Free Deed in Lieu of Foreclosure Template

In the landscape of real estate transactions, the Deed in Lieu of Foreclosure form serves as a crucial instrument for homeowners facing financial distress. This legal document allows a property owner to voluntarily transfer ownership of their property to the lender, effectively avoiding the lengthy and often painful process of foreclosure. By executing this form, the homeowner can mitigate the damage to their credit score and potentially eliminate the burden of a mortgage that has become unmanageable. The process typically involves negotiations with the lender, who must agree to accept the deed in exchange for releasing the borrower from the mortgage obligation. Key aspects of the form include the identification of the parties involved, a clear description of the property, and the stipulations regarding any remaining debts or obligations. Additionally, the form may address the condition of the property and any potential liabilities that the lender may assume upon taking ownership. Understanding the implications of this form is essential for homeowners seeking to navigate their financial challenges while minimizing the negative consequences associated with foreclosure.

Popular Deed in Lieu of Foreclosure Templates:

Correction Deed California - A Corrective Deed supports effective communication between involved parties.

For those looking to complete the transfer of a trailer, the Ohio Trailer Bill of Sale form is crucial, as it not only documents the sale but also offers protection against future disputes. It is recommended to use reliable resources, such as Ohio PDF Forms, to ensure the form is filled out correctly and meets all legal requirements.

Deed in Lieu of Foreclosure - Tailored for Individual States

Common Questions

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the title of their property to the lender to avoid foreclosure. This option is often considered when the homeowner is unable to make mortgage payments and wants to prevent the lengthy and costly foreclosure process. By doing this, the homeowner may be able to settle their debt and protect their credit score to some extent.

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility for a Deed in Lieu of Foreclosure typically depends on the lender's policies. Generally, homeowners facing financial hardship, such as job loss or medical expenses, may qualify. However, the property must be the homeowner's primary residence, and there should be no other liens on the property. It is advisable to consult with the lender to understand specific eligibility requirements.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several benefits to a Deed in Lieu of Foreclosure. First, it can help homeowners avoid the negative impact of foreclosure on their credit score. Second, the process is usually quicker and less costly than foreclosure. Third, homeowners may be able to negotiate with the lender for potential debt forgiveness. Lastly, it allows homeowners to move on from the property without the burden of a foreclosure on their record.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential drawbacks to consider. Homeowners may still face a negative impact on their credit score, although it may be less severe than a foreclosure. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and homeowners may have to provide proof of financial hardship. Furthermore, the lender may require the homeowner to vacate the property quickly, which can be stressful.

How does the process work?

The process begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will typically review the homeowner's financial situation and the property’s condition. If approved, both parties will sign the necessary documents to transfer the property title. After the transfer, the homeowner may need to vacate the property, and the lender may release the homeowner from the mortgage obligation. It is important to keep communication open throughout this process.

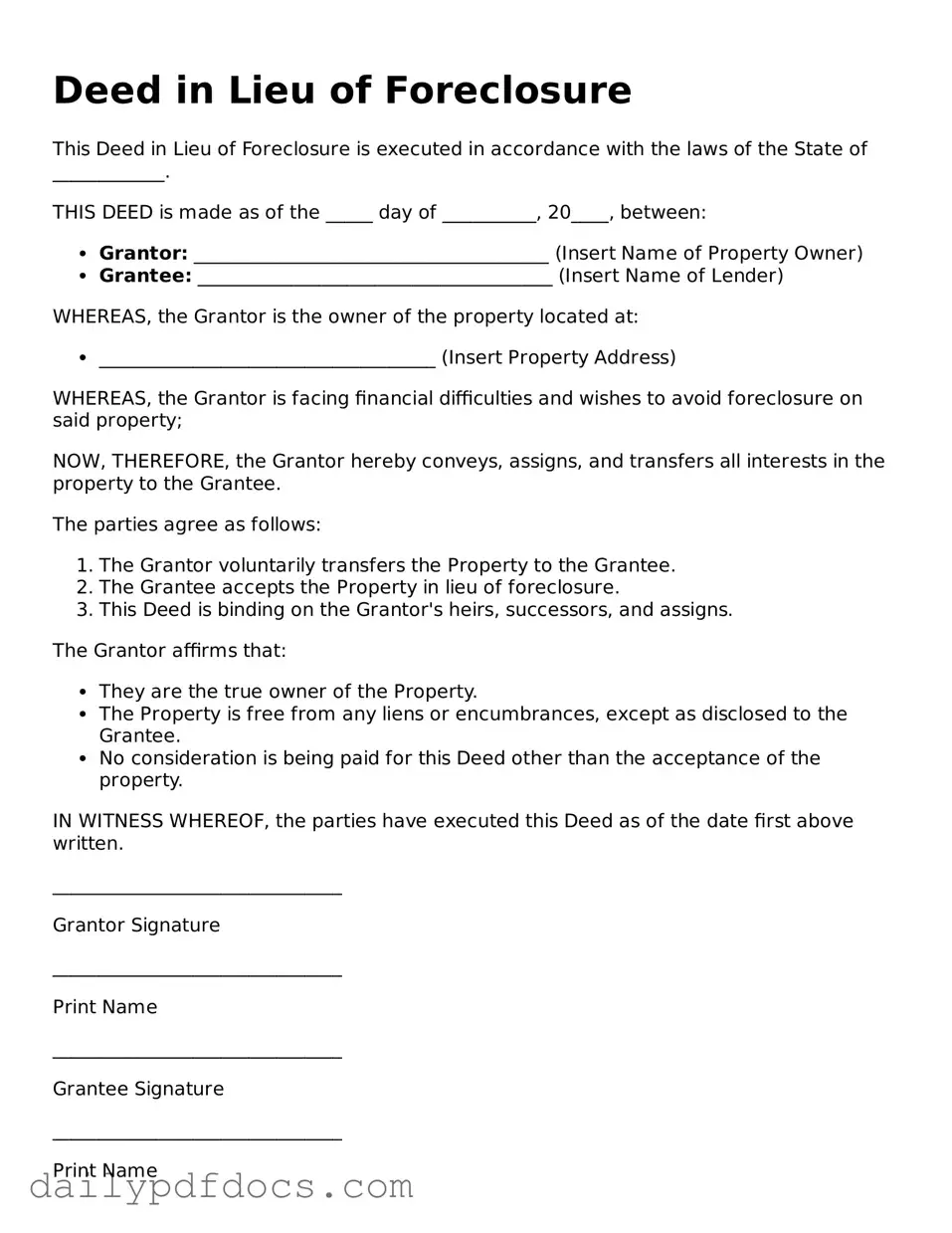

Preview - Deed in Lieu of Foreclosure Form

Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of ____________.

THIS DEED is made as of the _____ day of __________, 20____, between:

- Grantor: ______________________________________ (Insert Name of Property Owner)

- Grantee: ______________________________________ (Insert Name of Lender)

WHEREAS, the Grantor is the owner of the property located at:

- ____________________________________ (Insert Property Address)

WHEREAS, the Grantor is facing financial difficulties and wishes to avoid foreclosure on said property;

NOW, THEREFORE, the Grantor hereby conveys, assigns, and transfers all interests in the property to the Grantee.

The parties agree as follows:

- The Grantor voluntarily transfers the Property to the Grantee.

- The Grantee accepts the Property in lieu of foreclosure.

- This Deed is binding on the Grantor's heirs, successors, and assigns.

The Grantor affirms that:

- They are the true owner of the Property.

- The Property is free from any liens or encumbrances, except as disclosed to the Grantee.

- No consideration is being paid for this Deed other than the acceptance of the property.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

_______________________________

Grantor Signature

_______________________________

Print Name

_______________________________

Grantee Signature

_______________________________

Print Name

STATE OF ____________

COUNTY OF _______________

On this _____ day of ___________, 20____, before me, a Notary Public, personally appeared _____________ (Grantor's Name) and _____________ (Grantee's Name) to me known to be the persons described in and who executed this Deed and acknowledged that they executed the same freely and voluntarily for the purposes herein expressed.

_______________________________

Notary Public

My Commission Expires: ____________

Similar forms

- Mortgage Release: This document formally releases the borrower from the mortgage obligation, similar to a deed in lieu of foreclosure, which transfers property ownership to the lender to avoid foreclosure.

- Short Sale Agreement: In a short sale, the lender agrees to accept less than the full amount owed on the mortgage. Like a deed in lieu, it allows the borrower to avoid foreclosure and settle their debt.

- Loan Modification Agreement: This document changes the terms of the existing loan to make payments more manageable. It serves as an alternative to foreclosure, similar to a deed in lieu, by helping borrowers keep their homes.

- Forbearance Agreement: This agreement allows borrowers to temporarily reduce or pause their mortgage payments. It aims to prevent foreclosure, akin to a deed in lieu, by providing relief to struggling homeowners.

- Quitclaim Deed: This document transfers interest in property without guaranteeing the title. It is similar to a deed in lieu in that it conveys ownership but does not involve the lender’s acceptance of the property in lieu of foreclosure.

- Lease Agreement: This crucial document outlines the terms and conditions of renting property, ensuring clear communication between landlords and tenants, much like the details found at legalformspdf.com/.

- Release of Lien: This document removes a lender’s claim against a property. It parallels a deed in lieu by clearing the borrower’s obligation, although it does not involve the transfer of property.

- Settlement Statement: This document outlines the financial details of a real estate transaction. It shares similarities with a deed in lieu by detailing the terms of the transfer of property ownership to the lender.

- Property Transfer Agreement: This agreement facilitates the transfer of property ownership. Like a deed in lieu, it helps resolve financial obligations without going through the foreclosure process.

- Bankruptcy Filing: While not a direct transfer of property, filing for bankruptcy can halt foreclosure proceedings. It offers borrowers a chance to reorganize their debts, much like a deed in lieu provides an alternative solution to foreclosure.

Misconceptions

Understanding the Deed in Lieu of Foreclosure can be challenging, and several misconceptions often arise. Here are six common misunderstandings:

-

It eliminates all debts associated with the mortgage.

A Deed in Lieu of Foreclosure does not automatically wipe out all debts. While it may resolve the mortgage debt, borrowers could still be responsible for other liabilities, such as second mortgages or home equity lines of credit.

-

It is a quick fix to avoid foreclosure.

While a Deed in Lieu of Foreclosure may seem like a straightforward solution, the process can take time. Lenders often require extensive documentation and may take weeks or even months to approve the request.

-

It negatively impacts credit scores more than foreclosure.

Both options can harm credit scores, but the impact may not be as severe with a Deed in Lieu of Foreclosure. In many cases, it may be viewed more favorably than a foreclosure, depending on the lender's reporting practices.

-

It is available to everyone facing foreclosure.

Not all borrowers qualify for a Deed in Lieu of Foreclosure. Lenders typically require that the borrower is unable to continue making payments and that the property is in good condition. Additionally, borrowers must have a clear title to the property.

-

It resolves all legal issues related to the property.

A Deed in Lieu of Foreclosure may not address other legal issues, such as liens or judgments against the property. Borrowers should ensure they understand any outstanding legal matters before proceeding.

-

It is the same as a short sale.

A Deed in Lieu of Foreclosure and a short sale are different processes. In a short sale, the property is sold for less than the mortgage balance, with lender approval. In contrast, a Deed in Lieu involves transferring ownership directly to the lender without a sale.

Being aware of these misconceptions can help individuals make informed decisions about their options when facing financial difficulties with their property.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process allows homeowners to avoid the lengthy and stressful foreclosure process while settling their mortgage obligations. |

| Eligibility | Homeowners facing financial hardship may qualify, but they must demonstrate an inability to continue making mortgage payments. |

| State-Specific Forms | Each state may have its own Deed in Lieu of Foreclosure form. For example, in California, the governing law is found in the California Civil Code. |

| Impact on Credit | A Deed in Lieu of Foreclosure can negatively affect a borrower's credit score, but typically less than a foreclosure would. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any remaining debt, as this could be considered taxable income. |

| Process Duration | The process can be quicker than foreclosure, often taking a few weeks to a couple of months, depending on the lender's policies. |