Fill Your Employee Advance Form

The Employee Advance form serves as a crucial tool for employees seeking financial assistance from their employers. This form typically outlines the request for an advance on salary or wages, enabling employees to address urgent financial needs without delay. It requires the employee to provide essential information, including their name, department, and the amount requested. Additionally, the form often asks for a brief explanation of the reason for the advance, ensuring that employers can assess the legitimacy of the request. Approval processes may vary by organization, but generally, the form must be signed by both the employee and a supervisor or manager. Timely submission of this form can significantly impact an employee's financial stability, making it vital for individuals to understand the requirements and procedures involved. By navigating the Employee Advance form effectively, employees can secure necessary funds while maintaining a positive relationship with their employer.

Find Other Documents

Dd 214 - Veterans may need to show this form for employment applications as proof of service.

In California, understanding the nuances of a California Lease Agreement form is essential for both landlords and tenants, as it lays out the specific terms of rental arrangements, including rent amount, lease duration, and the responsibilities of each party. For more comprehensive information and resources regarding lease agreements, you can visit legalformspdf.com/.

California Sdi - It allows individuals to formally request the disability insurance benefits to which they are entitled.

Common Questions

What is the Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This form is typically used for situations where an employee faces unexpected expenses and needs financial assistance before their regular payday. By submitting this form, employees can formally request a portion of their earned income ahead of time.

Who is eligible to request an advance?

Generally, all employees who have been with the company for a certain period may be eligible to request an advance. However, specific eligibility criteria can vary by organization. It is important to check your company’s policy regarding advances, as there may be restrictions based on employment status, length of service, or financial need.

How do I fill out the Employee Advance form?

Filling out the Employee Advance form is straightforward. Start by providing your personal information, including your name, employee ID, and department. Next, indicate the amount you wish to request and provide a brief explanation of why you need the advance. Be sure to review the form for completeness and accuracy before submitting it to your supervisor or HR department.

What happens after I submit the form?

Once you submit the Employee Advance form, it will typically be reviewed by your supervisor or the HR department. They will assess your request based on company policies and your current financial situation. You should receive a response within a specified timeframe, which may vary depending on the organization’s procedures.

Will the advance be deducted from my future paychecks?

Yes, in most cases, the amount of the advance will be deducted from your future paychecks. The specific repayment terms, including the amount and duration of the deductions, should be outlined in the policy or discussed with your HR representative. Understanding these terms before accepting an advance is crucial to avoid any surprises in your future paychecks.

Can I request an advance more than once?

While it is possible to request multiple advances, doing so may depend on your company's policies. Some organizations may limit the number of advances an employee can request within a certain period. It is advisable to check with your HR department for guidance on how often you can apply for an advance and any potential implications of doing so.

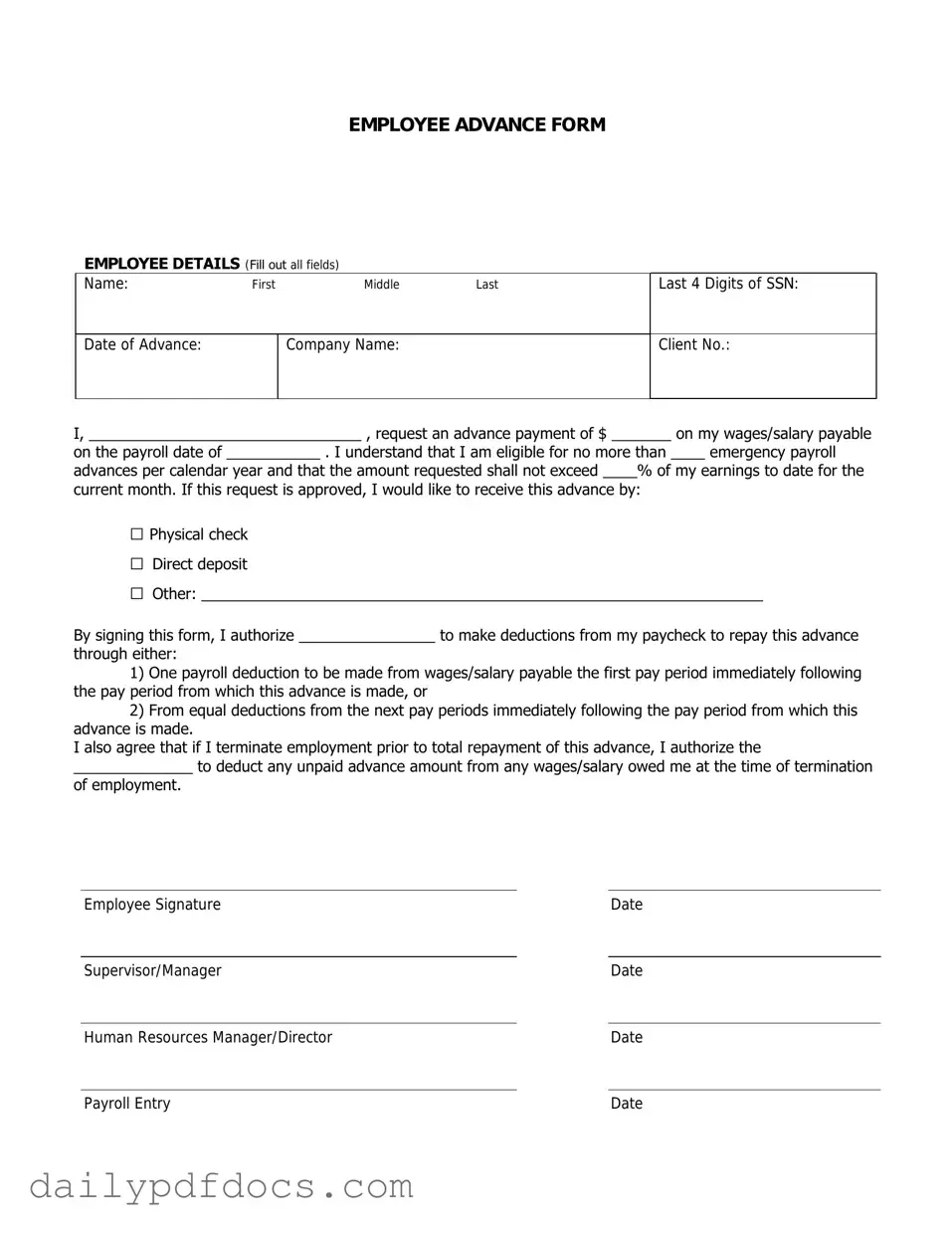

Preview - Employee Advance Form

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Similar forms

- Expense Reimbursement Form: Both documents allow employees to request funds for work-related expenses. They require documentation of expenses incurred and often demand approval from a supervisor.

- Travel Authorization Form: This form is similar in that it seeks pre-approval for travel expenses. Employees must outline the purpose of travel and expected costs, similar to how an advance is requested.

- Residential Lease Agreement: Important for renting residential properties, the Ohio PDF Forms provide the necessary framework to ensure clear communication of rights and responsibilities between landlords and tenants.

- Payroll Advance Request: Like the Employee Advance form, this document requests an advance on wages. Employees must explain their need for the advance and provide necessary details for approval.

- Loan Application Form: Both documents involve a request for funds. The loan application requires justification for the funds, much like the rationale needed in an Employee Advance request.

- Petty Cash Request Form: This form is used to request small amounts of cash for minor expenses. It shares similarities in that it seeks funds in advance and requires an explanation of the intended use.

- Grant Application Form: Employees may use this document to request funding for specific projects. It requires detailed justification and a budget, paralleling the need for clarity in an advance request.

- Scholarship Application Form: This document is used to request financial support for educational purposes. It requires applicants to justify their need for funds, similar to how employees justify their advance requests.

- Procurement Request Form: This form is utilized to request the purchase of goods or services. It requires a clear explanation of the need for the funds, akin to the rationale provided in an advance request.

- Reimbursement Request for Training Expenses: Employees submit this document to seek reimbursement for training costs. It requires proof of payment and justification, similar to the Employee Advance form.

- Project Funding Request Form: This form is used to seek financial support for specific projects. Employees must provide a detailed budget and justification, much like the requirements of an advance request.

Misconceptions

Misconceptions about the Employee Advance form can lead to confusion and improper use. Here are eight common misunderstandings:

- Only high-ranking employees can request advances. This is false. All employees, regardless of their position, may be eligible for an advance, provided they meet the necessary criteria.

- Employee advances are considered loans. This is misleading. Advances are typically not loans; they are pre-payments for expenses that employees will incur on behalf of the company.

- There is no limit to how much can be requested. In reality, most companies have set limits on the amount that can be requested to ensure proper financial management.

- Submitting the form guarantees approval. This is incorrect. Approval depends on various factors, including company policy and the nature of the request.

- Advances must be repaid immediately. This is not always the case. Repayment terms can vary, and some companies allow for deductions from future paychecks.

- Only travel-related expenses can be advanced. This is a misconception. Advances can be requested for a variety of business-related expenses, not just travel.

- The form is only required for large expenses. This is untrue. Even small expenses may require an advance, depending on company policy.

- Once the form is submitted, no further communication is needed. This is misleading. Employees should follow up to ensure their request is processed and to clarify any questions that may arise.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on salary or wages, helping employees manage unexpected expenses. |

| Eligibility | Typically, only full-time employees who have completed a probationary period can request an advance. |

| Repayment Terms | Repayment is usually deducted from future paychecks, with specific terms outlined in the form. |

| Governing Laws | In some states, such as California and New York, specific labor laws govern the use of employee advances. |