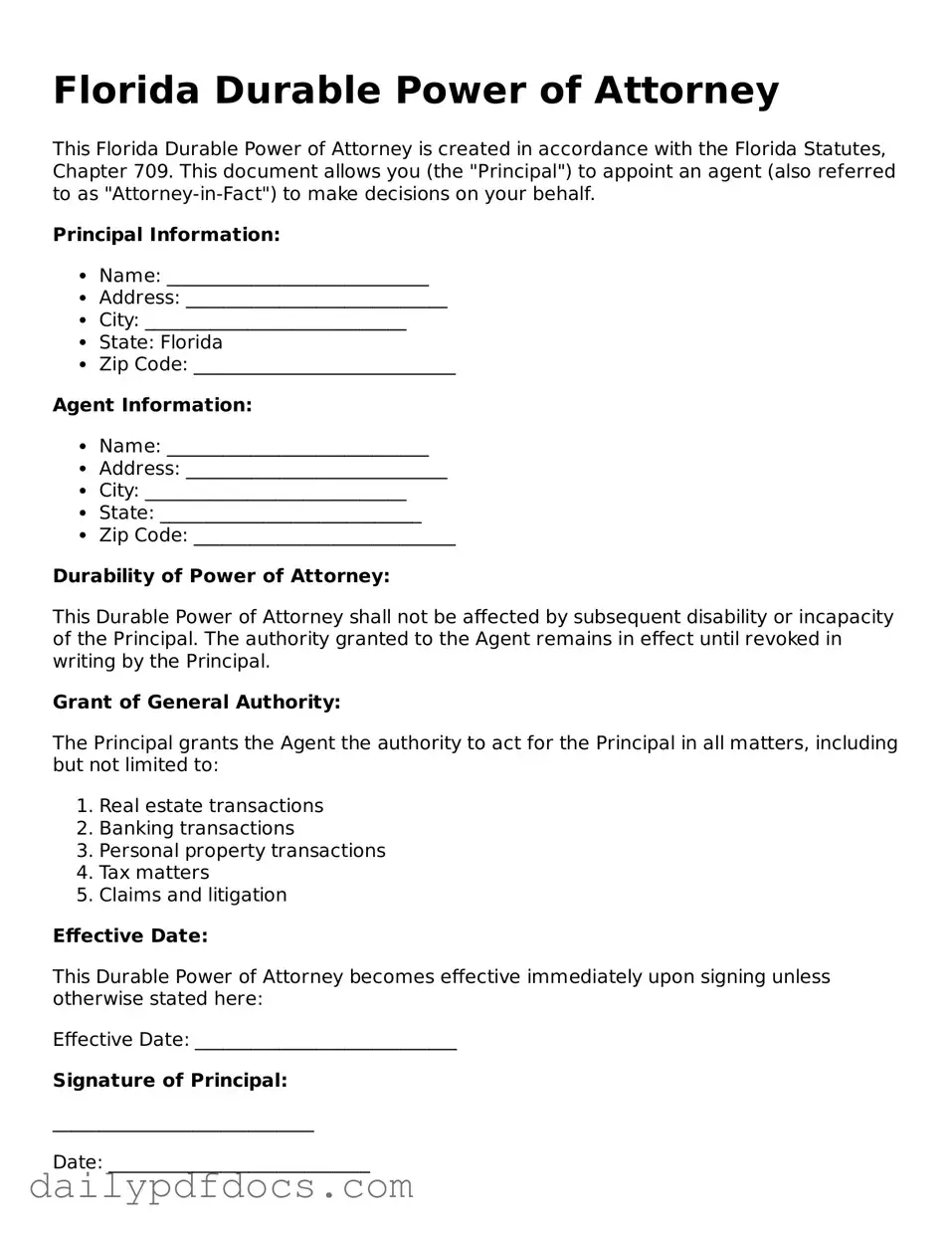

Preview - Florida Durable Power of Attorney Form

Florida Durable Power of Attorney

This Florida Durable Power of Attorney is created in accordance with the Florida Statutes, Chapter 709. This document allows you (the "Principal") to appoint an agent (also referred to as "Attorney-in-Fact") to make decisions on your behalf.

Principal Information:

- Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: Florida

- Zip Code: ____________________________

Agent Information:

- Name: ____________________________

- Address: ____________________________

- City: ____________________________

- State: ____________________________

- Zip Code: ____________________________

Durability of Power of Attorney:

This Durable Power of Attorney shall not be affected by subsequent disability or incapacity of the Principal. The authority granted to the Agent remains in effect until revoked in writing by the Principal.

Grant of General Authority:

The Principal grants the Agent the authority to act for the Principal in all matters, including but not limited to:

- Real estate transactions

- Banking transactions

- Personal property transactions

- Tax matters

- Claims and litigation

Effective Date:

This Durable Power of Attorney becomes effective immediately upon signing unless otherwise stated here:

Effective Date: ____________________________

Signature of Principal:

____________________________

Date: ____________________________

Witnesses:

- Witness 1: ____________________________

- Witness 2: ____________________________

Notary Acknowledgment:

State of Florida

County of ____________________________

On this _____ day of ___________, 20__, before me, a Notary Public, personally appeared _______________________________, known to me to be the person described in and who executed this Durable Power of Attorney. I affirm that they signed this document in my presence.

My Commission Expires: ____________________________

Notary Public Signature: ____________________________

Similar forms

- General Power of Attorney: This document grants someone the authority to act on your behalf in a broad range of matters, similar to a Durable Power of Attorney, but it typically becomes invalid if you become incapacitated.

- Health Care Proxy: A health care proxy allows you to appoint someone to make medical decisions for you if you cannot do so yourself. Like a Durable Power of Attorney, it is focused on decision-making authority but is specific to health care.

- Living Will: A living will outlines your wishes regarding medical treatment in the event of a terminal illness or incapacitation. It complements the Durable Power of Attorney by providing guidance to your agent about your preferences.

- Financial Power of Attorney: This document specifically grants authority to manage your financial affairs. While similar to a Durable Power of Attorney, it may not cover health care decisions.

- Revocable Trust: A revocable trust allows you to manage your assets during your lifetime and specifies how they should be distributed after your death. It shares similarities with a Durable Power of Attorney in terms of asset management but operates differently in terms of legal authority.

- Advance Directive: An advance directive combines a living will and health care proxy, outlining your medical treatment preferences and appointing someone to make decisions on your behalf. It parallels the Durable Power of Attorney in its focus on health care decisions.

- Guardian Appointment: This document designates a guardian for your minor children in the event of your incapacity. It serves a protective role similar to that of a Durable Power of Attorney but is specifically for child custody and care.

- Non-disclosure Agreement: To protect sensitive information shared between parties, consider using a Washington Templates for your NDA. This legal document ensures that confidential details remain private and are not disclosed to unauthorized individuals.

- Business Power of Attorney: This type of power of attorney allows someone to manage business affairs on your behalf. Like a Durable Power of Attorney, it grants authority but is limited to business-related decisions.

Misconceptions

Understanding the Florida Durable Power of Attorney form is crucial for anyone looking to manage their affairs effectively. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

-

Misconception 1: A Durable Power of Attorney is only for financial matters.

This is not true. While many people associate the Durable Power of Attorney with financial decisions, it can also cover health care decisions. You can specify what medical treatments you want or don’t want if you become unable to communicate your wishes.

-

Misconception 2: A Durable Power of Attorney is only effective when the principal is incapacitated.

In fact, this type of power of attorney becomes effective immediately upon signing, unless specified otherwise. This means the appointed agent can act on your behalf right away, even if you are still capable of making decisions.

-

Misconception 3: Once signed, a Durable Power of Attorney cannot be revoked.

This is incorrect. As long as you are mentally competent, you can revoke a Durable Power of Attorney at any time. It’s advisable to inform your agent and any institutions that may have relied on the document.

-

Misconception 4: A Durable Power of Attorney grants unlimited power to the agent.

This is misleading. The authority granted can be tailored to fit your specific needs. You can outline the exact powers you wish to give your agent, ensuring that they only have authority in areas where you feel comfortable.

By clarifying these misconceptions, individuals can make more informed decisions about their legal planning in Florida.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A Florida Durable Power of Attorney allows an individual (the principal) to designate another person (the agent) to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes Chapter 709. |

| Durability | This form remains effective even if the principal becomes incapacitated, ensuring continuous management of their affairs. |

| Agent Authority | The agent can perform a wide range of actions, including handling bank transactions, managing real estate, and making healthcare decisions if specified. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Witness Requirements | The form must be signed in the presence of two witnesses who are not related to the principal and who will not benefit from the principal’s estate. |