Fill Your Cash Drawer Count Sheet Form

Managing cash effectively is crucial for any business that handles transactions, and the Cash Drawer Count Sheet form plays an essential role in this process. This form provides a systematic way to document the amount of cash in a cash drawer at the end of a shift or business day. It helps ensure that cash balances match sales records, allowing for accurate financial reporting. With sections dedicated to recording the starting cash amount, cash received, cash paid out, and the final cash count, this form simplifies the reconciliation process. Additionally, it often includes spaces for signatures, which can help maintain accountability among employees. By utilizing the Cash Drawer Count Sheet, businesses can reduce the risk of discrepancies and theft, fostering a secure environment for both staff and customers. This straightforward tool not only aids in tracking cash flow but also enhances overall financial management, making it a vital component for retail operations.

Find Other Documents

How to Report a Company to the Better Business Bureau - Turn a negative experience into a positive change for others.

Understanding the intricacies of a California Residential Lease Agreement is crucial for both landlords and tenants, as it serves to clarify respective responsibilities and rights. To further enhance your knowledge about this important document, you can refer to resources such as legalformspdf.com/, which provide detailed guidance and templates for lease agreements tailored to California's regulations.

Chick Fil a Hiring Near Me - Embrace our values of integrity and excellence in every task.

Common Questions

What is the purpose of the Cash Drawer Count Sheet form?

The Cash Drawer Count Sheet form is used to track the amount of cash in a cash drawer at the end of a business day or shift. It helps ensure that the cash on hand matches the sales recorded in the system. By documenting the cash count, businesses can identify discrepancies, manage cash flow, and maintain accurate financial records.

How do I fill out the Cash Drawer Count Sheet form?

To fill out the Cash Drawer Count Sheet form, start by entering the date and your name or employee ID. Next, count the cash in the drawer, including bills and coins. Record the amounts in the designated fields for each denomination. Finally, calculate the total cash and compare it to the expected amount based on sales. Ensure all entries are clear and legible to avoid confusion.

What should I do if the cash count does not match the expected amount?

If the cash count does not match the expected amount, first double-check your calculations and recount the cash. If discrepancies persist, report the issue to your supervisor or manager. They may want to investigate further to determine if there was an error in the sales records or if there has been a theft. Document any findings on the form for future reference.

How often should I complete the Cash Drawer Count Sheet form?

The Cash Drawer Count Sheet form should be completed at the end of each business day or shift. Regular counting helps maintain accurate records and prevents cash discrepancies from accumulating over time. In some businesses, it may be necessary to count the cash drawer multiple times a day, especially during busy periods or when cash levels are low.

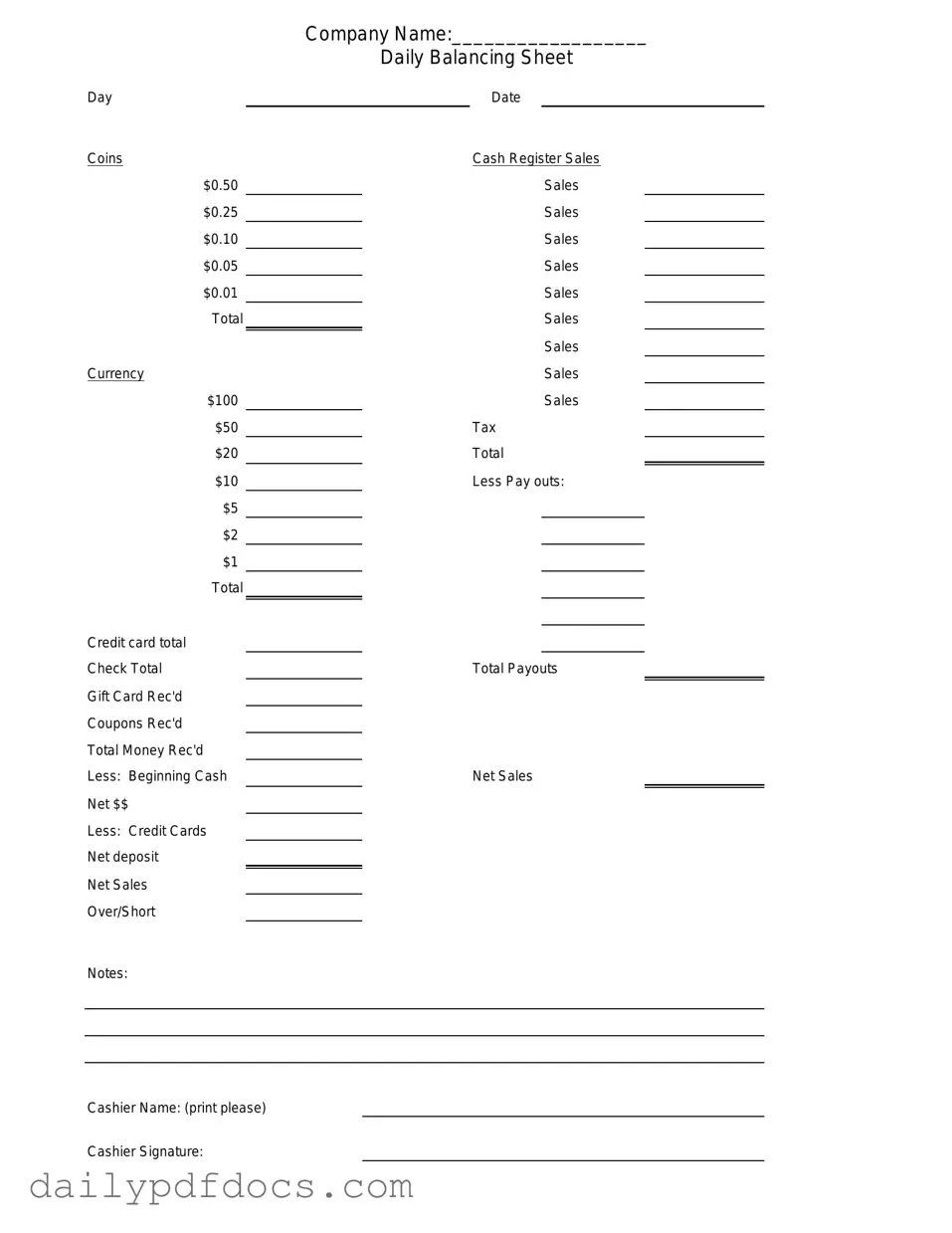

Preview - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Similar forms

- Daily Sales Report: This document summarizes the sales made during a specific day. Like the Cash Drawer Count Sheet, it helps track revenue and ensure accuracy in financial reporting.

- Cash Register Tape: This is a printed record from the cash register showing all transactions. Similar to the Cash Drawer Count Sheet, it provides a detailed account of cash flow for a given period.

- Bank Deposit Slip: This document is used to deposit cash into a bank account. It resembles the Cash Drawer Count Sheet as both involve counting and verifying cash amounts before a transaction.

- Expense Report: This report outlines all business expenses incurred over a specific time. It is similar to the Cash Drawer Count Sheet in that both documents track financial transactions and ensure proper accounting.

Mobile Home Bill of Sale: A critical document for the transfer of ownership, including buyer and seller details and the sale price, available at Washington Templates.

- Inventory Count Sheet: This sheet records the quantity of products on hand. Just like the Cash Drawer Count Sheet, it helps maintain accurate records and assists in financial accountability.

Misconceptions

Misconceptions about the Cash Drawer Count Sheet form can lead to confusion and errors in financial management. Here are nine common misunderstandings:

- It is only necessary for cash transactions. Many believe the Cash Drawer Count Sheet is only relevant for cash sales. In reality, it is important for tracking all types of transactions, including credit and debit card sales, to ensure overall accuracy in financial reporting.

- It is only needed at the end of the day. Some think that the count sheet is only required at closing. However, regular counts throughout the day can help identify discrepancies early and prevent larger issues later on.

- Anyone can fill it out. While it may seem simple, not everyone should complete the form. It is best filled out by someone trained in cash handling procedures to ensure accuracy and accountability.

- It is not important for non-cash businesses. Even businesses that primarily deal with credit or digital payments can benefit from using the Cash Drawer Count Sheet. It helps maintain a clear record of all financial activities and can reveal patterns or discrepancies.

- It only tracks cash amounts. The form is often misunderstood as a tool for tracking only cash. In fact, it can also record checks, credit card transactions, and other forms of payment, providing a comprehensive view of financial activity.

- It is only a formality. Some may view it as an unnecessary step. However, the Cash Drawer Count Sheet serves as a vital tool for accountability and can help prevent theft or loss.

- It does not need to be filed. There is a misconception that once the count is done, the sheet can be discarded. In truth, keeping a record of these sheets is important for audits and financial reviews.

- It is not useful for future planning. Some believe that the count sheet is only relevant for immediate cash management. In reality, analyzing past count sheets can provide insights for future budgeting and financial strategies.

- It can be filled out quickly without attention to detail. Many think that speed is more important than accuracy. However, taking the time to fill out the form correctly is crucial to ensure that all financial records are accurate and reliable.

File Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to record the amount of cash in a cash drawer at the end of a shift or day. |

| Importance | This form helps ensure accurate financial reporting and accountability for cash handling. |

| Frequency of Use | It is typically completed daily, but may be used more frequently depending on the business's cash handling policies. |

| Governing Laws | State-specific regulations may apply, particularly regarding cash handling and record-keeping, such as those outlined in the Uniform Commercial Code (UCC). |