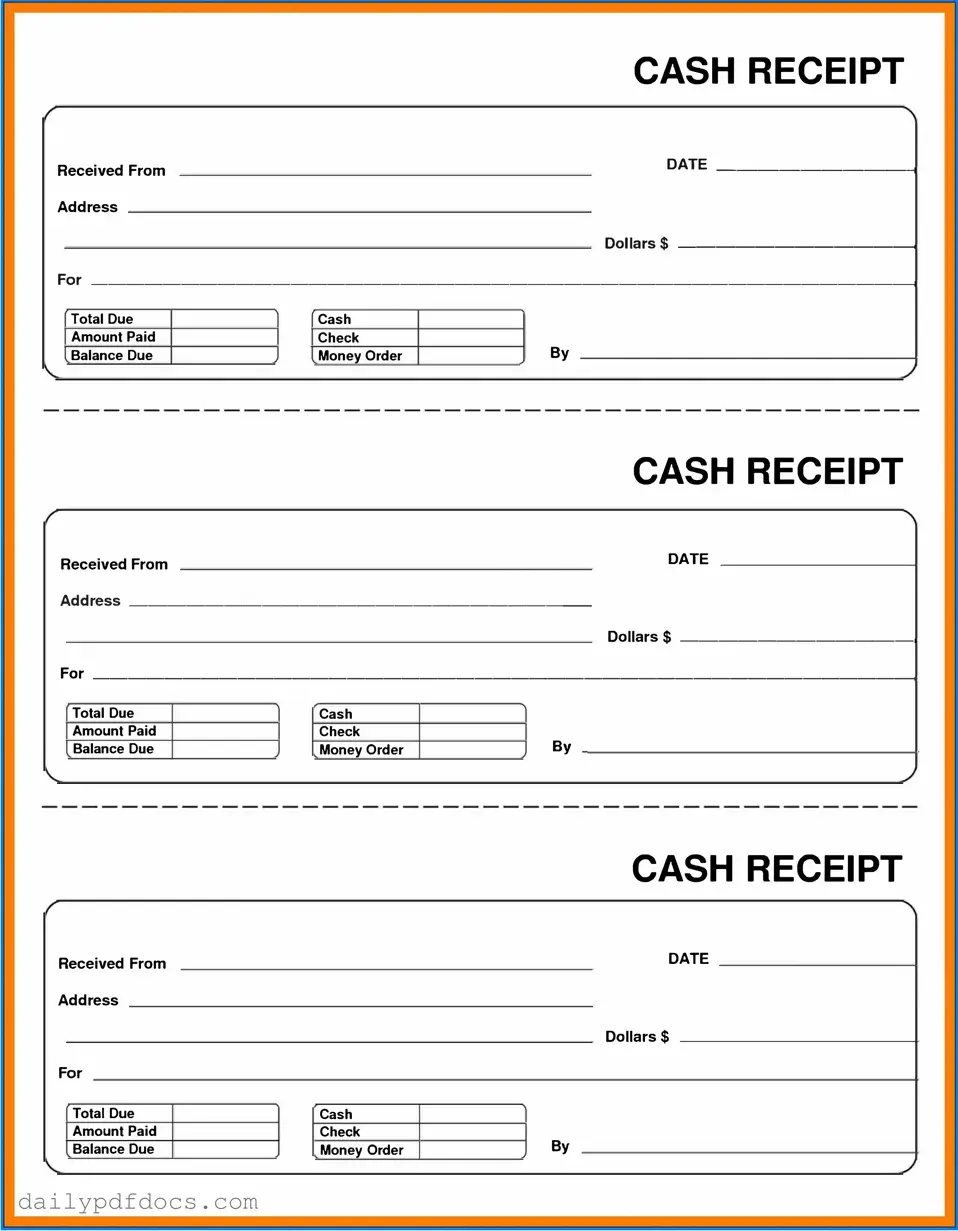

Fill Your Cash Receipt Form

The Cash Receipt form plays a crucial role in financial transactions, serving as a documented record of cash received by a business or organization. This form typically captures essential details such as the date of the transaction, the amount received, and the source of the funds. It may also include information about the method of payment, whether cash, check, or electronic transfer. By providing a clear outline of the transaction, the Cash Receipt form helps maintain accurate financial records and ensures transparency in accounting practices. Additionally, it often features sections for signatures or approvals, reinforcing accountability and verification. Overall, the Cash Receipt form is an indispensable tool for tracking income, managing finances, and facilitating audits, making it a vital component of effective financial management.

Find Other Documents

Texas Temporary Tag - Temporary tags can be issued for new or used vehicles.

For individuals seeking clarity in their separation, the detailed Marital Separation Agreement process is vital to ensuring that both parties understand their rights and responsibilities during this transitional period. You can find a helpful resource at important aspects of the Marital Separation Agreement.

Construction Business Proposal Template - Acts as a foundation for quality control measures during construction.

Common Questions

What is a Cash Receipt form?

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof of transaction for both the payer and the recipient. This form typically includes details such as the date, amount received, payer's information, and the purpose of the payment.

Who needs to use a Cash Receipt form?

Anyone who receives cash payments should use a Cash Receipt form. This includes businesses, non-profit organizations, and individuals who conduct transactions involving cash. By using this form, you ensure that both parties have a record of the payment for their records.

What information is required on the Cash Receipt form?

The Cash Receipt form should include the following information: the date of the transaction, the name of the payer, the amount received, the purpose of the payment, and the signature of the person receiving the cash. Additional notes or references can also be included for clarity.

Is a Cash Receipt form necessary for all cash transactions?

While it may not be legally required for every cash transaction, using a Cash Receipt form is highly recommended. It provides a clear record that can help prevent disputes and ensure accurate accounting. For larger amounts or business transactions, it is particularly important.

Can a Cash Receipt form be used for electronic payments?

No, a Cash Receipt form is specifically designed for cash transactions. For electronic payments, other forms of documentation, such as invoices or payment confirmations, should be used. However, you can create a similar receipt for electronic payments to maintain consistency in record-keeping.

How should I store Cash Receipt forms?

Cash Receipt forms should be stored securely, whether in physical or digital format. If using paper forms, keep them in a locked file cabinet. For digital forms, ensure they are stored in a password-protected folder. This will help maintain confidentiality and protect sensitive information.

What should I do if I lose a Cash Receipt form?

If a Cash Receipt form is lost, it is important to notify the payer as soon as possible. You may need to issue a duplicate receipt or create a new one. Document the situation and maintain a record of the original transaction to ensure transparency.

Can I customize the Cash Receipt form?

Yes, you can customize the Cash Receipt form to fit your needs. Adding your business logo, adjusting the layout, or including additional fields can make the form more effective for your specific transactions. Just ensure that all essential information remains clear and accessible.

Preview - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Similar forms

- Invoice: Like a cash receipt, an invoice documents a transaction. However, an invoice requests payment, while a cash receipt confirms that payment has been received.

- Sales Receipt: A sales receipt serves a similar purpose as a cash receipt. Both confirm a sale, but a sales receipt is typically issued at the point of sale, whereas a cash receipt may be issued after payment is processed.

- Payment Voucher: A payment voucher is used to authorize payment for goods or services. While it facilitates payment, a cash receipt verifies that payment has already occurred.

- Non-compete Agreement: To protect your business interests, utilize the Arizona non-compete agreement form template which helps prevent employees from engaging in competition during or after their employment.

- Deposit Slip: A deposit slip is used to deposit cash or checks into a bank account. It is similar to a cash receipt in that both document the transfer of funds, but a deposit slip is specifically for banking transactions.

- Credit Memo: A credit memo is issued to reduce the amount owed by a customer. It is similar to a cash receipt in that both involve financial transactions, but a credit memo reflects a decrease in revenue, whereas a cash receipt indicates a completed payment.

- Expense Report: An expense report details costs incurred by an employee. While it tracks spending, a cash receipt confirms the receipt of funds, focusing on income rather than expenses.

- Purchase Order: A purchase order is a document sent to a supplier to confirm an order. Both documents relate to transactions, but a purchase order is a request for goods or services, while a cash receipt confirms payment.

- Billing Statement: A billing statement summarizes amounts owed by a customer. It is similar to a cash receipt in that both pertain to financial transactions, but a billing statement indicates outstanding balances, while a cash receipt confirms payment.

- Transaction Record: A transaction record logs details of a financial transaction. Similar to a cash receipt, it serves as documentation, but a transaction record may not confirm that payment has been received.

Misconceptions

Understanding the Cash Receipt form is crucial for both individuals and businesses. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about the Cash Receipt form:

- Cash Receipt forms are only for cash transactions. Many believe that these forms are only used when cash is involved. In reality, they can also document transactions made by check or credit card.

- Only businesses need Cash Receipt forms. While businesses frequently use them, individuals can also benefit from using these forms to keep track of personal transactions.

- Cash Receipt forms are unnecessary for small transactions. Some think that small transactions don’t require documentation. However, keeping a record is always a good practice, regardless of the amount.

- Cash Receipt forms are the same as invoices. While both documents serve to record transactions, they have different purposes. Invoices request payment, while Cash Receipts confirm that payment has been received.

- Once a Cash Receipt form is filled out, it cannot be changed. It is possible to amend a Cash Receipt if errors are found. However, it is important to keep a record of the original entry for accountability.

- Cash Receipt forms are only needed for tax purposes. Although they can help during tax season, these forms also aid in budgeting and tracking expenses throughout the year.

- All Cash Receipt forms look the same. There is no standard format for Cash Receipt forms. Different businesses may have unique designs or required information.

- Cash Receipt forms are not legally binding. While they may not be contracts, they can serve as evidence of a transaction and may be used in legal situations.

- Only the seller needs to keep a Cash Receipt form. Both parties should retain a copy. This ensures that there is a mutual record of the transaction.

- Cash Receipt forms are outdated in the digital age. Although many transactions are now electronic, Cash Receipt forms remain relevant. They provide a simple way to document transactions in various settings.

Addressing these misconceptions can help individuals and businesses utilize Cash Receipt forms more effectively. Keeping accurate records is a vital part of financial management.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments for goods or services. |

| Importance | This form serves as proof of transaction, helping to maintain accurate financial records. |

| Components | Typically, it includes details such as the date, amount received, payer's name, and purpose of the payment. |

| Storage | It is essential to keep copies of Cash Receipt forms for auditing and tax purposes. |

| State-Specific Requirements | Some states may have specific regulations governing the use of cash receipts, such as California's Business and Professions Code. |

| Digital Options | Many businesses now use digital formats for cash receipts, which can streamline record-keeping and improve accessibility. |