Free Durable Power of Attorney Template

The Durable Power of Attorney form serves as a vital legal document that allows individuals to designate someone they trust to make decisions on their behalf, especially in situations where they may become incapacitated. This form is particularly important because it remains effective even if the individual becomes unable to manage their own affairs due to illness or injury. By granting authority through this document, the principal can ensure that their financial, medical, and legal matters are handled according to their wishes. The appointed agent, often referred to as an attorney-in-fact, can manage a variety of tasks, from paying bills and managing investments to making healthcare decisions. It is essential for individuals to consider the scope of authority they wish to grant, as the Durable Power of Attorney can be tailored to specific needs, whether broad or limited. Additionally, understanding the implications of revocation and the importance of selecting a trustworthy agent cannot be overstated, as these choices significantly impact the principal's future well-being and peace of mind.

Popular Durable Power of Attorney Templates:

Sample Power of Attorney for Property - Use this document to ensure your real estate interests are properly represented.

A Washington Non-disclosure Agreement (NDA) is a legal document designed to protect sensitive information shared between parties. This agreement ensures that confidential details remain private and are not disclosed to unauthorized individuals. For a reliable source to obtain this essential document, you can refer to Washington Templates. To safeguard your interests, consider filling out the NDA form by clicking the button below.

Durable Power of Attorney - Tailored for Individual States

Common Questions

What is a Durable Power of Attorney (DPOA)?

A Durable Power of Attorney is a legal document that allows one person to give another person the authority to make decisions on their behalf. This authority remains effective even if the person who created the DPOA becomes incapacitated. It is a crucial tool for ensuring that your financial and healthcare decisions are managed according to your wishes when you cannot do so yourself.

Who should consider creating a Durable Power of Attorney?

Anyone over the age of 18 should consider creating a DPOA. This is especially important for individuals with health concerns, those approaching retirement, or anyone who wants to ensure their affairs are handled by a trusted person in case of unexpected events. It provides peace of mind knowing that someone you trust will manage your affairs if you cannot.

What types of decisions can a Durable Power of Attorney cover?

A DPOA can cover a wide range of decisions. These may include managing bank accounts, paying bills, handling real estate transactions, and making healthcare decisions. You can specify which powers you want to grant, allowing for flexibility based on your individual needs.

Can I limit the powers granted in a Durable Power of Attorney?

Yes, you can limit the powers granted in a DPOA. You have the option to specify certain tasks or decisions that your agent can or cannot make. This customization ensures that your agent acts in accordance with your wishes and within the boundaries you set.

How do I choose an agent for my Durable Power of Attorney?

Choosing an agent is a significant decision. Select someone you trust, who understands your values, and who is willing to take on the responsibility. This person should be reliable, organized, and capable of making decisions on your behalf. It’s also wise to discuss your wishes with them beforehand.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time as long as you are mentally competent. To do so, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original DPOA. This ensures that your wishes are clear and that the previous document is no longer valid.

Is a Durable Power of Attorney valid in all states?

While a DPOA is recognized in most states, the specific laws and requirements can vary. It is important to check the regulations in your state to ensure that your DPOA meets all legal requirements. Consulting with a legal professional can help you navigate these differences and ensure your document is valid.

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, your family may have to go through a lengthy court process to gain the authority to make decisions on your behalf. This can lead to disputes and added stress during an already difficult time. Having a DPOA in place can prevent this situation and provide clarity and support for your loved ones.

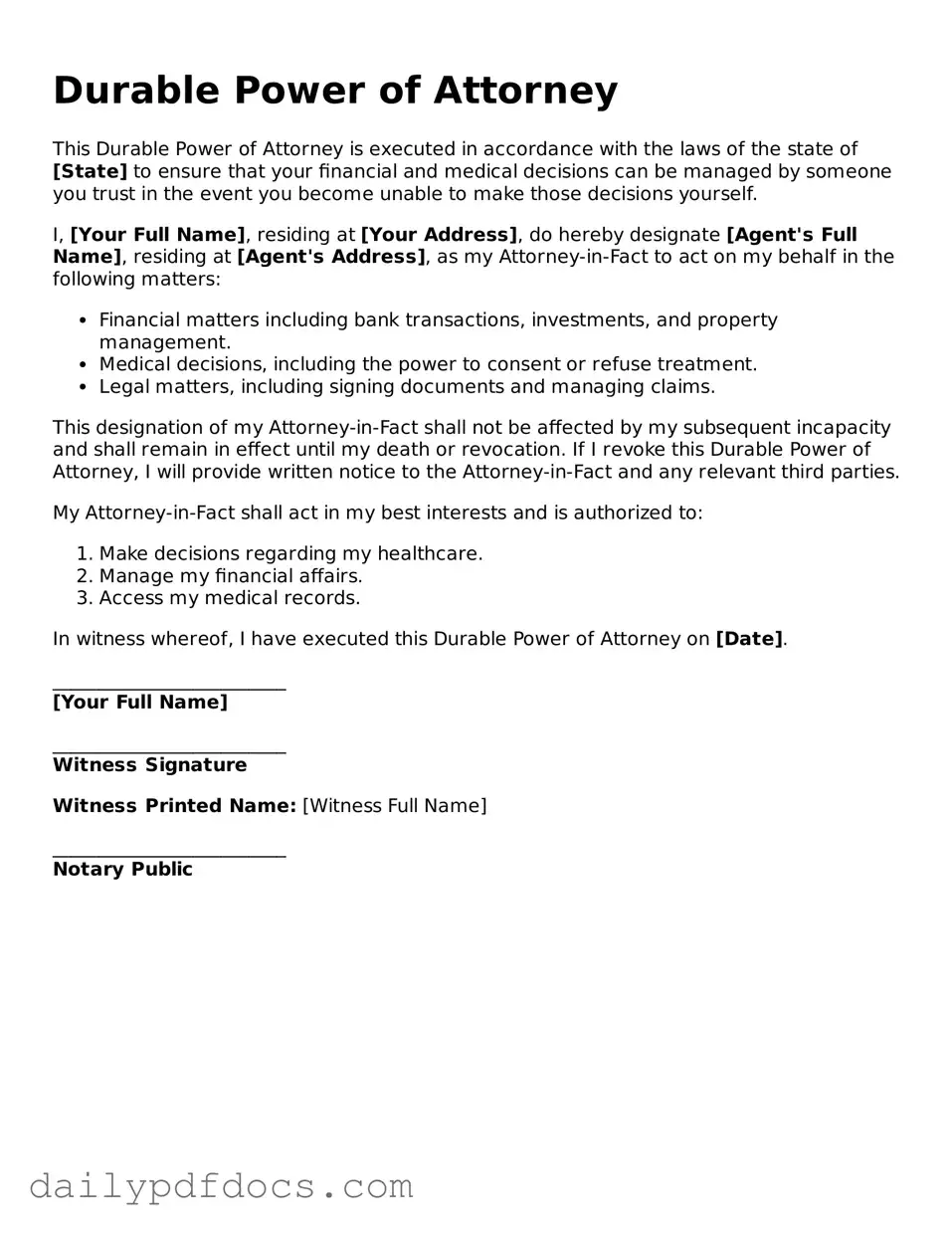

Preview - Durable Power of Attorney Form

Durable Power of Attorney

This Durable Power of Attorney is executed in accordance with the laws of the state of [State] to ensure that your financial and medical decisions can be managed by someone you trust in the event you become unable to make those decisions yourself.

I, [Your Full Name], residing at [Your Address], do hereby designate [Agent's Full Name], residing at [Agent's Address], as my Attorney-in-Fact to act on my behalf in the following matters:

- Financial matters including bank transactions, investments, and property management.

- Medical decisions, including the power to consent or refuse treatment.

- Legal matters, including signing documents and managing claims.

This designation of my Attorney-in-Fact shall not be affected by my subsequent incapacity and shall remain in effect until my death or revocation. If I revoke this Durable Power of Attorney, I will provide written notice to the Attorney-in-Fact and any relevant third parties.

My Attorney-in-Fact shall act in my best interests and is authorized to:

- Make decisions regarding my healthcare.

- Manage my financial affairs.

- Access my medical records.

In witness whereof, I have executed this Durable Power of Attorney on [Date].

_________________________

[Your Full Name]

_________________________

Witness Signature

Witness Printed Name: [Witness Full Name]

_________________________

Notary Public

Similar forms

The Durable Power of Attorney (DPOA) is an important legal document that allows one person to act on behalf of another in financial or legal matters. Several other documents share similarities with the DPOA, each serving distinct but related purposes. Here are seven documents that are similar to the Durable Power of Attorney:

- General Power of Attorney: This document grants broad authority to an agent to handle a person's financial and legal affairs. Unlike the DPOA, it may become invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This document allows an individual to appoint someone to make medical decisions on their behalf if they are unable to do so. Like the DPOA, it is effective during periods of incapacity.

- Living Will: A living will outlines a person's wishes regarding medical treatment in situations where they cannot communicate their preferences. While it does not appoint an agent, it works alongside a Healthcare Power of Attorney.

- Revocable Trust: This legal arrangement allows a person to place assets into a trust during their lifetime, with the ability to alter it as needed. It can help manage assets if the person becomes incapacitated, similar to a DPOA.

- Financial Power of Attorney: This document specifically grants authority to an agent to manage financial matters. It can be durable or non-durable, depending on whether it remains effective during incapacity.

- Advance Healthcare Directive: This combines a living will and a healthcare power of attorney, allowing individuals to express their medical treatment preferences and designate an agent for healthcare decisions.

- Guardianship Documents: In cases where a person is unable to manage their own affairs, guardianship documents appoint someone to make decisions on their behalf. This is often a more formal process than a DPOA.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is crucial for making informed decisions about your financial and healthcare matters. However, several misconceptions can lead to confusion. Here are ten common misconceptions about the DPOA form:

- A Durable Power of Attorney is only for the elderly. Many people believe that only seniors need a DPOA, but anyone can benefit from this document, especially those with significant assets or health concerns.

- Once I sign a DPOA, I lose control over my decisions. This is not true. You retain control and can revoke the DPOA at any time, as long as you are mentally competent.

- A DPOA can only be used for financial matters. While it is often used for financial decisions, a DPOA can also grant authority over healthcare decisions.

- I can only appoint a family member as my agent. You can choose anyone you trust to act as your agent, including friends or professionals, regardless of their relationship to you.

- A DPOA is the same as a will. These are distinct documents. A DPOA is effective during your lifetime, while a will only takes effect after your death.

- All DPOAs are the same. DPOAs can vary significantly in terms of the powers granted. It’s essential to customize the document to meet your specific needs.

- My DPOA will automatically become invalid if I become incapacitated. On the contrary, a Durable Power of Attorney remains effective even if you become incapacitated, which is its primary purpose.

- I don’t need a DPOA if I have joint accounts. Joint accounts can simplify some matters, but they do not cover all situations. A DPOA provides broader authority for decision-making.

- Once I create a DPOA, I don’t need to think about it again. It’s important to review and update your DPOA periodically, especially after major life changes such as marriage, divorce, or relocation.

- A DPOA can only be used in the state where it was created. While laws vary by state, a properly executed DPOA may be recognized in other states, but it’s wise to check local laws.

By understanding these misconceptions, individuals can better navigate the complexities of creating and using a Durable Power of Attorney. Making informed choices is essential for ensuring that your wishes are respected and your affairs are managed according to your preferences.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to designate someone to make decisions on their behalf, even if they become incapacitated. |

| Durability | The term "durable" means that the authority granted remains in effect even if the principal is no longer able to make decisions due to mental or physical incapacity. |

| State-Specific Forms | Each state has its own specific Durable Power of Attorney form. For example, in California, the governing law is found in the California Probate Code, Sections 4000-4545. |

| Agent's Authority | The agent can be granted broad or limited powers, including financial decisions, healthcare choices, and property management. |

| Revocation | The principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Legal Requirements | Most states require the DPOA to be signed by the principal and witnessed or notarized to be legally valid. |