Printable Promissory Note Document for California

In California, a Promissory Note serves as a crucial financial document that outlines a borrower's commitment to repay a loan under specific terms. This form typically includes essential details such as the principal amount borrowed, the interest rate applicable, and the repayment schedule. Additionally, it often specifies the consequences of default, which can include late fees or legal action. By clearly stating these terms, the Promissory Note helps protect both the lender's investment and the borrower's obligations. It's important to note that while the document is straightforward, it carries significant legal weight, making it essential for both parties to understand its implications. Whether used for personal loans, business financing, or real estate transactions, the California Promissory Note is designed to provide clarity and security in financial agreements.

More State-specific Promissory Note Forms

Georgia Promissory Note Template - The document should clearly identify the parties involved in the agreement.

Ohio Promissory Note - Interest calculations must be clearly stated to avoid future disputes.

When engaging in a mobile home transaction, it is crucial to utilize the proper documentation to ensure a seamless exchange of ownership. The Ohio Mobile Home Bill of Sale serves as an essential tool in this process, as it captures the necessary details regarding the sale, including the buyer and seller's information, the mobile home's description, and the sale price. For a copy of this important form, you can visit mobilehomebillofsale.com/blank-ohio-mobile-home-bill-of-sale, ensuring both parties have a clear and legally binding record of the transaction.

Personal Loan Promissory Note - The note can be secured or unsecured, depending on the agreement between the parties.

Common Questions

What is a California Promissory Note?

A California Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a predetermined time or on demand. It serves as a legal document outlining the terms of the loan, including the principal amount, interest rate, payment schedule, and any applicable fees.

Who can use a California Promissory Note?

Any individual or business can use a California Promissory Note to document a loan agreement. This includes personal loans between friends or family, as well as business loans between companies or between an individual and a business. It is important for all parties involved to understand the terms of the note.

What information is typically included in a California Promissory Note?

A California Promissory Note generally includes the following information: the names and addresses of the borrower and lender, the loan amount, interest rate, payment schedule, maturity date, and any provisions for default or late payments. Additional clauses may also be included to address specific circumstances.

Is a California Promissory Note legally binding?

Yes, a properly executed California Promissory Note is legally binding. Once signed by both parties, it creates an obligation for the borrower to repay the loan according to the agreed-upon terms. If the borrower fails to repay, the lender may take legal action to recover the owed amount.

Do I need a lawyer to create a California Promissory Note?

While it is not required to have a lawyer draft a California Promissory Note, it is advisable to seek legal advice, especially for larger loans or more complex agreements. A lawyer can help ensure that the document complies with California law and adequately protects the interests of both parties.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. These may include pursuing legal action to recover the amount owed, negotiating a new payment plan, or taking possession of any collateral specified in the note. The specific actions taken will depend on the terms outlined in the Promissory Note and applicable laws.

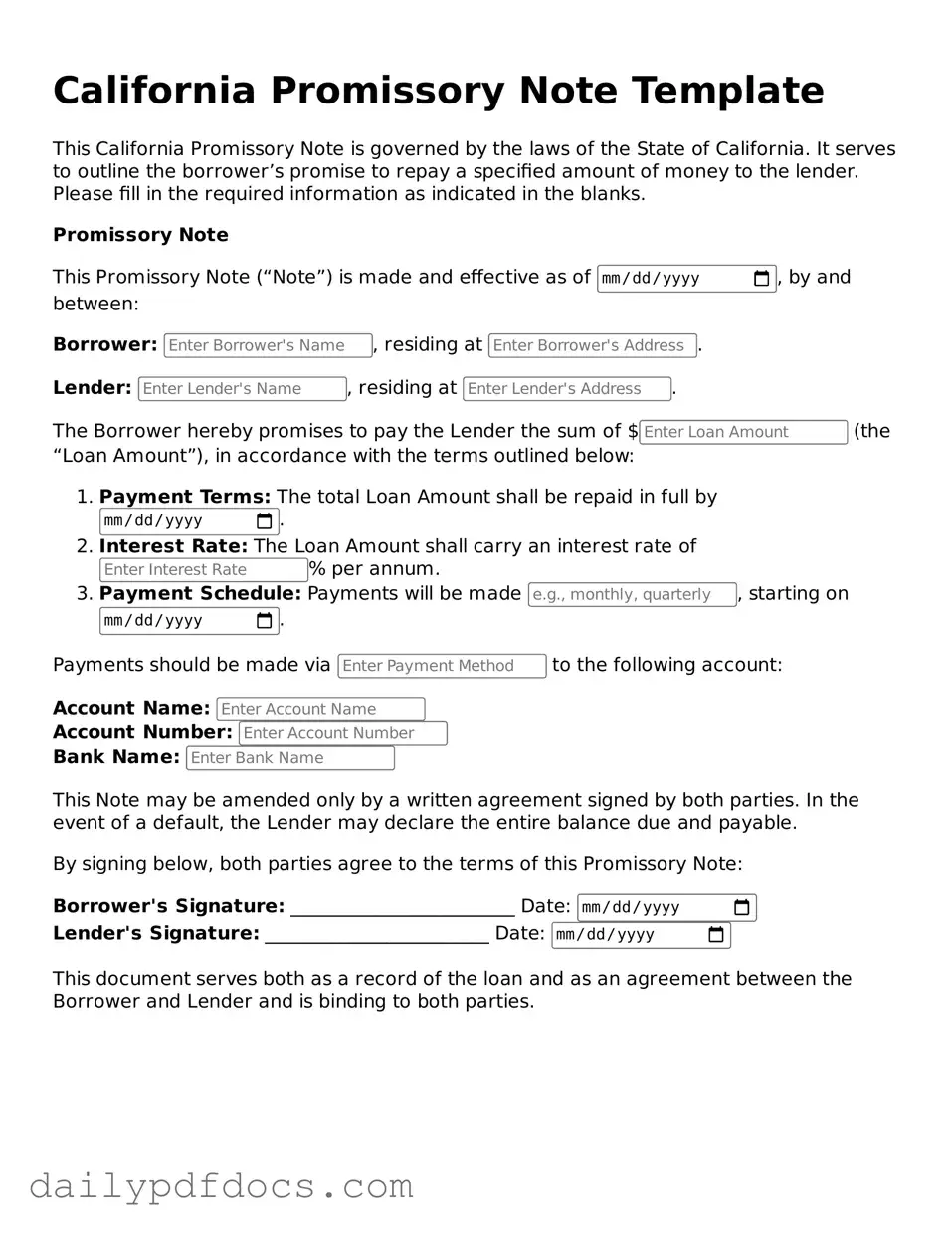

Preview - California Promissory Note Form

California Promissory Note Template

This California Promissory Note is governed by the laws of the State of California. It serves to outline the borrower’s promise to repay a specified amount of money to the lender. Please fill in the required information as indicated in the blanks.

Promissory Note

This Promissory Note (“Note”) is made and effective as of , by and between:

Borrower: , residing at .

Lender: , residing at .

The Borrower hereby promises to pay the Lender the sum of $ (the “Loan Amount”), in accordance with the terms outlined below:

- Payment Terms: The total Loan Amount shall be repaid in full by .

- Interest Rate: The Loan Amount shall carry an interest rate of % per annum.

- Payment Schedule: Payments will be made , starting on .

Payments should be made via to the following account:

Account Name:

Account Number:

Bank Name:

This Note may be amended only by a written agreement signed by both parties. In the event of a default, the Lender may declare the entire balance due and payable.

By signing below, both parties agree to the terms of this Promissory Note:

Borrower's Signature: ________________________ Date:

Lender's Signature: ________________________ Date:

This document serves both as a record of the loan and as an agreement between the Borrower and Lender and is binding to both parties.

Similar forms

A Promissory Note is a vital financial document that outlines a borrower's promise to repay a loan under specific terms. However, it shares similarities with several other documents in the realm of finance and legal agreements. Here are six documents that resemble a Promissory Note:

- Loan Agreement: Like a Promissory Note, a loan agreement specifies the terms of the loan, including the amount, interest rate, and repayment schedule. However, it is often more comprehensive, detailing the rights and obligations of both the lender and borrower.

- Employment Verification: This crucial document validates an employee's work history and job details; for more information, refer to Washington Templates.

- Mortgage: A mortgage is a type of secured loan document that not only outlines the borrower's promise to repay but also secures the loan with the property being purchased. This means that if the borrower defaults, the lender has the right to take possession of the property.

- Installment Agreement: This document details a repayment plan for a loan, similar to a Promissory Note. It breaks down the total amount owed into smaller, manageable payments over a specified period, often including interest calculations.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. While it does not outline repayment terms like a Promissory Note, it serves as a commitment to ensure that the loan will be repaid, providing additional security for the lender.

- Credit Agreement: This document outlines the terms under which a borrower can access credit from a lender. It shares similarities with a Promissory Note in that it establishes the borrower's obligations, but it typically covers a broader range of terms related to credit usage and repayment.

- Debt Settlement Agreement: This agreement details the terms under which a borrower can settle a debt for less than the total amount owed. While it may not function as a traditional Promissory Note, it still involves the borrower's commitment to pay a specified amount, often in a lump sum or through a payment plan.

Understanding these documents can help borrowers and lenders navigate their financial relationships more effectively. Each serves a unique purpose, yet they all share the common goal of outlining obligations and protecting the interests of both parties involved.

Misconceptions

Understanding the California Promissory Note form is essential for both lenders and borrowers. However, several misconceptions can lead to confusion and misinterpretation. Below is a list of common misconceptions surrounding this important financial document.

- All Promissory Notes are the Same: Many believe that all promissory notes are identical in structure and function. In reality, each note can vary significantly based on the terms agreed upon by the parties involved.

- A Promissory Note Must Be Notarized: Some assume that notarization is a requirement for a promissory note to be valid. While notarization can enhance the document's credibility, it is not a legal necessity in California.

- Only Banks Can Issue Promissory Notes: It is a common belief that only financial institutions can create promissory notes. In fact, any individual or entity can issue a promissory note as long as they have the legal capacity to do so.

- Interest Rates Are Fixed: Many people think that interest rates in promissory notes are always fixed. However, they can be variable and depend on the terms set forth in the agreement.

- Promissory Notes Are Unenforceable: A misconception exists that promissory notes lack enforceability. In California, a properly executed promissory note is legally binding and can be enforced in court.

- Only Written Promissory Notes Are Valid: Some believe that verbal agreements are not valid. While written notes are preferred for clarity, oral agreements can also be enforceable, depending on the circumstances.

- Defaulting on a Promissory Note Has No Consequences: It is a misconception that failing to repay a promissory note carries no repercussions. Defaulting can lead to legal action and damage to one's credit score.

- Promissory Notes Are Only for Personal Loans: Many think that promissory notes apply only to personal loans. In reality, they can be used for a wide range of financial transactions, including business loans and real estate financing.

By addressing these misconceptions, individuals can better navigate the complexities of promissory notes and make informed decisions regarding their financial agreements.

Form Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | California Civil Code Sections 3300-3302 govern promissory notes in California. |

| Parties Involved | The note involves two main parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the note. |

| Repayment Terms | Repayment terms, including the due date and payment schedule, must be specified. |

| Default Clause | A default clause outlines the actions that can be taken if the borrower fails to repay. |

| Signatures | Both parties must sign the note for it to be legally binding. |