Printable Deed Document for Florida

The Florida Deed form serves as a critical document in real estate transactions, facilitating the transfer of property ownership between parties. This form typically includes essential information such as the names of the grantor and grantee, a legal description of the property, and the terms of the conveyance. It may also specify any conditions or restrictions related to the property. Various types of deeds exist in Florida, including warranty deeds, quitclaim deeds, and special purpose deeds, each serving different purposes and offering varying levels of protection to the parties involved. Proper execution of the Florida Deed form requires notarization and, in some cases, witnesses, ensuring the authenticity of the document. Additionally, recording the deed with the county clerk is crucial for establishing public notice of the ownership transfer. Understanding these components is vital for anyone involved in real estate transactions in Florida, as they help safeguard interests and clarify property rights.

More State-specific Deed Forms

Estate Title - Can affect estate planning and inheritance issues.

Texas Deed Forms - A Deed is integral to documenting transfers of land or buildings.

How to Obtain the Deed to My House - This form requires accurate property descriptions to avoid disputes later.

A Quitclaim Deed is a legal document used in Ohio to transfer ownership of real estate from one party to another without any warranties. This form allows the grantor to relinquish their interest in the property, making it a straightforward option for transferring property rights. To properly complete and file this form, you can refer to resources such as Ohio PDF Forms, which provide essential guidance for ensuring a smooth transaction.

Pennsylvania Deed Form - A deed can be revoked or altered under specific conditions, which should be outlined clearly.

Common Questions

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer ownership of real property in the state of Florida. It outlines the details of the transaction, including the names of the parties involved, a description of the property, and the terms of the transfer. This form is essential for ensuring that the transfer of ownership is legally recognized and recorded with the appropriate government authorities.

What types of deeds are available in Florida?

Florida recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special purpose deeds. A warranty deed provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property. A quitclaim deed, on the other hand, transfers whatever interest the seller has without any warranties. Special purpose deeds may include personal representative deeds or trustee deeds, each serving specific purposes in property transfers.

How do I complete a Florida Deed form?

To complete a Florida Deed form, you will need to gather specific information, including the names of the grantor (seller) and grantee (buyer), a legal description of the property, and the date of the transaction. It is crucial to ensure that all information is accurate and complete. Once filled out, the deed must be signed by the grantor in the presence of a notary public. Some deeds may also require witnesses, depending on the type of deed being used.

Do I need a lawyer to prepare a Florida Deed?

While it is not legally required to have a lawyer prepare a Florida Deed, it is highly recommended. A lawyer can help ensure that the deed is completed correctly and complies with all state laws. They can also provide guidance on the best type of deed for your situation and help address any potential legal issues that may arise during the transfer process.

Where do I file a Florida Deed after it is completed?

After completing and signing the Florida Deed, it must be filed with the county clerk's office in the county where the property is located. Filing the deed ensures that the transfer of ownership is recorded in public records, which protects the rights of the new owner and provides notice to the public about the property ownership.

Are there any fees associated with filing a Florida Deed?

Yes, there are fees associated with filing a Florida Deed. These fees can vary by county and may include recording fees, documentary stamp taxes, and other applicable charges. It is advisable to check with the local county clerk's office for the specific fees that will apply to your deed filing.

Can I revoke a Florida Deed after it has been executed?

Generally, once a Florida Deed has been executed and recorded, it cannot be revoked or undone unilaterally. However, there are circumstances under which a deed can be challenged or set aside, such as fraud, undue influence, or lack of capacity. If you believe you have grounds to contest a deed, it is essential to consult with a legal professional to explore your options.

What is the difference between a joint tenancy and a tenancy in common in Florida?

Joint tenancy and tenancy in common are two types of property ownership structures in Florida. In a joint tenancy, two or more individuals own property together with equal rights and the right of survivorship, meaning that if one owner dies, their share automatically transfers to the surviving owner(s). In contrast, tenancy in common allows for ownership shares to be unequal, and there is no right of survivorship; when one owner dies, their share passes according to their will or state law.

What should I do if I lose my Florida Deed?

If you lose your Florida Deed, you can obtain a copy by contacting the county clerk's office where the deed was originally recorded. They can provide you with a certified copy of the deed for a small fee. It is important to keep a copy of the deed for your records, as it serves as proof of ownership and may be required for future transactions involving the property.

Can a Florida Deed be used for transferring property to a trust?

Yes, a Florida Deed can be used to transfer property into a trust. This process typically involves drafting a deed that names the trust as the grantee. It is important to ensure that the deed is properly executed and recorded to reflect the trust's ownership. Consulting with an attorney experienced in estate planning can provide valuable guidance in this process.

Preview - Florida Deed Form

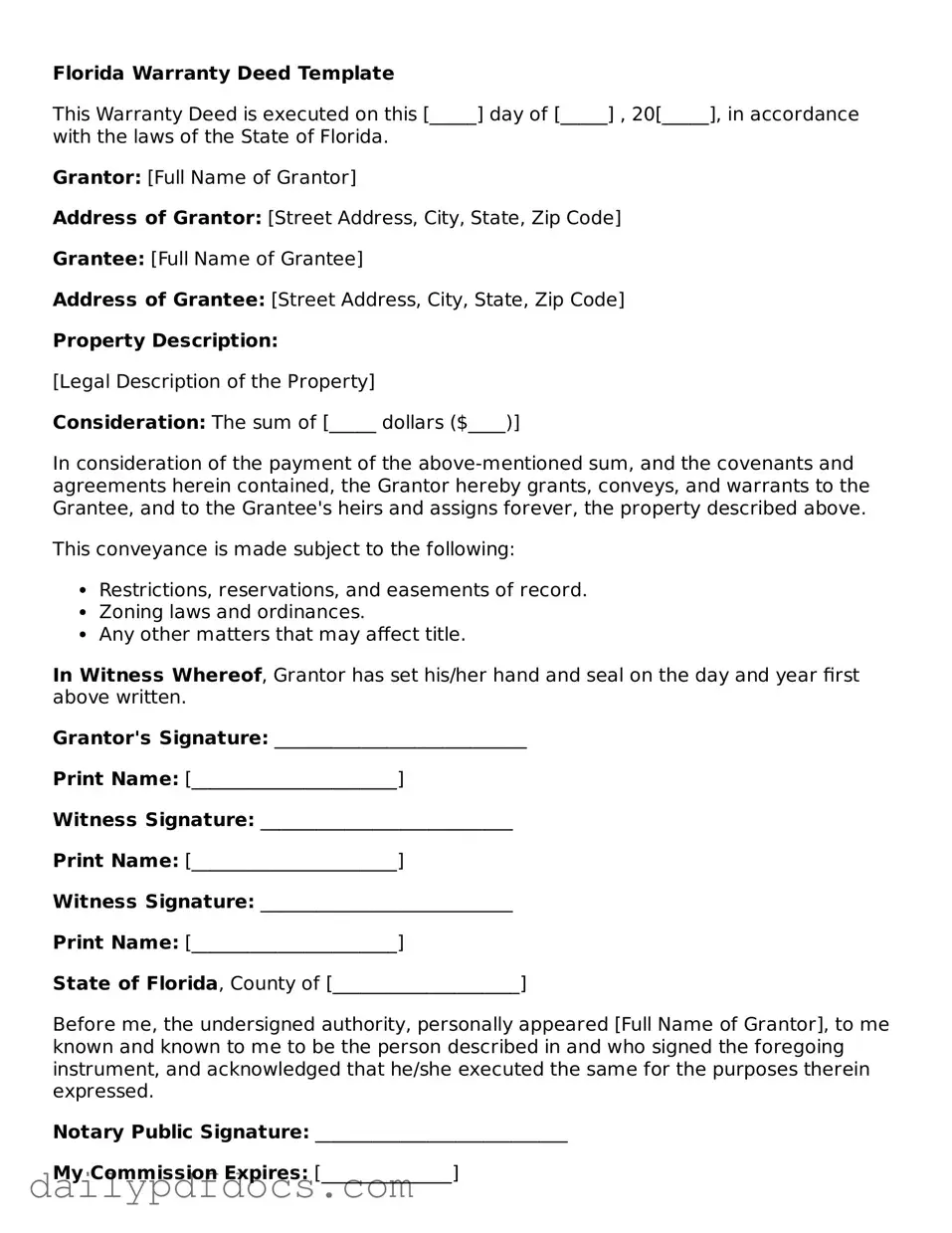

Florida Warranty Deed Template

This Warranty Deed is executed on this [_____] day of [_____] , 20[_____], in accordance with the laws of the State of Florida.

Grantor: [Full Name of Grantor]

Address of Grantor: [Street Address, City, State, Zip Code]

Grantee: [Full Name of Grantee]

Address of Grantee: [Street Address, City, State, Zip Code]

Property Description:

[Legal Description of the Property]

Consideration: The sum of [_____ dollars ($____)]

In consideration of the payment of the above-mentioned sum, and the covenants and agreements herein contained, the Grantor hereby grants, conveys, and warrants to the Grantee, and to the Grantee's heirs and assigns forever, the property described above.

This conveyance is made subject to the following:

- Restrictions, reservations, and easements of record.

- Zoning laws and ordinances.

- Any other matters that may affect title.

In Witness Whereof, Grantor has set his/her hand and seal on the day and year first above written.

Grantor's Signature: ___________________________

Print Name: [______________________]

Witness Signature: ___________________________

Print Name: [______________________]

Witness Signature: ___________________________

Print Name: [______________________]

State of Florida, County of [____________________]

Before me, the undersigned authority, personally appeared [Full Name of Grantor], to me known and known to me to be the person described in and who signed the foregoing instrument, and acknowledged that he/she executed the same for the purposes therein expressed.

Notary Public Signature: ___________________________

My Commission Expires: [______________]

Similar forms

The Deed form is an important document in property transactions, but it's not the only one of its kind. Here are ten other documents that share similarities with the Deed form, along with explanations of how they relate:

- Title Transfer Document: Like a Deed, this document serves to officially transfer ownership of property from one party to another, ensuring that the new owner has legal rights to the property.

- Bill of Sale: This document is used to transfer ownership of personal property, such as vehicles or equipment. Similar to a Deed, it provides proof of ownership and outlines the terms of the sale.

- Lease Agreement: While primarily used for rental arrangements, a Lease Agreement outlines the rights and responsibilities of both the landlord and tenant, similar to how a Deed details the rights of property owners.

- Trust Agreement: This document establishes a trust, which can hold property on behalf of beneficiaries. Like a Deed, it defines ownership and the rights associated with the property held in trust.

- Mobile Home Bill of Sale: This document facilitates the transfer of ownership of a mobile home, detailing critical information about the buyer and seller. For more information, visit mobilehomebillofsale.com/blank-florida-mobile-home-bill-of-sale/.

- Quitclaim Deed: A specific type of Deed, a Quitclaim Deed transfers any interest the grantor has in the property without guaranteeing that the title is clear, similar to how a standard Deed conveys ownership.

- Mortgage Agreement: This document secures a loan against a property, detailing the borrower's obligations. It relates to the Deed in that it involves the property as collateral, affecting ownership rights.

- Affidavit of Title: This sworn statement confirms the seller's ownership and the absence of liens. It complements the Deed by assuring the buyer of clear title, similar to the assurances made in a Deed.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. It can be used in conjunction with a Deed to facilitate property transfers.

- Warranty Deed: This type of Deed guarantees that the seller holds clear title to the property and has the right to sell it, similar to a standard Deed but with additional protections for the buyer.

- Deed of Trust: Used in some states instead of a mortgage, this document secures a loan with real estate. It functions similarly to a Deed by outlining the rights of the lender and borrower regarding the property.

Misconceptions

Understanding the Florida Deed form is crucial for anyone involved in property transactions in the state. However, several misconceptions can lead to confusion. Here are six common misunderstandings about the Florida Deed form:

-

All deeds are the same. Many people believe that all deeds serve the same purpose. In reality, different types of deeds exist, such as warranty deeds and quitclaim deeds, each with specific functions and implications for the parties involved.

-

A deed must be notarized to be valid. While notarization adds an extra layer of authenticity, not all deeds require notarization to be legally binding in Florida. However, having a notarized deed can help avoid disputes in the future.

-

Once a deed is signed, it cannot be changed. Some believe that a deed is permanent and unchangeable once executed. In fact, deeds can be amended or revoked under certain circumstances, but this often requires a formal process.

-

Only attorneys can prepare a deed. While hiring an attorney can be beneficial, especially for complex transactions, individuals can prepare their own deeds. However, it is essential to ensure that all legal requirements are met.

-

Deeds are only necessary for selling property. Many think that deeds are only used in sales transactions. However, deeds are also needed for gifts, transfers between family members, and other property transfers.

-

A deed is the same as a title. Some people mistakenly equate a deed with property title. A deed is a document that transfers ownership, while a title represents the legal rights to that property. They are related but not the same.

Being aware of these misconceptions can help you navigate property transactions more confidently. Always consider seeking professional advice if you have any doubts or questions regarding the Florida Deed form.

Form Overview

| Fact Name | Description |

|---|---|

| Type of Deed | In Florida, the most common types of deeds are Warranty Deed, Quit Claim Deed, and Special Warranty Deed. |

| Governing Law | The Florida Deed form is governed by Florida Statutes, Chapter 689, which outlines real property conveyances. |

| Signature Requirement | The deed must be signed by the grantor (seller) to be valid. |

| Witnesses | Florida law requires two witnesses to sign the deed for it to be valid. |

| Notarization | A notary public must acknowledge the grantor's signature on the deed. |

| Recording | To protect the interests of the grantee (buyer), the deed should be recorded in the county where the property is located. |

| Property Description | A legal description of the property must be included in the deed to ensure clarity in the transfer. |

| Transfer Tax | Florida imposes a documentary stamp tax on the transfer of real property, which must be paid when recording the deed. |