Free Employee Loan Agreement Template

When employees need financial assistance, an Employee Loan Agreement can serve as a practical solution for both the employee and the employer. This form outlines the terms and conditions under which the employer provides a loan to the employee, ensuring clarity and mutual understanding. Key components typically include the loan amount, repayment schedule, interest rates, and any applicable fees. Additionally, it details the consequences of defaulting on the loan, which helps to protect the employer's interests. By establishing clear expectations, this agreement fosters trust and transparency in the workplace. It also serves as a valuable tool for employers to support their employees during challenging times, ultimately contributing to a positive work environment.

Common Questions

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document outlining the terms and conditions under which an employer provides a loan to an employee. This agreement helps protect both parties by clearly stating the loan amount, repayment terms, interest rates, and any consequences of defaulting on the loan.

Who can apply for an Employee Loan?

Typically, all employees who meet certain criteria set by the employer can apply for an Employee Loan. These criteria may include length of employment, job performance, and financial need. It’s important to check with your HR department for specific eligibility requirements.

What information is included in the Employee Loan Agreement?

The agreement generally includes the loan amount, interest rate, repayment schedule, and any fees associated with the loan. It may also outline the consequences of late payments and what happens in case of termination of employment.

Is interest charged on the loan?

Interest may or may not be charged, depending on the company’s policy. Some employers offer interest-free loans, while others may charge a nominal interest rate. Always review the agreement carefully to understand the financial implications.

How is the repayment of the loan structured?

Repayment can be structured in various ways. Common methods include payroll deductions, where a portion of your salary is withheld each pay period, or monthly payments. The specific repayment structure will be detailed in the agreement.

What happens if I cannot repay the loan?

If you cannot repay the loan, it is crucial to communicate with your employer as soon as possible. The agreement will outline the consequences, which may include additional fees, salary deductions, or legal action. Open communication can often lead to alternative arrangements.

Can the loan be forgiven?

Loan forgiveness is not common, but some employers may offer it under specific circumstances, such as long-term employment or financial hardship. Check your agreement or consult HR for any forgiveness policies that may apply.

Will taking a loan affect my credit score?

Generally, an Employee Loan does not directly impact your credit score since it is not reported to credit bureaus. However, failure to repay the loan could lead to negative consequences, including potential legal action, which may affect your credit indirectly.

How do I apply for an Employee Loan?

To apply for an Employee Loan, you typically need to fill out an application form provided by your employer. This form may require details about your financial situation and the purpose of the loan. Once submitted, your employer will review your application and inform you of the decision.

Can I take out more than one loan?

Taking out multiple loans may be possible, but it often depends on your employer's policies. Some companies may have limits on the total amount an employee can borrow at any given time. Always consult with HR for guidance on this matter.

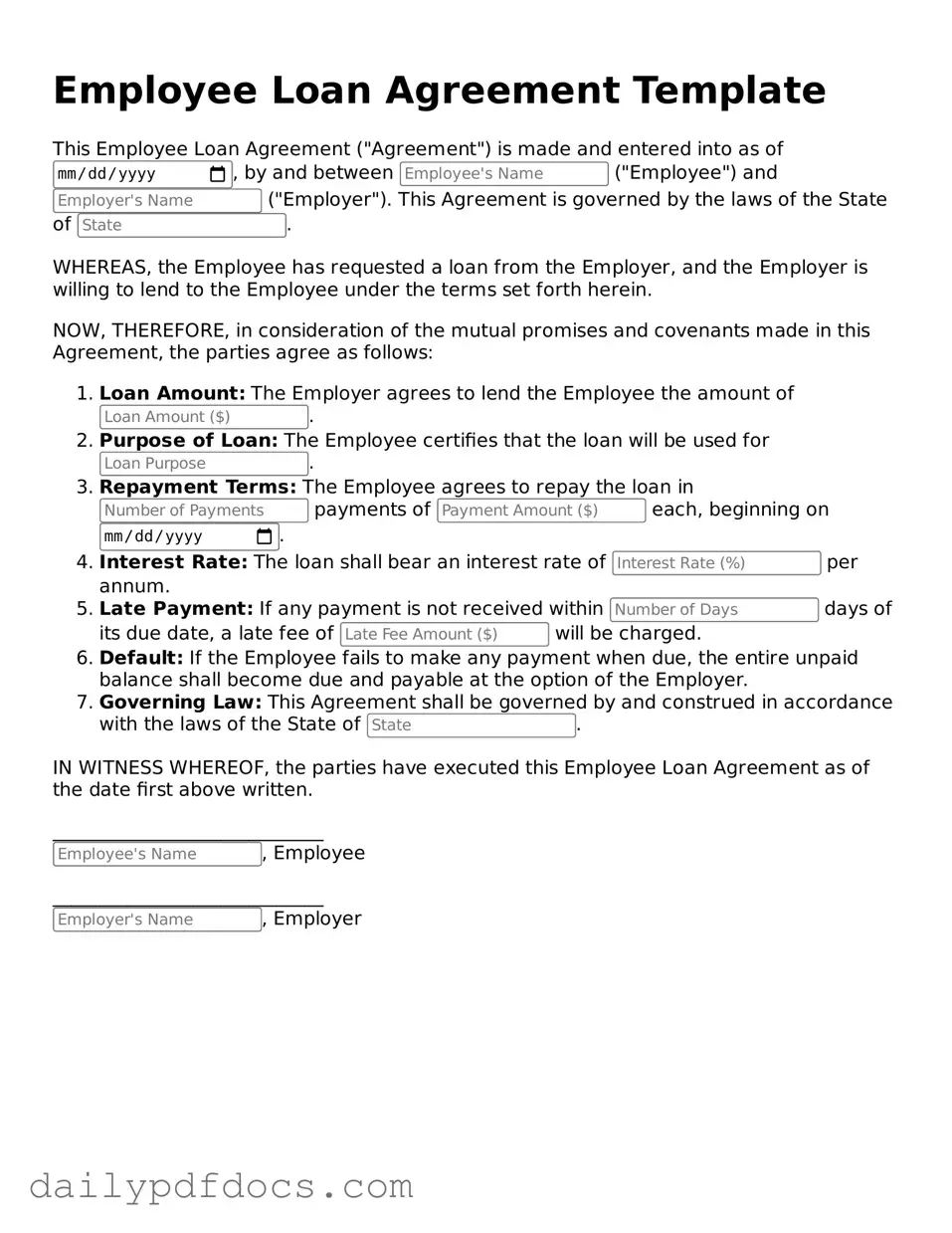

Preview - Employee Loan Agreement Form

Employee Loan Agreement Template

This Employee Loan Agreement ("Agreement") is made and entered into as of , by and between ("Employee") and ("Employer"). This Agreement is governed by the laws of the State of .

WHEREAS, the Employee has requested a loan from the Employer, and the Employer is willing to lend to the Employee under the terms set forth herein.

NOW, THEREFORE, in consideration of the mutual promises and covenants made in this Agreement, the parties agree as follows:

- Loan Amount: The Employer agrees to lend the Employee the amount of .

- Purpose of Loan: The Employee certifies that the loan will be used for .

- Repayment Terms: The Employee agrees to repay the loan in payments of each, beginning on .

- Interest Rate: The loan shall bear an interest rate of per annum.

- Late Payment: If any payment is not received within days of its due date, a late fee of will be charged.

- Default: If the Employee fails to make any payment when due, the entire unpaid balance shall become due and payable at the option of the Employer.

- Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of .

IN WITNESS WHEREOF, the parties have executed this Employee Loan Agreement as of the date first above written.

_____________________________

, Employee

_____________________________

, Employer

Similar forms

- Promissory Note: This document outlines a borrower's promise to repay a loan. Like the Employee Loan Agreement, it specifies the amount borrowed, interest rate, and repayment schedule.

- Loan Agreement: Similar to the Employee Loan Agreement, this document details the terms of a loan between a lender and a borrower, including repayment terms and any collateral involved.

- Employment Contract: While primarily focused on the terms of employment, this contract may include provisions related to loans or advances, similar to the Employee Loan Agreement's focus on loan terms.

- Credit Agreement: This document governs the terms of a credit arrangement. It shares similarities with the Employee Loan Agreement in outlining the obligations of both the lender and the borrower.

-

Loan Agreement Form: A Loan Agreement form is essential as it lays down the terms under which the loan is provided, ensuring that both borrower and lender are clear on the obligations. For templates, visit smarttemplates.net.

- Mortgage Agreement: This document secures a loan with real property. It is similar to the Employee Loan Agreement in that it specifies the terms of repayment and the consequences of default.

- Secured Loan Agreement: This agreement involves a loan backed by collateral. Like the Employee Loan Agreement, it includes details about the loan amount, interest, and repayment terms.

Misconceptions

Understanding the Employee Loan Agreement form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are nine common misconceptions explained:

- It is a mandatory document. Many believe that an Employee Loan Agreement is required by law. In reality, it is a voluntary agreement between the employer and employee.

- All loans must be documented. Some think that every loan to an employee must be formalized in writing. While it is advisable, informal loans can occur without a written agreement.

- The agreement is only for large loans. Many assume that the Employee Loan Agreement is only necessary for substantial amounts. However, even small loans can benefit from a clear agreement.

- Once signed, the terms cannot change. Some believe that the terms of the agreement are set in stone. In fact, both parties can negotiate changes if both agree.

- Only HR can initiate the agreement. There is a misconception that only human resources can create an Employee Loan Agreement. In truth, any manager or supervisor can initiate the process.

- It guarantees loan approval. Many think that signing the agreement guarantees the loan will be approved. Approval is subject to the employer’s policies and discretion.

- Interest rates are always included. Some believe that all Employee Loan Agreements must specify interest rates. This is not true; employers can choose whether to charge interest.

- Loans can be repaid at any time. It is often thought that employees can repay the loan whenever they want. Repayment terms should be clearly defined in the agreement.

- The agreement protects only the employer. Many think that the Employee Loan Agreement is designed solely to protect the employer’s interests. In fact, it also safeguards the employee by outlining clear terms.

Clarifying these misconceptions can lead to better understanding and smoother transactions between employers and employees regarding loans.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement helps clarify the loan amount, repayment terms, and any interest rates involved. |

| Governing Law | The agreement is typically governed by state laws, which can vary. For example, in California, the California Civil Code applies. |

| Repayment Terms | Repayment terms should include the schedule, method, and any penalties for late payments. |

| Tax Implications | Loans may have tax implications for both the employer and the employee, particularly if the loan is forgiven. |

| Confidentiality | Confidentiality clauses may be included to protect the privacy of the employee's financial information. |