Printable Transfer-on-Death Deed Document for California

The California Transfer-on-Death Deed form serves as a valuable estate planning tool, allowing property owners to transfer their real estate to designated beneficiaries without the need for probate. This simple yet effective document enables individuals to maintain control over their property during their lifetime while ensuring a smooth transition to heirs upon their passing. By filling out this form correctly, property owners can specify who will receive their property, thereby avoiding potential disputes among family members. Importantly, the Transfer-on-Death Deed is revocable, meaning that the owner can change their mind and alter the beneficiaries at any point before death. Additionally, this deed does not affect the owner’s ability to sell or mortgage the property while they are still alive. Understanding the nuances of this form can help individuals make informed decisions about their estate planning and ensure that their wishes are honored after they are gone.

More State-specific Transfer-on-Death Deed Forms

Florida Transfer on Death Deed Form - The Transfer-on-Death Deed applies only to real estate, like your house or land, not personal belongings.

For those navigating the complexities of separation, the essential overview of the Marital Separation Agreement is crucial. This form enables couples to establish clear terms related to asset distribution and other critical matters, ensuring a smoother transition during this period of change. You can find more information on creating this important document at how to draft a proper Marital Separation Agreement guide.

Free Printable Transfer on Death Deed Form Georgia - Changes to beneficiaries or property details can be made through a new Transfer-on-Death Deed if necessary.

Common Questions

What is a California Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD) allows a property owner to transfer real estate to a beneficiary upon their death, without the need for probate. This deed must be recorded during the owner's lifetime and becomes effective only after their death.

Who can use a Transfer-on-Death Deed in California?

Any individual who owns real estate in California can use a Transfer-on-Death Deed. This includes sole owners and co-owners, as long as the property is not held in a trust or part of a partnership.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must fill out the form with your information, the beneficiary's information, and a legal description of the property. The form must be signed in front of a notary public and then recorded with the county recorder's office where the property is located.

Do I need to notify the beneficiary when I create a Transfer-on-Death Deed?

While it is not legally required to notify the beneficiary, it is a good practice to inform them. This can help avoid confusion and ensure they are aware of their future interest in the property.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must create a new deed or file a revocation form with the county recorder’s office, ensuring that the previous deed is effectively canceled.

What happens if the beneficiary dies before me?

If the beneficiary named in the Transfer-on-Death Deed dies before you, the deed will become void. You may want to name an alternate beneficiary to ensure the property is transferred as intended.

Is a Transfer-on-Death Deed subject to taxes?

Generally, a Transfer-on-Death Deed does not trigger property taxes at the time of transfer. However, the beneficiary may be responsible for property taxes once the transfer is complete. It is advisable to consult a tax professional for specific guidance.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed can only be used for residential real estate. It cannot be used for commercial properties or personal property such as vehicles or bank accounts.

What if I have multiple beneficiaries?

You can name multiple beneficiaries in a Transfer-on-Death Deed. The property will then be divided among them according to your instructions. Make sure to clearly specify how you want the property divided to avoid disputes later.

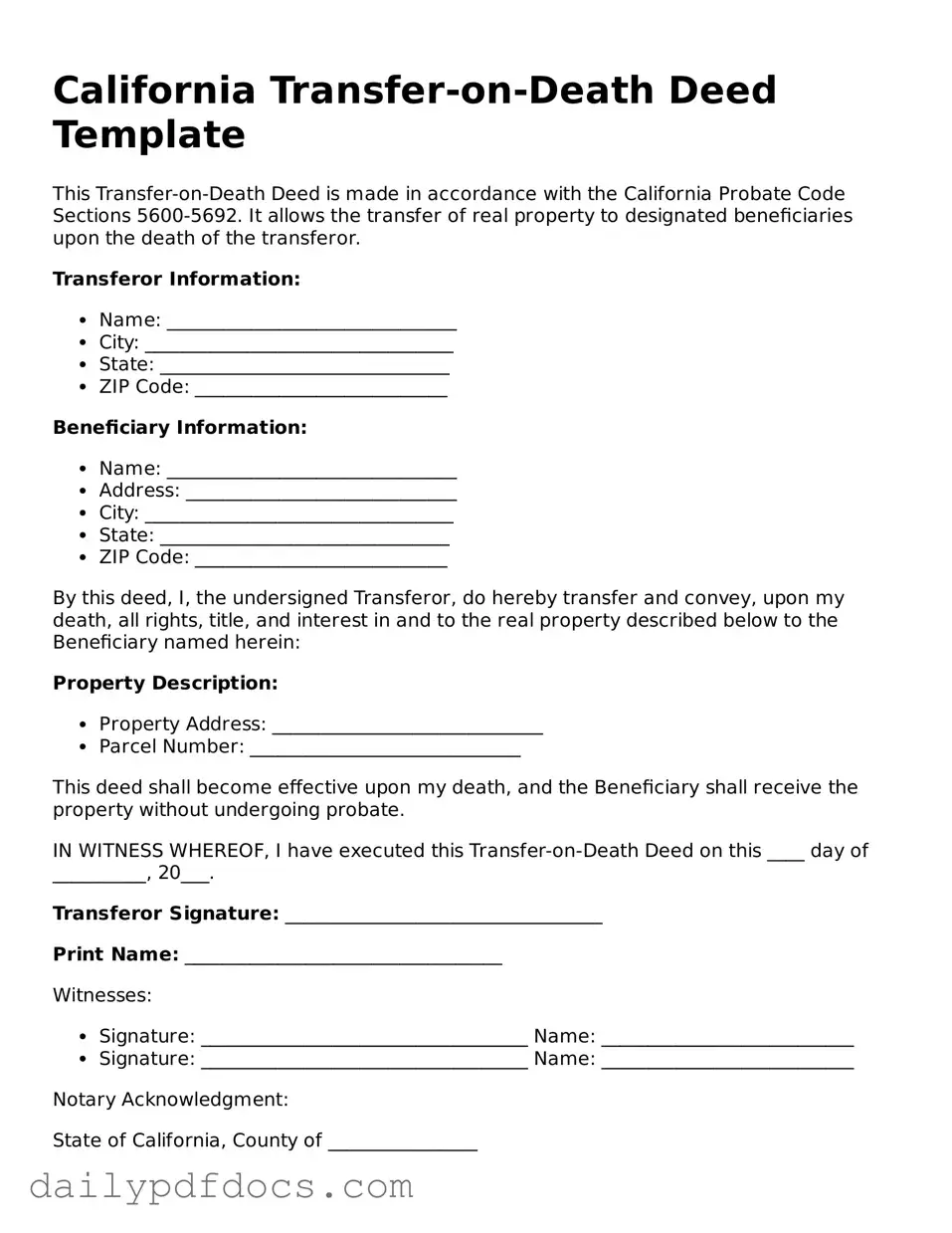

Preview - California Transfer-on-Death Deed Form

California Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the California Probate Code Sections 5600-5692. It allows the transfer of real property to designated beneficiaries upon the death of the transferor.

Transferor Information:

- Name: _______________________________

- City: _________________________________

- State: _______________________________

- ZIP Code: ___________________________

Beneficiary Information:

- Name: _______________________________

- Address: _____________________________

- City: _________________________________

- State: _______________________________

- ZIP Code: ___________________________

By this deed, I, the undersigned Transferor, do hereby transfer and convey, upon my death, all rights, title, and interest in and to the real property described below to the Beneficiary named herein:

Property Description:

- Property Address: _____________________________

- Parcel Number: _____________________________

This deed shall become effective upon my death, and the Beneficiary shall receive the property without undergoing probate.

IN WITNESS WHEREOF, I have executed this Transfer-on-Death Deed on this ____ day of __________, 20___.

Transferor Signature: __________________________________

Print Name: __________________________________

Witnesses:

- Signature: ___________________________________ Name: ___________________________

- Signature: ___________________________________ Name: ___________________________

Notary Acknowledgment:

State of California, County of ________________

Subscribed and sworn to before me this ____ day of __________, 20___.

Notary Public Signature: ____________________________

Notary Seal:

Similar forms

- Will: A will specifies how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate to execute the terms.

- Living Trust: A living trust holds property during a person's lifetime and specifies distribution upon death. Both documents avoid probate, but a living trust can manage assets during life as well.

- Joint Tenancy with Right of Survivorship: This arrangement allows two or more people to own property together. When one owner dies, their share automatically passes to the surviving owner, similar to the Transfer-on-Death Deed's function.

- Prenuptial Agreement: A prenuptial agreement helps couples outline asset division and responsibilities should the marriage end, ensuring clarity in legal matters. Explore the comprehensive Prenuptial Agreement details to protect your interests effectively.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to designate a beneficiary who will receive the funds upon death. This process is straightforward, like the transfer of real estate via a Transfer-on-Death Deed.

- Transfer-on-Death Registration for Securities: This allows individuals to designate beneficiaries for stocks or bonds. The transfer occurs automatically upon death, mirroring the function of a Transfer-on-Death Deed for real estate.

- Beneficiary Designations: Commonly used for retirement accounts and life insurance policies, these designations allow assets to pass directly to named beneficiaries without going through probate, similar to the Transfer-on-Death Deed.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while designating another party to receive the property after their death. It shares the goal of transferring property but operates differently in terms of rights during life.

- Family Limited Partnership: This structure allows family members to pool resources and manage property collectively. While it serves a different purpose, it can facilitate property transfer upon death, akin to the Transfer-on-Death Deed.

Misconceptions

Understanding the California Transfer-on-Death Deed (TOD) can be tricky. Many people hold misconceptions about this legal tool. Here are ten common myths and the truths behind them.

- Only wealthy people can use a TOD. Anyone can use a TOD, regardless of their financial status. It’s a simple way to transfer property without going through probate.

- A TOD can only be used for real estate. While primarily for real estate, a TOD can also apply to other types of property, depending on state laws.

- A TOD automatically transfers property upon signing. The transfer occurs only after the owner passes away. Until then, the owner retains full control.

- There are no tax implications with a TOD. While a TOD can help avoid probate, it may still have tax consequences, such as property tax reassessment or capital gains taxes.

- A TOD deed is the same as a will. A TOD deed specifically transfers property outside of probate, while a will covers all assets and must go through probate.

- You can’t change a TOD once it’s filed. This is false. A TOD can be revoked or amended at any time before the owner’s death.

- All heirs must agree to a TOD. The property owner can designate beneficiaries without needing consent from other family members.

- A TOD deed is only for married couples. Single individuals, friends, and family members can also use a TOD to pass on property.

- You need a lawyer to create a TOD. While it’s wise to consult a lawyer, many people successfully create a TOD on their own using state-provided forms.

- Once a TOD is filed, the property is no longer part of the estate. The property remains part of the estate until the owner passes away, at which point it transfers directly to the designated beneficiaries.

By understanding these misconceptions, you can make informed decisions about using a Transfer-on-Death Deed in California. Always consider consulting with a legal expert for personalized advice.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in California to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by California Probate Code Sections 5600-5690. |

| Form Requirements | The deed must be in writing, signed by the transferor, and recorded with the county recorder's office prior to the transferor's death. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time before the transferor's death by recording a revocation form. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the death of the transferor, at which point they inherit the property directly. |