Fill Your Childcare Receipt Form

The Childcare Receipt form serves as a crucial document for both parents and childcare providers. It provides a clear record of payment for services rendered, ensuring transparency in financial transactions related to childcare. Each receipt includes essential details such as the date of service, the amount paid, and the name of the child or children receiving care. Additionally, it specifies the timeframe during which the childcare services were provided, making it easier for parents to track their childcare expenses. The provider’s signature is a vital component, confirming that the payment has been received. This form not only aids in maintaining accurate financial records but also supports parents in their efforts to claim childcare expenses on their taxes. Understanding the importance of this document can help both parties navigate their responsibilities more effectively.

Find Other Documents

Pharmacy Dispensing Labels - Family member contact information can also be included.

Dd 214 - A member's separation authority is also documented on the form.

For those considering marriage, a well-prepared prenuptial agreement can be invaluable. This document serves to clarify asset ownership and protect individual rights. To ensure you are equipped for any eventuality, explore the benefits of a comprehensive Arizona prenuptial agreement today.

Form 6059B Customs Declaration - It aids in identifying prohibited items to prevent illegal goods from entering the country.

Common Questions

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as a formal acknowledgment of payment made for childcare services. It provides both the provider and the parent with a record of the transaction, including details such as the date, amount paid, and the names of the children receiving care. This document can be useful for budgeting, tax purposes, or any disputes regarding payments.

What information is required on the Childcare Receipt form?

To complete the Childcare Receipt form, you need to fill in several key details. This includes the date of payment, the amount paid, the name of the individual making the payment, the names of the children receiving care, the duration of the childcare services, and the provider’s signature. Each of these elements is essential for ensuring clarity and accountability.

How can I obtain a Childcare Receipt form?

You can typically obtain a Childcare Receipt form from your childcare provider, as they often have pre-printed versions available. Alternatively, you can create your own using the information provided in the template. Ensure that all necessary fields are included to maintain proper documentation.

Is the Childcare Receipt form necessary for tax purposes?

Yes, the Childcare Receipt form can be important for tax purposes. Parents may need to present this receipt when claiming childcare expenses on their tax returns. Keeping accurate records helps ensure that you receive any eligible tax credits or deductions related to childcare costs.

Can I use the Childcare Receipt form for multiple children?

Absolutely! The form allows you to list multiple children who received care during the specified period. This feature is particularly helpful for families with more than one child in childcare, ensuring that all relevant information is documented in a single receipt.

What should I do if I lose my Childcare Receipt?

If you lose your Childcare Receipt, it’s best to contact your childcare provider as soon as possible. They can often issue a duplicate receipt or provide a new one with the same details. Keeping a backup of important documents can help prevent this situation in the future.

How should I store my Childcare Receipts?

It's advisable to store your Childcare Receipts in a safe and organized manner. Consider using a dedicated folder or digital storage system to keep track of all receipts. This practice not only helps with easy access but also ensures you have all necessary documents ready for tax time or any inquiries.

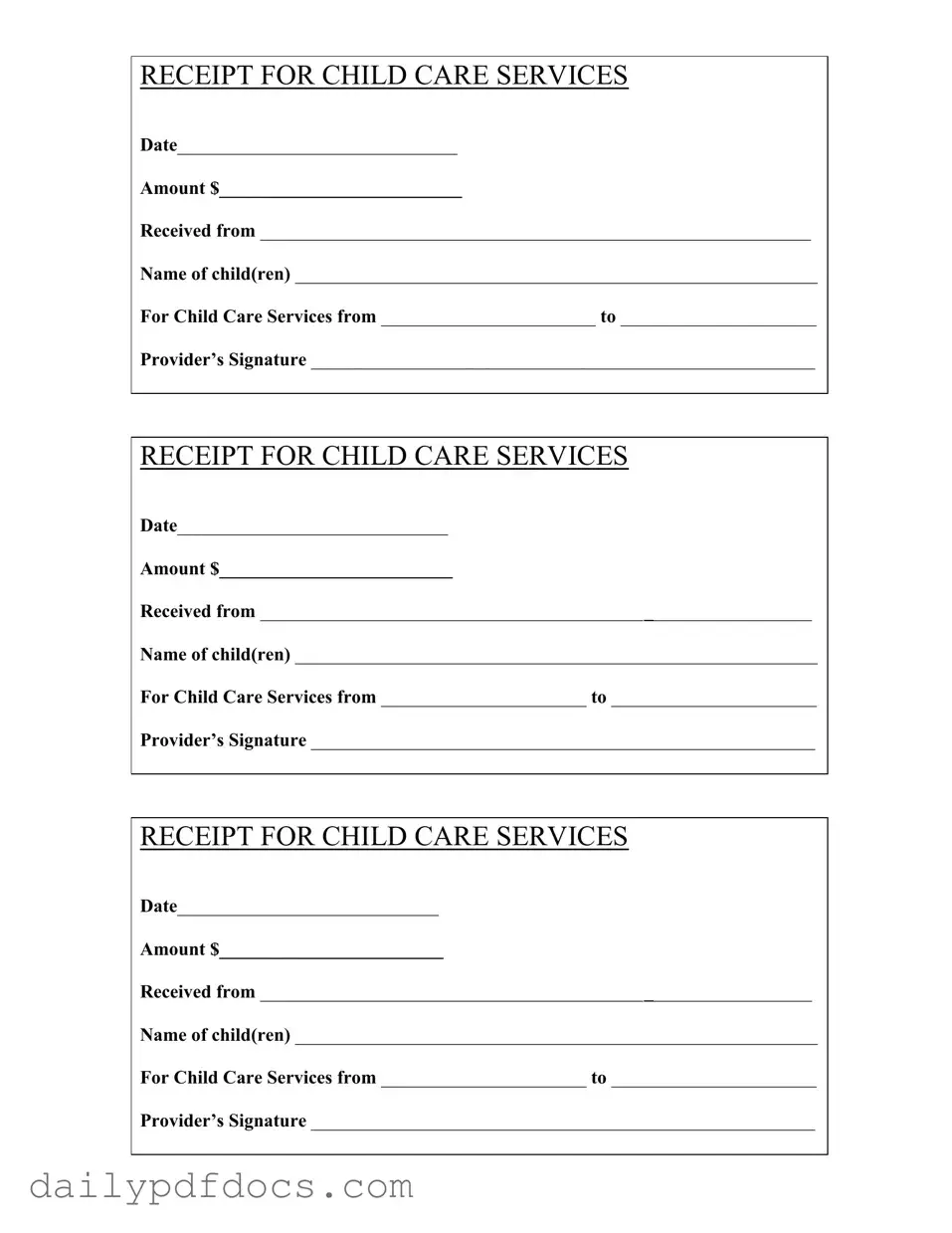

Preview - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Similar forms

-

Invoice for Childcare Services: Like the Childcare Receipt form, an invoice outlines the services provided, the amount due, and the date. It serves as a request for payment and can be used for record-keeping purposes.

-

Payment Receipt: This document confirms that a payment has been made for services rendered. Similar to the Childcare Receipt, it includes the date, amount, and details about the service recipient.

-

Service Agreement: A service agreement details the terms of service between the provider and the client. While it may not include payment details, it shares the same purpose of formalizing the arrangement.

-

Tax Document (Form 1099): This form reports income received by the childcare provider. While it serves a different purpose, both documents are essential for financial record-keeping and tax reporting.

- Divorce Settlement Agreement: This form outlines the mutually agreed-upon terms in a divorce, covering critical areas like asset division and custody arrangements, making it vital for both parties. For a detailed template, visit Washington Templates.

-

Enrollment Form: An enrollment form collects essential information about the child and the family. Though it differs in function, it is related to the childcare process and helps establish the provider-client relationship.

Misconceptions

Understanding the Childcare Receipt form is essential for parents and guardians who utilize childcare services. However, several misconceptions often arise regarding its purpose and use. Here are nine common misunderstandings:

- It is only needed for tax purposes. Many believe that the Childcare Receipt form is solely for tax deductions. While it can be useful for tax purposes, it also serves as proof of payment for services rendered.

- All childcare providers must issue a receipt. Not every childcare provider is required to provide a receipt. However, it is a best practice for transparency and record-keeping.

- Receipts need to be issued immediately. Some think that receipts must be given right after payment. In reality, providers can issue them at a later date, as long as they are provided upon request.

- The amount on the receipt is always final. Some parents assume that the amount listed is the total cost. However, additional fees may apply for extra services, and these should be clearly communicated by the provider.

- Only full-time care requires a receipt. This is a common belief, but receipts are necessary for both part-time and full-time childcare services.

- Receipts are not important for informal care arrangements. Even in informal settings, receipts can help clarify payments and protect both parties in case of disputes.

- Childcare receipts are the same as invoices. While both documents relate to payments, receipts confirm that payment has been made, whereas invoices request payment.

- Providers can alter receipts after issuance. Once a receipt is issued, it should not be changed. Any corrections should be made on a new receipt to maintain accurate records.

- Receipts do not need to include specific information. In fact, a proper receipt should include details such as the date, amount, name of the child, and provider’s signature to be valid.

By dispelling these misconceptions, parents can better navigate the childcare landscape and ensure they have the necessary documentation for their records.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form serves as proof of payment for childcare services provided to families. |

| Date Requirement | The form must include the date of payment to establish when the transaction occurred. |

| Amount Specification | The total amount paid for childcare services must be clearly stated on the form. |

| Provider Information | Providers must sign the form, confirming receipt of payment for their services. |

| Child Information | Names of the children receiving care must be documented to ensure clarity on services rendered. |

| Service Dates | The form requires the start and end dates of the childcare services provided. |

| State-Specific Laws | In some states, such as California, the form must comply with the Child Care and Development Services Act. |

| Record Keeping | Families should retain copies of these receipts for tax purposes and to document childcare expenses. |