Fill Your Citibank Direct Deposit Form

For individuals seeking a seamless way to receive their payments, the Citibank Direct Deposit form is an essential tool that simplifies the process. This form allows employees, pensioners, and government benefit recipients to authorize their payments to be deposited directly into their Citibank accounts. By providing key information such as account numbers, routing numbers, and personal identification details, users can ensure that their funds are transferred securely and efficiently. Not only does direct deposit eliminate the hassle of paper checks, but it also enhances financial security and expedites access to funds. Understanding the components of the Citibank Direct Deposit form is crucial for anyone looking to streamline their payment process and enjoy the convenience of having their earnings deposited automatically. As you explore the intricacies of this form, you'll discover how it can positively impact your financial management and overall peace of mind.

Find Other Documents

How to Check How Many College Credits You Have - Any request processing will be recorded for official use only.

When selling or buying a motorcycle, it's important to have the proper documentation to prevent any misunderstandings. Completing the Washington Motorcycle Bill of Sale not only protects both parties but also provides legal clarity. For an easy-to-use template, you can visit Washington Templates to ensure that all necessary details are captured effectively.

Waiver of Lein - The affidavit section strengthens the contractor's claim of no pending obligations.

Progressive Logo - Contains essential details about your insurance policy.

Common Questions

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows you to authorize your employer or other payers to deposit your paycheck or other funds directly into your Citibank account. This process ensures that your funds are available to you quickly and securely without the need for paper checks.

How do I obtain the Citibank Direct Deposit form?

You can obtain the Citibank Direct Deposit form by visiting the Citibank website or by contacting customer service. Many employers also provide their own versions of the form, which you can fill out and submit to your employer.

What information do I need to fill out the form?

To complete the form, you typically need to provide your personal information, including your name, address, and Social Security number. Additionally, you will need to include your Citibank account number and the routing number for your bank. This information ensures that deposits are directed to the correct account.

Is it safe to use the Direct Deposit form?

Yes, using the Citibank Direct Deposit form is safe. Direct deposit is a secure method for receiving payments. Your personal information is protected by bank security measures. However, always ensure you are sharing your information with trusted employers or payers.

How long does it take for direct deposits to start?

Once you submit the Citibank Direct Deposit form, it may take one to two pay cycles for the direct deposit to begin. This timeframe allows your employer or payer to process the request and set up the necessary arrangements with Citibank.

Can I change my direct deposit information later?

Yes, you can change your direct deposit information at any time. Simply fill out a new Citibank Direct Deposit form with your updated account details and submit it to your employer or payer. Ensure that you do this well in advance of your next payment to avoid any disruptions.

What should I do if my direct deposit doesn’t appear?

If your direct deposit does not appear in your account, first check with your employer or payer to confirm that the deposit was processed. If everything seems correct on their end, contact Citibank customer service for assistance. They can help you trace the transaction and resolve any issues.

Are there any fees associated with direct deposit?

Generally, there are no fees associated with receiving direct deposits into your Citibank account. However, it’s always a good idea to review your account terms or consult with Citibank to understand any potential fees related to your specific account type.

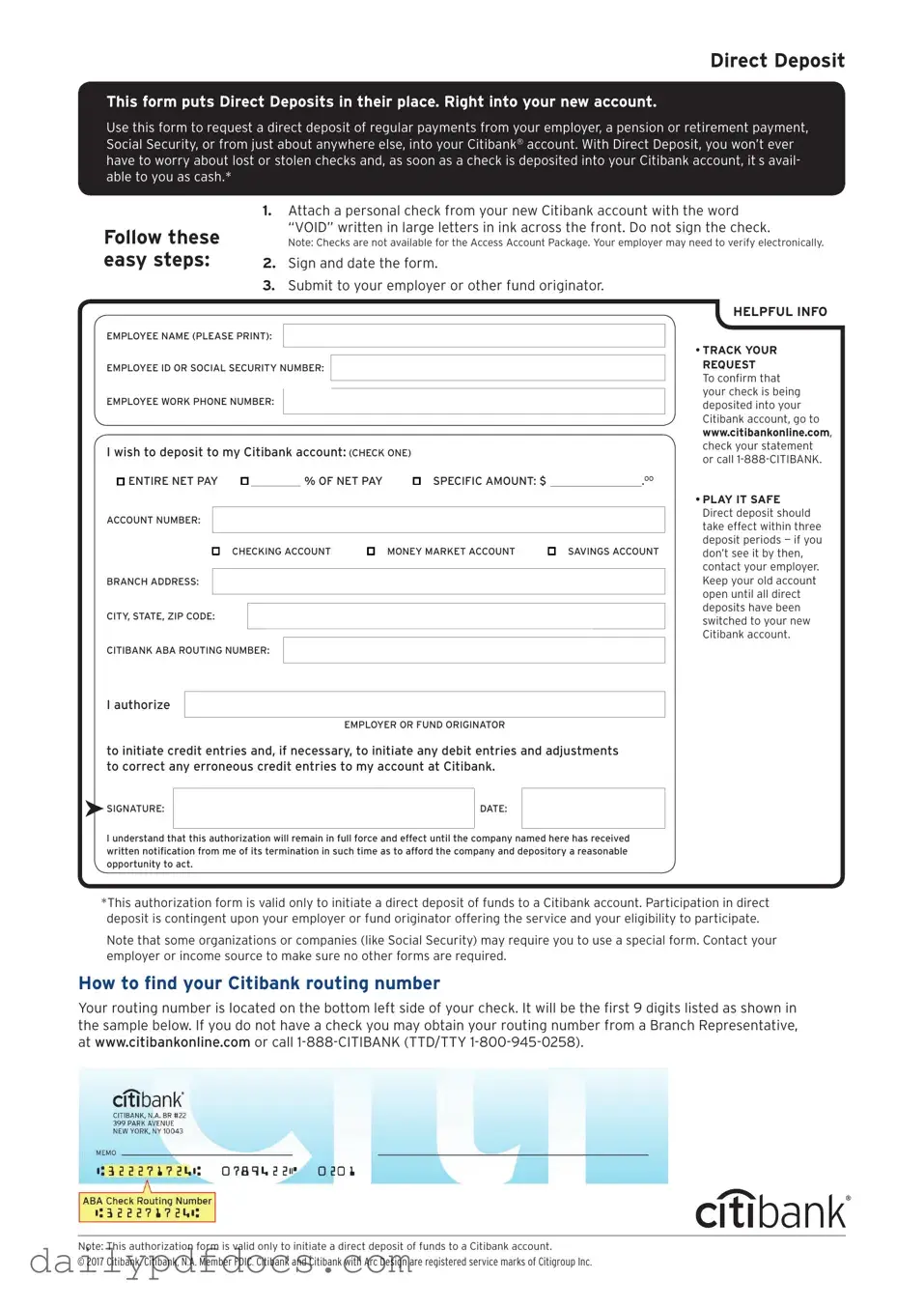

Preview - Citibank Direct Deposit Form

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

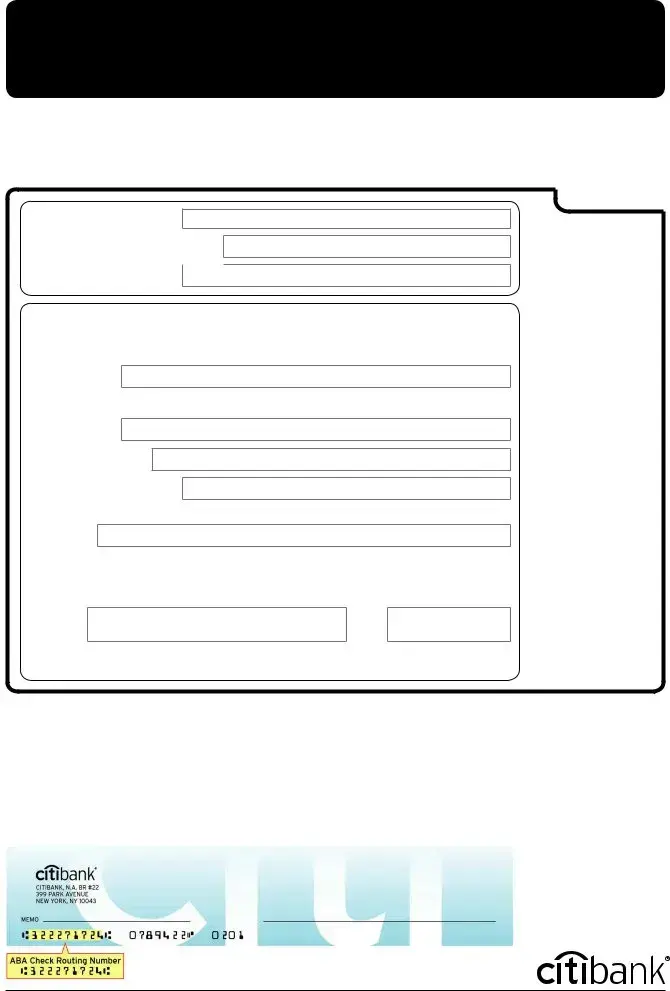

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Similar forms

The Citibank Direct Deposit form serves as a crucial tool for setting up automatic deposits into a bank account. Its purpose aligns closely with several other financial documents, each facilitating the management of funds. Here are nine documents that share similarities with the Citibank Direct Deposit form:

- W-4 Form: This form is used by employees to indicate their tax withholding preferences. Like the Direct Deposit form, it requires personal information and is essential for accurate financial management.

- Bank Account Application: When opening a new bank account, individuals must provide personal details and identification, similar to what is required for setting up direct deposits.

- Payroll Authorization Form: This document authorizes an employer to deposit wages directly into an employee's bank account. Both forms are designed to streamline the payment process.

- Automatic Payment Authorization Form: This form allows individuals to set up automatic payments for bills. It also involves sharing banking information, akin to the Direct Deposit form.

- ACH Transfer Form: Used for initiating Automated Clearing House transfers, this form requires account details and serves to facilitate electronic funds transfers, similar to direct deposits.

- Direct Deposit Authorization for Government Benefits: This document is used by individuals receiving government benefits to authorize direct deposits into their accounts, mirroring the purpose of the Citibank form.

- Loan Payment Authorization Form: When taking out a loan, borrowers may authorize automatic deductions for repayments. This process is akin to the authorization needed for direct deposits.

- Investment Account Setup Form: This form collects personal and financial information for setting up investment accounts. Like the Direct Deposit form, it requires careful attention to detail.

Arizona Deed Form: For those looking to transfer property ownership, the accurate Arizona deed form resources provide essential guidance for legal documentation.

- Tax Refund Direct Deposit Form: Taxpayers can choose to have their refunds directly deposited into their bank accounts, similar to how the Citibank form facilitates the deposit of regular income.

Each of these documents plays a vital role in financial transactions, emphasizing the importance of accurate information and authorization in managing one’s finances effectively.

Misconceptions

Understanding the Citibank Direct Deposit form is crucial for ensuring that your funds are deposited correctly and promptly. However, several misconceptions can lead to confusion. Here are seven common misunderstandings about this form:

-

Direct deposit is only for payroll. Many people believe that direct deposit can only be used for salary payments. In reality, direct deposit can be set up for various types of payments, including government benefits, tax refunds, and other recurring payments.

-

You need a Citibank account to use the form. While the form is specific to Citibank accounts, you can still use it if your employer or payment provider allows for direct deposits to other banks. Always check with them first.

-

Filling out the form is complicated. Some individuals think that completing the direct deposit form is a complex process. In fact, it typically requires just a few basic details, such as your account number and routing number, making it quite straightforward.

-

Direct deposit is instant. Many assume that once they submit the form, their funds will be available immediately. However, it may take one or two pay cycles for the direct deposit to become active, depending on your employer's payroll schedule.

-

Once set up, you never need to update the form. This is a common belief, but it’s important to update your direct deposit information if you change banks, accounts, or personal details like your name. Regular updates ensure that your deposits continue without interruption.

-

Your employer can see your bank account information. Many worry that by providing their bank details, their employer will have access to sensitive information. In reality, employers typically only see the last four digits of your account number for verification purposes.

-

Direct deposit is less secure than checks. Some people think that direct deposits are riskier than receiving paper checks. In fact, direct deposits are often more secure, as they reduce the risk of lost or stolen checks and minimize the chances of fraud.

By understanding these misconceptions, individuals can navigate the Citibank Direct Deposit form with greater confidence and clarity.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to authorize Citibank to deposit funds directly into their bank account. |

| Required Information | To complete the form, individuals must provide their account number, routing number, and personal identification details. |

| State-Specific Forms | Some states may require specific forms or additional documentation based on local banking regulations. |

| Governing Laws | Direct deposit agreements are generally governed by federal laws, but state-specific regulations may apply, such as those in California or New York. |

| Submission Process | Once completed, the form must be submitted to Citibank, either online or in person, to initiate the direct deposit setup. |