Printable Deed in Lieu of Foreclosure Document for Florida

In the state of Florida, homeowners facing the possibility of foreclosure often seek alternatives to protect their financial interests and minimize the impact on their credit. One such alternative is the Deed in Lieu of Foreclosure, a legal instrument that allows a homeowner to voluntarily transfer the ownership of their property back to the lender in exchange for the cancellation of the mortgage debt. This process can provide a quicker resolution than traditional foreclosure proceedings, which can be lengthy and costly for all parties involved. The Deed in Lieu of Foreclosure form outlines the terms of this transfer, including any conditions that must be met by the homeowner, such as vacating the property and ensuring it is in good condition. Additionally, the form addresses potential liabilities, ensuring that the homeowner is released from further obligations related to the mortgage. By understanding the intricacies of this form, homeowners can make informed decisions that may lead to a more favorable outcome during challenging financial times.

More State-specific Deed in Lieu of Foreclosure Forms

Foreclosure Vs Deed in Lieu - The Deed in Lieu offers a way for borrowers to clear mortgage debt without going through a lengthy foreclosure process.

When considering the establishment of a Power of Attorney, it's important to familiarize yourself with the necessary documentation to ensure your rights and preferences are duly represented. The Ohio Power of Attorney form is a legal document that allows one person to grant another individual the authority to make decisions on their behalf. This form can cover various areas, including financial and medical decisions, ensuring that your wishes are respected even when you cannot communicate them. For more detailed information on obtaining this document, you can visit Ohio PDF Forms, which provides resources to guide you through the process effectively.

Foreclosure Vs Deed in Lieu - A Deed in Lieu may not always halt foreclosure actions immediately.

Will I Owe Money After a Deed in Lieu of Foreclosure - It allows for a more private resolution, as opposed to public foreclosure filings.

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option can help both parties by allowing the homeowner to walk away from the mortgage without the long-term consequences of foreclosure on their credit report.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically depends on the lender's policies, but generally, homeowners facing financial difficulties, such as job loss or medical expenses, may qualify. The homeowner must also be unable to keep up with mortgage payments and must have a property that is not encumbered by other liens, such as second mortgages or tax liens.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits. For homeowners, it can provide a quicker resolution to financial distress compared to a lengthy foreclosure process. It can also minimize the impact on credit scores, as it may be reported more favorably than a foreclosure. For lenders, it reduces the costs associated with foreclosure proceedings and allows them to take possession of the property more efficiently.

What are the drawbacks of a Deed in Lieu of Foreclosure?

One significant drawback is that homeowners may still face tax implications, as the forgiven debt might be considered taxable income. Additionally, not all lenders accept Deeds in Lieu, and homeowners might need to provide extensive documentation to prove their financial hardship.

How does the process work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu. After the lender reviews the homeowner's financial situation, they may request documentation. If approved, the homeowner signs the deed, and the lender takes possession of the property. It's essential to ensure that all terms are clearly understood and documented.

Can I still live in my home during the process?

Typically, once the Deed in Lieu is executed, the homeowner must vacate the property. However, some lenders may allow a short period for the homeowner to remain in the home, often referred to as a "cash for keys" agreement. This arrangement can provide a smoother transition for the homeowner.

Will a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it can still negatively impact your credit score. The degree of impact varies based on individual credit histories, but it is generally viewed as a serious derogatory mark. It’s advisable to consult with a financial advisor to understand the potential effects on your credit.

What should I do if I’m considering a Deed in Lieu of Foreclosure?

If you’re contemplating this option, start by gathering your financial documents and contacting your lender. It may also be beneficial to seek advice from a housing counselor or legal professional who specializes in foreclosure alternatives. Understanding your options will empower you to make the best decision for your situation.

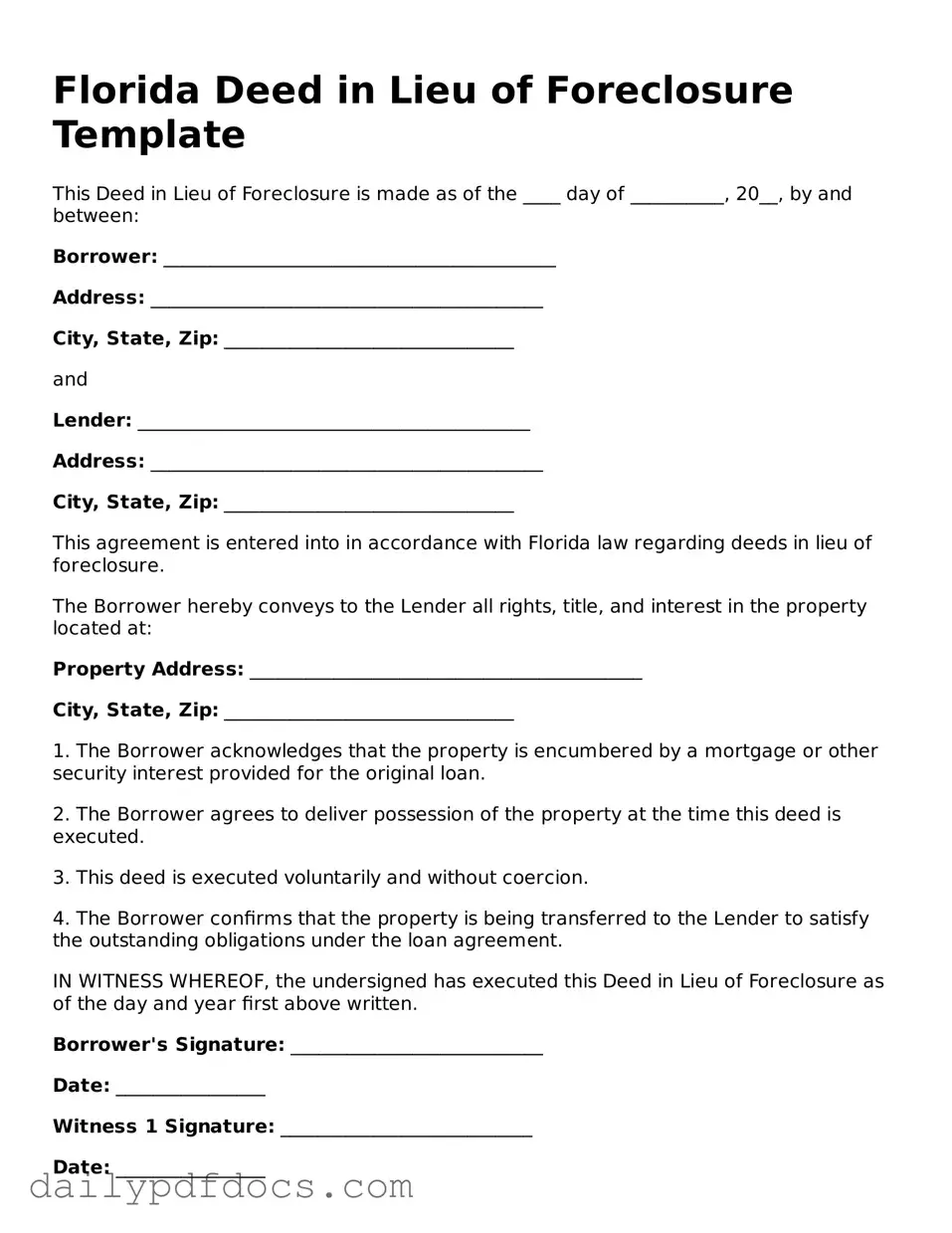

Preview - Florida Deed in Lieu of Foreclosure Form

Florida Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made as of the ____ day of __________, 20__, by and between:

Borrower: __________________________________________

Address: __________________________________________

City, State, Zip: _______________________________

and

Lender: __________________________________________

Address: __________________________________________

City, State, Zip: _______________________________

This agreement is entered into in accordance with Florida law regarding deeds in lieu of foreclosure.

The Borrower hereby conveys to the Lender all rights, title, and interest in the property located at:

Property Address: __________________________________________

City, State, Zip: _______________________________

1. The Borrower acknowledges that the property is encumbered by a mortgage or other security interest provided for the original loan.

2. The Borrower agrees to deliver possession of the property at the time this deed is executed.

3. This deed is executed voluntarily and without coercion.

4. The Borrower confirms that the property is being transferred to the Lender to satisfy the outstanding obligations under the loan agreement.

IN WITNESS WHEREOF, the undersigned has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Borrower's Signature: ___________________________

Date: ________________

Witness 1 Signature: ___________________________

Date: ________________

Witness 2 Signature: ___________________________

Date: ________________

State of Florida

County of ___________________

On this ____ day of __________, 20__, before me, the undersigned notary public, personally appeared ________________________, known to me or satisfactorily proven to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________

My Commission Expires: ________________

Similar forms

The Deed in Lieu of Foreclosure form is a legal document that allows a borrower to transfer ownership of their property to the lender in order to avoid foreclosure. This document shares similarities with several other legal instruments. Below are six documents that are comparable to the Deed in Lieu of Foreclosure, along with an explanation of how they are similar:

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the outstanding mortgage balance, with the lender's approval. Like a Deed in Lieu of Foreclosure, it aims to avoid foreclosure and mitigate financial loss for both parties.

- Loan Modification Agreement: In this document, the terms of an existing loan are changed, often to make payments more manageable for the borrower. Similar to a Deed in Lieu of Foreclosure, it seeks to provide a solution that allows the borrower to retain ownership of the property while addressing financial difficulties.

- Forbearance Agreement: This agreement temporarily pauses or reduces mortgage payments for a specified period. It is similar to a Deed in Lieu of Foreclosure in that both options are designed to help borrowers avoid foreclosure and maintain their homes during financial hardship.

- Quitclaim Deed: This document transfers any interest the owner has in the property to another party without guaranteeing that the title is clear. It shares similarities with the Deed in Lieu of Foreclosure as both involve the transfer of property ownership, although a quitclaim deed does not necessarily involve a lender.

- Bankruptcy Filing: Filing for bankruptcy can provide relief from debts, including mortgage obligations. Both bankruptcy and a Deed in Lieu of Foreclosure can serve as mechanisms to prevent foreclosure, offering different paths to financial recovery.

- Mobile Home Bill of Sale: This legal document effectively transfers ownership of a mobile home between parties. It shares similarities with the Deed in Lieu of Foreclosure by ensuring clarity in ownership transfer and is vital for protecting the rights of both buyers and sellers. For more details, visit mobilehomebillofsale.com/blank-connecticut-mobile-home-bill-of-sale/.

- Property Settlement Agreement: Often used in divorce proceedings, this agreement outlines the division of property between parties. It is similar to a Deed in Lieu of Foreclosure in that it involves the transfer of property rights, although it typically occurs under different circumstances.

Misconceptions

Understanding the Florida Deed in Lieu of Foreclosure can be tricky. Many people hold misconceptions about this process, which can lead to confusion and poor decision-making. Here are nine common misconceptions explained.

- It automatically cancels the mortgage debt. While a deed in lieu can relieve you of the property, it doesn't always eliminate the entire debt. In some cases, lenders may still pursue you for any remaining balance.

- It's a quick fix to avoid foreclosure. Although it might seem like a fast solution, the process can still take time. Lenders need to review your situation and approve the deed in lieu, which can delay the resolution.

- All lenders accept deeds in lieu. Not every lender offers this option. Some may prefer to go through the foreclosure process instead. Always check with your lender to see if they accept deeds in lieu.

- It won't affect your credit score. A deed in lieu of foreclosure can still impact your credit score negatively. It may not be as severe as a foreclosure, but it can still leave a mark.

- You can do it without legal help. While it’s possible to navigate the process on your own, having legal assistance can help you understand the implications and protect your interests.

- It releases you from all liabilities. A deed in lieu may not release you from all liabilities associated with the property. For example, if there are liens or other debts tied to the property, you may still be responsible for those.

- It is the same as a short sale. A deed in lieu is different from a short sale. In a short sale, the property is sold for less than the mortgage balance with lender approval, while a deed in lieu transfers ownership back to the lender without a sale.

- It’s only for homeowners in financial distress. While it is commonly used by those facing financial difficulties, homeowners who simply want to avoid the lengthy foreclosure process can also consider this option.

- Once you sign, you can’t change your mind. While it’s true that signing a deed in lieu is a significant commitment, there may be some circumstances where you can negotiate or reverse the decision if you act quickly.

Being informed about these misconceptions can empower homeowners to make better decisions regarding their properties and financial futures. Always consider seeking professional advice tailored to your specific situation.

Form Overview

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | The deed in lieu of foreclosure in Florida is governed by Florida Statutes, specifically Chapter 701. |

| Eligibility | Borrowers must be in default on their mortgage payments to qualify for a deed in lieu of foreclosure. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process and may allow them to leave the property without further legal complications. |

| Impact on Credit | A deed in lieu of foreclosure can negatively affect a borrower's credit score, but it may be less damaging than a full foreclosure. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any remaining mortgage debt after the deed is transferred. |

| Process | The process typically involves the borrower submitting a request to the lender, followed by negotiations and the signing of the deed. |