Fill Your CBP 6059B Form

The CBP 6059B form plays a crucial role in the realm of international travel, serving as a vital document for travelers entering the United States. This form is designed to collect essential information about individuals and their belongings, ensuring that customs officials can efficiently assess any duties or restrictions that may apply. Travelers are required to disclose details such as their citizenship, the purpose of their visit, and any items they are bringing into the country. By completing the CBP 6059B, individuals help facilitate a smoother entry process, allowing customs agents to quickly and accurately process each traveler. Furthermore, understanding the nuances of this form can alleviate potential delays at the border and enhance the overall travel experience. Whether you are a seasoned globetrotter or embarking on your first international journey, familiarity with the CBP 6059B form can empower you to navigate the customs process with confidence.

Find Other Documents

Guardianship Documents - The form assists in preserving familial connections despite separation.

An Employee Handbook is a comprehensive document provided by an employer to its employees. It contains important information on company policies, procedures, and the workplace culture. This handbook serves as a guide for both new and existing employees to understand their rights and responsibilities within the company, and can be found at legalformspdf.com.

Profits or Loss From Business - Profit from the business is taxed at the owner’s personal income tax rate.

Common Questions

What is the CBP 6059B form?

The CBP 6059B form is a declaration form required by U.S. Customs and Border Protection (CBP). It is used by travelers entering the United States to declare items they are bringing into the country. This form helps customs officials assess any duties or restrictions on goods being imported.

Who needs to fill out the CBP 6059B form?

Any traveler arriving in the United States from abroad must complete the CBP 6059B form. This includes U.S. citizens, permanent residents, and foreign visitors. If you are traveling with family, you can submit one form for the entire household, but each individual must still declare their personal items.

How do I obtain the CBP 6059B form?

The CBP 6059B form is available at U.S. ports of entry. You can also find it online on the CBP website. It is advisable to fill out the form before arriving in the U.S. to expedite the customs process.

What information is required on the CBP 6059B form?

The form requires basic personal information, including your name, address, and passport number. Additionally, you must declare items you are bringing into the country, such as gifts, food, and currency. Be honest and thorough in your declarations to avoid penalties.

What happens if I do not fill out the CBP 6059B form?

Failing to fill out the CBP 6059B form can lead to delays during the customs process. In some cases, you may face fines or confiscation of undeclared items. It is essential to comply with this requirement to ensure a smooth entry into the United States.

Can I make changes to the CBP 6059B form after submitting it?

Once you have submitted the CBP 6059B form to customs officials, you cannot make changes. If you realize you need to correct information, inform the customs officer immediately. They can guide you on how to proceed and ensure your declarations are accurate.

What should I do if I have questions while filling out the CBP 6059B form?

If you have questions while completing the form, ask a customs officer for assistance. They are trained to help travelers understand the process and can clarify any uncertainties you may have. It’s better to ask than to risk making an error.

Where do I submit the CBP 6059B form?

You submit the CBP 6059B form at the customs checkpoint when you arrive in the United States. Hand the completed form to the customs officer along with your passport and any other required documents. They will review your declarations and guide you through the process.

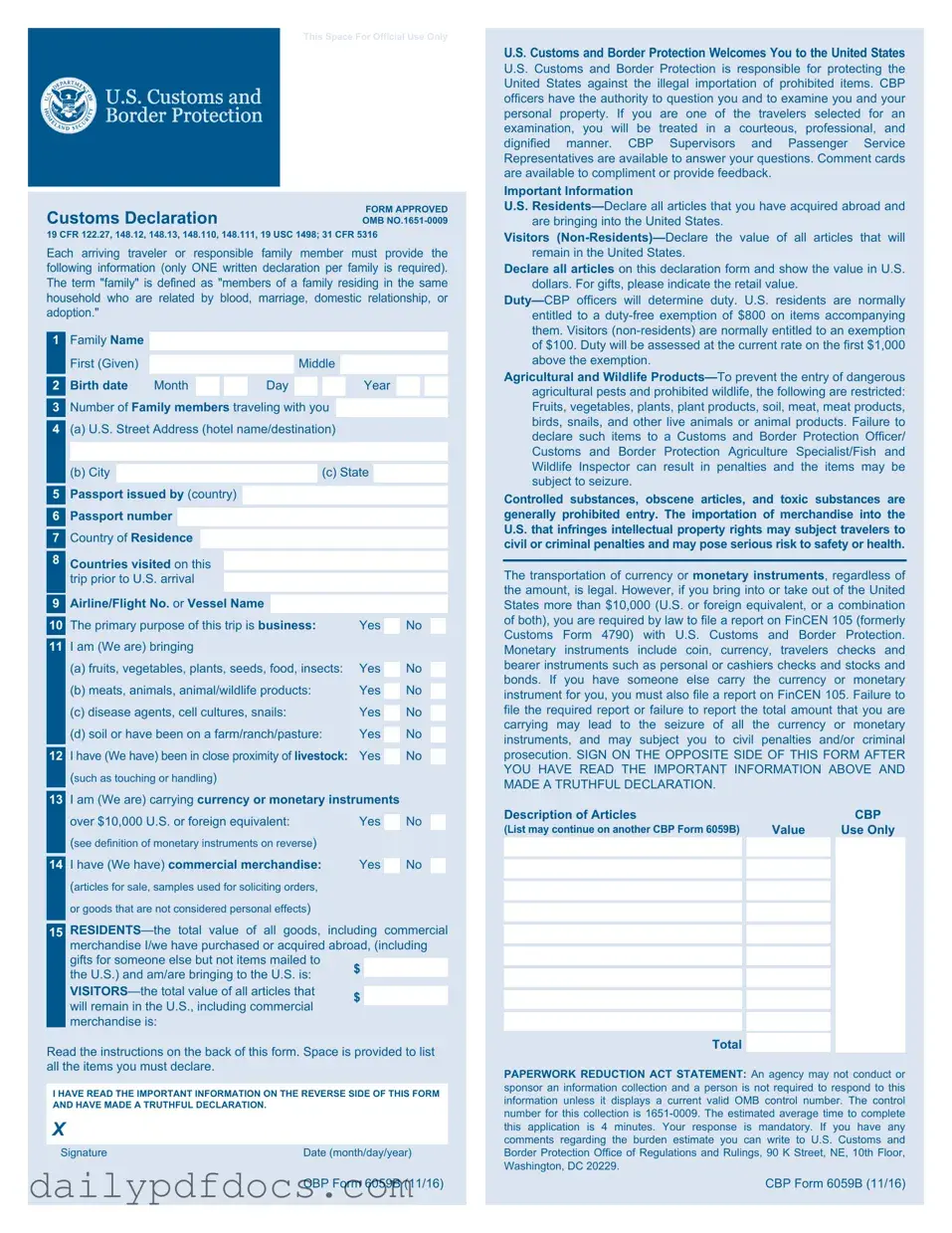

Preview - CBP 6059B Form

This Space For Official Use Only

Customs Declaration |

FORM APPROVED |

OMB |

19 CFR 122.27, 148.12, 148.13, 148.110, 148.111, 19 USC 1498; 31 CFR 5316

Each arriving traveler or responsible family member must provide the following information (only ONE written declaration per family is required). The term "family" is defined as "members of a family residing in the same household who are related by blood, marriage, domestic relationship, or adoption."

1Family Name

|

First (Given) |

|

|

|

|

|

Middle |

|

|

|

|

|||

|

Birth date |

Month |

|

|

|

Day |

|

|

|

|

Year |

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

||||

3Number of Family members traveling with you

4(a) U.S. Street Address (hotel name/destination)

(b) City  (c) State

(c) State

5Passport issued by (country)

6Passport number

7Country of Residence

8 Countries visited on this

trip prior to U.S. arrival

9 |

Airline/Flight No. or Vessel Name |

|

|

|

|

|

|

|

The primary purpose of this trip is business: |

|

|

|

|

|

|

10 |

Yes |

|

No |

|

|

||

11I am (We are) bringing

(a)fruits, vegetables, plants, seeds, food, insects: Yes  No

No

(b) meats, animals, animal/wildlife products: |

Yes |

|

No |

|

(c) disease agents, cell cultures, snails: |

Yes |

|

No |

|

|

|

|||

(d) soil or have been on a farm/ranch/pasture: |

Yes |

|

No |

|

|

|

12I have (We have) been in close proximity of livestock: Yes  No (such as touching or handling)

No (such as touching or handling)

13I am (We are) carrying currency or monetary instruments

|

over $10,000 U.S. or foreign equivalent: |

Yes |

|

No |

|

|

(see definition of monetary instruments on reverse) |

|

|

|

|

|

|

|

|

|

|

14 |

I have (We have) commercial merchandise: |

Yes |

|

No |

|

|

|

||||

|

(articles for sale, samples used for soliciting orders, |

|

|

|

|

|

or goods that are not considered personal effects) |

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

|||

|

merchandise I/we have purchased or acquired abroad, (including |

||

|

gifts for someone else but not items mailed to |

$ |

|

|

|

||

|

the U.S.) and am/are bringing to the U.S. is: |

|

|

|

|

|

|

|

$ |

|

|

|

|

||

|

will remain in the U.S., including commercial |

|

|

|

|

|

|

|

merchandise is: |

|

|

Read the instructions on the back of this form. Space is provided to list all the items you must declare.

I HAVE READ THE IMPORTANT INFORMATION ON THE REVERSE SIDE OF THIS FORM AND HAVE MADE A TRUTHFUL DECLARATION.

X

Signature |

Date (month/day/year) |

U.S. Customs and Border Protection Welcomes You to the United States

U.S. Customs and Border Protection is responsible for protecting the United States against the illegal importation of prohibited items. CBP officers have the authority to question you and to examine you and your personal property. If you are one of the travelers selected for an examination, you will be treated in a courteous, professional, and dignified manner. CBP Supervisors and Passenger Service Representatives are available to answer your questions. Comment cards are available to compliment or provide feedback.

Important Information

U.S.

Visitors

Declare all articles on this declaration form and show the value in U.S. dollars. For gifts, please indicate the retail value.

Agricultural and Wildlife

Controlled substances, obscene articles, and toxic substances are generally prohibited entry. The importation of merchandise into the U.S. that infringes intellectual property rights may subject travelers to civil or criminal penalties and may pose serious risk to safety or health.

The transportation of currency or monetary instruments, regardless of the amount, is legal. However, if you bring into or take out of the United States more than $10,000 (U.S. or foreign equivalent, or a combination of both), you are required by law to file a report on FinCEN 105 (formerly Customs Form 4790) with U.S. Customs and Border Protection. Monetary instruments include coin, currency, travelers checks and bearer instruments such as personal or cashiers checks and stocks and bonds. If you have someone else carry the currency or monetary instrument for you, you must also file a report on FinCEN 105. Failure to file the required report or failure to report the total amount that you are carrying may lead to the seizure of all the currency or monetary instruments, and may subject you to civil penalties and/or criminal prosecution. SIGN ON THE OPPOSITE SIDE OF THIS FORM AFTER YOU HAVE READ THE IMPORTANT INFORMATION ABOVE AND MADE A TRUTHFUL DECLARATION.

Description of Articles |

|

|

CBP |

(List may continue on another CBP Form 6059B) |

|

Value |

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number. The control number for this collection is

CBP Form 6059B (11/16) |

CBP Form 6059B (11/16) |

Similar forms

- CBP Form 7501: This form, known as the Entry Summary, is used for the declaration of imported goods. Like the CBP 6059B, it is essential for customs processing and ensures compliance with U.S. regulations.

- CBP Form 3461: This is the Entry/Immediate Delivery form. It facilitates the quick processing of imported goods and is similar to the CBP 6059B in that both forms are required for customs clearance.

- CBP Form I-94: The Arrival/Departure Record is issued to foreign visitors. It serves a similar purpose in tracking entry into the U.S., much like the CBP 6059B for travelers entering the country.

- CBP Form 7506: This is the In-Bond Application form. It is used for goods that are transported under bond, similar to how the CBP 6059B is used for travelers bringing items into the U.S.

- CBP Form 1302: The Declaration for Free Entry of Returned American Products is used for goods returning to the U.S. It is akin to the CBP 6059B as both documents help facilitate customs procedures.

- Customs Declaration Form (Canada): Used by travelers entering Canada, this form is similar to the CBP 6059B as it requires travelers to declare items they are bringing into the country.

- Washington Homeschool Letter of Intent: This crucial document notifies the state of a family's decision to homeschool and is essential for ensuring that homeschooling is recognized. For more information, visit homeschoolintent.com/editable-washington-homeschool-letter-of-intent/.

- USDA APHIS Form 7001: This form is for the declaration of animals and animal products entering the U.S. It shares similarities with the CBP 6059B in that both require specific declarations for entry.

- DOT Form 5800: This form is used for the declaration of hazardous materials. Like the CBP 6059B, it is necessary for compliance with safety regulations when entering the U.S.

- CBP Form 1300: This is the Application for a Certificate of Registration for Certain Imported Articles. It is similar to the CBP 6059B in that both are involved in the importation process.

- CBP Form 7502: The Customs Declaration for Mail is used for items sent through the postal service. It parallels the CBP 6059B as both require declarations for items entering the U.S.

Misconceptions

The CBP 6059B form, officially known as the "Customs Declaration," is an essential document for travelers entering the United States. However, several misconceptions surround its purpose and use. Here are four common misunderstandings:

- Misconception 1: The CBP 6059B form is only required for international travelers.

- Misconception 2: Completing the CBP 6059B form is optional.

- Misconception 3: The information on the CBP 6059B form is not important.

- Misconception 4: You can submit the CBP 6059B form online before traveling.

This is not entirely accurate. While the form is primarily designed for individuals arriving from outside the U.S., it may also be necessary for residents returning from certain territories. Understanding the specific requirements can help avoid confusion at customs.

Many travelers mistakenly believe that filling out the form is a matter of choice. In reality, it is a mandatory requirement for all travelers entering the U.S. Failure to complete the form can lead to delays and complications during the customs process.

Some individuals think that the details provided on the form are trivial. However, the information is crucial for customs officials to assess duties, taxes, and potential restrictions on certain items. Accuracy is vital to ensure a smooth entry process.

This is a common belief, but the form must be presented in person upon arrival in the U.S. Travelers should be prepared to complete the form during their flight or upon arrival at customs, as electronic submission is not an option.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The CBP 6059B form is used for declaring items being brought into the United States, primarily by travelers. It helps Customs and Border Protection assess any duties or taxes that may apply. |

| Who Needs It | All travelers entering the U.S. must complete the CBP 6059B form if they are bringing goods that exceed the duty-free exemption limits. |

| Filing Process | The form can be completed at the port of entry. Travelers typically receive the form during their flight or at the border checkpoint. |

| Legal Basis | The requirement for the CBP 6059B form is governed by U.S. Customs laws, specifically under the Tariff Act of 1930 and subsequent amendments. |