Printable Quitclaim Deed Document for California

The California Quitclaim Deed form serves as a crucial legal instrument for property transfers, allowing individuals to relinquish any claim they may have on a property without guaranteeing the title's validity. This form is particularly useful in various scenarios, such as transferring property between family members, clearing up title issues, or facilitating quick sales. Unlike other deed types, a quitclaim deed does not provide any warranties or guarantees regarding the property’s ownership status, which means the grantee accepts the property "as is." Understanding the specific requirements for executing this form is essential, as it must be properly filled out, signed, and notarized to be legally effective. Additionally, it is important to consider the implications of using a quitclaim deed, especially in terms of tax liabilities and potential future claims. By grasping these key aspects, individuals can navigate the property transfer process more confidently and effectively.

More State-specific Quitclaim Deed Forms

How to Quit Claim Deed - The quitclaim deed is a key document in real estate transfers.

Creating a Durable Power of Attorney is crucial for securing your financial future, and it is recommended to utilize reliable resources during this process, such as Washington Templates, to ensure all legal requirements are met and your wishes are clearly documented.

Quit Claim Deed Form Ohio - Sometimes, Quitclaim Deeds help streamline the property transfer process.

Quit Claim Deed Form Illinois Pdf - This form provides a simple way to transfer property interests.

Common Questions

What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any guarantees about the title. The grantor (the person transferring the property) relinquishes any claim they have to the property, but they do not guarantee that they own the property free and clear of any liens or claims. This type of deed is often used among family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed when transferring property between family members, adding or removing a spouse from the title, or transferring property into a trust. It is also common in divorce settlements where one party relinquishes their interest in the property to the other party.

What information is required on a California Quitclaim Deed?

A Quitclaim Deed in California should include the names of the grantor and grantee, a legal description of the property, the date of the transfer, and the signature of the grantor. It's also important to include the notary's acknowledgment to ensure the deed is legally binding.

Do I need to notarize a Quitclaim Deed?

Yes, a Quitclaim Deed must be notarized to be valid in California. The notary public will verify the identity of the grantor and witness their signature. This step is crucial for the deed to be recorded in the county where the property is located.

How do I record a Quitclaim Deed in California?

To record a Quitclaim Deed, you need to take the notarized document to the county recorder's office where the property is located. There may be a recording fee, so be prepared to pay that. Once recorded, the deed becomes part of the public record, which provides notice to anyone interested in the property.

Are there any tax implications when using a Quitclaim Deed?

While transferring property via a Quitclaim Deed may not trigger immediate tax consequences, it can have implications for property taxes and capital gains taxes in the future. It's advisable to consult a tax professional to understand how the transfer may affect your tax situation.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. The grantor would need to create a new legal document, such as a revocation of the Quitclaim Deed, or execute another deed to transfer the property back, if applicable. Always consult with a legal expert for guidance in such situations.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees about the title and protects the grantee against any claims or issues that may arise. In contrast, a Quitclaim Deed offers no such protections and simply transfers whatever interest the grantor has in the property.

Can I use a Quitclaim Deed for commercial property?

Yes, a Quitclaim Deed can be used for commercial property in California. However, it's crucial to understand the implications and potential risks involved, especially regarding title issues. Consulting with a legal professional is recommended before proceeding with such a transfer.

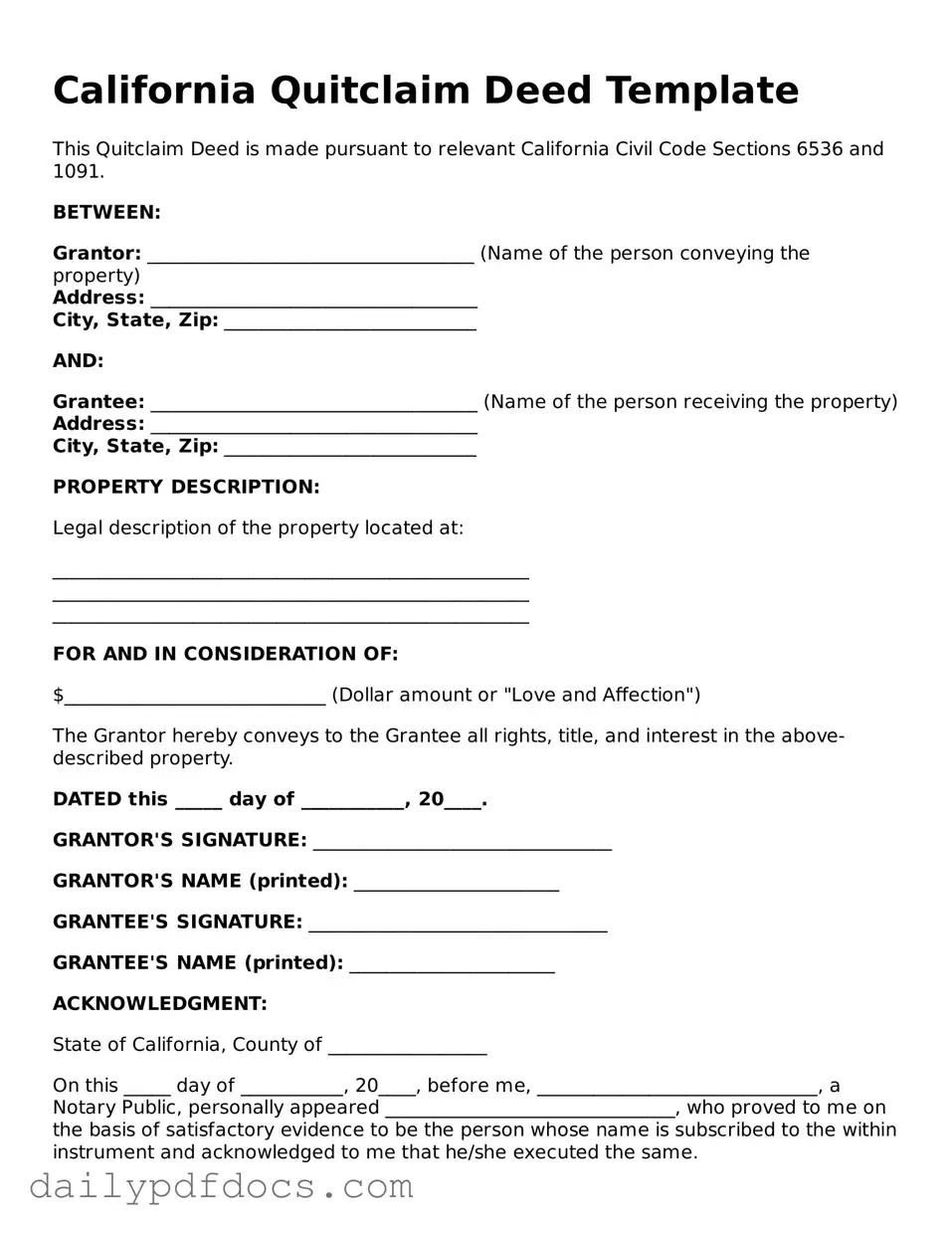

Preview - California Quitclaim Deed Form

California Quitclaim Deed Template

This Quitclaim Deed is made pursuant to relevant California Civil Code Sections 6536 and 1091.

BETWEEN:

Grantor: ___________________________________ (Name of the person conveying the property)

Address: ___________________________________

City, State, Zip: ___________________________

AND:

Grantee: ___________________________________ (Name of the person receiving the property)

Address: ___________________________________

City, State, Zip: ___________________________

PROPERTY DESCRIPTION:

Legal description of the property located at:

___________________________________________________

___________________________________________________

___________________________________________________

FOR AND IN CONSIDERATION OF:

$____________________________ (Dollar amount or "Love and Affection")

The Grantor hereby conveys to the Grantee all rights, title, and interest in the above-described property.

DATED this _____ day of ___________, 20____.

GRANTOR'S SIGNATURE: ________________________________

GRANTOR'S NAME (printed): ______________________

GRANTEE'S SIGNATURE: ________________________________

GRANTEE'S NAME (printed): ______________________

ACKNOWLEDGMENT:

State of California, County of _________________

On this _____ day of ___________, 20____, before me, ______________________________, a Notary Public, personally appeared _______________________________, who proved to me on the basis of satisfactory evidence to be the person whose name is subscribed to the within instrument and acknowledged to me that he/she executed the same.

WITNESS my hand and official seal.

Signature of Notary: ________________________________

Notary Public, State of California

Similar forms

-

Warranty Deed: This document guarantees that the grantor has clear title to the property and has the right to transfer it. Unlike a quitclaim deed, a warranty deed offers protection to the grantee against any future claims on the property.

-

Grant Deed: Similar to a warranty deed, a grant deed transfers ownership and includes certain warranties. It assures that the property has not been sold to anyone else and that it is free from undisclosed encumbrances.

-

Deed of Trust: This document secures a loan by transferring property to a trustee until the debt is paid. While a quitclaim deed transfers ownership without guarantees, a deed of trust involves a lender and includes terms related to a loan.

- Prenuptial Agreement Form: To ensure clarity in asset ownership, utilize the important Arizona prenuptial agreement resources for legal protection in a marriage.

-

Lease Agreement: A lease agreement allows a tenant to use a property for a specified time in exchange for rent. Although it does not transfer ownership, it grants rights to the tenant similar to how a quitclaim deed transfers rights to a new owner.

-

Power of Attorney: This document gives one person the authority to act on another's behalf in legal matters. While a quitclaim deed transfers property rights, a power of attorney allows someone to manage those rights for the property owner.

-

Affidavit of Title: This sworn statement confirms the ownership of a property and discloses any claims against it. While a quitclaim deed transfers title, an affidavit of title provides assurance about the condition of that title.

-

Real Estate Purchase Agreement: This contract outlines the terms of a property sale. While a quitclaim deed finalizes the transfer of ownership, the purchase agreement details the conditions and responsibilities of both parties involved in the transaction.

Misconceptions

Many people have misunderstandings about the California Quitclaim Deed form. Here are four common misconceptions:

-

Quitclaim Deeds Transfer Ownership Completely.

Some believe that a quitclaim deed transfers ownership of property without any issues. In reality, it transfers whatever interest the grantor has in the property, which may not be complete or even valid.

-

Quitclaim Deeds Are Only Used Between Family Members.

While quitclaim deeds are often used in family transactions, they can also be used in various situations, including sales or transfers between strangers or business entities.

-

A Quitclaim Deed Eliminates All Liens on the Property.

This is not true. A quitclaim deed does not remove any existing liens or encumbrances on the property. The new owner may still be responsible for these debts.

-

Quitclaim Deeds Are Always Simple and Quick to Execute.

While the form itself is straightforward, the process can be complicated if there are disputes over ownership or other legal issues. Proper execution and recording are essential.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one person to another without any warranties. |

| Governing Law | The California Quitclaim Deed is governed by California Civil Code Section 2721. |

| Use Cases | This form is commonly used in situations such as transferring property between family members or clearing up title issues. |

| Requirements | The deed must be signed by the grantor, and it should be notarized to be legally effective. |