Printable Real Estate Purchase Agreement Document for California

When buying or selling property in California, having a clear and comprehensive Real Estate Purchase Agreement (REPA) is essential. This form serves as a legally binding contract that outlines the terms and conditions of the sale. It includes crucial details such as the purchase price, financing arrangements, and the closing date. The REPA also specifies the responsibilities of both the buyer and the seller, ensuring that each party understands their obligations. Additionally, it addresses contingencies, which are conditions that must be met for the sale to proceed, such as home inspections and securing financing. By detailing these aspects, the agreement helps to minimize misunderstandings and provides a framework for the transaction. Understanding the components of the California Real Estate Purchase Agreement is vital for anyone involved in a real estate deal, as it protects the interests of both parties and facilitates a smoother transaction process.

More State-specific Real Estate Purchase Agreement Forms

Real Estate Contract for Sale by Owner Free Georgia - Addresses closing costs responsibilities.

When seeking to rent a property, it is essential for prospective tenants to complete a Rental Application form, which allows landlords to assess their suitability. This form encompasses vital information such as personal details, rental history, employment background, and references. To streamline this process, landlords may refer to resources like legalformspdf.com/ for effective rental application templates, ensuring they collect comprehensive information from applicants.

Simple Real Estate Purchase Agreement - Dictates access to the property during the selling process.

Common Questions

What is the California Real Estate Purchase Agreement?

The California Real Estate Purchase Agreement (RPA) is a legal document used in real estate transactions within California. It outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement typically includes details such as the purchase price, financing terms, contingencies, and closing date.

Who uses the California Real Estate Purchase Agreement?

This form is primarily used by buyers and sellers involved in residential real estate transactions. Real estate agents often facilitate the process, ensuring that both parties understand the terms and conditions outlined in the agreement. It is important for both parties to review the document carefully before signing.

What are the key components of the agreement?

The agreement includes several critical components, such as the property description, purchase price, earnest money deposit, contingencies (like home inspections or financing), and the closing process. Each section is designed to protect the interests of both the buyer and the seller.

What is an earnest money deposit?

An earnest money deposit is a sum of money that the buyer provides to demonstrate their serious intent to purchase the property. This deposit is typically held in escrow and is applied to the purchase price at closing. If the buyer backs out of the deal without a valid reason, the seller may keep the deposit.

What contingencies can be included in the agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include home inspections, financing approval, and appraisal requirements. These clauses protect the buyer by allowing them to withdraw from the agreement without penalty if certain conditions are not met.

How is the closing process handled?

The closing process involves several steps, including finalizing financing, conducting a title search, and signing the necessary documents. Both parties typically meet at a title company or attorney's office to complete the transaction. The buyer pays the purchase price, and the seller transfers ownership of the property.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to any changes. Modifications should be documented in writing and signed by both the buyer and the seller to ensure clarity and enforceability.

What should I do if I have questions about the agreement?

If you have questions about the California Real Estate Purchase Agreement, it is advisable to consult with a qualified real estate attorney or a licensed real estate professional. They can provide guidance specific to your situation and help ensure that your rights and interests are protected throughout the transaction.

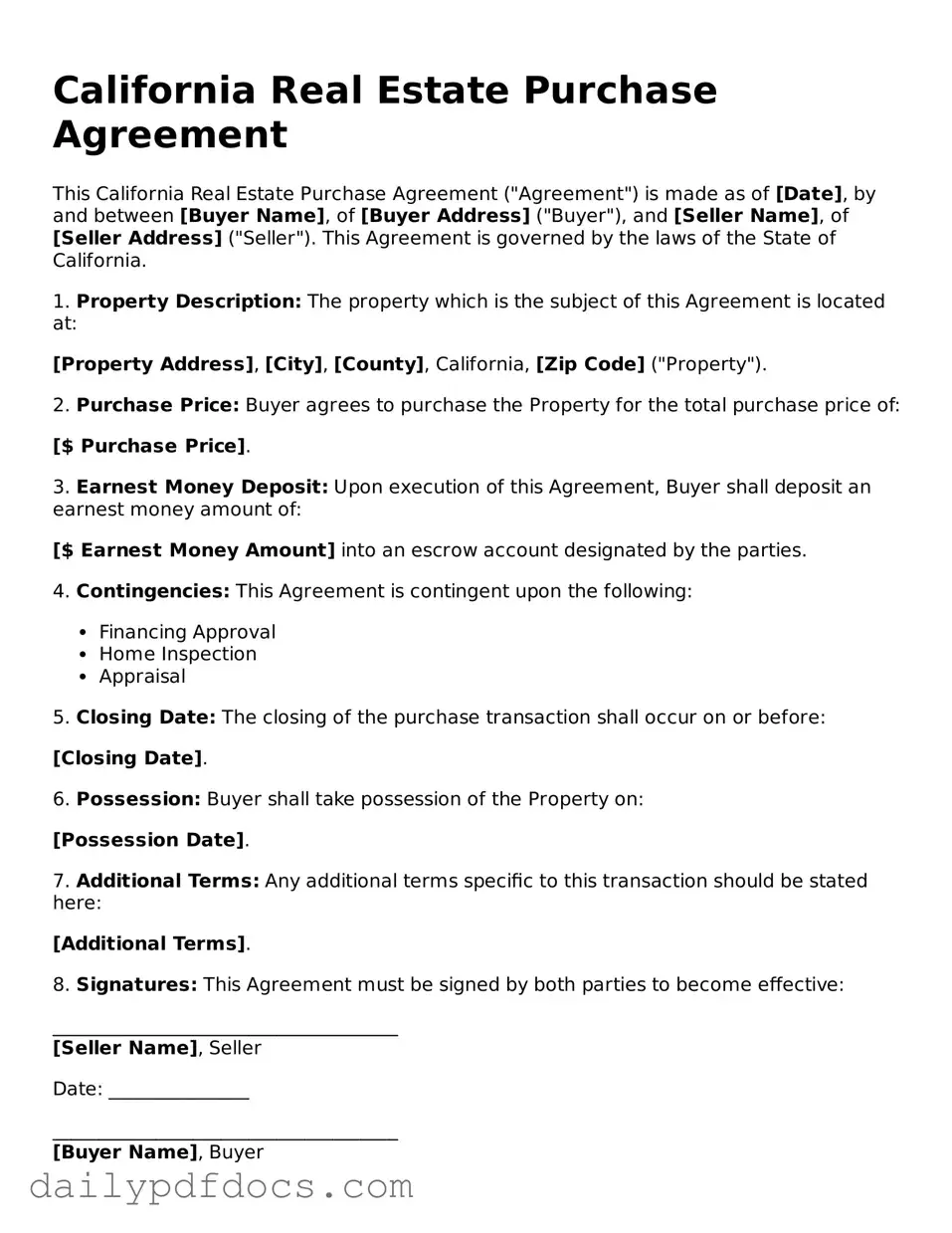

Preview - California Real Estate Purchase Agreement Form

California Real Estate Purchase Agreement

This California Real Estate Purchase Agreement ("Agreement") is made as of [Date], by and between [Buyer Name], of [Buyer Address] ("Buyer"), and [Seller Name], of [Seller Address] ("Seller"). This Agreement is governed by the laws of the State of California.

1. Property Description: The property which is the subject of this Agreement is located at:

[Property Address], [City], [County], California, [Zip Code] ("Property").

2. Purchase Price: Buyer agrees to purchase the Property for the total purchase price of:

[$ Purchase Price].

3. Earnest Money Deposit: Upon execution of this Agreement, Buyer shall deposit an earnest money amount of:

[$ Earnest Money Amount] into an escrow account designated by the parties.

4. Contingencies: This Agreement is contingent upon the following:

- Financing Approval

- Home Inspection

- Appraisal

5. Closing Date: The closing of the purchase transaction shall occur on or before:

[Closing Date].

6. Possession: Buyer shall take possession of the Property on:

[Possession Date].

7. Additional Terms: Any additional terms specific to this transaction should be stated here:

[Additional Terms].

8. Signatures: This Agreement must be signed by both parties to become effective:

_____________________________________

[Seller Name], Seller

Date: _______________

_____________________________________

[Buyer Name], Buyer

Date: _______________

By signing above, both parties agree to the terms and conditions set forth in this Agreement, which represents the entire understanding between them.

Similar forms

Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like a purchase agreement, it specifies the parties involved, property details, and payment terms, but it focuses on rental rather than ownership.

Option to Purchase Agreement: This gives a tenant the right to buy a property at a later date. Similar to a purchase agreement, it includes terms regarding price and conditions but allows for a delay in the actual purchase.

Purchase and Sale Agreement: This is often used interchangeably with the Real Estate Purchase Agreement. It details the sale of property and includes buyer and seller obligations, just like the purchase agreement.

Real Estate Listing Agreement: This document is between a property owner and a real estate agent. It outlines the agent's authority to sell the property, similar to how a purchase agreement outlines the terms of a sale.

Buyer’s Agency Agreement: This establishes a relationship between a buyer and a real estate agent. It specifies the agent's duties to the buyer, akin to how a purchase agreement details the responsibilities of both buyer and seller.

- Durable Power of Attorney: This form allows an individual to appoint someone else to manage their financial and legal affairs if they become incapacitated. To learn more, visit Washington Templates.

Seller’s Disclosure Statement: This document informs potential buyers about the property's condition. It complements a purchase agreement by ensuring buyers are aware of any issues before making a purchase.

Closing Statement: This summarizes the final transaction details at closing. It parallels the purchase agreement by outlining the financial aspects of the sale, including costs and credits.

Title Report: This document provides information about the ownership of a property. It is similar to a purchase agreement in that it confirms the legitimacy of the sale and the seller's right to sell.

Home Inspection Report: This report evaluates the property's condition and identifies any issues. It serves as a critical tool for buyers, much like a purchase agreement that details the terms of the sale.

Financing Agreement: This document outlines the terms of a loan for purchasing property. It is similar to a purchase agreement in that it specifies obligations and expectations for both the lender and the buyer.

Misconceptions

Understanding the California Real Estate Purchase Agreement (REPA) is crucial for anyone involved in real estate transactions. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this important document.

- The REPA is the same as a lease agreement. Many people believe that the REPA serves the same purpose as a lease. In reality, the REPA is a legally binding contract for the sale of property, while a lease agreement outlines the terms of renting a property.

- All real estate transactions require a REPA. Some individuals think that every real estate transaction must utilize a REPA. However, informal agreements may exist for smaller transactions, although using a formal document is highly recommended for clarity and legal protection.

- The REPA is only for residential properties. This form is often associated with residential real estate, but it can also be used for commercial properties. The specific terms may vary, but the fundamental structure remains applicable across property types.

- The REPA guarantees the sale of the property. A common misconception is that signing a REPA guarantees that the sale will occur. The agreement outlines the terms, but contingencies and negotiations can still affect the final outcome.

- Buyers and sellers can ignore contingencies. Some believe that contingencies in the REPA can be overlooked. In fact, contingencies are critical elements that protect both parties and should not be disregarded.

- The REPA does not require legal review. Many assume that a REPA is straightforward and does not need legal scrutiny. However, having an attorney review the agreement can help identify potential issues and ensure compliance with state laws.

- Once signed, the REPA cannot be changed. Some people think that after signing the REPA, the terms are set in stone. In reality, amendments can be made if both parties agree to the changes in writing.

- All agents are equally qualified to draft a REPA. There is a belief that all real estate agents have the same level of expertise in drafting a REPA. However, the experience and knowledge of the agent can significantly impact the quality of the agreement.

- The REPA is a one-size-fits-all document. Many assume that the REPA is a generic form that applies to all situations. In truth, it should be customized to reflect the specific terms and conditions of the transaction.

- Buyers do not need to understand the REPA. Some buyers think they can simply sign the REPA without understanding it. This can lead to serious issues. It is essential for all parties to comprehend the terms before signing.

Addressing these misconceptions can lead to a smoother real estate transaction. It is vital to approach the California Real Estate Purchase Agreement with knowledge and care.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Real Estate Purchase Agreement form is used to outline the terms and conditions under which a buyer agrees to purchase real estate from a seller. |

| Governing Law | This agreement is governed by the California Civil Code, particularly sections related to real property transactions. |

| Parties Involved | The form typically includes the buyer, seller, and any agents representing them in the transaction. |

| Key Components | Essential elements of the agreement include purchase price, property description, contingencies, and closing date. |

| Contingencies | Buyers often include contingencies such as home inspections, financing, and appraisal to protect their interests. |

| Legal Binding | Once signed by both parties, the agreement becomes a legally binding contract, enforceable in a court of law. |