Printable Mobile Home Bill of Sale Document for California

The California Mobile Home Bill of Sale form serves as a crucial document in the transfer of ownership for mobile homes within the state. This form is designed to protect both the buyer and the seller by providing a clear record of the transaction. It includes essential details such as the names and addresses of both parties, a description of the mobile home being sold, and the sale price. Additionally, the form may require information about any outstanding liens or encumbrances, ensuring that the buyer is fully informed before completing the purchase. By documenting the sale, this form also facilitates the transfer of title with the California Department of Housing and Community Development. Understanding the importance of this document can help streamline the buying and selling process, making it a vital resource for anyone involved in mobile home transactions in California.

More State-specific Mobile Home Bill of Sale Forms

Bill of Sale for Mobile Home in Texas - Buyers should review the Mobile Home Bill of Sale before signing to ensure all information is accurate.

For those navigating marital separations, the Arizona Marital Separation Agreement process can provide clarity and ensure that both parties understand their rights and obligations. This form plays a crucial role in outlining the specifics of the separation, helping to mitigate potential conflicts that may arise in the future.

What Is a Bill of Sale - Ensures that the sale complies with local regulations.

Common Questions

What is a California Mobile Home Bill of Sale form?

A California Mobile Home Bill of Sale form is a legal document that records the sale of a mobile home. It includes details about the buyer, the seller, and the mobile home being sold. This form helps to transfer ownership and can be used for registration purposes with the Department of Housing and Community Development (HCD).

Why do I need a Bill of Sale for my mobile home?

The Bill of Sale serves as proof of the transaction between the buyer and the seller. It protects both parties by documenting the sale and the agreed-upon terms. This is especially important for future legal matters or if any disputes arise.

What information is included in the Bill of Sale?

The form typically includes the names and addresses of both the buyer and the seller, the purchase price, a description of the mobile home (including the make, model, and year), and the Vehicle Identification Number (VIN). It may also contain the date of the sale and any conditions related to the sale.

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Bill of Sale in California, but having it notarized can provide an extra layer of security. It may help verify the identities of the parties involved and can be beneficial if any disputes arise later.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale, but it is important to ensure that it includes all necessary information and complies with California laws. Using a standard form can help avoid missing important details and can make the process smoother.

Is a Bill of Sale the same as a title transfer?

No, a Bill of Sale is not the same as a title transfer. The Bill of Sale documents the sale, while the title transfer is the official process of changing ownership with the state. Both are necessary to complete the sale legally.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer must then take the Bill of Sale to the local Department of Motor Vehicles (DMV) or HCD to complete the title transfer process.

Are there any fees associated with the Bill of Sale?

There are no fees specifically for creating a Bill of Sale. However, there may be fees associated with the title transfer process at the DMV or HCD. It is advisable to check with the relevant agency for details on any applicable fees.

What if the mobile home is financed?

If the mobile home is financed, you will need to contact the lender before selling. The lender may have specific requirements or procedures for transferring ownership. It’s important to ensure that any outstanding loans are settled as part of the sale.

Can I use the Bill of Sale for tax purposes?

Yes, the Bill of Sale can be used for tax purposes. It serves as proof of the transaction and may be needed when filing taxes or for future reference. Keep it in a safe place for your records.

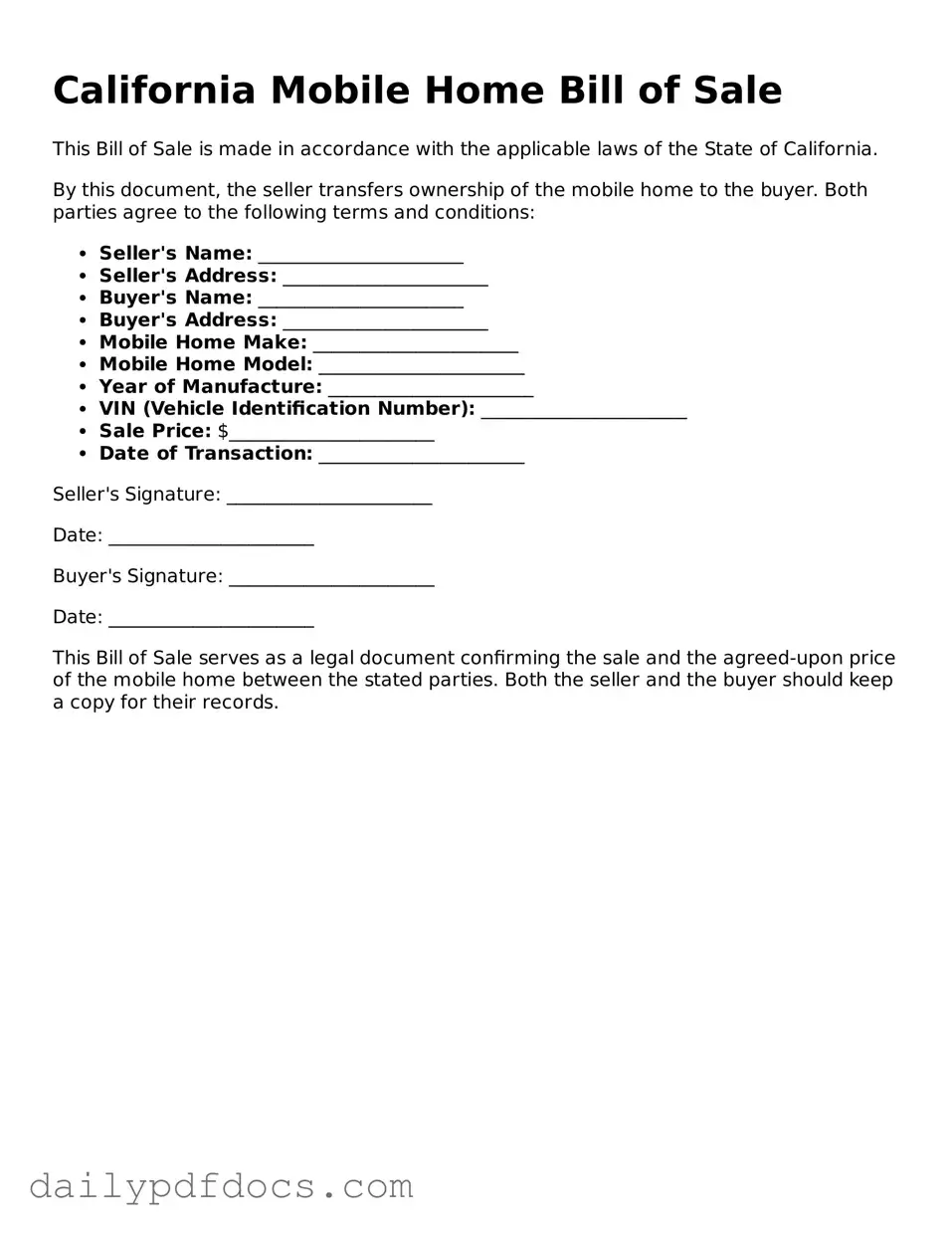

Preview - California Mobile Home Bill of Sale Form

California Mobile Home Bill of Sale

This Bill of Sale is made in accordance with the applicable laws of the State of California.

By this document, the seller transfers ownership of the mobile home to the buyer. Both parties agree to the following terms and conditions:

- Seller's Name: ______________________

- Seller's Address: ______________________

- Buyer's Name: ______________________

- Buyer's Address: ______________________

- Mobile Home Make: ______________________

- Mobile Home Model: ______________________

- Year of Manufacture: ______________________

- VIN (Vehicle Identification Number): ______________________

- Sale Price: $______________________

- Date of Transaction: ______________________

Seller's Signature: ______________________

Date: ______________________

Buyer's Signature: ______________________

Date: ______________________

This Bill of Sale serves as a legal document confirming the sale and the agreed-upon price of the mobile home between the stated parties. Both the seller and the buyer should keep a copy for their records.

Similar forms

Vehicle Bill of Sale: Similar to the Mobile Home Bill of Sale, this document transfers ownership of a vehicle from one party to another. It includes details such as the vehicle's make, model, year, and Vehicle Identification Number (VIN), ensuring clarity in the transaction.

Real Estate Purchase Agreement: This document outlines the terms of a real estate sale, including the purchase price and property description. Like the Mobile Home Bill of Sale, it formalizes the transfer of ownership and protects both parties' interests.

Boat Bill of Sale: Just as the Mobile Home Bill of Sale facilitates the transfer of a mobile home, this document serves to transfer ownership of a boat. It includes details about the boat, such as its hull identification number, ensuring a clear record of the transaction.

Personal Property Bill of Sale: This document is used for the sale of personal items, such as furniture or electronics. It is similar in function to the Mobile Home Bill of Sale, as both serve to document the transfer of ownership and provide protection for both buyer and seller.

Business Asset Bill of Sale: When a business is sold, this document outlines the assets being transferred, such as equipment and inventory. Like the Mobile Home Bill of Sale, it formalizes the sale and provides a clear record of what is included in the transaction.

- Divorce Settlement Agreement: Essential for couples going through divorce, this form details asset division, child custody arrangements, and support obligations. For comprehensive guidance on creating this document, visit Washington Templates.

Lease Agreement: Although primarily used for renting, a lease agreement can also contain terms for eventual purchase. This document shares similarities with the Mobile Home Bill of Sale in that it details the rights and responsibilities of both parties, especially regarding ownership transfer.

Misconceptions

The California Mobile Home Bill of Sale form is an important document for those buying or selling mobile homes. However, several misconceptions exist about this form that can lead to confusion. Here are seven common misunderstandings:

-

It is not legally required to use a Bill of Sale. Many people believe that a Bill of Sale is optional when selling a mobile home. In reality, while not always legally required, it is highly recommended to protect both parties and provide proof of the transaction.

-

All mobile home sales require notarization. Some assume that every Bill of Sale must be notarized. This is not true. Notarization is generally not required for mobile home sales, but it can add an extra layer of security and legitimacy to the document.

-

Only the seller needs to sign the Bill of Sale. A common misconception is that only the seller's signature is necessary. In fact, both the buyer and the seller should sign the document to confirm the agreement and protect their interests.

-

The form is the same for all types of mobile homes. Some people think that a single Bill of Sale form can be used for any mobile home. However, variations exist depending on the type of mobile home and the specific circumstances of the sale.

-

It does not need to include specific details about the mobile home. Some individuals believe that a simple statement of sale is sufficient. However, including detailed information, such as the vehicle identification number (VIN) and the condition of the mobile home, is crucial for clarity and future reference.

-

Once signed, the Bill of Sale cannot be changed. Many think that the document is final and unchangeable after signing. In truth, amendments can be made if both parties agree, but it is advisable to document any changes formally.

-

It is not necessary to keep a copy of the Bill of Sale. Some sellers and buyers may think they can discard the document after the transaction. However, keeping a copy is essential for record-keeping and may be required for future legal or financial matters.

Understanding these misconceptions can help ensure a smoother transaction when dealing with mobile homes in California.

Form Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Mobile Home Bill of Sale form is used to document the sale of a mobile home, ensuring both the buyer and seller have a record of the transaction. |

| Governing Law | This form is governed by California Civil Code Sections 798.1 to 798.88, which outline the regulations surrounding mobile home transactions. |

| Required Information | Essential details such as the names of the buyer and seller, the mobile home's identification number, and the sale price must be included in the form. |

| Signatures | Both parties must sign the Bill of Sale to validate the transfer of ownership, making it legally binding. |