Free Corrective Deed Template

The Corrective Deed form serves as an important legal tool for property owners seeking to rectify errors in existing deeds. Mistakes in property descriptions, names, or other critical details can lead to confusion and complications in ownership rights. By utilizing a Corrective Deed, individuals can amend these inaccuracies, ensuring that the public record accurately reflects the true ownership and specifics of the property. This form typically includes essential information such as the names of the parties involved, the legal description of the property, and the specific corrections being made. Importantly, the Corrective Deed must be executed in accordance with state laws, which often require notarization and, in some cases, witness signatures. By addressing discrepancies through this formal process, property owners can protect their interests and maintain clear titles, ultimately fostering trust in real estate transactions.

Popular Corrective Deed Templates:

What Is a Deed in Lieu of Foreclosure? - Signing a Deed in Lieu can lead to tax liabilities, so homeowners must consult tax professionals.

A Texas Quitclaim Deed is a legal document that allows a property owner to transfer their ownership interest in a property to another party. This form does not guarantee that the property title is free of liens or other claims; instead, it conveys whatever interest the grantor has at the time of the transfer. Often used among family members or in situations where a full title search is not required, it is a straightforward way to change property ownership. For more information, you can visit https://topformsonline.com/texas-quitclaim-deed/.

Common Questions

What is a Corrective Deed?

A Corrective Deed is a legal document used to amend or correct errors in a previously executed deed. These errors may include misspellings, incorrect legal descriptions, or other inaccuracies that could affect the property’s title or ownership. The purpose of this document is to ensure that the public record accurately reflects the true intentions of the parties involved in the property transaction.

When should I use a Corrective Deed?

You should consider using a Corrective Deed when you discover an error in a deed that has already been recorded. Common scenarios include typographical errors, changes in property boundaries, or mistakes in the names of the parties involved. It is essential to address these inaccuracies promptly to avoid potential disputes or complications in the future.

How do I prepare a Corrective Deed?

Preparing a Corrective Deed typically involves drafting the document to clearly state the corrections being made. You will need to include the original deed’s details, such as the date it was executed and the names of the parties involved. Additionally, you must specify the errors and provide the correct information. It is often advisable to consult with a legal professional to ensure that the document is properly formatted and complies with state laws.

Do I need to have the Corrective Deed notarized?

Yes, in most cases, a Corrective Deed must be notarized. Notarization serves to verify the identities of the signers and confirms that they are signing the document willingly. This step adds a layer of authenticity and helps ensure that the deed is accepted by the relevant authorities when recorded.

Where do I file a Corrective Deed?

A Corrective Deed should be filed with the same office where the original deed was recorded, typically the county recorder or clerk’s office. By filing it in the same location, you ensure that the public record is updated to reflect the corrections made. It is important to check with your local office for any specific filing requirements or fees that may apply.

Is there a fee associated with filing a Corrective Deed?

Yes, there is usually a fee for filing a Corrective Deed. The amount can vary depending on the county or state where you are filing. It is advisable to contact the local recorder’s office to inquire about the exact fees and any additional costs that may be involved in the filing process.

Will a Corrective Deed affect my property taxes?

Generally, a Corrective Deed itself does not directly affect your property taxes. However, if the corrections made significantly alter the property’s boundaries or ownership, it could potentially impact your property tax assessment. It is wise to consult with your local tax assessor’s office to understand any implications that may arise from the changes made in the Corrective Deed.

Can a Corrective Deed be contested?

Yes, a Corrective Deed can be contested, particularly if there are disputes regarding the corrections made or if one party believes that the changes were not agreed upon. To minimize the risk of contestation, it is crucial to ensure that all parties involved are in agreement with the corrections and that the document is executed properly.

How long does it take for a Corrective Deed to be processed?

The processing time for a Corrective Deed can vary depending on the county’s workload and specific procedures. Typically, it may take anywhere from a few days to several weeks for the deed to be recorded and processed. It is advisable to follow up with the recorder’s office after submission to confirm the status of your filing.

What happens if I don’t file a Corrective Deed?

If you choose not to file a Corrective Deed after discovering an error, the inaccuracies will remain on the public record. This could lead to potential complications in the future, such as challenges to your ownership, difficulties in selling the property, or issues arising during refinancing. Addressing errors promptly helps protect your interests and maintains the integrity of the property’s title.

Preview - Corrective Deed Form

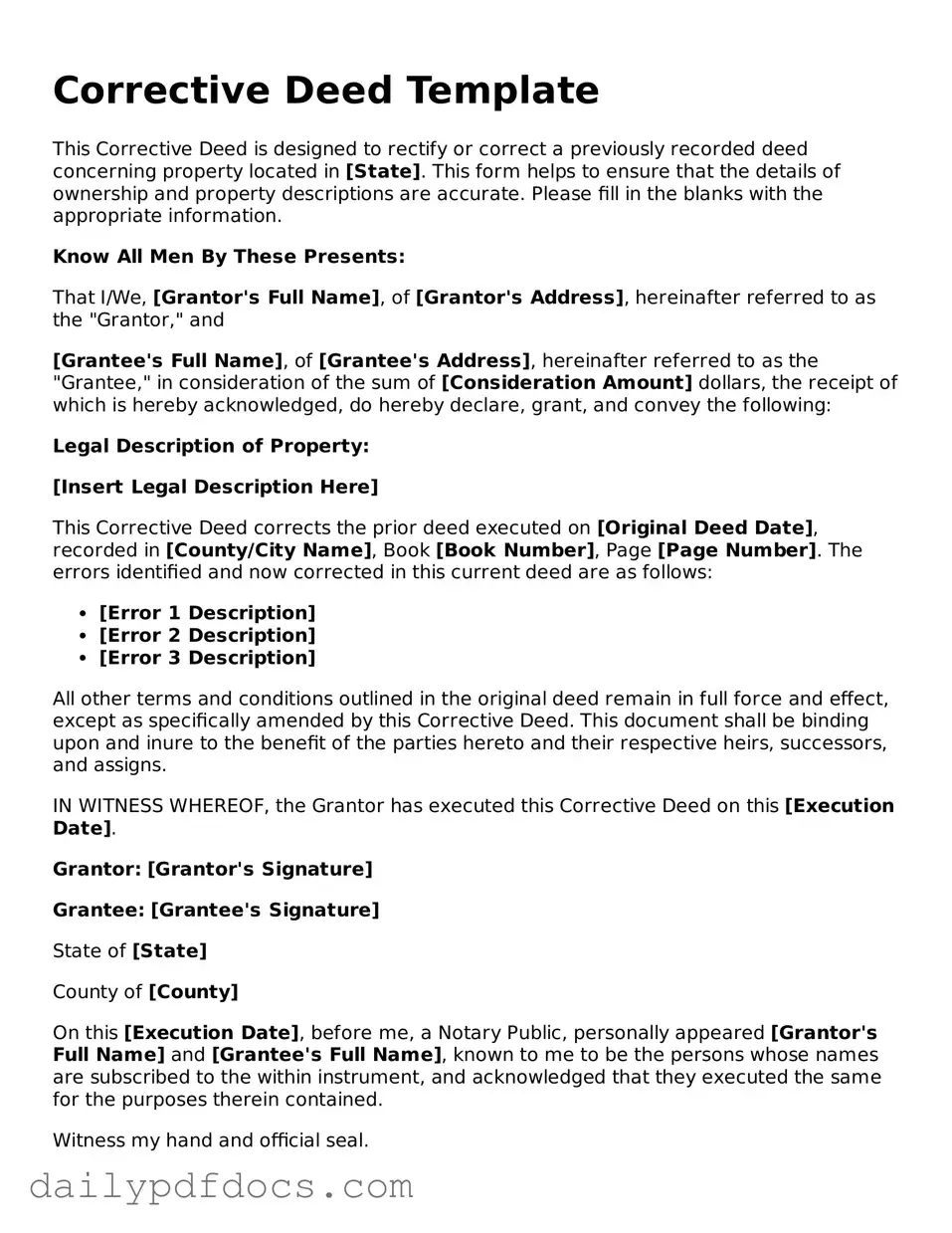

Corrective Deed Template

This Corrective Deed is designed to rectify or correct a previously recorded deed concerning property located in [State]. This form helps to ensure that the details of ownership and property descriptions are accurate. Please fill in the blanks with the appropriate information.

Know All Men By These Presents:

That I/We, [Grantor's Full Name], of [Grantor's Address], hereinafter referred to as the "Grantor," and

[Grantee's Full Name], of [Grantee's Address], hereinafter referred to as the "Grantee," in consideration of the sum of [Consideration Amount] dollars, the receipt of which is hereby acknowledged, do hereby declare, grant, and convey the following:

Legal Description of Property:

[Insert Legal Description Here]

This Corrective Deed corrects the prior deed executed on [Original Deed Date], recorded in [County/City Name], Book [Book Number], Page [Page Number]. The errors identified and now corrected in this current deed are as follows:

- [Error 1 Description]

- [Error 2 Description]

- [Error 3 Description]

All other terms and conditions outlined in the original deed remain in full force and effect, except as specifically amended by this Corrective Deed. This document shall be binding upon and inure to the benefit of the parties hereto and their respective heirs, successors, and assigns.

IN WITNESS WHEREOF, the Grantor has executed this Corrective Deed on this [Execution Date].

Grantor: [Grantor's Signature]

Grantee: [Grantee's Signature]

State of [State]

County of [County]

On this [Execution Date], before me, a Notary Public, personally appeared [Grantor's Full Name] and [Grantee's Full Name], known to me to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

Witness my hand and official seal.

[Notary Public Signature]

My Commission Expires: [Expiration Date]

Similar forms

- Quitclaim Deed: This document transfers ownership of property without guaranteeing that the title is clear. Like a Corrective Deed, it can correct errors in the property title but does not assure the buyer of any rights.

- Warranty Deed: This deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. While a Corrective Deed aims to fix mistakes, a Warranty Deed offers more protection to the buyer.

- Grant Deed: A Grant Deed transfers property ownership and includes implied warranties about the title. Similar to a Corrective Deed, it can rectify issues but typically does not address existing title defects.

Georgia Deed Form: To adequately transfer ownership of property in Georgia, it's crucial to use the right legal documentation. A Georgia Deed form is essential for this purpose; for more details, you can explore resources like Georgia Documents.

- Deed of Trust: This document secures a loan with real property as collateral. While it serves a different purpose than a Corrective Deed, both can involve changes to property ownership and may require correction if errors arise.

Misconceptions

Understanding the Corrective Deed form can be challenging. Here are nine common misconceptions about this legal document.

- Corrective Deeds are only for major errors. Many people believe that these deeds are only necessary for significant mistakes. However, even minor errors, such as misspellings or incorrect property descriptions, can warrant a corrective deed.

- Anyone can create a Corrective Deed. Some think that any individual can draft a corrective deed without legal assistance. While it is possible to create one, it is advisable to consult a legal expert to ensure accuracy and compliance with local laws.

- Corrective Deeds invalidate the original deed. There is a misconception that a corrective deed nullifies the original deed. In reality, it serves to amend the original document while keeping it valid.

- All errors can be corrected with a Corrective Deed. Some believe that any mistake can be fixed using this form. However, certain issues, like changes in ownership or property boundaries, may require different legal actions.

- Corrective Deeds are unnecessary if the error is minor. Many assume that small mistakes do not need correction. Yet, leaving errors unaddressed can lead to confusion or disputes in the future.

- A Corrective Deed must be notarized. While notarization is often recommended, it is not always legally required. The requirements can vary by state.

- Filing a Corrective Deed is a lengthy process. Some people think that the process takes a long time. In fact, it can often be completed relatively quickly, depending on local regulations.

- Once filed, a Corrective Deed cannot be changed. There is a belief that after filing, no further changes can be made. However, if new errors are discovered, additional corrective deeds can be filed.

- Corrective Deeds are only for residential properties. Many assume that these deeds apply only to homes. However, they can also be used for commercial properties and land.

By understanding these misconceptions, individuals can better navigate the process of using a Corrective Deed and ensure their property records are accurate.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | A Corrective Deed is used to correct errors in a previously executed deed, ensuring the property title reflects the accurate information. |

| Common Errors | Errors may include misspellings of names, incorrect property descriptions, or clerical mistakes that occurred during the original deed execution. |

| Governing Law | In the United States, laws governing corrective deeds vary by state, often outlined in property or real estate statutes. |

| Execution Requirements | Typically, a Corrective Deed must be signed by the original parties involved in the transaction, and may need to be notarized. |

| Filing | After completion, the Corrective Deed must be filed with the appropriate county recorder's office to ensure public notice of the correction. |

| Legal Effect | Once recorded, the Corrective Deed has the same legal effect as the original deed, correcting any inaccuracies in the public record. |